Advisor Innovations Podcast: Julie Littlechild on Client Feedback and the Engagement Engine

Wealth Management

APRIL 20, 2023

Absolute Engagement's Julie Littlechild discusses taking client engagement feedback to the next level.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

APRIL 20, 2023

Absolute Engagement's Julie Littlechild discusses taking client engagement feedback to the next level.

Wealth Management

MARCH 5, 2025

Edelman Financial Engines claims John Carey violated non-solicitation and trade secret agreements when he moved to Farther, taking 55 clients and over $55 million in AUM.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Wealth Management

AUGUST 16, 2024

Neil Gilfedder, the firm’s CIO, talks about how the RIA has incorporated its co-founder’s risk-adjusted investment analysis and how it stays transparent with clients.

Nerd's Eye View

OCTOBER 9, 2023

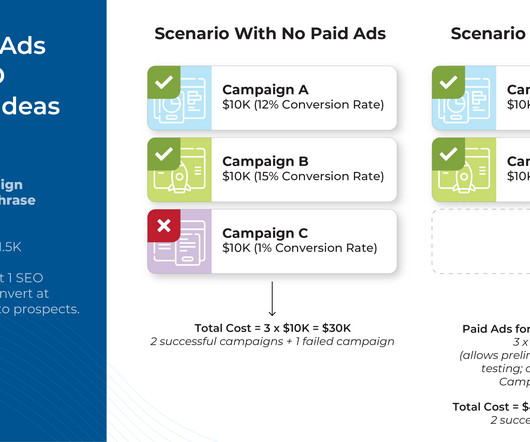

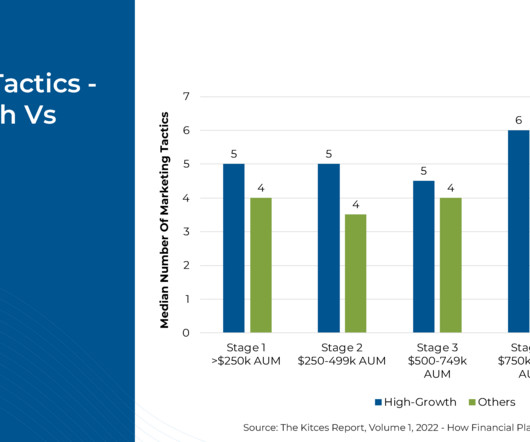

Different strategies have different Client Acquisition Costs (CACs), in terms of both hard-dollar marketing expenses and the cost of the advisor's time spent on the strategy, and an efficient market strategy is one that can effectively attract new clients while minimizing the amount spent to acquire them.

Wealth Management

NOVEMBER 14, 2023

The co-founder discusses the why of Bento through to the predictive client-communications platform's just announced partnership with marketing firm FMG Suite.

Wealth Management

APRIL 18, 2023

Julie Littlechild's practice management consultancy's recently launched "Engagement Engine" wants to drag the client survey into the digital age.

Nerd's Eye View

NOVEMBER 11, 2024

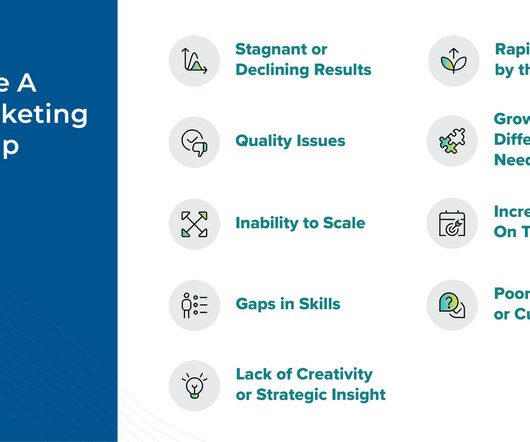

Advisors might consider outsourcing roles such as social media management, search engine optimization, web development, event management, and performance analytics, among other options. Reviewing both current marketing efforts and aspirational goals for client engagement can help advisors determine where outsourcing may add the most value.

Wealth Management

NOVEMBER 18, 2022

Bento addresses wealth transfer and financial literacy while Holistiplan joins LPL's Vendor Affinity Program and Addepar adds UBS as client.

Wealth Management

NOVEMBER 17, 2023

Mariner Wealth Advisors' "ongoing" campaign to lure Edelman Financial Engines advisors incentivizes them to break employment agreements and a "sinking ship"

Wealth Management

NOVEMBER 17, 2023

Mariner's "ongoing" campaign to lure Edelman Financial Engines advisors incentivizes them to break employment agreements and a "sinking ship"

Wealth Management

DECEMBER 19, 2023

Dan Seder shares Blue Chip Partners’ unique approach to managing human capital and building a growth engine inside a $1 billion AUM firm.

Wealth Management

OCTOBER 10, 2024

According to Baird, Robert Sargent is joining the firm's Fairfax office after leaving Edelman Financial Engines, where he managed about $245 million in client assets.

Wealth Management

JANUARY 17, 2024

Mariner asked a federal court to pause Edelman Financial Engines' trade-secret lawsuit during an ongoing arbitration process. Edelman says that would only let Mariner continue raiding its advisors and clients "with impunity."

The Big Picture

SEPTEMBER 9, 2023

We discuss his career in machine learning, from Amazon’s recommendation engine to using AI to manage portfolios. The firm applies machine learning to a four step process of data assembly, Prediction Engine, Portfolio Construction, and Execution. You can find all of our earlier podcasts on your favorite platforms here.

Nerd's Eye View

AUGUST 29, 2023

Jeff is the Owner and Founder of Cypress Financial Planning, an independent RIA based in Haddon Heights, New Jersey, that oversees $275 million in assets under management for 380 client households.

Abnormal Returns

OCTOBER 30, 2023

Podcasts Brendan Frazier talks with Jake Northrup of Experience Your Wealth about how he infuses the human side to help clients live their ideal life. kitces.com) AI How recommendation engines could work in wealth management. kitces.com) Why formal retirement plans provide clients with additional confidence.

Abnormal Returns

JULY 17, 2023

Podcasts Michael Kitces talks with Thor McIlrath of McIlrath & Eck about rotating client coverage. standarddeviationspod.com) Charles Schwab Charles Schwab ($SCHW) clients with $1 million in assets now are automatically enrolled in one of its private wealth management programs.

Indigo Marketing Agency

FEBRUARY 1, 2025

Your website is often the first impression potential clients have of your firm, and it needs to reflect your professionalism, expertise, and ability to solve their unique financial challenges. Niche Pages That Speak to Ideal Clients Connecting with the right audience is critical for financial advisors.

Nerd's Eye View

APRIL 15, 2024

Foremost among their responsibilities is business development, which compels them to seek out prospects who will eventually become clients (so that they can grow their firms, allocate resources accordingly, and do even more financial planning!). Read More.

The Big Picture

JULY 30, 2022

It is surprisingly easy to tell when a car is being subjected to a laboratory-based emissions test, because engines on a test track run with a regularity never seen in real-world use. This is ‘trivial’, as engineers say, for software to detect. Is Selling Shares in Yourself the Way of the Future? London Review of Books ). •

Nerd's Eye View

APRIL 3, 2023

million in seed funding to support its growth as it builds out its "end-to-end" financial planning and advice engagement platform (but will it be able to replace, rather than augment, advisors' existing financial planning software?)

Nerd's Eye View

MAY 29, 2023

One of the key decisions is determining the type of clients they want to serve. Some advisors may choose to take a generalist approach that leaves the door open to working with the broadest possible pool of prospective clients. When a financial advisor starts their own firm, they face many important choices.

Nerd's Eye View

JANUARY 30, 2024

Tim is the founder of Goodwin Investment Advisory, an RIA based in Woodstock, Georgia, that oversees $275M in assets under management for 370 client households. return in new onboarded client revenue for every $1 spent in marketing. return in new onboarded client revenue for every $1 spent in marketing.

Nerd's Eye View

AUGUST 21, 2023

Many financial advisors start their own firm because of an entrepreneurial itch, a desire to work with a specific type of client, or perhaps because they want to have more control over their work life. Nonetheless, one group of advisors reported more marketing success than others: those serving client niches.

Nerd's Eye View

FEBRUARY 2, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a Morningstar survey has found that financial advisory clients are more likely to stick with their advisor for emotional reasons rather than investment returns alone.

FMG

MARCH 6, 2025

AI-powered search, social media algorithms, and Answer Engine Optimization (AEO) are transforming how potential clients find financial advisors. Instead, you should be asking, “How do I ensure clients find my financial services wherever they search? How Can Financial Advisors Adapt to AI-Powered Search Engines?

Indigo Marketing Agency

JANUARY 16, 2025

10 Growth Marketing Strategies for Financial Planners in 2025 The new year wipes the slate clean and gives financial planners a fresh opportunity to focus on marketing strategies that attract and retain more clients in less time and with less energy. And new leads and clients keep coming. Case in point, Kevin Brown.

Nerd's Eye View

APRIL 28, 2023

House of Representatives committee this week approved legislation that would expand the pool of individuals who would qualify as accredited investors able to access certain private offerings Proposed bipartisan legislation would allow individuals to use funds in 529 plans for expenses associated with acquiring or maintaining postsecondary credentials, (..)

The Big Picture

AUGUST 26, 2022

His counter has been that responsible brokers (like himself) run a transactional business for clients who want those services. He has high client retention and has generated respectable performance for those customers. My examples of overpriced, low-performing, abusive account management have been derided as outliers.

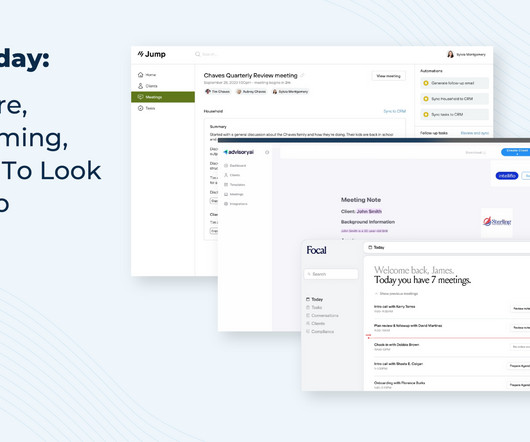

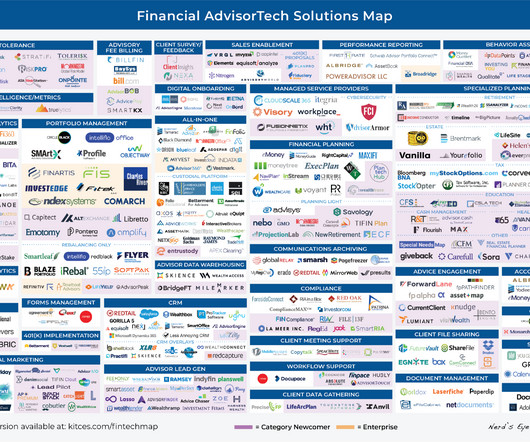

Nerd's Eye View

FEBRUARY 19, 2024

In the wake of an AdvisorTech boom over the last decade, many advisors have all the tools they need to build truly comprehensive solutions for their clients. As software providers grow in number and their offerings expand in complexity, automation and cybersecurity will be central themes as client preferences continue to change.

Nerd's Eye View

SEPTEMBER 18, 2024

Today, AI is now almost ubiquitous across many of the tools that we use, from smartphone cameras to search engines to office productivity software. In the nearly 2 years since the launch of ChatGPT, there has been an explosion of new technology solutions incorporating Artificial Intelligence (AI).

Million Dollar Round Table (MDRT)

AUGUST 9, 2022

By Antoinette Tuscano, MDRT Content Specialist In this internet age, before clients do business with you, they go online to find who you are, what your business is and why you might care about doing your best for them. Or is your “About us” page functioning at its max potential for attracting clients and increasing your income?

Harness Wealth

JUNE 17, 2024

Steve Cheung, who most recently served as Architect and Director of Engineering at Flatiron Health, joins Harness as its Head of Engineering. He will lead the engineering and software development functions for both Harness Wealth consumer products and services, as well as the Harness for Advisors SaaS platform. He earned a B.A.

Nerd's Eye View

JULY 3, 2023

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including: All-in-one software platform Blueleaf has launched a new “aggregation-as-a-service” solution, promising better client data aggregation capabilities than existing solutions by automating the process of weaving multiple (..)

The Big Picture

JANUARY 25, 2023

Bloomberg ) • For Tech Companies, Years of Easy Money Yield to Hard Times : Rock-bottom rates were the secret engine fueling $1 billion start-ups and virtual attempts to conquer the physical world. NYSE says it’s investigating issues with the opening auction. But in 2023, reality bites. ( 6 committee’s legacy.

Nerd's Eye View

JANUARY 2, 2023

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including: Docupace launches an ‘RIA Productivity Toolkit’ as it increasingly expands beyond its document management roots in a bid to become more of the back-office workflow engine of small-to-mid-sized advisor enterprises.

Trade Brains

JUNE 5, 2024

Jash Engineering: Water, the elixir of life, is a precious resource facing ever growing pressures. Jash Engineering Ltd, a leading player in this vital sector, has been a key contributor for over 50 years. Jash Engineering focuses on manufacturing a comprehensive range of equipment for water and wastewater treatment plants.

Midstream Marketing

DECEMBER 6, 2024

Explore how to reach potential clients by using educational content and CRM systems. It helps them connect with clients and grow their business. You will find tips to improve your online presence, attract more clients, and create successful campaigns. Clients now want financial advice online.

Nerd's Eye View

SEPTEMBER 12, 2023

What's unique about Jason, though, is how he built Altruist as an "all-in-one" custodian platform for RIAs that includes the portfolio management and performance reporting software that most advisory firms have to purchase separately… as Jason found while he was building his own TAMP a decade ago, the limitations of current RIA custodians made (..)

The Big Picture

MAY 31, 2024

We discuss how he began as a math major but didn’t want to go into physics, engineering or academia, so finance was the next logical career option. Be sure to check out our Masters in Business next week with Peter Mallouk, CEO of Creative Planning, which manages over $300 billion in client assets.

BlueMind

NOVEMBER 24, 2022

Category: Client Relations. The demands of high-net-worth clients are no small feat and can be challenging and daunting to deal with, to say the least. However, acquiring and retaining an HNW client is every financial advisor’s dream. Related: Effective Strategies To Deal With Difficult Clients.

Midstream Marketing

NOVEMBER 7, 2024

They help attract the right leads and improve your search engine rankings. This includes content marketing, keyword research, and tips to enhance your website for search engines. Introduction In financial planning, it is key to know about search engine optimization (SEO) and search engine marketing (SEM).

Wealth Management

SEPTEMBER 6, 2022

But showing clients the role of these assets in a whole portfolio context takes significant time and effort without an analytical engine that can efficiently analyze the data. After years of historically low yields in public markets, private assets have significantly grown in importance for many investors and their portfolios.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content