Quantifying (More Accurately) The Real Impact Of A Financial Advisor’s Costs On Their Clients’ Nest Eggs

Nerd's Eye View

OCTOBER 23, 2024

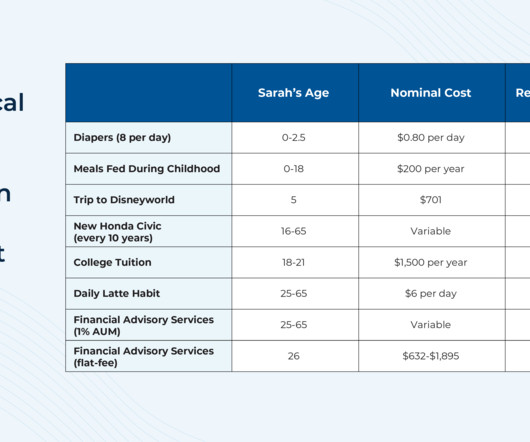

While the financial advice industry has transformed in many ways over the past several decades, one aspect that has remained relatively constant is the use of the Assets Under Management (AUM) fee model as a common way for many advisors to get paid. So too does the impact of the infamous daily latte.

Let's personalize your content