Fifteen Creative Client Events for Financial Advisors

Wealth Management

MARCH 28, 2025

Smaller, more intentional gatherings financial advisors hold with clients create opportunities for conversations, introductions and growth.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

MARCH 28, 2025

Smaller, more intentional gatherings financial advisors hold with clients create opportunities for conversations, introductions and growth.

Nerd's Eye View

NOVEMBER 19, 2024

Welcome to the 412th episode of the Financial Advisor Success Podcast ! Anjali is the Founder of FIT Advisors, an RIA based in Torrance, California (but works virtually with clients nationwide) and oversees $65 million in assets under management for 45 client households. Welcome everyone!

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Nerd's Eye View

OCTOBER 29, 2024

Welcome to the 409th episode of the Financial Advisor Success Podcast ! Travis is the founder of Student Loan Planner, an RIA and student loan consulting company based in Chapel Hill, North Carolina that serves nearly 1,400 households with ongoing financial planning (as well as consulting with over 15,000 clients on student loan debt).

Nerd's Eye View

JANUARY 23, 2025

However, as the public’s understanding of AI has developed, the common consensus has largely shifted to the understanding that while processes may change, the expertise and human connection offered by specialists like financial advisors will be hard to replace. ” – can guide ChatGPT toward more tailored results.

Nerd's Eye View

JANUARY 7, 2025

Welcome to the 419th episode of the Financial Advisor Success Podcast ! Pete is the Director of Sustainable Investing of Earth Equity Advisors, an RIA based in Asheville, North Carolina, that oversees approximately $200 million in assets under management for 250 client households. Welcome everyone!

Nerd's Eye View

OCTOBER 31, 2024

For many years, the traditional career track for financial advisors has been an 'eat what you kill' model – where advisors must independently find, convert, and manage their own clients. As such, it isn't uncommon for an advisor's first few years to be characterized by long hours, high rejection rates, and low pay.

Nerd's Eye View

MARCH 17, 2025

And with the advent of AI in particular, questions have emerged about whether technology will replace many human jobs, including financial advisors. For which industry-specific providers are building the entire advisor-CRM-integrated workflow. Yet now, two years later, AI has not driven a mass wave of unemployment.

Nerd's Eye View

DECEMBER 24, 2024

Welcome to the 417th episode of the Financial Advisor Success Podcast ! Paul is the CEO of More Clients More Fun, a marketing company that helps financial advisors conceptualize and publish their own book in a consolidated 6-week process. Welcome everyone! My guest on today's podcast is Paul G McManus.

Wealth Management

OCTOBER 9, 2023

This article examines three key use cases where AI can benefit financial advisors: practice management, client engagement and prospecting.

Nerd's Eye View

DECEMBER 30, 2024

Each week in Weekend Reading For Financial Planners, we seek to bring you synopses and commentaries on 12 articles covering news for financial advisors including topics covering technical planning, practice management, advisor marketing, career development, and more.

Nerd's Eye View

DECEMBER 17, 2024

Welcome to the 416th episode of the Financial Advisor Success Podcast ! Fran is the CEO of Toler Financial Group, an RIA based in Silver Spring, Maryland, that oversees nearly $200 million in assets under management for 280 client households. Welcome everyone! My guest on today's podcast is Fran Toler. Read More.

Nerd's Eye View

MARCH 6, 2025

New financial advisors often start with below-market fees – sometimes to build confidence that prospects will actually pay, other times to attract clients quickly and establish a base. But as the firm grows, so does an advisor's skill set and the demands on their time.

Nerd's Eye View

FEBRUARY 5, 2025

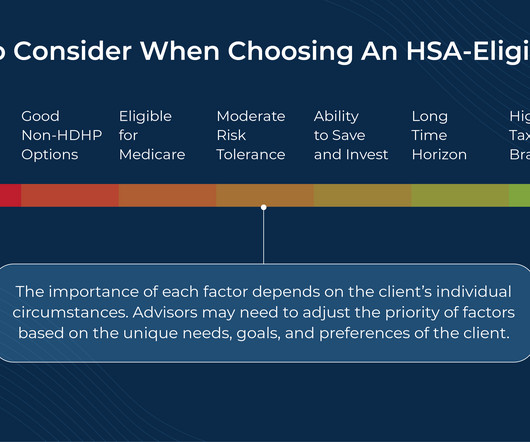

Health Savings Accounts (HSAs) have become an increasingly popular tool for financial advisors and their clients due in part to the 'triple tax savings' they offer: tax-deductible contributions, tax-free growth, and non-taxable distributions for qualifying expenses. Read More.

Wealth Management

SEPTEMBER 9, 2024

Verdence Capital's Leo Kelly details how artificial intelligence and enhance the evolving relationship between advisors and clients.

Nerd's Eye View

FEBRUARY 4, 2025

Welcome to the 423rd episode of the Financial Advisor Success Podcast ! Cristina is the CEO of Mana Financial Life Design, an RIA based in Los Angeles, California (but works virtually with clients nationwide), that oversees approximately $70 million in assets under management for 119 client households.

Nerd's Eye View

APRIL 2, 2025

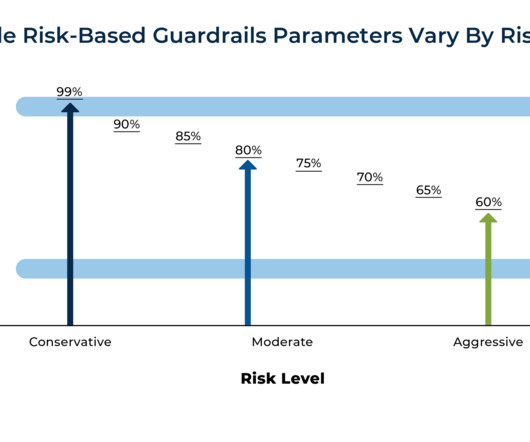

For many financial advisors, a core part of the retirement planning process involves simulating whether the client's assets will last through retirement. Yet while these tools offer mathematical metrics, they often fall short in helping clients connect the numbers to their real lives.

Nerd's Eye View

APRIL 8, 2025

Welcome to the 432nd episode of the Financial Advisor Success Podcast! Seth is the founder of Heartwood Financial Planning, an advisory firm affiliated with PlanMember Securities Corporation that is based in Fresno, California, and oversees approximately $100 million in assets under management for 850 client households.

The Chicago Financial Planner

FEBRUARY 2, 2024

A part of this process might include hiring a financial advisor or hiring a new financial advisor if you have decided to move on from your current advisor. Hiring the right advisor for your needs is critical. Here are six questions to ask when choosing a financial advisor: How do you get paid?

Wealth Management

AUGUST 6, 2024

Financial advisors view the market correction as a normal course of events and a good buying opportunity. Market volatility is my best friend,” one advisor said. This is an opportunity to show clients why they pay us a fee, to navigate difficult times with a rock steady approach.”

Nerd's Eye View

NOVEMBER 29, 2024

Which could prove to be a boon for the financial advice industry as more consumers are willing to entrust their assets to an advisor (while at the same time possibly making it tougher for some advisors to differentiate themselves primarily by how they put their clients' interests first?). Read More.

Nerd's Eye View

FEBRUARY 18, 2025

Welcome to the 425th episode of the Financial Advisor Success Podcast ! Sebastian is the President of Guerra Wealth Advisors, a hybrid advisory firm based in Miami, Florida, with nearly $15M of revenue and almost 60 team members, supporting over 1,700 client households. Welcome everyone!

The Big Picture

OCTOBER 15, 2022

This week, we speak with Thomas Rampulla, managing director of Vanguard’s Financial Advisor Services. The division provides investments, services, education and research to more than 1,000 financial advisory firms representing more than $3 trillion in assets. in client funds. Tom Rampulla’s favorite books.

Nerd's Eye View

JANUARY 9, 2025

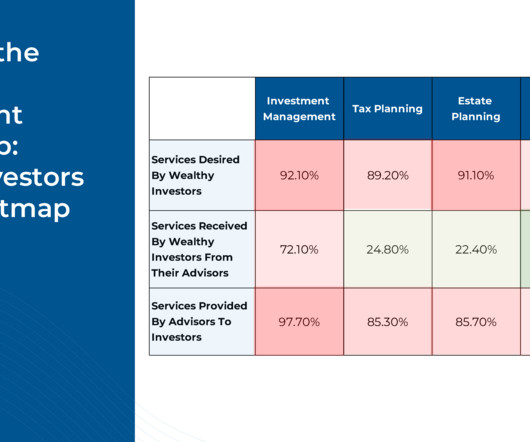

While financial advisors offer valuable services for their clients, it can sometimes be challenging to gauge how much clients actually value those services. On one hand, a client's willingness to pay an ongoing fee for financial advice suggests that they find the advisor's services worthwhile.

Nerd's Eye View

JANUARY 21, 2025

Welcome to the 421st episode of the Financial Advisor Success Podcast ! Daniel is the CEO of WMGNA, a hybrid advisory firm based in Farmington, Connecticut, that oversees approximately $270 million in assets under management for 200 client households. Welcome everyone! My guest on today's podcast is Daniel Friedman.

Indigo Marketing Agency

MARCH 20, 2025

Recession Concerns & Market Volatility: How Financial Advisors Should Communicate With Clients As financial advisors , youre well aware that so far the 2025 financial market has been more unpredictable than a toddler. Thats where financial advisors come in! The wrong way? Brace yourselves!

Nerd's Eye View

SEPTEMBER 30, 2024

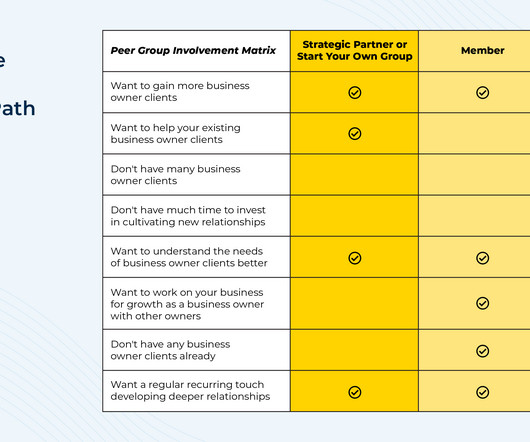

When it comes to focusing on a niche for financial advisors, business owner clients can be an appealing target as they can have complex financial planning problems ranging from cash flow management to tax planning to acquisition strategies.

Wealth Management

NOVEMBER 20, 2024

New tools automate the process of personalizing service and communications to improve the advisor-client relationship.

Wealth Management

APRIL 3, 2025

As client expectations evolve, estate planning is no longer an afterthought for financial advisors.

Nerd's Eye View

JANUARY 17, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that at a time when brokerage firms' cash sweep programs come under increased scrutiny (and as the Federal Reserve has cut interest rates), Charles Schwab (the largest RIA custodian) continues to slash sweep rates for client (..)

Nerd's Eye View

FEBRUARY 6, 2025

And at the same time, prospects are likely to feel vulnerable and equally nervous with their own set of concerns – how to present themselves to the advisor, what questions to ask, and how to explain their issues while still feeling competent. Read More.

Nerd's Eye View

JUNE 10, 2024

client retention rates remaining robust, and at least a bit of client referral growth trickling in. Which is leading to healthy profit margins at the typical advisory firm, as more and more advisors eye the possibility that AI will produce even more business efficiencies (and stronger profitability) in the year to come.

Nerd's Eye View

JANUARY 6, 2025

Welcome to the January 2025 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors! FINNY AI, an AI-powered prospecting tool, has raised $4.2

Nerd's Eye View

JANUARY 22, 2025

Financial advisors often engage with a variety of prospects, each with unique needs and motivations. Some prospects approach an advisor with an immediate 'problem to be solved', such as a fast-approaching retirement date. I help clients in retirement by doing X, Y, and Z.").

Nerd's Eye View

FEBRUARY 14, 2025

Which suggests firms that can meet clients' evolving needs as they advance up the wealth spectrum (e.g., Which suggests firms that can meet clients' evolving needs as they advance up the wealth spectrum (e.g.,

Wealth Management

JANUARY 17, 2023

As portfolio performance becomes the top concern among clients, one in four have either thought about switching, or switched, financial advisors in the last three years, a YCharts survey found.

Nerd's Eye View

FEBRUARY 25, 2025

Welcome to the 426th episode of the Financial Advisor Success Podcast ! Jennifer is the CEO of The Mather Group, an RIA based in Chicago, Illinois, that oversees $15 billion in combined assets under management and advisement for approximately 4,400 client households. Welcome everyone! Read More.

Wealth Management

APRIL 27, 2023

Getting advisors on board with building a social media presence will help leverage authenticity, grow thought leadership, ensure compliance and get to know clients on a new level.

Nerd's Eye View

JANUARY 22, 2024

In the early days of wealth management, a financial advisor's value proposition was relatively explicit, typically focusing on a limited range of portfolio management activities (e.g., Even with the best intentions, this disconnect can ultimately damage an advisor's perceived value over time.

Nerd's Eye View

NOVEMBER 4, 2024

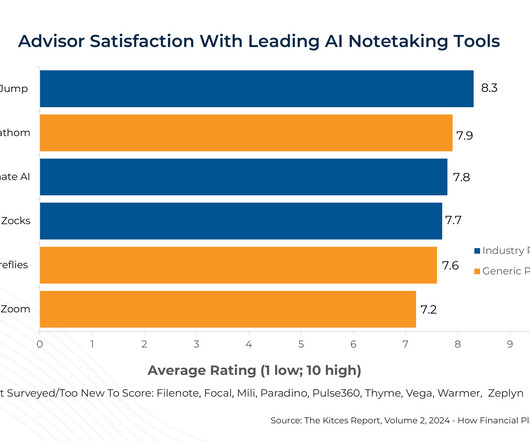

Welcome to the November 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Don Connelly & Associates

MARCH 17, 2025

Some advisors are natural communicators with inherent skills for demonstrating empathy, telling relatable stories, displaying a natural curiosity by asking open-ended questions, and translating complex ideas into terms clients can understand.

Indigo Marketing Agency

MARCH 17, 2025

How Ivn Mendoza Scored a $5 Million Call With Financial Advisor Marketing Services You might think our niche in financial advisor marketing services has a small audience. But did you know there are more than 241,225 financial advisors currently employed in the United States? But Mendoza was game.

Nerd's Eye View

JANUARY 24, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that while overall financial advisor headcount remains relatively flat, the RIA channel continues to gain share in terms of both headcount (as brokers break away to start their own independent firms and aspiring advisors seek (..)

Nerd's Eye View

APRIL 29, 2024

Financial advisors add value for their clients not only by helping them grow their wealth, but also by working with them to create a plan for how to use it. While much of this process may focus on the client's own lifetime planning needs (e.g.,

Wealth Management

MARCH 28, 2024

John Bowen describes the research from his team at CEG Worldwide regarding what high-net-worth clients want most from their advisors.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content