Why To Use George Kinder’s 3 Life Planning Questions With Financial Planning Clients

Nerd's Eye View

JULY 27, 2022

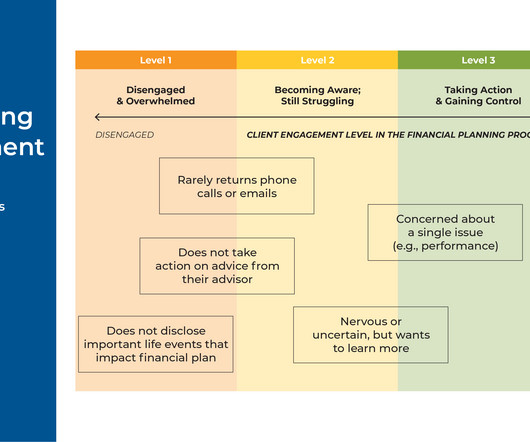

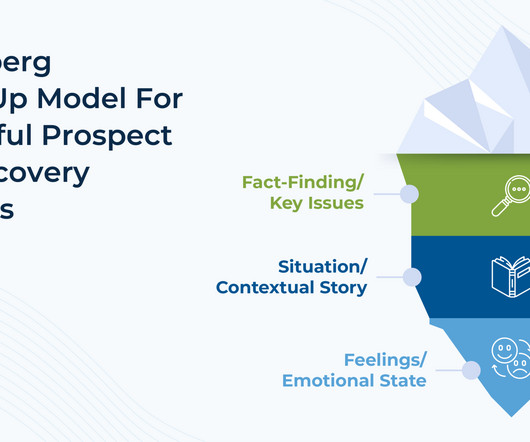

Financial planning is both an art and a science. While an advisor needs technical financial planning knowledge to create and implement plans for clients, soft skills that involve effective communication and relationship building are also crucial to both relate to prospects and clients and to understand their needs.

Let's personalize your content