ETFs Could Claim the Biggest Share of Client Portfolios by 2026

Wealth Management

JUNE 25, 2024

A new report from Cerulli & Associates finds the retail financial advisor channel has been the biggest growth driver behind ETFs.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 25, 2024

A new report from Cerulli & Associates finds the retail financial advisor channel has been the biggest growth driver behind ETFs.

Wealth Management

JUNE 26, 2024

is expanding further into private-markets investing, striking a new partnership to include the assets alongside traditional ETFs and mutual funds in model portfolios pitched to wealthy US retail clients. (Bloomberg) -- BlackRock Inc. The firm will w

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Wealth Management

SEPTEMBER 6, 2022

Asset managers and technology firms are luring retail advisors into alts with easier access and promises of diversification and enhanced returns. Here's what advisors themselves think about broadening their client portfolios.

Random Roger's Retirement Planning

MARCH 15, 2025

You're 81 and been taking income from your portfolio for 15 years, what matters to you more, that you can continue to take what you need from your portfolio or that four year run in your mid-50's when you beat (or lagged) the market? If you're 81 and can no longer meet your income need from your portfolio, that is what matters.

Random Roger's Retirement Planning

FEBRUARY 11, 2025

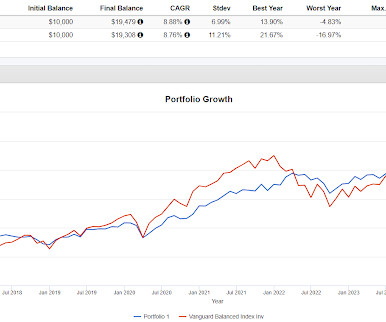

Morningstar did a quick writeup on model portfolios. The article wasn't too insightful but there was an example of a model portfolio and then an example of how to customize that same model. All I tried to do was simplify the portfolio, not do anything to improve it. Should a model portfolio have any sort of differentiation?

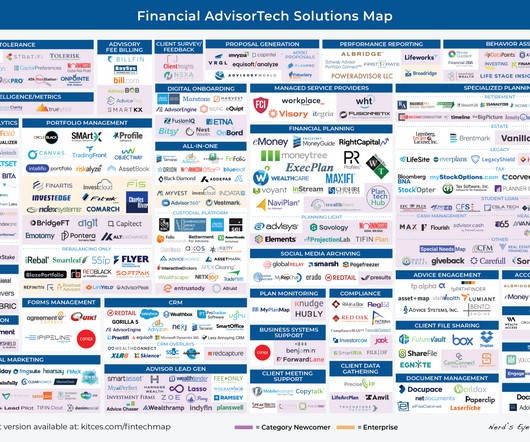

Nerd's Eye View

MAY 1, 2023

This month's edition kicks off with the news that robo-advisor Betterment entered into a $9M settlement with the SEC for misrepresenting its tax-loss harvesting practices in its client agreements and marketing materials compared with its actual practices (e.g.,

The Big Picture

DECEMBER 4, 2024

But suddenly they find themselves sitting on an uncomfortably large percentage of their portfolio in a single name. To help us unpack all of this and what it means for your portfolio Let’s bring in Meb Faber He’s the founder and chief investment officer of Cambria. Perhaps they have some founder stock from a startup.

The Big Picture

DECEMBER 11, 2024

And on today’s edition of at the money, we’re going to discuss how Wall Street has been using personal health to gain a competitive advantage to help us understand all of this and its implications for your portfolio. How does that show up in our portfolios? Not only does that show up in our portfolios.

The Big Picture

NOVEMBER 26, 2024

His firm runs over $10 billion in client crypto assets. And find the entire musical playlist of At the Money on Spotify Responsible Crypto Investing Matt Hougan How should retail investors responsibly think about crypto? To help us unpack all of this and what it means for your portfolio, let’s bring in Matt Hogan.

Trade Brains

SEPTEMBER 22, 2023

It also offers comprehensive health check-up packages for men, women, senior citizens, young people, and corporate clients. Fungicides, herbicides, insecticides, plant growth regulators, rodenticides, and speciality crop chemicals are all included in the company’s crop protection portfolio. The company presence in 7 countries.

Trade Brains

SEPTEMBER 17, 2023

Top Indian Stocks Held By Goldman Sachs : Goldman Sachs has been serving clients in India since the 1980s and established an onshore presence in Bengaluru, in 2004, Mumbai, India in December 2006 and a new office in Hyderabad opened in 2021 following a ten-year joint venture. 2,977 crore to Rs. 3,382 crore. 65 crore to Rs. Market Cap (Cr.)

Trade Brains

SEPTEMBER 26, 2023

Top Indian Stocks Held By Morgan Stanley : With more than 29 years of experience in India, Morgan Stanley offers both domestic and foreign clients a range of services. Key clients including Power Grid Corp., The post Top Indian Stocks Held By Morgan Stanley – Portfolio Analysis! Market Cap (Cr.) 17,991 EPS (TTM) 13.24

The Big Picture

DECEMBER 1, 2023

ETF.com ) • The annoying — and hard to solve — problem of stolen packages : A thoroughly modern nuisance for consumers, shippers, and retailers alike. ( Vox ) • New Billionaires Are Inheriting More Wealth Than Creating It — And Shaking Up Portfolios : Over the coming decades, about a thousand billionaires will pass on an estimated $5.2

Trade Brains

NOVEMBER 11, 2023

The firm provides its services to equity and fixed-income investment groups, investment pooling vehicles, mutual funds, and separate account institutional clients. Its domestic broadcast portfolio includes over 48 channels. The Company’s 41-channel international broadcast portfolio is available in over 170 countries.

Trade Brains

SEPTEMBER 28, 2023

The company employs 4000+ personnel across 8 states and is also the 1st Listed multi-brand, multi-location Indian Auto Retailer In FY23, the company’s revenue grew 14% YoY, from Rs. The company’s key clients include Deutsche bank, Standard Chartered, ICICI bank, Axis Bank, State Bank of India and Yes Bank. EPS (TTM) 20.97 3,382 crore.

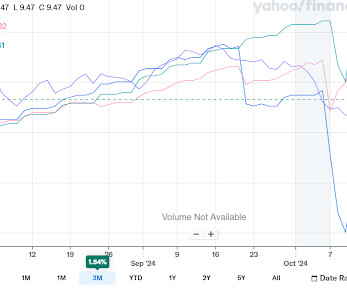

Random Roger's Retirement Planning

FEBRUARY 12, 2025

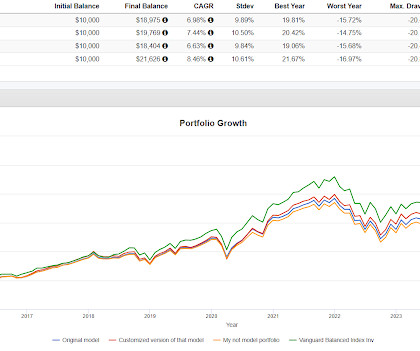

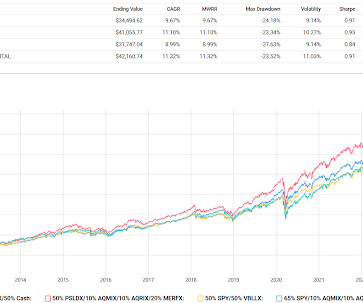

The timeframe in today's chart is more useful because it gets into the period where retail accessible funds started to become available. I used AQMIX, AQRIX and client/personal holding MERFX because they've all been around for a while and BTAL is also a client/personal holding. I think some of the portfolio stats are distorted.

Random Roger's Retirement Planning

MAY 15, 2023

I have no idea what SYK will do going forward, I don't own the stock personally or for clients, but if you are allocating to some sort of healthcare theme in your portfolio then chances are being right or wrong won't prove out in just a few months. Put differently, that sort of attribute would add volatility to the portfolio.

Trade Brains

OCTOBER 4, 2023

The textiles industry, which sells fabrics, clothing, and fabric retail, contributes to revenue. The company’s clients include Tata Steel, BHEL, ONGC, HAL, SCCL, NTPC, ISRO and Others. The post Top Stocks Held by Quant Small-Cap Fund – Portfolio Analysis appeared first on Trade Brains. Market Cap (Cr) 1,387.6

The Big Picture

SEPTEMBER 12, 2022

They run over $800 billion in client assets, and Kristen’s group, the North American Group, is responsible for about half of the revenue that that massive organization generates. And it was this combination of being, like I said, kind of geeky, kind of quanti, but then being client-facing. I want to be client-facing.

Advisor Perspectives

DECEMBER 2, 2023

Collateralized loan obligations, or CLOs, may be a way for advisors to enhance retail clients’ portfolios. While they have been primarily used by institutional clients to date, CLOs could enhance risk-adjusted returns for individual clients.

Random Roger's Retirement Planning

DECEMBER 22, 2023

With that preamble, I started thinking about the 75/50 portfolio that I first started writing about during the Financial Crisis. I've mentioned 75/50 a couple of times in passing but the big idea was to create a portfolio that captures 75% of the upside of the equity market with only 50% of the downside. ARBFX 3.7%

Nationwide Financial

DECEMBER 1, 2022

A quickly accelerating inflation rate coupled with periods of unprecedented market volatility and negative returns have many clients holding large portions of their assets in cash — particularly in money markets. Another poll 3 shows that these concerns already have clients adjusting their behaviors across their everyday lives.

eMoney Advisor

APRIL 13, 2023

In its Retail Banking: 2025 and Beyond report, PwC analysts explore five possible versions of the sector’s future. Closer Than Ever to Clients “We are incredibly bullish on the future of financial advice.” Part of that equation includes client-facing tools that promote engagement with their planning.

Random Roger's Retirement Planning

DECEMBER 3, 2024

YTD SSO is up 51% versus 26% for the S&P 500 and down 19% for SH which I am currently holding for clients. As an advisor of retail sized clients, there's no reason to add the complexity of a 2x long S&P 500 ETF even if the idea was not to leverage up. And we'll close with a change in fund strategy from Bitwise.

Advisor Perspectives

OCTOBER 30, 2023

Calamos Investments and Aksia joined forces this year to launch the Calamos Aksia Alternative Credit and Income Fund (CAPIX), an interval fund designed to provide advisors and their clients access to private debt investments – most of them historically only accessible to institutions – with the liquidity investors demand.

The Richer Geek

JUNE 14, 2023

APMEX is one of the largest retailers of physical gold, silver, platinum and palladium, and has sold over $15 billion in product over its 20+ year history. In this episode, we’re discussing… [1:29] Investing in gold and silver [4:05] Why is diversification important for your portfolio? [6:09] Today we have Patrick Yip.

Random Roger's Retirement Planning

MARCH 3, 2025

The obvious flow from almost 20 years ago was that retail accessible products, mostly ETFs, would evolve to offer more sophisticated strategies making it easier to neutralize stock market volatility without necessarily having to sell to get more defensive. On Friday, I added gold to client accounts with GLDM. What is yours?

Random Roger's Retirement Planning

OCTOBER 29, 2024

Fund provider Tidal/ETF Masters, more of a white label than an actual provider, had a fun article titled Building A Financial Independence/Retire Early Portfolio With ETFs. The article spells out several alternative strategies to build out a portfolio once you achieve FIRE.

Fortune Financial

APRIL 22, 2023

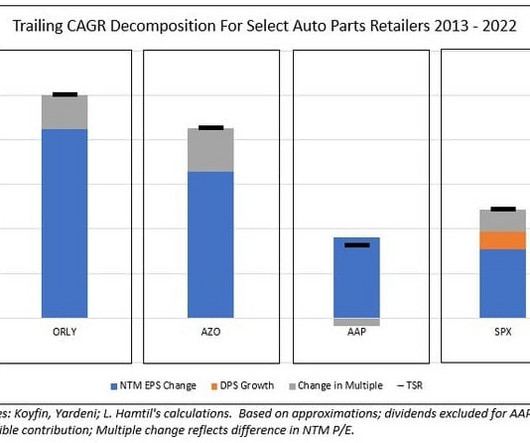

Even Advance, generally accepted as the weakest of the large chains grew earnings per share at an above-market rate: Despite the low growth environment for auto parts retail, it is critical to point out that there is a somewhat unique tailwind to this category which is that the industry is generally cycle-agnostic.

Validea

APRIL 14, 2023

In a second consecutive week of outflows, Bank of America clients sold off around $2.3 The withdrawals were from equities of all sizes, during a relatively quiet week in the stock market, and came mainly from institutional, retail, and hedge-fund clients. for a globally diversified 60/40 portfolio. billion in U.S.

Random Roger's Retirement Planning

OCTOBER 25, 2022

With all the time we've spent learning about new alternative strategies (new in that they've become accessible in funds for retail sized accounts) and how to incorporate them into a diversified portfolios, I thought it might be worthwhile to revisit a couple of older school alternatives to see how they're doing through the current event.

Random Roger's Retirement Planning

NOVEMBER 27, 2023

Portfolio replication is a tricky thing that frequently doesn't work. We look at a lot of different ideas here, whether we are talking about replication or not, not to simply copy what someone else is doing but to see if some random strategy might have some piece of process or an idea to incorporate in a way that adds value to our portfolio.

Validea

OCTOBER 18, 2022

And while tax season is still half a year away, it’s a good time to start considering options for what’s known as “tax-loss selling”—offloading a stock at a loss in order to offset gains somewhere else in your portfolio.

Trade Brains

OCTOBER 9, 2023

Shareholdings and portfolio as of June 30, 2023, for the GOVERNMENT OF SINGAPORE. The residential, commercial, retail, property management, and hospitality sectors are all included in The Prestige Group’s property portfolio. The company has 400+ active clients, 6,000+ scientists, 400+ patents, and 2.2 ROE (%) 13.73

Advisor Perspectives

OCTOBER 27, 2023

Private credit is being sought—with the goals of income and capital preservation—to achieve real capital growth and drive portfolio returns among retail and institutional clients alike.

The Big Picture

DECEMBER 6, 2022

when I first moved from Spain, and I learned a lot because I spent a lot of time with financial advisors, which, as you know, is a key segment of our client base today. And definitely, their retail market participation is significantly lower than you can see in the U.S. Is that the clients you’re aiming for?

Fortune Financial

AUGUST 7, 2023

Are Alternative Investments the Key to Diversifying Your Portfolio? Commercial properties, such as office spaces or retail buildings, can offer higher potential returns. If you prefer a more indirect approach, Real Estate Investment Trusts (REITs) allow you to invest in a portfolio of properties without the hassle of direct ownership.

Fortune Financial

AUGUST 7, 2023

Are Alternative Investments the Key to Diversifying Your Portfolio? Commercial properties, such as office spaces or retail buildings, can offer higher potential returns. If you prefer a more indirect approach, Real Estate Investment Trusts (REITs) allow you to invest in a portfolio of properties without the hassle of direct ownership.

Random Roger's Retirement Planning

SEPTEMBER 3, 2023

The advantage then might be it lowers overall portfolio volatility but the disadvantage might be that it won't offer much protection if it drops 2% in a 30% drawdown for the broad equity market. I've been using alts in client portfolios since before the Financial Crisis but am still plenty skeptical. I just don't think it works.

Risk Management Guru

APRIL 21, 2020

Why portfolio diversification is for the ignorant investor. This is often mentioned in the world of investing where clients trust their advisors to spread their money over a hundred stock funds among other asset classes such as bonds and commodities to protect their customers against risk. of the principal invested in Canada.

Random Roger's Retirement Planning

SEPTEMBER 2, 2022

We've mentioned Jason a couple of times this summer, most prominently in this post about a portfolio concept they came up with called The Cockroach Portfolio. He said they are way too complex, he'd just build them a simple ETF portfolio an then rebalance a couple of times per year. Here are the results.

Trade Brains

JANUARY 18, 2023

Peter Lynch, an American investor, and mutual fund manager who is known for his stock-picking skills, attributed his success to a small number of these stocks in his portfolio. Diversification provides stability to a portfolio and balances risks. He coined the terms “multi-baggers” and “ten baggers”.

Trade Brains

JUNE 14, 2024

It plays a crucial role in providing full service commercial banking which involves catering to retail, MSME (micro, small and medium enterprise) and corporate clients. In FY 2022-23, YES BANK’s retail advances climbed to 45%, up from 24% in FY 2019-20. It has its headquarters in Mumbai, Maharashtra.

The Big Picture

SEPTEMBER 19, 2023

Elizabeth Burton is Goldman Sachs asset management’s client investment strategist. Her job is portfolio and product solutions and that means she could go anywhere in the world and do anything. And so I often would look at investments in my portfolio that may be different from what most other people put in their portfolios.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content