Firms Not Offering Tax, Retirement Planning Are Getting it Wrong

Wealth Management

OCTOBER 4, 2023

Advisors are overdelivering services such as health care, estate and business planning, while falling short in the areas their clients most desire.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

OCTOBER 4, 2023

Advisors are overdelivering services such as health care, estate and business planning, while falling short in the areas their clients most desire.

Nerd's Eye View

JANUARY 31, 2025

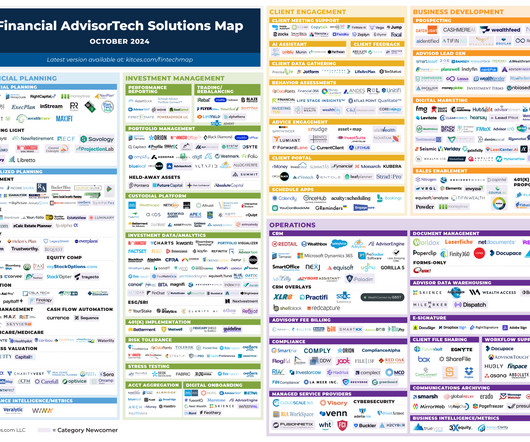

Also in industry news this week: While RIA M&A deal flow hit record levels in 2024 (both in terms of volume and the speed of completing them), firm valuations saw relatively modest gains In its latest annual regulatory oversight report, FINRA joined the SEC in flagging the potential risks to firm and client data from the use of third-party vendors (..)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Nerd's Eye View

APRIL 8, 2025

Seth is the founder of Heartwood Financial Planning, an advisory firm affiliated with PlanMember Securities Corporation that is based in Fresno, California, and oversees approximately $100 million in assets under management for 850 client households.

Nerd's Eye View

MARCH 28, 2025

Which suggests that, amidst ongoing debate over fiduciary-related regulations, an advisor's status as a fiduciary could both lead to greater client trust (both in their individual advisor relationship and perhaps in the financial advice industry as a whole) and, ultimately, higher client retention rates.

Nerd's Eye View

NOVEMBER 29, 2024

Which could prove to be a boon for the financial advice industry as more consumers are willing to entrust their assets to an advisor (while at the same time possibly making it tougher for some advisors to differentiate themselves primarily by how they put their clients' interests first?). Read More.

Nerd's Eye View

DECEMBER 27, 2024

The report suggests this might be due in part to increased RIA valuations and the assumption of some firm founders that next-generation employees won't be financially able to buy out the firm from them, though additional data indicates that many firms don't have career paths in place that could help next-generation advisors envision their path to firm (..)

Nerd's Eye View

SEPTEMBER 29, 2022

a state’s income tax rules can have a significant impact on where they might choose to live. That’s because many states (including those typically labeled as “high-tax”) feature a slew of different tax breaks that can significantly reduce the tax burden for retirees in those states.

The Chicago Financial Planner

FEBRUARY 8, 2023

You’ve paid Social Security taxes over the course of your working life and you’ve earned these benefits. Many retirees and others collecting Social Security wonder about the tax treatment of their benefit. The answer to the question in the title is that your Social Security benefits may be subject to taxes.

Abnormal Returns

FEBRUARY 24, 2025

morningstar.com) Carl Richards and Michael Kitces on whether a client should take time before coming on as a client. thinkadvisor.com) Cutting IRS workers is going to make life more difficult for tax preparers (and payers). How to do better for clients. kitces.com) Working with UNHW clients is more complex.

Nerd's Eye View

AUGUST 2, 2023

Which means that financial advisors can play an important role in adoption planning – helping clients strategically plan for the costs involved in the process, including accessing tax credits that can significantly defray these expenses. Read More.

Nerd's Eye View

MAY 17, 2023

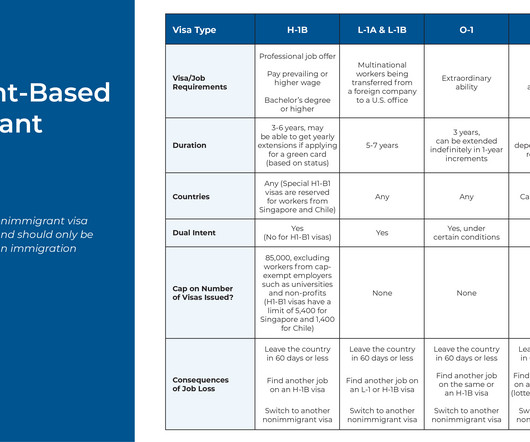

Like native-born workers, foreign workers need to think about saving for retirement, planning for their children’s college, managing healthcare costs, and all manner of other financial goals. For example, the tax benefits of certain accounts can sometimes work in the other direction if a non-U.S.-born Read More.

Nerd's Eye View

OCTOBER 7, 2024

This month's edition kicks off with the news that digital estate planning platform Wealth.com has raised a whopping $30 million in Series A funding, following on the heels of Vanilla's follow-on $20M capital round just a few months ago – which on the one hand reflects the anticipated enthusiasm for solutions that can help advisors efficiently (..)

Abnormal Returns

JANUARY 15, 2024

riaintel.com) HNW clients want additional services. citywire.com) Taxes There simply aren't enough tax preparers to go around. obliviousinvestor.com) It's hard to say you are a holistic financial adviser without tax management. thinkadvisor.com) Retirement Baby Boomers were supposed to retire in penury.

Nerd's Eye View

MARCH 13, 2024

Most of the time, people are subject to state taxes in the states where they live and/or earn their income. So when moving to a lower-tax state or another, their income tax burden likewise shifts to the new state along with them.

Nerd's Eye View

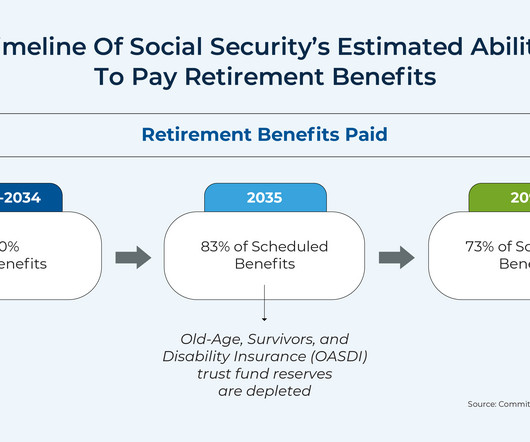

OCTOBER 2, 2024

In this environment, financial advisors have the opportunity to add value for their clients not only by giving a clear explanation about the current status of Social Security and the potential legislative changes that could improve its solvency, but also by modeling what (realistic) changes would mean for their clients' financial plans.

Nerd's Eye View

JANUARY 26, 2024

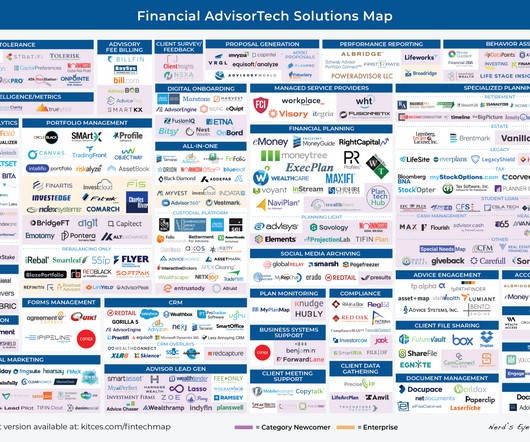

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news of a survey indicating that about 90% of financial advisors would switch firms based on bad technology at their current firm, and that 44% have already done so.

Million Dollar Round Table (MDRT)

APRIL 1, 2025

Would you rather give that amount directly to the organization or withdraw $100,000, pay $40,000 in taxes and have only $60,000 of your contribution left to donate? Obviously, youd choose to avoid taxes and give the full amount, especially if that approach brought additional tax benefits with it. Note: This only applies to U.S.-based

Carson Wealth

MARCH 28, 2024

Retirement planning is a journey that generally takes decades to complete and most of us start out along the do-it-yourself path. More than likely, your first step was to enroll in an employer-provided plan such as a 401(k) or setting up an individual retirement account, also known as an IRA.

Nerd's Eye View

NOVEMBER 1, 2023

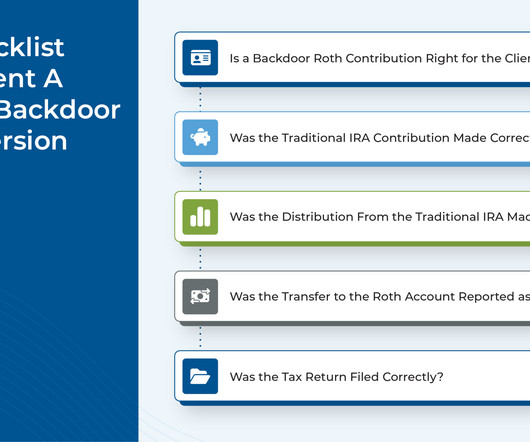

There are many tax planning strategies that allow financial advisors to demonstrate the ongoing value they provide to clients in exchange for the fees they charge. The backdoor Roth strategy can be valuable for clients whose high income levels preclude them from making regular contributions to a Roth IRA.

Harness Wealth

APRIL 16, 2025

Let us face ittech startups encounter a unique set of tax challenges that can make or break their financial future. The complex interplay between traditional tax regulations and the innovative nature of tech businesses demands smart planning from day one.

Abnormal Returns

NOVEMBER 6, 2023

Podcasts Brendan Frazier on how your clients change will inevitably over time. citywire.com) Creative Planning is expanding its reach in the retirement plan space. papers.ssrn.com) Taxes A 2023 year-end tax planning guide. citywire.com) Choreo is buying the wealth management business of BDO USA.

Abnormal Returns

APRIL 1, 2024

(youtube.com) Christine Benz and Amy Arnott talk with Peter Mallouk, President and CEO of Creative Planning, about the 'messy' business of financial advice. morningstar.com) Thomas Kopelman and Jacob Turner talk with Ankur Nagpal about tax considerations when selling a business. thinkadvisor.com) Not everyone is happier in retirement.

Nerd's Eye View

FEBRUARY 8, 2023

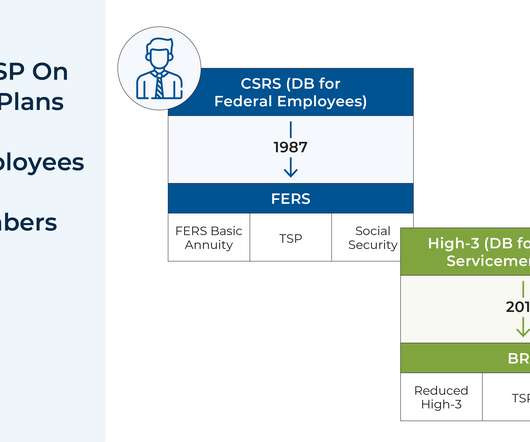

Seasoned financial advisors have likely worked with clients with a wide variety of workplace retirement accounts, which can vary in terms of their investment offerings, fees, and other characteristics. But given that the U.S.

Nerd's Eye View

MAY 1, 2023

This month's edition kicks off with the news that robo-advisor Betterment entered into a $9M settlement with the SEC for misrepresenting its tax-loss harvesting practices in its client agreements and marketing materials compared with its actual practices (e.g.,

Nerd's Eye View

NOVEMBER 4, 2022

Morningstar has joined an increasingly competitive market of direct indexing platforms for advisors and their clients. From there, we have several articles on investment planning: While I Bonds have received significant attention during the past year, TIPS could be an attractive alternative for many client situations.

Nerd's Eye View

SEPTEMBER 6, 2022

Andy is the owner of Tenon Financial, a virtual independent RIA that oversees $70 million in assets under management for 43 retired client households.

Nerd's Eye View

DECEMBER 23, 2022

”, a series of measures that will have significant impacts on the world of retirement planning. A review of financial planning actions, from tax-loss harvesting to charitable giving, that have a December 31 deadline.

Nerd's Eye View

OCTOBER 1, 2022

A new bill would make many parts of the Tax Cuts and Jobs Act of 2017 permanent, including its changes to tax brackets, the higher standard deduction, and the cap on state and local tax deductions. What advisory firms can do to make the most out of client testimonials and avoid negative reviews on third-party websites.

Nerd's Eye View

DECEMBER 25, 2023

And as 2023 draws to a close, we wanted to highlight 25 of the most popular and insightful articles that were featured throughout the year (that you might have missed!).

Nerd's Eye View

NOVEMBER 23, 2022

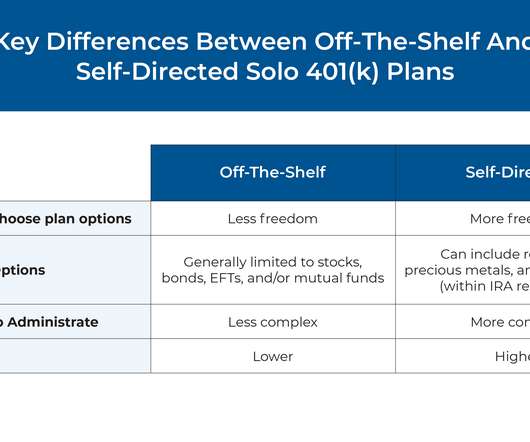

Among the several different types of retirement plans that are available to self-employed workers, solo 401(k) plans can offer the most flexibility and the ability to contribute the highest amount of tax-advantaged savings. Read More.

Harness Wealth

MARCH 7, 2025

This weeks Tax Advisor news roundup covers key updates for financial professionals. Last but not least, we have a rundown of the IRSs ‘Dirty Dozen’ tax scams for 2025. Wealth Taxes in Europe, 2025 ( Cristina Enache , Tax Foundation) Net wealth taxes are recurrent taxes on an individuals wealth, net of debt.

Nerd's Eye View

OCTOBER 20, 2023

Also in industry news this week: The latest update on the status of the Department of Labor's proposed regulation related to fiduciary advice on retirement accounts and why the agency is referring to it as a "retirement security rule" rather than a "fiduciary rule" A report suggests that RIA M&A surged in the 3rd quarter, as large acquirers resumed (..)

Harness Wealth

MARCH 6, 2025

Freelancers and contractors may enjoy greater flexibility and independence than full-time employees, however, this autonomy brings increased tax responsibility. Unlike W-2 employees, freelancers and independent contractors are responsible for managing their own tax obligations, which can be a complex process.

Abnormal Returns

AUGUST 5, 2024

kitces.com) Taxes Following the RMD rules for inherited IRAs may not be optimal. investmentnews.com) On the importance of tax planning in the first few years of retirement. nber.org) Advisers Stellar client care requires the right metrics. papers.ssrn.com) Four steps to create a digital estate plan.

Harness Wealth

JANUARY 29, 2025

April 15 marks the IRS tax return filing deadline for 2025. Although this is the traditional tax filing deadline, given the spate of recent natural disasters (such as the California wildfires and Hurricane Milton), the IRS is granting certain filing and payment extensions beyond this date.

The Chicago Financial Planner

FEBRUARY 2, 2024

One of the tactics used by Bernard Madoff to perpetrate his fraud was to send clients his own statements instead of statements generated by a third-party custodian like Charles Schwab, Fidelity, TD Ameritrade, and others. Ask your financial advisor about their client base. Where will my money be housed? What can you do for me?

Million Dollar Round Table (MDRT)

JUNE 27, 2023

We want our clients, our prospects and those who refer us to understand what we’re great at and that we’re specialists in that field, much like cardiologists are specialists in their field. Our clients have specific problems and fit a specific profile. Of course, it boosts the amount of money clients are saving for retirement.

Indigo Marketing Agency

FEBRUARY 8, 2025

Marketing for Financial Planners: Strategies to Build Trust and Grow Your Client Base Strategic Client Growth: Win Trust in a Trust Economy More than many other fields, trust is truly the currency that drives growth for financial planners. But thats not even the biggest challenge you face with winning more clients.

Carson Wealth

JULY 3, 2024

Get Help with Tax Planning Tax planning is a critical component of financial management. Proper tax planning can save your business money and ensure compliance with regulations. More importantly, be prepared to pay the proper taxes throughout the year.

Carson Wealth

DECEMBER 8, 2023

That must mean it’s time to roll up my sleeves and get to work on year-end financial planning – with an emphasis on 2023 income tax. One consideration this year is that we’re two years from the expiration of the Tax Cuts and Jobs Act of 2017 (TJCA). AGI impacts multiple other tax considerations.

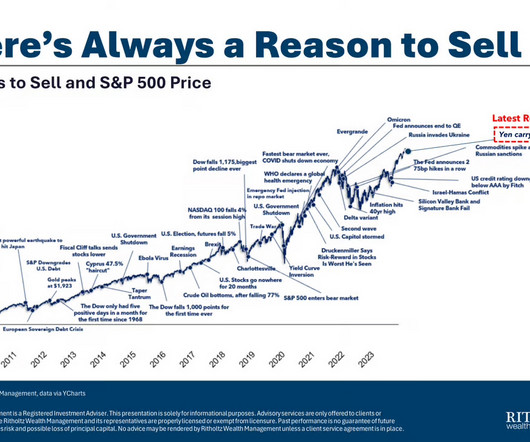

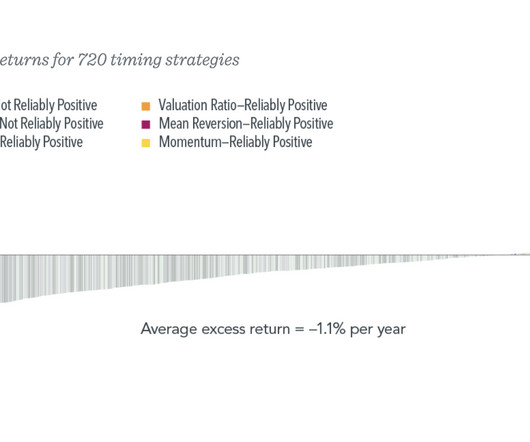

The Big Picture

NOVEMBER 27, 2023

This is before we get to the issue of capital gains taxes, which create a hurdle of (minimum) 20% on those pesky profits just to get to breakeven. When you get it wrong, it crushes your retirement plans. Let’s add some color to the discussion on timing itself and add a little nuance.1

Darrow Wealth Management

NOVEMBER 17, 2022

In November 2022, proponents of the Massachusetts ‘millionaires’ tax (question 1) won their bid to nearly double the income tax rate on individuals with taxable income over $1M a year. As proposed, the new legislation would increase these tax rates to 9% and perhaps even 16% , respectively, starting in 2023.

FMG

MARCH 3, 2025

For financial advisors, this means more visibility, more potential clients, and stronger professional connections. For example, if you post about how you helped a client save for their childs college education, ask followers to share their own financial wins or challenges. Whats your biggest question about retirement?

Nerd's Eye View

DECEMBER 13, 2023

Although numerous tax-advantaged vehicles are available for retirement savings, Health Savings Accounts (HSAs) have particular benefits for individuals saving for retirement. This can allow individuals to save a significant amount that can be withdrawn tax-free for medical expenses later in retirement.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content