QSBS Valuation for Enhanced Estate And Tax Benefits

Wealth Management

MAY 21, 2024

A cornerstone in strategic planning to optimize clients’ financial legacies.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

MAY 21, 2024

A cornerstone in strategic planning to optimize clients’ financial legacies.

Nerd's Eye View

OCTOBER 14, 2024

Many employee advisors gravitate toward service-oriented roles; this preference often stems from their initial motivation for entering the profession – wanting to help clients or perform the more analytical aspects of investing and financial planning. Rarely do they enter the field to be in a sales or marketing role.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Nerd's Eye View

SEPTEMBER 2, 2022

From there, we have several articles on investments: How Morningstar plans to simplify its rating system amid continued concerns about its effectiveness. Why private placement life insurance policies could become an increasingly popular option for ultra-high-net-worth clients.

Nerd's Eye View

AUGUST 2, 2023

Which means that financial advisors can play an important role in adoption planning – helping clients strategically plan for the costs involved in the process, including accessing tax credits that can significantly defray these expenses. Read More.

NAIFA Advisor Today

JANUARY 23, 2025

Mark Willis, CFP , is a dedicated financial professional and the founder of Lake Growth Financial Services , located in St. Charles, IL. Since entering the financial services industry, Mark has been driven by a deep passion to help individuals and families achieve their financial goals and create lasting security.

Nerd's Eye View

MARCH 28, 2023

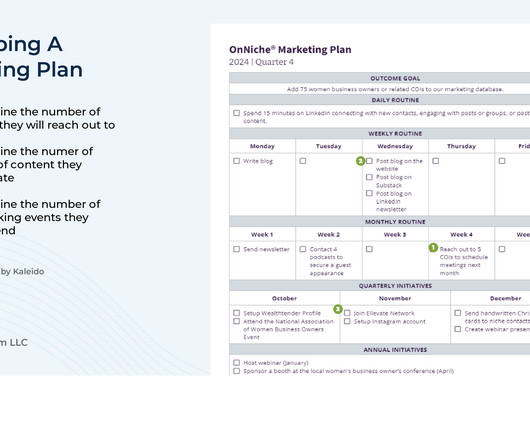

What's unique about Erica, though, is how she built a series of spreadsheet tools to measure the details of each step of her advisory firm’s marketing funnel, from lead generation to each meeting in the sales process to client onboarding and getting initial revenue for the firm… and then turned it into a series of tools that any advisory (..)

Nerd's Eye View

NOVEMBER 17, 2022

And by identifying how to break up their process into smaller, more manageable steps and keeping the potential failure of each particular step in perspective, advisors can more easily see their plan through.

Brown Advisory

APRIL 19, 2022

The Family Mission Statement and Strategic Plan jharrison Tue, 04/19/2022 - 16:38 Download the Report We believe a family mission statement – and a strategic plan to implement that mission – allows a family to filter out the “background noise” of day-to-day challenges and focus on long-term goals and objectives.

Million Dollar Round Table (MDRT)

AUGUST 30, 2022

By Matt Pais, MDRT Content Specialist With seven advisors and six support staff in the office, Carrie Rae Mullins recognizes how essential it is to get some space – away from client meetings, operations questions and more – for strategic planning.

Harness Wealth

NOVEMBER 27, 2023

Within the accounting profession, Client Accounting Services (CAS) has emerged as a pivotal offering for entrepreneurial CPAs wishing to help their clients with more than just annual tax filings. Table of Contents What are Client Accounting Services (CAS)? What are Client Accounting Services (CAS)?

The Big Picture

FEBRUARY 21, 2023

And certainly for us, that has been a time to show up and answer the bell for our clients. I mean it was a company owned by its clients with a clear purpose to really give them a fair shake and provide them with a better future. We looked at client success, it was defined by the funds they hold, but also by the advice they got from us.

Steve Sanduski

FEBRUARY 6, 2023

Pam Perskie is the Founder and CEO of Seven Mile Advisory , a multi-family office that works with clients who have significant financial complexity, including business owners, private equity professionals, real estate investors and operators, professional athletes, and entertainers. The multi-family office structure. Minimums could be higher.

Steve Sanduski

AUGUST 27, 2024

How to create a strategic plan and hold team members accountable for following through. Integrating key strategic initiatives into paths to promotion and succession planning. Focusing on an ideal client persona and origin stories to enhance your website, branding, and marketing. So this is all about marketing.

Brown Advisory

NOVEMBER 1, 2023

At Brown Advisory, we have a similarly single-minded mission—to help clients chart their long-term path of progress—and we want to help them develop clear and unmistakable mission statements of their own. Such a plan should address: Empowerment : How will family members be empowered to advance the family mission?

SEI

AUGUST 16, 2022

Strategic planning. Kevin is a Financial Services Sales Executive with a proven track record of establishing and cultivating strategic partnerships in the investment, insurance, trust, legal, and accounting communities. Director of Sales. Kevin Kline SEI Sphere. IT Professionals (ITS). IT professionals (US). kkline@seic.com.

Brown Advisory

FEBRUARY 23, 2022

We are by no means experts, but we have invested substantial time and effort reflecting on how to bring our colleagues back to the office in the most effective, safest way possible, for the benefit of our clients, our colleagues and our culture. Topics will included: • How to structure the earn out.

Brown Advisory

FEBRUARY 23, 2022

We are by no means experts, but we have invested substantial time and effort reflecting on how to bring our colleagues back to the office in the most effective, safest way possible, for the benefit of our clients, our colleagues and our culture. Planning for Your Liquidity Event and Beyond. Thursday, May 6, 2021. Approaching the Exit.

Steve Sanduski

AUGUST 2, 2023

And everything the firm does — from its marketing initiatives and client experience to the people it hires and its succession plan — is organized around maintaining a steady stream of new business, strong independence, and happy clients. The differences between wealth management and financial planning.

Indigo Marketing Agency

AUGUST 13, 2024

Consider a financial advisor with 100 existing clients averaging $1M in assets each. Implementing automated tools for scheduling, client communications, and portfolio tracking can significantly reduce manual workload. responding to emails, creating content, or preparing client reports).

Harness Wealth

OCTOBER 23, 2023

Specialized areas can include estate planning and tax-efficient investment strategies. If you’re a CPA who works with clients on more than just annual tax returns, you’re likely already providing accounting advisory services.

FMG

AUGUST 1, 2023

We’re sharing Tuesday’s resources to help you better engage clients and prospects, no matter the channel you’re focused on. And it starts by figuring out what questions you want answered so that you can create a strategic plan. Learn more here. For topic ideas, read here. Well, struggle no more.

Elevating Your Business

AUGUST 23, 2022

A Mission Statement is about your clients, their results when they work with you, and the benefits of working with you. A Mission Statement is no longer than eight words. A Business Vision Statement paints a picture of your company goals and your growth. It’s usually a paragraph or a few sentences in length.

Brown Advisory

JULY 30, 2015

In a nutshell, that is what we strive to do at Brown Advisory: help our clients to be prepared. According to the Scouts, you should be prepared by “having thought out beforehand any situation that might occur, so that you know the right thing to do at the right moment.”.

Brown Advisory

SEPTEMBER 25, 2023

Six Considerations When Inheriting Wealth ajackson Mon, 09/25/2023 - 12:15 During our Women’s Listening Tour we heard from clients that they wanted to better understand what questions they should be asking during specific financial milestones, one of which could be inheriting wealth.

Brown Advisory

JUNE 15, 2022

During our Women’s Listening Tour we heard from clients that they wanted to better understand what questions they should be asking during specific financial milestones, one of which could be inheriting wealth. Six Considerations When Inheriting Wealth. Wed, 06/15/2022 - 12:15. Click Here to Download the Six Considerations. .

MarketWatch

MARCH 16, 2023

Jefferies analyst Ken Usdin said in a note to clients Thursday that he met with Citigroup Inc. While Citi is mindful of the more uncertain operating environment and current volatility, the bank’s overall strategic plan is intact, including its divestiture strategy, growth priorities, and cost reduction plans,” Usdin said.

Brown Advisory

JULY 28, 2022

In all cases, we believe that thoughtful and careful estate planning in conjunction a prenuptial agreement is best way to safeguard family assets. The Family Mission Statement and Strategic Plan. For a more comprehensive conversation, don’t hesitate to contact us. . MORE ON THIS TOPIC.

Steve Sanduski

AUGUST 22, 2023

Carving out a place for your firm is going to require a new level of clarity around both strategic planning and how you communicate what makes you unique to your team, clients, and prospects. Some of these firms are growing organically, many more are only growing at the rate of market returns.

Indigo Marketing Agency

JUNE 7, 2024

Financial advisors can leverage this tool to connect with clients, build trust, and grow their business. At Indigo, we help advisors craft tailored social media plans that align with their business objectives and client needs. Meaningful interactions can turn followers into clients.

Brown Advisory

MAY 4, 2020

When we are able to offer sound strategic advice on topics beyond investing—balance sheet management, donor engagement strategy, mission-related investing, leadership development, succession planning and many other issues—it can be as impactful for our clients as the work we do managing their investment assets.

Brown Advisory

SEPTEMBER 4, 2019

When we are able to offer sound strategic advice on topics beyond investing—balance sheet management, donor engagement strategy, mission-related investing, leadership development, succession planning and many other issues—it can be as impactful for our clients as the work we do managing their investment assets. BACKGROUND.

Brown Advisory

OCTOBER 12, 2023

Clarity and shared understanding are the two key principles that we seek to resolve when helping clients create a prenuptial agreement—and this is especially important in the case of a child getting married when their parents are seeking to protect that child’s inheritance.

Brown Advisory

NOVEMBER 28, 2022

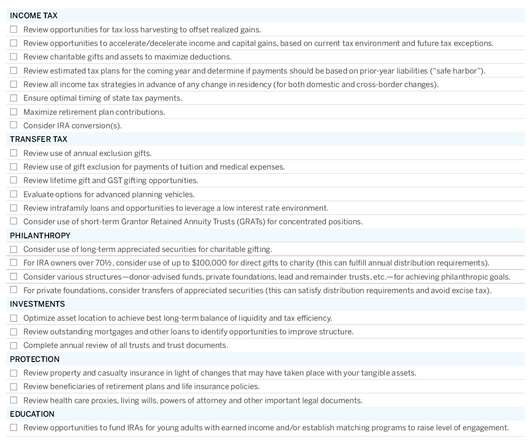

2022 Year-End Planning Letter: Reflections and Perspectives ajackson Mon, 11/28/2022 - 11:10 The end of the calendar year is traditionally a time of reflection, and for us it is a chance to sit with clients, review progress, discuss the events shaping the investment landscape, and revisit goals for both the near term and the long term.

Brown Advisory

NOVEMBER 28, 2022

2022 Year-End Planning Letter: Reflections and Perspectives. The end of the calendar year is traditionally a time of reflection, and for us it is a chance to sit with clients, review progress, discuss the events shaping the investment landscape, and revisit goals for both the near term and the long term. Mon, 11/28/2022 - 11:10.

NAIFA Advisor Today

MARCH 30, 2023

The series of events was created as part of NAIFA’s participation in Women’s History Month and to deliver on several aspects of its Diversity, Equity, and Inclusion initiative that is part of its 2025 Strategic Plan.

Brown Advisory

APRIL 20, 2022

To help meet this return objective, we find that our clients’ investment portfolios are becoming increasingly complex as a result of their reliance on private equity, real estate and other less liquid “alternatives” to sustain their growth objectives and, ultimately, their charitable objectives. Confirm the role of your board of directors.

Indigo Marketing Agency

JULY 10, 2024

Ask for Engagement, Don’t Wait for It The Problem: Posting content without encouraging interaction or engagement leaves potential client relationships underdeveloped. SEO helps your content rank higher in search engine results, making it easier for potential clients to discover you.

International College of Financial Planning

MARCH 9, 2024

Who is a Certified Financial Planner® Professional A Certified Financial Planner® (CFP®) professional is a beacon in the financial advisory landscape, offering unmatched expertise in financial management and strategic planning.

Brown Advisory

NOVEMBER 5, 2021

We recognize these factors are creating concern for many of our clients and, in some cases, a feeling that it is imperative to act before December 31. Formulating a plan to take the first incremental steps and assessing regularly are critical. But, there are other considerations to keep in mind, like changes in tax exposure.

Good Financial Cents

DECEMBER 14, 2022

Because much of an advisor’s job revolves around talking to clients and seeking new investment opportunities, excellent communication skills are essential in this role. Investment bankers also need to be able to work long hours, as they often have to travel to meet with clients. Senior Accountants. Investment Banker.

Brown Advisory

NOVEMBER 1, 2019

2019 Year-End Planning Letter. Each year, we send a letter to clients to help guide year-end planning discussions and to offer ideas for them to consider with their other advisors. Market conditions may be volatile, but our planning efforts are, as always, focused on stability and consistency. Fri, 11/01/2019 - 13:44.

Midstream Marketing

AUGUST 13, 2024

Key Highlights A good marketing plan is important for financial advisors. It helps them find ideal clients, build trust, and grow their business. This guide shows key strategies to build a financial advisor marketing plan. Introduction In financial services, finding the right clients requires a smart marketing plan.

WiserAdvisor

NOVEMBER 14, 2023

To conclude The essence of retirement planning lies in its ability to provide senior citizens with a blueprint for achieving financial stability, ensuring adequate healthcare, and realizing lifelong aspirations, ultimately leading to a comfortable retirement.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content