NAPFA Updates Membership Standards to Allow for Some Commissions

Wealth Management

JULY 5, 2023

The membership organization for fee-only advisors will now allow for a de minimis amount of commission business, as long as it's relinquished.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JULY 5, 2023

The membership organization for fee-only advisors will now allow for a de minimis amount of commission business, as long as it's relinquished.

Darrow Wealth Management

FEBRUARY 13, 2025

If youre looking for a fee-only financial advisor or wealth manager, its probably because you know fee-only advisors don’t sell products. Here are some ways to find the best fee-only financial advisor to suit your needs. Heres an explainer on the differences between fee-only and fee-based advisors.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

MainStreet Financial Planning

MARCH 7, 2025

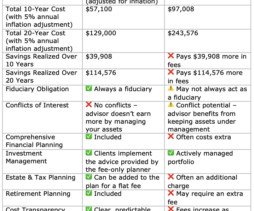

The two most common pricing models are fee-only financial planners (flat-fee or fixed-fee advisors) and AUM-based financial advisors (who charge a percentage of assets under management). While AUM advisors may seem appealing, they often come with high lifetime fees and potential conflicts of interest.

Nerd's Eye View

JUNE 30, 2023

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that NAPFA has announced that it will no longer exclude advisors who receive up to $2,500 in annual trailing commissions from previous product sales, if they agree to donate that money to a non-profit organization (..)

Nerd's Eye View

SEPTEMBER 13, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the SEC this week fined 4 RIAs for violations of its marketing rule related to their claims that they offered 'conflict-free' financial advice.

Darrow Wealth Management

NOVEMBER 4, 2024

Most fiduciaries don’t sell products: Most fiduciary advisors are only paid by a percentage of assets they manage for clients. This AUM based fee structure is common among fee-only advisors who are almost always full-time fiduciaries. NAPFA advisors are all fee-only financial advisors.

Nerd's Eye View

NOVEMBER 28, 2022

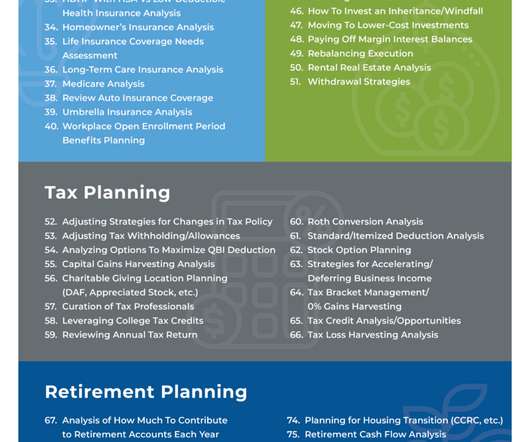

From advisors who earn commissions from the sales of financial products to fee-only investment advisors who charge based on client assets under management, the value advisors provide to their clients has often been centered on investment management.

Nerd's Eye View

NOVEMBER 28, 2022

From advisors who earn commissions from the sales of financial products to fee-only investment advisors who charge based on client assets under management, the value advisors provide to their clients has often been centered on investment management.

Nerd's Eye View

FEBRUARY 9, 2024

Also in industry news this week: A recent study finds that having a defined marketing strategy is a linchpin of marketing success, as advisors with a defined strategy were more likely to have seen an increase in inbound leads during the past 12 months and have more confidence in meeting their practice goals during the coming year than those without (..)

Yardley Wealth Management

MAY 30, 2023

The post What’s a Fiduciary & Fee-Only Advisor? What’s a Fiduciary & Fee-Only Advisor? A fiduciary and fee-only advisor is an expert who acts in your best interest and only charges a fee for their services. What is a Fee-Only Advisor? What is a Fiduciary?

Truemind Capital

JANUARY 24, 2025

Too many products: If your portfolio has more than 20 products in varied proportions, then there is a high likelihood that your advisor is selling you new and new products that pay higher commissions than the existing ones. Usually, equity products offer higher commissions than debt which offer higher commissions than Gold.

Inside Information

JULY 25, 2024

My subscription service is paid for by the user, just like fee-only advisors are paid by their clients. Their incentives and model are similar to commission-based advisors, whose service inevitably revolves around products that may or may not be in the best interests of their customers.

Nerd's Eye View

JULY 26, 2022

In this episode, we talk in-depth about how after working for years in the financial industry, Amy realized there was a missed opportunity in working with career-driven Gen X women like her and decided to focus on serving that type of clientele she knew so well, how the initial fear of launching a firm on her own initially led Amy to partner with another (..)

Walkner Condon Financial Advisors

APRIL 17, 2023

Fee-Only financial advisors and firms receive no sales-related compensation or incentives. They are compensated only by the fee the client pays. The amount of commission that a financial advisor receives can vary depending on the financial products they are selling and the company they are working for.

Leading Advisor

MARCH 20, 2024

Banning commissions related to financial products and services has been on the horizon for decades, and Fee-Based Fee-Only is inevitable. The Challenge with Transitioning from… The post The Ultimate Mindset and Script to Seamlessly Transition to Fee-Based Fee-Only appeared first on Leading Advisor - Simon Reilly.

Ron A. Rhodes

DECEMBER 13, 2023

It is possible that all commission-based compensation involving the sale of investment products, life insurance products, and annuities could be eliminated. And it would be right and just to do…

The Big Picture

SEPTEMBER 5, 2024

billion in fee only asset flows for the full year 2013; 37% of Morgan Stanley wealth management’s total client assets are now in fee based accounts a record high. Wells Fargo Advisors said at the end of 2013 it had $375 billion in managed account assets, roughly 27% of the $1.4

MainStreet Financial Planning

FEBRUARY 1, 2024

During recent conversations, I’ve come across several people unfamiliar with the concept of fee-only financial planning, let alone considering it as a feasible choice. Importantly, we do not accept sales commissions or any compensation beyond what is directly agreed upon with our clients.

Truemind Capital

AUGUST 23, 2024

We met a prospective client a few days ago and enlightened him about our 0% commission, conflict-free advisory model. The bank (and many wealth management firms) earns commissions when investors buy its products. We explained how commissions create a conflict of interest.

Sara Grillo

OCTOBER 21, 2022

Fee-only advisor – This is an advisor that does not charge commissions and hence is believed to be more aligned with the client’s best interests. Fee-only advisors are bound to the fiduciary standard. He knew before graduating fee-only was the path for him, his conscience, and his personality.

Walkner Condon Financial Advisors

APRIL 21, 2023

What does it mean to be a Fee-Only financial advisor ? Fee-Only financial advisors and firms receive no sales-related compensation or incentives. They are compensated only by the fee the client pays. Fee-based advisors are where it can get complicated. What does it mean to be a fiduciary?

Truemind Capital

AUGUST 9, 2024

The best way to solve this problem is by increasing the number of fee-only SEBI Registered Investment Advisors (RIAs) who by design think in the interest of clients. By regulation, RIAs can’t earn from commissions received from product companies.

WiserAdvisor

AUGUST 18, 2023

Below are the different types of financial advisors you can choose from based on their fee model: 1. Fee-only financial advisors Average cost: $200 to $400 an hour/ $1,000 to $3,000 per plan/ 1.18% to 0.59% of AUM Fee-only financial advisors are professionals who do not receive commissions from selling financial products.

WiserAdvisor

JULY 22, 2022

The advisors can be differentiated based on the fee structure they use to charge fees such as fee-only, commission-only, hourly-fee, monthly fee, etc. It may also be the case that the advisor pushes a particular investment in the hopes of earning a commission.

Ron A. Rhodes

JANUARY 6, 2024

The insurance lobby is against the imposition of the fiduciary standard by the DOL, as it will lower the excessive commissions often paid on the sale of Fixed Index Annuities…

Inside Information

JUNE 28, 2023

This is really none of my business, but I can’t help saying that I hate the new policy at the National Association of Personal Financial Advisors regarding trail commissions. We will have to cheapen the hard, strong language that we’re accustomed to using when we recommend working with a fee-only planner.

Your Richest Life

JULY 29, 2022

Your teen will receive their own debit card with no account fees, account minimum or trading commissions. At Your Richest Life, Katie Brewer, CFP®, believes you too should have access to financial resources and fee-only financial planning. Financial Literacy Books for Parents. About Your Richest Life.

eMoney Advisor

MAY 1, 2023

Regularly one of the highest-ranked NAPFA-registered fee-only financial advisors, he has set the bar for Zhang Financial characteristically high. ” Recently in the news for her appointment to the CFP Board’s new Competency Standards Commission, Yung is managing director at Midtown Financial.

International College of Financial Planning

AUGUST 2, 2021

There are two types of Financial Advisors in India – Fee-Only Advisors and Commission Only Advisors. Fee-only advisors need to be registered with SEBI certified financial advisors (Securities and Exchange Board of India) as an RIA (Registered Investment Advisor).

Carson Wealth

AUGUST 28, 2022

They are paid a commission by their underlying broker/dealer or insurance company when a customer purchases a product, such as a mutual fund, annuity or life insurance policy. . The commission is not paid directly by the consumer. Financial advisors who only charge fees might categorize themselves as “fee-only.”

International College of Financial Planning

SEPTEMBER 3, 2021

They may charge for their services either on a commission basis or hourly rates. However, our advice is to trust financial planners who either take a flat annual fee or charge per hour for managing your portfolio instead of charging a commission on every stock they buy or sell. Go for Fee-Only Financial Advisors.

Sara Grillo

MAY 10, 2024

My client’s estate planning attorney said they should hire a fee-only advisor to manage their assets, and then they asked me if I charge fees or commissions. As a fiduciary, I charge 1% of your assets, and do not accept commissions.” I’m a Social Security expert.

Harness Wealth

MAY 25, 2023

The primary fee structures are: Fee-only : Advisors only receive payment from their clients for the services they provide, not receiving any commissions or other incentives from product providers. Fee-based : This structure is a blend of fees and commissions. Financial Advisor FAQs 1.

Tobias Financial

NOVEMBER 29, 2022

Brokers are paid by a commission on the investment products they sell. Fiduciary advisors are generally fee-only. In this structure, they charge a specific fee for the work they provide, untethered to any products or investment options they recommend. They must always put clients’ interests above their own. .

Truemind Capital

FEBRUARY 8, 2024

– Hidden costs & agenda : There may be hidden costs in terms of commissions or kickbacks that are not explicitly disclosed while making the sale of any product. On top of it, a fee-only SEBI Registered Investment Advisor would ensure your and his/her interests are aligned. Do you still want free advice?

XY Planning Network

JULY 11, 2022

Direct indexing is consuming a lot more ink recently, and one of the primary reasons might be that the elimination of commissions on equities has made it dramatically less expensive to pursue. And, technology, too, might be a big driver. New software tools open the door for an advisory practice of any size to offer it.

WiserAdvisor

AUGUST 3, 2023

Generally, financial advisors charge a flat fee based on the services offered and the duration of the engagement, such as $xx for a month/ quarter/ year. They may also charge an hourly rate for every meeting you have or a commission for the financial instruments they recommend. Are financial advisors worth it?

Sara Grillo

JULY 10, 2023

He asked for help and found a support community Right now Thomas is a fee-only fiduciary financial advisor. But when he started out, he was working for a broker-dealer firm that charged commissions. He stumbled across a man named Russ Ford who was a fee-only flat fee advisor, and he liked the message.

Inside Information

JANUARY 31, 2022

The obvious next priority to put on the regulatory watch list is sales commissions. I think it’s self-evident that any product that has to pay people to recommend it is probably not competitive on its own merits.

Darrow Wealth Management

OCTOBER 29, 2024

Trading costs vary by platform and commissions may apply if you’re not working with a fee-only advisor. If you’re not confident your original asset allocation is the best one, it likely doesn’t make sense to rebalance back to this potentially flawed allocation. Both can add up and reduce returns.

Sara Grillo

OCTOBER 10, 2022

Fee-only vs. fee-based. But… Fee for service (and only fee for service) is a haven where the sales agenda mimicry cannot follow. Providing financial plans vs. canned financial plans with a sales agenda. Fiduciary vs. ‘best interest.’.

Inside Information

FEBRUARY 27, 2023

The leading tip of the spear was the first fee-only financial planners, who publicly and even defiantly sat on the same side of the table with their clients. The whole idea of turning financial customers into clients was invented in the fee-only financial planning world.

Yardley Wealth Management

AUGUST 24, 2020

03% for IXUS and they can be bought commission-free and the spreads on each average only $.01. We are a fiduciary, fee-only financial planning, and wealth management firm in Newtown, Pennsylvania (that’s in Bucks County). We only do Estate Planning work and I am licensed in Pennsylvania and New Jersey.

Inside Information

OCTOBER 29, 2023

I said that brokers and sales agents are essentially predators, wolves in sheep’s clothing, where the sheep are fiduciary advisors, and the clothing is, well, you know what it is: ‘fee-based’ and ‘best interest’ (instead of fee-only and fiduciary).

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content