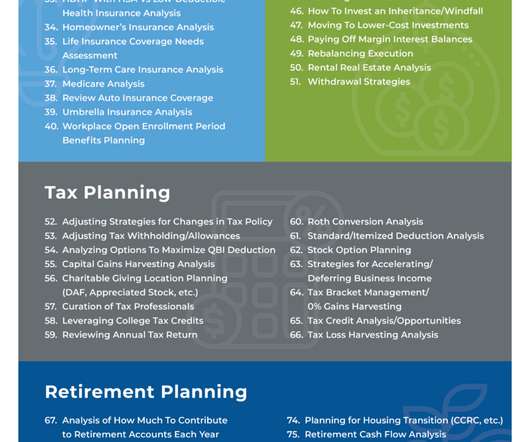

101 Things That Advisors Actually DO To Add Value (Beyond Just Allocating A Portfolio)

Nerd's Eye View

NOVEMBER 28, 2022

Traditionally, investment planning has been at the forefront of how financial advisors add value for their clients.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Tobias Financial

MARCH 11, 2025

Stay up to date with market insights from our Portfolio Manager, Charles Chad NeSmith, CFA, CFP. DISCLOSURES Tobias Financial Advisors is registered as an investment advisor with the SEC. In this update, Chad discusses inflationary and deflationary pressures, as well as the potential economic impact of tariffs.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

WiserAdvisor

JULY 22, 2022

This decision depends on whether you would benefit from hiring a single advisor or more. Some investors may require the services of multiple advisors as they have extensive investment portfolios comprising real estate, art, collectibles, global businesses, etc. The more advisors you hire, the more you will have to pay.

Trade Brains

NOVEMBER 3, 2024

Also read… Will Petrol prices come down across India after OMCs hike in dealer commission? Dixon Technologies leads the market with its diverse product portfolio, manufacturing everything from LED TVs to mobile phones. Investors must therefore exercise due caution while investing or trading in stocks.

Truemind Capital

AUGUST 9, 2024

I understood her situation and educated her about the process and what to expect from the investments in terms of risks and returns. With our guidance, she started investing soon, has now built a substantial investment portfolio, and is on track to meet her goals. Her case of “initial inertia” is not isolated.

Good Financial Cents

JUNE 11, 2023

One thing that I have craved for investors is a tool that allows you to sync all your financial accounts – your investment portfolio, checking and savings accounts, credit cards and other loan accounts – in one place, and then provides an investment-related analysis of your entire portfolio.

Trade Brains

OCTOBER 28, 2024

The company has a diverse portfolio of beauty, personal care, and fashion products, including owned brand products manufactured by it. As of December 31, 2023, its product portfolio comprised 16 major brands across five main categories of IMFL, i.e., whisky, brandy, rum, vodka, and gin.

Good Financial Cents

AUGUST 5, 2022

Ad Invest as little or as much as you want with a Robinhood portfolio. With Robinhood, you can build a balanced portfolio and trade stocks, ETFs and options as frequently as you want, commission-free. Click your state to start investing today! Build your portfolio alongside over a million other community members.

Truemind Capital

SEPTEMBER 10, 2019

To generate above-average risk-adjusted returns and to meet your investment objective successfully, you must look for these three non-negotiable qualities in an investment adviser which are extremely important for value addition to your investment portfolio: 1.

International College of Financial Planning

JULY 10, 2023

How Investment Advisors Play a Significant Role in Managing Finances? The field of investment advisory presents a world of opportunities for individuals passionate about finance and investments. Their primary objective is to help clients make informed investment decisions, manage risks, and achieve financial objectives.

Yardley Wealth Management

AUGUST 17, 2022

When you buy stock, your cost basis is the total purchase price of the stock plus brokerage commissions and fees. If you buy or sell individual stocks there may be commission charges paid to the transacting broker for each transaction. The commissions may be less if you do frequent trading, or if you have a big account.

Ron A. Rhodes

MAY 5, 2023

In the design and management of investment portfolios, both brokers (under Reg BI) and investment advisors (as fiduciaries) possess a duty of due care. This includes undertaking sufficient due diligence…

WiserAdvisor

JUNE 2, 2023

These professionals also hold expertise in various fields, such as retirement planning, tax management, estate planning, investment management, insurance, debt management, wealth management, and more. Below are the different kinds of financial advisors you may choose from: 1.

Harness Wealth

MAY 25, 2023

The primary fee structures are: Fee-only : Advisors only receive payment from their clients for the services they provide, not receiving any commissions or other incentives from product providers. Fee-based : This structure is a blend of fees and commissions. and 2%, often decreasing as the size of the portfolio increases.

Truemind Capital

FEBRUARY 8, 2024

That’s why a majority of people get stuck with duds in their portfolios. – Hidden costs & agenda : There may be hidden costs in terms of commissions or kickbacks that are not explicitly disclosed while making the sale of any product. A good financial advisor should ace all of these aspects.

Trade Brains

OCTOBER 30, 2024

Also read… Will Petrol prices come down across India after OMCs hike in dealer commission? As a result, their comprehensive service portfolio positions them well for future opportunities. Investors must therefore exercise due caution while investing or trading in stocks.

Trade Brains

OCTOBER 22, 2024

These projects are expected to be commissioned within 24 months. The company’s portfolio includes 3,508 MW thermal, 2,152 MW wind, 1,391 MW hydel, and 675 MW solar power. Investors must therefore exercise due caution while investing or trading in stocks. Please consult your investment advisor before investing.

Carson Wealth

SEPTEMBER 19, 2022

When you hold a mix of investments, your portfolio is protected from being wiped out if one investment fails. . Many mutual funds also have minimum investment requirements. Both ETFs and mutual funds are managed by professional investment advisors. . Have Questions About Investing?

Park Place Financial

SEPTEMBER 8, 2022

Registered Investment Advisor (RIA) . As the name indicates, an RIA recommends the best investment options based on a person’s financial circumstances and goals. They register with the United States Securities and Exchange Commission ( SEC ) to gain the designation. . Request a Meeting with a Potential Advisor .

Trade Brains

AUGUST 11, 2023

As a part of its portfolio, Avonmore owns the largest distillery in Himachal Pradesh with a production capacity of 85 KLPD ENA and 35KLPD Ethanol. Along these lines, it has commissioned two facilities for the expansion of its operations. Investors must therefore exercise due caution while investing or trading in stocks.

Carson Wealth

SEPTEMBER 13, 2022

Investors have a range of assets to choose from when building their portfolios. Learn more about what mutual funds are, how they work, about the advantages and potential downsides, and how to invest in them. The combination of securities is typically managed by a professional investment advisor. exchanges close.

Sara Grillo

NOVEMBER 14, 2022

Should those with only insurance licenses that allow them to sell annuities and/or life insurance be held to the same “fiduciary standard” as Registered Investment Advisers (RIAs) with the SEC or state regulators? Are commissions bad? Salaske agrees that many advisors don’t do a great job. Are commissions bad?

Sara Grillo

DECEMBER 12, 2022

Watch as all h&#@ breaks loose discussing the question of broker vs. financial advisor, commissions, fees, value, and more! The advisors made the point that the cost of insurance can’t be separated from the “cost of service” or the commission the agent makes. The commission is the commission. Who cares?

Good Financial Cents

NOVEMBER 14, 2022

Warren took it one step further, once betting hedge fund manager Ted Seides $1 million that an index fund would outperform a portfolio of hedge funds over the next ten years. But does it make sense for ALL investors to invest in the S&P 500? What if you’re not 100% comfortable investing all your money in the stock market?

The Big Picture

JULY 11, 2023

And I remember being on the phone thinking, as the PMs were asking questions about cash flows and things, I was thinking, you’re asking all the wrong questions about whether this portfolio will perform because it’s things like down payment. ” Whereas if they got that upfront commission, they’d spend the time doing it.

Good Financial Cents

JULY 3, 2023

No matter which option you choose the most important thing with any investing is to get started. A new type of investment advisor has been created by using machine learning to make the investments for us. These new advisors are called robo-advisors and have become a very popular place to open your Roth IRA.

Inside Information

SEPTEMBER 28, 2021

Then came Reg BI, in 2019, where the Commission decided that adopting a separate rule restricting these terms was ‘unnecessary.’. 202(a)(11)(c) of the Advisers Act,” the petition says, “the Commission can increase investor protection by (re-)asserting a distinction between product sales and stand-alone investment advice.”.

WiserAdvisor

NOVEMBER 16, 2022

Consider consulting with a professional financial advisor who can help create a financial plan and investment portfolio for you to achieve your financial needs and goals. Here are 9 questions to ask when investing. How much of my income should be going into investments? Need a financial advisor?

Inside Information

JULY 31, 2022

Yes, there are regulatory requirements to register as an investment advisor. The organization did not help its case as a regulator by carelessly allowing advisors to omit their (often significant) regulatory history that they were supposed to disclose in their web profiles. But not as a financial planner.).

WiserAdvisor

MAY 31, 2022

According to the Federal Trade Commission (FTC), in 2021, American consumers lost over $5.8 The objective is to thoroughly understand the background of the broker or investment advisor from whom you intend to buy a product or engage in a business. However, the numbers tell a different story. In 2021, over 2.8

Clever Girl Finance

DECEMBER 21, 2022

Investing in stocks is one way to avoid having to make an active income by simply growing your money, and expanding your portfolio. It's also possible to buy shares of REITs (real estate investment trusts) and earn a share of income from the real estate projects they hold. Crowdfund real estate. Advertise using your vehicle.

Sara Grillo

JANUARY 9, 2023

What are the changes in Colorado investment advisor regulations regarding financial planning? Specific examples: Educating financial advisors of all business models (AUM, fee only, commission, etc.) If somebody has a $500k portfolio and we just use a standard 1%, they’d be charged $5k a fee.

Inside Information

OCTOBER 30, 2021

The argument with the regulators is that the more they require all advisors (including, of course, wirehouse brokers who call themselves ‘advisors’) to behave as fiduciaries, the more likely investors will be to receive advice in their interests, quality investment counsel, low portfolio expenses and fewer conflicts getting in the way.

Clever Girl Finance

AUGUST 2, 2023

Investing in stocks is one way to avoid having to make an active income by simply growing your money and expanding your portfolio. REITs It’s also possible to buy shares of REITs (real estate investment trusts) and earn a share of income from the real estate projects they hold.

Financial Symmetry

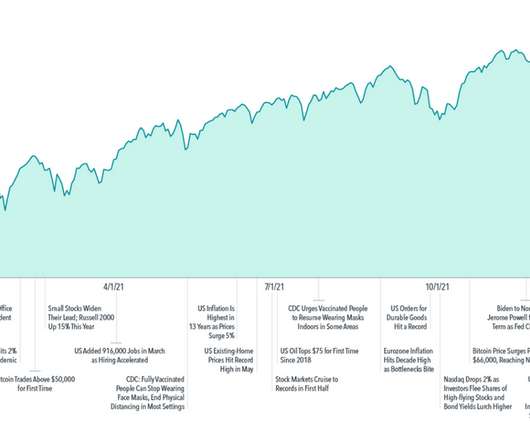

FEBRUARY 20, 2025

3 So, as investors, what can we do about it within our portfolios? Source: Avantis Investors is an investment advisor registered with the Securities and Exchange Commission. Key Takeaways for Investors The key point is that concentration in isolation doesnt tell you about future expected returns, but valuations do.3

Tobias Financial

MARCH 11, 2025

He also emphasized the value of diversification when managing investments. When we look at retirement investors, we really encourage them to be in diversified portfolios. Disclosure : Tobias Financial Advisors is registered as an investment advisor with the SEC. You want to be in the U.S.,

ClearMoney

NOVEMBER 4, 2021

As with many things in life, the truth is somewhere between the extremes: While both simulated and real-world data suggest momentum may not be suitable as a driver of long-term asset allocations, we believe momentum considerations can be integrated in a cost-effective way to help inform daily portfolio management decisions. A Matter of Time.

ClearMoney

JANUARY 4, 2022

For investors worried about the impact of inflation on their portfolios, it is important to remember that US stocks since 1991 have generally provided returns that outpaced inflation. Concentrating your portfolio in a few hot stocks or cryptocurrencies—like focusing on any small number of holdings—can expose investors to substantial risk.

ClearMoney

DECEMBER 14, 2021

In Dimensional’s case, systematic fixed income is hardly new; we have been managing fixed income portfolios since 1983. For example, a bond trading like one rated BBB may become ineligible for a portfolio restricted to securities rated AA and above, even if its stated rating meets the portfolio’s guidelines.

ClearMoney

DECEMBER 5, 2021

Given bitcoin’s dramatic price changes, it is not surprising that many are speculating about its possible role in a portfolio. Assessing the merits of bitcoin as an investment can be problematic. Adding it to a portfolio could mean paring back the allocation to investments such as stocks, property, or fixed income.

ClearMoney

SEPTEMBER 24, 2021

You’re much more likely to “lose it all” with concentrated investments than with a well-diversified portfolio. Individual investments may go to zero, but the modern-day market has been around for almost a century, has an average annual return of 10%, and has never lost more than 43% in a year.2.

ClearMoney

DECEMBER 13, 2021

Indices are not available for direct investment. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. UNITED STATES: Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Sara Grillo

SEPTEMBER 26, 2022

I do believe it should be different regulated differently from portfolio management, which is the typical definition of the registered investment advisor, but that it shouldn’t be the CFP Board that is controlling the regulatory environment for financial planners. Salaske: What is an investment advisor?

ClearMoney

DECEMBER 5, 2021

Indices are not available for direct investment. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. UNITED STATES: Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content