Weekend Reading For Financial Planners (March 22–23)

Nerd's Eye View

MARCH 21, 2025

of advisor compensation, while commission-based revenues have declined to 23% of an average advisor's revenue.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

MARCH 21, 2025

of advisor compensation, while commission-based revenues have declined to 23% of an average advisor's revenue.

Nerd's Eye View

JANUARY 24, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that while overall financial advisor headcount remains relatively flat, the RIA channel continues to gain share in terms of both headcount (as brokers break away to start their own independent firms and aspiring advisors seek (..)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Abnormal Returns

MARCH 24, 2024

morningstar.com) How home buying is going to change with the upheaval of realtor commissions. allstarcharts.com) It's hard to wrap your head around the numbers with Nvidia's ($NVDA) new chips. (abnormalreturns.com) Top clicks this week Ten things to know about building a diversified portfolio. wsj.com) TIPS are one again outperforming.

Nerd's Eye View

MARCH 14, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that Securities and Exchange Commission (SEC) Commissioner Hester Peirce suggested in a recent interview that she would like to see the SEC give advisors more leeway to provide customized solutions to clients (rather than feeling (..)

Nerd's Eye View

APRIL 26, 2024

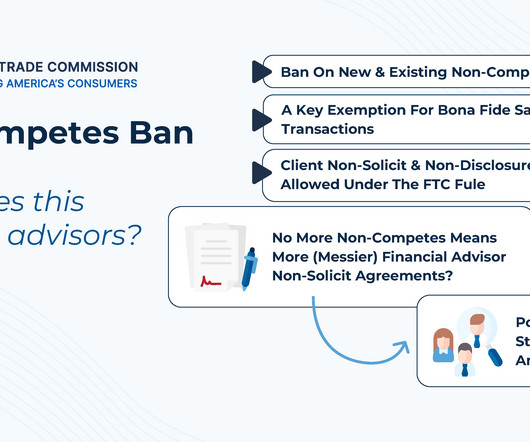

Also in industry news this week: The Federal Trade Commission released a final rule that would ban most non-compete agreements, which could lead to an increasing number of non-solicit agreements (and, potentially, lawsuits regarding their enforcement) between financial planning firms and their advisors The Securities and Exchange Commission issued (..)

Nerd's Eye View

JULY 18, 2022

But these positions are often tenuous for new advisors, with extremely high failure rates, driven in large part by compensation that is reliant primarily on commissions from product sales.

Nerd's Eye View

JUNE 30, 2023

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that NAPFA has announced that it will no longer exclude advisors who receive up to $2,500 in annual trailing commissions from previous product sales, if they agree to donate that money to a non-profit organization (..)

Nerd's Eye View

FEBRUARY 9, 2024

Also in industry news this week: A recent study finds that having a defined marketing strategy is a linchpin of marketing success, as advisors with a defined strategy were more likely to have seen an increase in inbound leads during the past 12 months and have more confidence in meeting their practice goals during the coming year than those without (..)

Nerd's Eye View

SEPTEMBER 23, 2022

We also have a number of articles on advisor marketing: The latest trends in advisor marketing, from the continued dominance of client referrals to the return of in-person gatherings. A new designation is available for advisors looking to serve clients with nonqualified deferred compensation plans.

Nerd's Eye View

AUGUST 5, 2022

Also in industry news this week: A study suggests that a significant number of brokers who are disciplined by FINRA are engaging in ‘regulatory arbitrage’ by moving to state-regulated insurance companies, making it more difficult for consumers to learn about their past infractions.

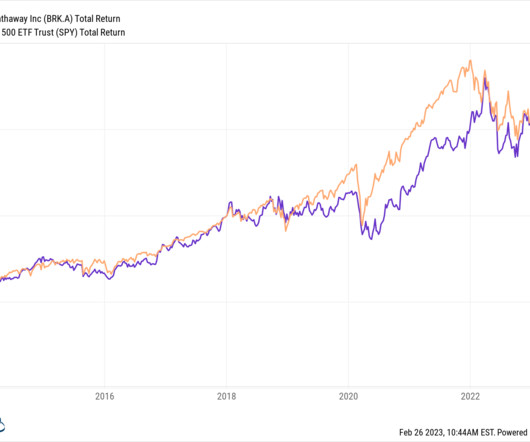

Abnormal Returns

FEBRUARY 26, 2023

institutionalinvestor.com) Amazon Amazon ($AMZN) is increasing the number of same-day shipping options. Sentencing Commission show judges rejected more than 80% of compassionate release requests filed from October 2019 through September 2022. (businessinsider.com) Airbnb ($ABNB) has a rating inflation problem.

Nerd's Eye View

OCTOBER 3, 2022

While the growth of DPL’s marketplace may itself usher in a greater level of annuity competitiveness, as companies are forced to compete for RIA attention not by offering the biggest commissions but by offering the best features and benefits to get through the RIA-as-gatekeeper.

Nerd's Eye View

SEPTEMBER 13, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the SEC this week fined 4 RIAs for violations of its marketing rule related to their claims that they offered 'conflict-free' financial advice.

Nerd's Eye View

DECEMBER 16, 2022

How firms can best leverage their internal data to improve the number of client referrals they receive. How advisors can benefit from reviewing their list of clients and letting go those who are no longer good fits for the firm.

Nerd's Eye View

MARCH 22, 2024

Also in industry news this week: A recent survey suggests that advisors who best understand their prospects' and clients' unique needs and communicate their value and fees clearly could be best positioned to win and retain clients Why a dearth of advisor talent could spur additional M&A activity and 'poaching', and what firms can do to attract (..)

Nerd's Eye View

AUGUST 16, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the Securities and Exchange Commission (SEC) announced that a total of 26 broker-dealers, investment advisers, and dually-registered firms agreed to pay combined civil penalties of almost $400 million for failing to maintain (..)

Nerd's Eye View

JANUARY 12, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the Securities and Exchange Commission this week authorized 11 Spot Bitcoin Exchange-Traded Funds (ETFs), which could provide financial advisors and their clients with a convenient way to invest in the cryptocurrency without (..)

Nerd's Eye View

SEPTEMBER 1, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the Massachusetts Supreme Judicial Court ruled that the state's fiduciary rule for broker-dealers can stand, potentially opening the door for other states to impose similar standards that exceed the requirements of the Securities (..)

Nerd's Eye View

JANUARY 6, 2023

We also have a number of articles on practice management: Why the most successful firms in the coming years might be those who dominate individual market segments rather than those that are ‘overdiversified’ Four ways firms can attract next-generation advisor talent.

Nerd's Eye View

SEPTEMBER 27, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent study by Cerulli has shown a sharp increase in the number of affluent investors willing to pay for advice, which on the one hand reflects the increasing financial complexity in peoples' lives (while they've also gotten (..)

Nerd's Eye View

JANUARY 13, 2023

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the Federal Trade Commission has proposed a nationwide ban on noncompete clauses in employee contracts, aiming to give employees more freedom to change jobs within the same industry.

Nerd's Eye View

MAY 10, 2024

billion (thanks to expected reductions in commissions and the embedded costs in these annuities). could save retirement plan participants $55 billion over the next 10 years (due to an expectation of more low-cost fees being offered in plans) and those rolling over workplace plans into IRAs to purchase annuities another $32.5

Nerd's Eye View

AUGUST 23, 2024

Also in industry news this week: A Federal judge struck down the Federal Trade Commission's ban on non-compete agreements before it could go into effect, though potential appeals mean the battle over the regulation might not be over A U.S.

The Big Picture

MAY 9, 2024

No audited returns, mathematically improbable claims, and zero accountability But none of these “influencers” sell securities to clients, so they do not fall under the regulatory oversight of the Securities and Exchange Commission (SEC).2 2 Sure, you can claim mainstream media is bad, but social media is worse.

Nerd's Eye View

JULY 5, 2024

Supreme Court decision shifting authority to interpret laws passed by Congress from Federal agencies to the judicial system could have significant impacts on regulation of the financial advice industry, including the potential for additional legal challenges to regulations from the Securities and Exchange Commission (SEC), the Department of Labor (DoL), (..)

Nerd's Eye View

MAY 22, 2024

With these factors in mind, the Federal Trade Commission (FTC) in April of 2024 announced a final rule banning most non-competes nationwide that is expected to take effect (pending legal challenges) on September 4, 2024.

Nerd's Eye View

DECEMBER 5, 2022

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including: DPL Partners launches a new advisor-matching solution to solve for the inbound demand of consumers increasingly seeking out a new crop of no-commission annuity products.

Nerd's Eye View

AUGUST 1, 2022

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including: Catchlight offers up a new system that scans information about prospects online to determine which ones are ‘qualified’ and worth pursuing further.

Nerd's Eye View

JULY 12, 2024

Also in industry news this week: 2 House committees this week advanced legislation that would halt implementation of the Department of Labor's new Retirement Security Rule, which, combined with ongoing lawsuits, threaten to derail the regulation either before or soon after it becomes effective in late September A Federal judge has put the future of (..)

Nerd's Eye View

NOVEMBER 28, 2022

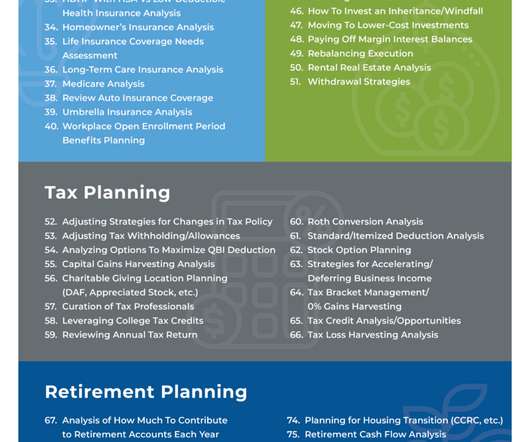

From advisors who earn commissions from the sales of financial products to fee-only investment advisors who charge based on client assets under management, the value advisors provide to their clients has often been centered on investment management.

Nerd's Eye View

NOVEMBER 28, 2022

From advisors who earn commissions from the sales of financial products to fee-only investment advisors who charge based on client assets under management, the value advisors provide to their clients has often been centered on investment management.

Investment Writing

FEBRUARY 7, 2023

When should you use numbers instead of bullets for indented lists? who says in The Plain English Approach to Business Writing : I suggest numbered lists when the order of the items is especially important; otherwise use bulleted lists. I agree with Edward P. That will also help readers to understand your message.

The Big Picture

NOVEMBER 21, 2023

A Wealth of Common Sense ) • A record number of $50 bills were printed last year. From staging to commission expenses, here’s what to expect. ( We’re a little less than four years into the 2020s and half of those years have seen no new highs but there have already been plenty of them this decade. ( why are you seeing more $50s?

Truemind Capital

JUNE 21, 2024

All investments were in commission-based regular plans generating a commission of at least INR 50 LAKHS ANNUALLY for the wealth management company & client had NO idea of the hefty commissions going out every year. Usually, a new product offers a higher commission to distributors. 20 depending upon certain cases).

The Big Picture

SEPTEMBER 5, 2024

trillion in total AUM…” As he observes, it wasn’t the shift from active to passive – that had been ramping up for decades – rather, it was the changeover from transactional commission business to a fee-based fiduciary model that made all of the difference. This is an enormously helpful skill when you are hiring people. It’s uncanny.

The Chicago Financial Planner

JANUARY 17, 2022

I’ll let the Securities and Exchange Commission (SEC) explain this in a quote from their website : “An annuity is a contract between you and an insurance company that is designed to meet retirement and other long-range goals, under which you make a lump-sum payment or series of payments. After all, what’s not to like about guaranteed income?

Investment Writing

MARCH 4, 2024

I’ve focused on the average number of syllables per word, words per sentence, and sentences per paragraph. Disclosure: If you click on an Amazon link in this post and then buy something, I will receive a small commission. On this blog—and in my writing workshops —I’ve written about things that affect reading ease.

Good Financial Cents

FEBRUARY 24, 2023

With most investing apps now offering commission-free trading, online brokers must find more creative ways to stand out. About Webull Launched in 2017, New York City-based Webull is a self-directed investment platform that offers commission-free trading. Cryptocurrency You can trade cryptocurrency on Webull commission-free.

The Big Picture

MARCH 25, 2025

And, and I kind of raised my hand and said, dad, uncle John, don’t you think it might be a better idea to look at it by the numbers? Jim O’Shaughnessy : So I think the most surprising thing was a number of people at various firms that I was investigating working for before starting my own. The numbers are pretty bad.

Good Financial Cents

JULY 21, 2022

Fees $0 for stocks or ETFs; no commissions or contract fees on options. $1/mo. 0 for stocks, options, and ETFs; over 4,000 commission-free mutual funds. $0 0 for stocks, options, and ETFs; more than 3,000 commission-free mutual funds. . $0 0 for stocks, options, and ETFs; more than 3,000 commission-free mutual funds.

Truemind Capital

AUGUST 9, 2024

The best way to solve this problem is by increasing the number of fee-only SEBI Registered Investment Advisors (RIAs) who by design think in the interest of clients. By regulation, RIAs can’t earn from commissions received from product companies.

Sara Grillo

OCTOBER 31, 2022

Any financial advisor who is registered as an advisor with a regulator has to fill out this form for initial approval by either a state or a Federal (the United States Securities and Exchange Commission) regulator. You should check the advisor’s CRD number and see if it matches what they sent you. Securities and Exchange Commission.

MarketWatch

MAY 22, 2023

Securities and Exchange Commission updating its strategy to accelerate entry to the U.S. The changes mean it will no longer require the consolidation of Canopy USA’s numbers into its results. Canopy Growth Corp. CGCCA:WEED said Monday it has filed a revised proxy statement with the U.S. cannabis industry through a U.S.-domiciled

The Big Picture

DECEMBER 27, 2023

And everybody gets this confirmation that it’s the right price because my neighbor and this person and that cross the street, everybody’s got that same number, yet none of them sell and none of them sell for a long period of time until they ultimately get removed from the market. It’s a small number.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content