Top Compliance and Litigation Tips for 401(k) Plans

Wealth Management

SEPTEMBER 18, 2023

Do not forget the basics regarding compliance and ligitation of 401(k) retirement plans.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

SEPTEMBER 18, 2023

Do not forget the basics regarding compliance and ligitation of 401(k) retirement plans.

Wealth Management

JANUARY 8, 2024

The 10-person Retirement Visions team left Securities America to harness technology, compliance and administrative support by Redhawk Wealth Ventures.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Nerd's Eye View

OCTOBER 29, 2024

We also talk about how Travis built the onboarding and compensation plans for his own (contracted) student loan consultants to scale the business while incentivizing them to take on a greater volume of meetings (and still ensuring that they could give high-quality student loan advice), how Travis decided to diversify his business's income streams when (..)

Nerd's Eye View

JANUARY 31, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that following the change of administration (and a new incoming chair of the SEC), the Investment Adviser Association is seeking to find ways to help RIAs (particularly smaller firms) manage the compliance responsibilities they (..)

Nerd's Eye View

MARCH 14, 2025

Which, if implemented under the new administration, could provide relief for investment advisers, particularly smaller firms that already have to balance compliance with client service, marketing, and the other duties that go into running a firm.

Nerd's Eye View

NOVEMBER 30, 2022

Almost every financial planning issue – whether it is retirement, investments, cash flow, insurance, or estate planning – has tax considerations, and advisors provide a great deal of value in helping clients minimize their overall tax burden.

Nerd's Eye View

SEPTEMBER 13, 2024

Also in industry news this week: A CFP Board study indicates that financial planners with the certification earn 10% more than other advisors and show very high levels of career satisfaction A Morningstar study has identified 4 main areas where investors find value from their financial advisors, which might not match an advisor's own list of top ways (..)

Abnormal Returns

OCTOBER 7, 2024

(citywire.com) Advisortech AI is coming for the compliance stack. riabiz.com) Charles Schwab Charles Schwab ($SCHW) CEO Wal Bettinger is retiring. investmentnews.com) The past month's advisor technology news including Wealth.com's big fundraising round. msn.com) InvestCloud has relaunched itself.

Abnormal Returns

DECEMBER 23, 2024

citywire.com) Compliance A comprehensive look at the books and record requirements for RIAs. investmentnews.com) Succession How Snowden Lane helps advisers transition into retirement. citywire.com) Retirement Retirement from farming is just different. kitces.com) Arbitration procedures should be included in the ADV.

Abnormal Returns

JULY 22, 2024

citywire.com) Retirement A Q&A with Wade Pfau about the challenges of spending in retirement. thinkadvisor.com) Why staggered retirements make a lot of sense. fastcompany.com) Advisers Off-channel communications surpassed marketing as the leading compliance concern for RIAs.

Nerd's Eye View

MAY 15, 2024

On April 25, 2024, the Department of Labor (DoL) issued the final version of its Retirement Security Rule (the "Final Rule"), which imposes an ERISA fiduciary standard "that applies uniformly to all investments that retirement investors may make with respect to their retirement accounts ".

Carson Wealth

FEBRUARY 4, 2025

Understanding Tax Compliance and Risk Management Ultra-high-net-worth individuals face unique tax challenges, including high rates and ever-changing complex tax codes. Navigating these tax issues can be incredibly complex, necessitating a comprehensive compliance and risk management plan. Donate to qualified charities.

Nerd's Eye View

JULY 14, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that while the new social media app Threads, designed to compete with Twitter, has surpassed 100 million users in its first week alone, its potential utility for advisors remains unclear and has raised compliance concerns for advisors (..)

Abnormal Returns

JULY 10, 2023

investmentnews.com) Compliance There's no winning the cybersecurity war, just stalemate. financial-planning.com) Advisers don't like spending time on administrative and compliance issues. larrykotlikoff.substack.com) A real-life example of balancing differing wants in retirement. wsj.com)

Nerd's Eye View

AUGUST 28, 2024

Historically, advisors haven't had many avenues to manage clients' 401(k) plan accounts, since unlike traditional custodial investment accounts, advisors generally lack discretionary trading authority in employer-sponsored retirement plans.

Nerd's Eye View

AUGUST 28, 2024

Historically, advisors haven't had many avenues to manage clients' 401(k) plan accounts, since unlike traditional custodial investment accounts, advisors generally lack discretionary trading authority in employer-sponsored retirement plans.

Nerd's Eye View

JULY 26, 2024

Also in industry news this week: While the number of RIA M&A deals has not surged in 2024, the average size of deals has increased, demonstrating interest from (often private-equity-backed) firms in pursuing larger targets Off-channel communication tops the list of concerns amongst RIA compliance professionals, with advertising and marketing coming (..)

BlueMind

JULY 15, 2022

Category: Compliance. The Significance Of Financial Compliance Financial compliance requires all actions, procedures, guidelines, and business culture to abide by the rules and regulations set by the regulatory authorities of the financial market. Related: Compliance and Automation – An Ideal Unison!

Abnormal Returns

DECEMBER 26, 2022

kitces.com) Christine Benz and Jeff Ptak discuss the recent "The State of Retirement Income" report. investmentnews.com) Practice management Why firms need to make compliance an ally, not an obstacle. nytimes.com) Retirement How to optimize Social Security benefits as a widow. morningstar.com) SECURE Act 2.0 morningstar.com).

Nerd's Eye View

JANUARY 26, 2024

Also in industry news this week: A House committee has advanced a bill that would extend several expired business-related tax measures from the Tax Cuts and Jobs Act and would increase the value of the Child Tax Credit The SEC released its examination priorities for 2024, which include a focus on advisers' adherence to their duty of care and duty of (..)

Nerd's Eye View

MAY 3, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent study indicates that nearly a third of advisors in the independent broker-dealer channel have considered transitioning to the RIA channel during the past year as they seek higher payouts and not just "independence" but (..)

Nerd's Eye View

AUGUST 5, 2022

We also have a number of articles on retirement planning: How the variability in annuity payouts across annuity providers has exploded in 2022, creating an opportunity for advisors to add value to clients by comparison shopping across insurance companies.

Abnormal Returns

JUNE 26, 2023

wiredplanning.com) Daniel Crosby talks with advice non-compliance with Derek Hagen who is the founder of Money Health Solutions. standarddeviationspod.com) Michael Kitces talks about the challenges of retirement with Tony Hixon who is the Co-founder and COO for Hixon Zuercher Capital Management.

Nerd's Eye View

JANUARY 13, 2023

FINRA has released its enforcement priorities for 2023, including a continued focus on compliance with Regulation Best Interest as well as several new priority topics, such as manipulative trading, fixed-income pricing, and trading in fractional shares.

Wealth Management

FEBRUARY 7, 2025

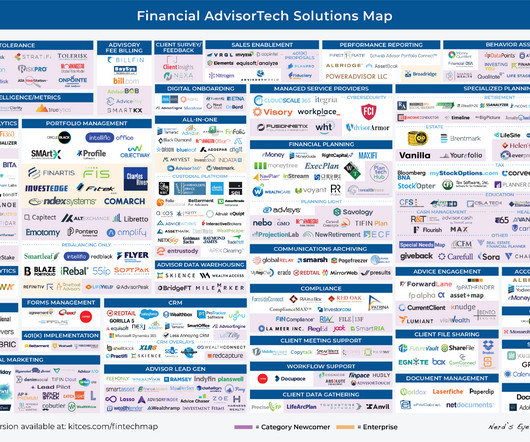

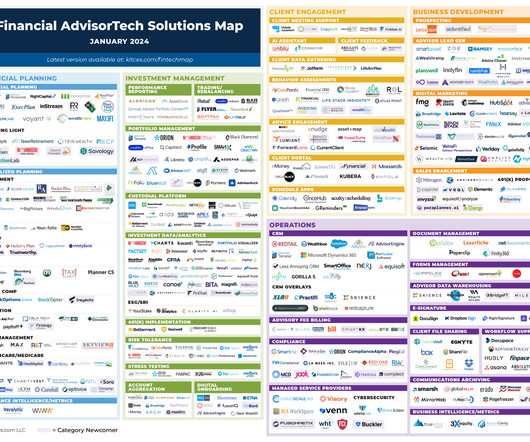

More choice in remotely managing heldaway retirement assets, Orion announces numerous updates at annual conference, Smarsh acquires audio compliance vendor.

Nerd's Eye View

NOVEMBER 11, 2022

While some are looking to gain a first-mover advantage by leveraging client testimonials and third-party endorsements (and adjusting their compliance programs before doing so), others are taking a wait-and-see approach. Also in industry news this week: Why “SECURE 2.0”

MainStreet Financial Planning

NOVEMBER 8, 2024

Maximize Your Retirement Contributions: Enhancing your retirement savings not only secures your future but also offers immediate tax benefits. Always consult with a tax professional, ( we happy to help you as well ) to tailor these strategies to your personal circumstances and ensure compliance with current tax laws.

Nerd's Eye View

AUGUST 4, 2023

Also in industry news this week: RIA M&A activity fell in the second quarter compared to the same period last year amid rising financing costs, though continued private equity interest in the RIA space could help buoy deal volume going forward According to a recent survey, RIAs appear to be taking a defensive approach toward the SEC's new marketing (..)

Nerd's Eye View

FEBRUARY 17, 2023

Further, an investment adviser who can make trades on behalf of a client would be deemed to have custody of the client’s assets, which could substantively shift a very sizable portion of the wealth management RIA community under the custody rule, though it remains to be seen whether or what exact custody rule compliance requirements would be (..)

Nerd's Eye View

JUNE 5, 2023

This month's edition kicks off with the news that Riskalyze has completed its previously-announced rebranding, and will now be known as “Nitrogen”, a ”growth platform” for advisory firms – which represents less of a shift in the platform’s core function (given that Riskalyze’s risk tolerance tool was always (..)

Wealth Management

FEBRUARY 7, 2025

More choice in remotely managing heldaway retirement assets, Orion announces numerous updates at annual conference, Smarsh acquires audio compliance vendor.

Nerd's Eye View

JANUARY 1, 2024

This month's edition kicks off with the news that held-away asset management platform Pontera has raised $60 million in venture capital funding as advisors increasingly seek to directly manage clients' 401(k) and other outside assets – although an ongoing investigation by Washington state regulators over whether advisors' use of Pontera violates (..)

Nerd's Eye View

FEBRUARY 16, 2024

Also in industry news this week: While AUM fees remain ubiquitous among fee-only advisors, recent data show that an increasing number leverage multiple fee models to meet different client needs and preferences While CFP Board has come out firmly in favor of the Department of Labor's proposed Retirement Security Rule, FPA has taken a more cautious approach, (..)

Nerd's Eye View

FEBRUARY 2, 2024

Also in industry news this week: A recent study from advisor digital marketing firm Snappy Kraken suggests firms that invest in Search Engine Optimization (SEO), have a regular cadence of emails to their subscriber list, and include video content in these messages tend to get greater returns from their marketing efforts CFP Board has created a guide (..)

Nerd's Eye View

MAY 31, 2024

House of Representatives and is now being considered in the Senate would increase the number of firms classified as “small entities” and would require the SEC to assess the impact of proposed regulation on this newly enlarged class of investment advisers (which tend to have fewer compliance staff and resources available compared to larger (..)

WiserAdvisor

MARCH 13, 2024

Achieving financial freedom in retirement requires meticulous planning, dedicated effort, and strategic management. Within this framework, the concept of the five pillars of retirement planning emerges as a valuable strategy. Without a solid plan, you risk drifting without direction.

WiserAdvisor

AUGUST 31, 2023

Financial advisors play a crucial role in assisting you before your retire. They can provide ongoing support so you can continue investing after retirement, monitor market fluctuations, and make necessary adjustments to your retirement portfolio. Here are 5 benefits of hiring a financial advisor after you retire: 1.

Nerd's Eye View

MAY 2, 2023

We also talk about why despite being a CFA charterholder Jake outsources investment management to First Ascent – for which clients pay an entirely separate additional fee – because it both allows him to simplify compliance to not manage investments in-house, and takes away the cost pressure of having to hire a separate employee to just (..)

Abnormal Returns

APRIL 17, 2023

podcasts.apple.com) The biz Why Dynasty Financial Partners and MarketCounsel are investing more in compliance software provider SmartRIA. investmentnews.com) Why it matter whether you take client fees from taxable or retirement accounts. morningstar.com) A real-world assessment of Monte Carlo retirement simulations in the real world.

Nerd's Eye View

SEPTEMBER 26, 2023

What's unique about Bridget, though, is how, as a solo advisor, she found herself overwhelmed with the pressures of having to manage different aspects of her business while also providing great service to her clients as she quickly grew to $77M of AUM in 7 years, and has decided to not to "scale" her firm by hiring more advisors but instead leverage (..)

Nerd's Eye View

JULY 24, 2024

When the original SECURE Act was passed in December 2019, it brought sweeping changes to the post-death tax treatment of qualified retirement accounts. As a whole, these regulations introduce significantly more complexity to the process of tax planning around retirement accounts, particularly after the death of the account's original owner.

Carson Wealth

JULY 3, 2024

Proper tax planning can save your business money and ensure compliance with regulations. Plan for Your Retirement As a small business owner, it’s essential to plan for your retirement independently since you may not have the benefit of employer-sponsored retirement plans.

Abnormal Returns

SEPTEMBER 26, 2022

riabiz.com) Compliance Many clients want to text with their adviser. citywireusa.com) Why people spend less money in retirement. (riabiz.com) This startup wants to make it easier to borrow against whole life insurance policies. techcrunch.com) DPL is gaining momentum selling annuities through advisers.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content