Top Compliance and Litigation Tips for 401(k) Plans

Wealth Management

SEPTEMBER 18, 2023

Do not forget the basics regarding compliance and ligitation of 401(k) retirement plans.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

SEPTEMBER 18, 2023

Do not forget the basics regarding compliance and ligitation of 401(k) retirement plans.

Nerd's Eye View

JANUARY 31, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that following the change of administration (and a new incoming chair of the SEC), the Investment Adviser Association is seeking to find ways to help RIAs (particularly smaller firms) manage the compliance responsibilities they (..)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Nerd's Eye View

JULY 14, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that while the new social media app Threads, designed to compete with Twitter, has surpassed 100 million users in its first week alone, its potential utility for advisors remains unclear and has raised compliance concerns for advisors (..)

Nerd's Eye View

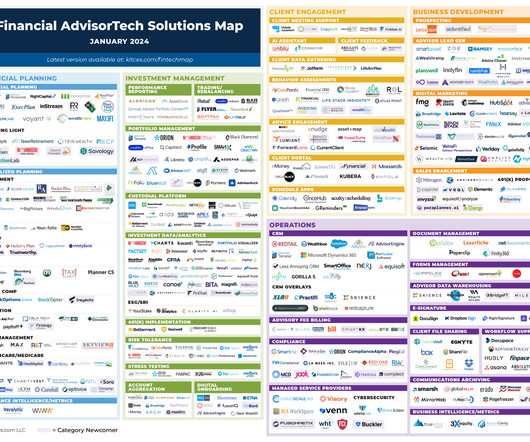

JANUARY 26, 2024

Also in industry news this week: A House committee has advanced a bill that would extend several expired business-related tax measures from the Tax Cuts and Jobs Act and would increase the value of the Child Tax Credit The SEC released its examination priorities for 2024, which include a focus on advisers' adherence to their duty of care and duty of (..)

Nerd's Eye View

AUGUST 28, 2024

Historically, advisors haven't had many avenues to manage clients' 401(k) plan accounts, since unlike traditional custodial investment accounts, advisors generally lack discretionary trading authority in employer-sponsored retirement plans.

Nerd's Eye View

AUGUST 28, 2024

Historically, advisors haven't had many avenues to manage clients' 401(k) plan accounts, since unlike traditional custodial investment accounts, advisors generally lack discretionary trading authority in employer-sponsored retirement plans.

Nerd's Eye View

JULY 26, 2024

Also in industry news this week: While the number of RIA M&A deals has not surged in 2024, the average size of deals has increased, demonstrating interest from (often private-equity-backed) firms in pursuing larger targets Off-channel communication tops the list of concerns amongst RIA compliance professionals, with advertising and marketing coming (..)

Nerd's Eye View

AUGUST 5, 2022

We also have a number of articles on retirement planning: How the variability in annuity payouts across annuity providers has exploded in 2022, creating an opportunity for advisors to add value to clients by comparison shopping across insurance companies.

Nerd's Eye View

NOVEMBER 11, 2022

While some are looking to gain a first-mover advantage by leveraging client testimonials and third-party endorsements (and adjusting their compliance programs before doing so), others are taking a wait-and-see approach. Also in industry news this week: Why “SECURE 2.0”

Nerd's Eye View

JANUARY 13, 2023

FINRA has released its enforcement priorities for 2023, including a continued focus on compliance with Regulation Best Interest as well as several new priority topics, such as manipulative trading, fixed-income pricing, and trading in fractional shares.

Nerd's Eye View

JANUARY 1, 2024

This month's edition kicks off with the news that held-away asset management platform Pontera has raised $60 million in venture capital funding as advisors increasingly seek to directly manage clients' 401(k) and other outside assets – although an ongoing investigation by Washington state regulators over whether advisors' use of Pontera violates (..)

Nerd's Eye View

AUGUST 4, 2023

Also in industry news this week: RIA M&A activity fell in the second quarter compared to the same period last year amid rising financing costs, though continued private equity interest in the RIA space could help buoy deal volume going forward According to a recent survey, RIAs appear to be taking a defensive approach toward the SEC's new marketing (..)

Nerd's Eye View

FEBRUARY 17, 2023

Further, an investment adviser who can make trades on behalf of a client would be deemed to have custody of the client’s assets, which could substantively shift a very sizable portion of the wealth management RIA community under the custody rule, though it remains to be seen whether or what exact custody rule compliance requirements would be (..)

Nerd's Eye View

JUNE 5, 2023

This month's edition kicks off with the news that Riskalyze has completed its previously-announced rebranding, and will now be known as “Nitrogen”, a ”growth platform” for advisory firms – which represents less of a shift in the platform’s core function (given that Riskalyze’s risk tolerance tool was always (..)

Carson Wealth

JULY 3, 2024

Develop a risk management plan to implement strategies that minimize or eliminate risks, and protect your business with appropriate insurance coverage, such as liability, property and business interruption insurance. Get Help with Tax Planning Tax planning is a critical component of financial management.

Nerd's Eye View

DECEMBER 6, 2023

Notably, while many financial coaches satisfy the majority of these requirements – they are in the business of offering advice to clients and are compensated as such – they often steer clear of making specific securities recommendations, focusing instead on areas like budgeting, debt management, savings, and retirement planning.

WiserAdvisor

SEPTEMBER 13, 2023

While grappling with various aspects of retirement planning, it is imperative to acknowledge a critical factor that often does not receive its due attention – longevity risk. While this is undoubtedly positive, it introduces the challenge of ensuring that your financial resources last an extended retirement period.

Nerd's Eye View

AUGUST 24, 2022

a single person, a couple, a business, or a retirement plan) and the date on which the agreement will become effective. To start, the agreement should contain basic information about the adviser-client relationship, including who the client is (e.g., The agreement should also lay out some acknowledgments for the client to review.

Nerd's Eye View

AUGUST 24, 2022

a single person, a couple, a business, or a retirement plan) and the date on which the agreement will become effective. To start, the agreement should contain basic information about the adviser-client relationship, including who the client is (e.g., The agreement should also lay out some acknowledgments for the client to review.

Harness Wealth

JANUARY 9, 2025

Backdoor strategies are retirement contribution methods that allow individuals to bypass income limits and contribute to tax-advantaged retirement accounts. While a Mega Backdoor Roth IRA rolls these contributions into a Roth IRA, a Mega Backdoor Roth 401(k) converts them directly into a Roth 401k within the employer’s plan.

Park Place Financial

JULY 6, 2022

RETIREMENT PLANNING The Impact of Public Retirement in Texas Schedule a Complimentary Financial Review CLICK HERE TO SCHEDULE. Current and upcoming rulings are changing public retirement for Texans. Current and upcoming rulings are changing public retirement for Texans. What Is Texas HB 3898?

Carson Wealth

JULY 12, 2022

Translating from the secret language of financial planning, the sentence would read “Tammy specializes in insurance. She reviewed two types of annuity contracts often used for retirement and helped determine which one is the best fit for her client.” . The first step in the competency stairway is regulatory compliance. .

Sara Grillo

DECEMBER 16, 2024

What if the local baker had a 401k plan? Small business retirement plans are the way to save the American middle class from retirement failure! Why are small business owners not offering 401k plans? Instead of trying to pitch lower fund fees or compliance, strike them in the heart. The neighborhood laundry?

Brown Advisory

JANUARY 20, 2023

We work closely with our clients and their outside professional advisors to identify when FBAR filings are required and to help facilitate compliance. In 2014, an 87-year-old, retired specialty-glass importer faced more than $2 million in penalties for failing to disclose a $7 million Swiss account which dated back to the 1960s.

Fortune Financial

MARCH 5, 2024

One powerful tool that might not be on every entrepreneur’s radar — but definitely should be — is a 401k plan. Aside from just being a retirement savings option, a 401k for small business owners can be a game-changer that offers benefits extending well beyond your future financial security and that of your employees.

Fortune Financial

JANUARY 11, 2024

Based on the 2022 Workplace Wellness Survey , published in the Employee Benefit Research Institute (EBRI) journal, younger employees prioritize professional development opportunities, while older employees value retirement planning more. Retirement benefits are a key component of a benefits package that attracts and retains top talent.

Indigo Marketing Agency

MAY 5, 2020

How To Grow Your Retirement Plan Business In The 2020 Economic Crisis. We’ll review: – How has the retirement landscape been affected by COVID-19? – How can advisors grow their retirement business in the current crisis? I’m super excited to welcome the team at Retirement Learning Center.

Midstream Marketing

DECEMBER 6, 2024

Running focused social media campaigns that highlight their services and share their skills in areas like tax planning or retirement planning. Compliance and Security for RIAs Compliance and data security matter a lot in the financial services industry. A lot of clients use these devices.

Fortune Financial

SEPTEMBER 25, 2023

Whether planning for retirement, saving for your children’s education or simply looking to grow your investments, finding the right wealth management services in Kansas City can make all the difference. Long-term goals typically encompass retirement planning, wealth preservation and estate planning.

Midstream Marketing

DECEMBER 10, 2024

Do you specialize in retirement planning for small business owners? You might have a webinar about planning for retirement, easy investments for beginners, or key estate planning tips. Financial advisors can use videos in different parts of financial planning. It helps create a record for compliance.

Fortune Financial

SEPTEMBER 25, 2023

Whether planning for retirement, saving for your children’s education or simply looking to grow your investments, finding the right wealth management services in Kansas City can make all the difference. Long-term goals typically encompass retirement planning, wealth preservation and estate planning.

Midstream Marketing

NOVEMBER 6, 2024

Or are you focusing on older people who are concerned about estate planning for retirement or retirement income planning? Financial Goals: These include saving for retirement, managing money, and paying for education. Retirement Planning: Give tips on how to save for retirement.

WiserAdvisor

OCTOBER 9, 2023

The rules surrounding Individual Retirement Accounts (IRAs) undergo frequent and impactful changes. While IRAs are a cornerstone for many retirement plans, these accounts being inherited adds a layer of complexity to them. A professional can help guide you through the complex maze of retirement account regulations.

Sara Grillo

AUGUST 25, 2023

Transform Retirement www.transformretirement.com Avg account size: Approx. Clients are given full access to our entire offering (investments, retirement, college, insurance, tax, estate, etc.) Services: Brava provides advice-only planning delivered through hourly, project-based, or ongoing engagements. 56 Capital Partners www.56capitalpartners.com

WiserAdvisor

MAY 31, 2023

While both SIMPLE IRA and 401(k) plans serve the common goal of providing individuals with an opportunity to save for retirement, they differ in certain aspects that can significantly impact employers and employees. Additionally, employers must meet specific eligibility requirements and should not have another retirement plan.

Sara Grillo

MARCH 22, 2024

Matthew Etzler [link] Colorado Skip Fleming Home Advice only planner Downshift Financial Home Eric Courage Margin Flat fee advisor Delaware Sam Lewis www.wecanplanforthat.com Flat Fee and hourly Advice-only only planning to help young professionals and pre-retirees retire early. Chris Shoup [link] Georgia David E.

Brown Advisory

JANUARY 20, 2023

We work closely with our clients and their outside professional advisors to identify when FBAR filings are required and to help facilitate compliance. In 2014, an 87-year-old, retired specialty-glass importer faced more than $2 million in penalties for failing to disclose a $7 million Swiss account which dated back to the 1960s.

International College of Financial Planning

MARCH 31, 2023

The program is designed to provide students with practical exposure to the wealth management industry through internships and hands-on training.

Diamond Consultants

JULY 16, 2024

Common examples of such ancillary services include trust and estate planning, tax advisory, concierge/UHNW services, bill-pay, specialty financing, bespoke alternative and private investments, and many more. Expand your affiliations. A broader menu of products and services, as defined above, does not necessarily mean doing it all in-house.

International College of Financial Planning

OCTOBER 5, 2021

Hence, you must have a passion for finance and always stay ahead in the game.The laws, regulations, and compliance requirements concerning investment, planning, and finance keep changing regularly and you must stay abreast with them. Investments, tax planning, retirement planning is a dynamic field.

Random Roger's Retirement Planning

APRIL 8, 2023

The tasks of interacting with clients and navigating markets is fun for me (helping people and studying markets) versus the complexity of running an advisory shop, all the regulatory filings, compliance processes that have to be overseen and even mundane stuff like leases and utility bills doesn't sound fun to me at all.

Brown Advisory

NOVEMBER 12, 2015

AGI includes all taxable income, including wages, bonuses, taxable interest, dividends, capital gains, retirement distributions, annuities, rents and royalties. Circular 230 Compliance Statement. In compliance with those regulations, we must inform you that: 1. Accelerate or postpone deductions to maximize tax advantages.

Random Roger's Retirement Planning

NOVEMBER 21, 2023

I outsource compliance (have to), technology stuff (pretty sure I have to) and we brought our support person with us to help with things like RMDs, money movement and other administrative work. The idea that I could do no work is culturally acceptable.

Midstream Marketing

NOVEMBER 6, 2024

Or are you targeting older individuals planning for retirement income? Financial Goals : They want to save for retirement , manage their money, and pay for education. Retirement Planning : Offer tips on saving and managing retirement funds. It is important to manage compliance and regulations correctly.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content