Edelman Financial Engines Acquires $1.5B Retirement Plan Consultant

Wealth Management

DECEMBER 14, 2023

The deal with New England Pension Plans Systems is Edelman Financial Engine's largest acquisition since 2021.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

DECEMBER 14, 2023

The deal with New England Pension Plans Systems is Edelman Financial Engine's largest acquisition since 2021.

The Chicago Financial Planner

NOVEMBER 27, 2022

One of the best tax deductions for a small business owner is funding a retirement plan. Beyond any tax deduction you are saving for your own retirement. You deserve a comfortable retirement. If you don’t plan for your own retirement who will? I generally consider this a plan for the self-employed.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

DECEMBER 4, 2023

AFS 401(k) Retirement Services and AFS Financial Group is a retirement plan and wealth management consulting firm with $2.3 billion in assets under advisement.

Wealth Management

MARCH 9, 2023

billion firm with wealth, retirement planning, and endowment and foundation businesses. In its first acquisition of the year, Captrust adds a $5.8

Nerd's Eye View

MARCH 10, 2025

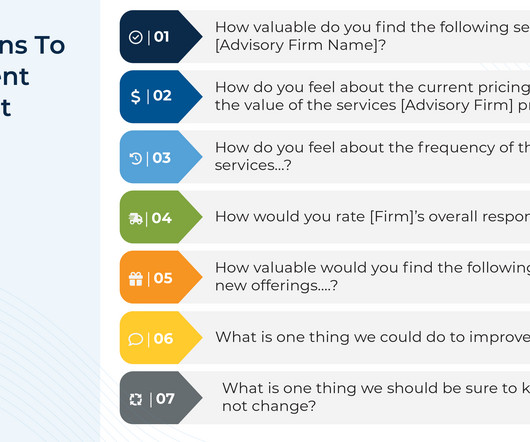

These services may range from 'standard' offerings like retirement planning to less traditional areas like credit card consulting. Financial advicers often market their comprehensive financial services as a way to differentiate themselves from other advisory firms and to stand out in the broader landscape of financial advice.

Wealth Management

SEPTEMBER 7, 2022

HUB International acquired Direct Advisors, a $600 million retirement plan consultant and third-party administrator in Latham, N.Y.

Wealth Management

APRIL 14, 2023

OneDigital acquired Huntington National Bank’s 401(k) and retirement plan business this week, while Clearstead Advisors picked up local firm CLS Consulting. The Mather Group and NewEdge Wealth both announced key hires.

Wealth Management

JUNE 16, 2023

billion retirement plan consulting business. In RIA news this week, Hightower announced its 3rd billion-dollar-plus acquisition this month, while SageView picked up a $5.2

Carson Wealth

MARCH 28, 2024

Retirement planning is a journey that generally takes decades to complete and most of us start out along the do-it-yourself path. More than likely, your first step was to enroll in an employer-provided plan such as a 401(k) or setting up an individual retirement account, also known as an IRA.

Darrow Wealth Management

SEPTEMBER 19, 2024

Unlike most types of retirement plans, the SEP IRA is funded by the employer. A SEP IRA (Simplified Employee Pension Individual Retirement Account) is a type of retirement plan specifically designed for self-employed individuals and small business owners. What is a SEP IRA?

Carson Wealth

OCTOBER 24, 2024

Retiring abroad can be a dream come true for many Americans, offering the opportunity to explore new cultures, enjoy different climates, and potentially stretch retirement savings. But moving to a new country involves significant financial planning. tax return every year. Knowing the tax landscape in both the U.S.

The Big Picture

FEBRUARY 27, 2023

Recall last week , we were discussing thinking about the impact of retiring Baby Boomers on the equity markets and of rising rates on housing. The demographic question touches on a big issue: $6 trillion dollars in 650,000 (401k) retirement plans held by 10s of millions of Americans.

The Chicago Financial Planner

FEBRUARY 8, 2023

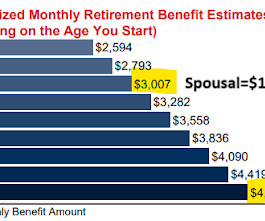

Is my Social Security subject to taxes once I reach my full retirement age? Your full retirement age (FRA) is a key number for many aspects of Social Security. Related to this, if you are working into retirement your wages or self-employment income are subject to FICA and Medicare taxes regardless of your age.

Random Roger's Retirement Planning

JANUARY 6, 2025

Do you plan to work one way or another, consulting, part time or monetized hobby? Maybe you have very few moving parts or have many more moving parts but it is important to realize that no one's retirement plan will be done in by everything going exactly as planned. What could go wrong there?

Darrow Wealth Management

APRIL 15, 2024

It goes by many different names: semi-retirement, partial or phased retirement, second career, and so on. But typically, it means the same thing: working in some capacity after retiring early. As more workers consider the growing appeal of semi-retirement, some ask — is working part-time in retirement a good idea?

Carson Wealth

JULY 3, 2024

Consulting a tax advisor or attorney can help develop strategies for minimizing tax liability and staying compliant. Plan for Your Retirement As a small business owner, it’s essential to plan for your retirement independently since you may not have the benefit of employer-sponsored retirement plans.

Talon Wealth

OCTOBER 26, 2023

Retirement planning can be intimidating, especially if you need help figuring out where to start. Determine When to Start Saving When it comes to saving for retirement, earlier is almost always better. Create a Budget Creating a budget allows you to track your expenses and ensure you’re saving enough for retirement.

The Big Picture

MARCH 6, 2023

Lawmakers are trying to restrict these investment choices in workplace retirement plans, but big fund managers are trying to give shareholders a voice. ( At Columbia, she did consulting work for numerous institutions before joining Soros Capital Management and S.A.C. A Wealth of Common Sense ) • On Wall St., Capital Advisors.

Zoe Financial

JANUARY 27, 2025

The Five Phases of Retirement Planning Published January 29, 2025 Reading Time: 2 minutes Written by: The Zoe Team Retirement is a journey with distinct phases, each requiring its own focus and preparation. The Transition Phase Approaching retirement brings the need for a shift in priorities. Ready to Grow Your Wealth?

Good Financial Cents

JANUARY 26, 2023

Early retirement has become a popular financial goal. Even if you never retire early, just knowing that you can is liberating! Can You Really Retire at 50? Can You Really Retire at 50? Table of Contents Can You Really Retire at 50? FAQs on Retiring Early at 50 It’s a big bold claim – retire at 50?

Nationwide Financial

OCTOBER 6, 2022

Key Takeaways: According to a new Nationwide Retirement Institute® survey, the overall outlook on retirement for Americans has changed significantly since 2021, as roughly one in four employees feel they are on the wrong track for retirement and fewer than six in 10 have a positive outlook on their retirement plan and financial investments.

Integrity Financial Planning

DECEMBER 18, 2023

One crucial aspect that you should financially monitor is the common financial stumbling block encountered when shifting to a retirement lifestyle. If your plan is working, then you probably want to stick with it. If your plan is working, then you probably want to stick with it. However, reality is often different.

Carson Wealth

JUNE 28, 2023

Your retirement income plan may be sending up bubbles, too, whether around Social Security, retirement account distributions, taxes or somewhere else – and these holes need to be patched up right away. So, to help your retirement plan be more airtight, let’s look at a few of the common leaks.

Integrity Financial Planning

JUNE 12, 2023

As you plan for retirement, it’s important to consider tax optimization strategies to minimize your tax liabilities. Here are three key ways to optimize taxes in retirement, based on information from sources published between 2022 and 2023.

WiserAdvisor

NOVEMBER 14, 2023

Retirement planning is an essential aspect of financial security, especially as one transitions from a phase of regular income to relying on savings and investments. The concept of retirement has undergone a significant transformation in recent times. Traditional retirement plans often rely heavily on pension schemes.

Nationwide Financial

JANUARY 10, 2023

Key Takeaways: Female participants are delaying their retirement at a greater rate than male counterparts due to concerns about inflation and market volatility. Plan sponsors can help with education and new solutions. Only 4% of women respondents are moderately or extremely familiar with retirement planning for decumulation.

Carson Wealth

DECEMBER 8, 2023

Many states also exempt retirement income, which may include Social Security. However, retirement income is generally included for income related monthly adjustment amount (IRMAA) computations to determine if supplemental payments are due for Medicare Part B and Medicare Part D premiums.

Carson Wealth

OCTOBER 3, 2024

Retirement is an exciting milestone—a time to leave behind the hustle and bustle of work and embrace a new chapter filled with more freedom and opportunities to enjoy life. Planning well in advance ensures that your retirement years will be financially secure, fulfilling, and less stressful than your working years.

WiserAdvisor

DECEMBER 18, 2023

Navigating the journey to retirement can often feel like a complex puzzle, especially when it comes to figuring out how much you need to save. The answer to “how much you need to retire” is shaped by various factors, including the kind of retirement life you dream of, your age, and the expenses you anticipate during your retirement years.

Darrow Wealth Management

NOVEMBER 20, 2023

If you think retirement planning moves stop at retirement, think again. Although it won’t make sense in every situation, retirement can be a unique opportunity for Roth conversions for some investors. For high earners, converting an IRA to a Roth IRA while you’re still working could be the worst time of all.

WiserAdvisor

SEPTEMBER 20, 2023

In retirement planning, the concept of vesting is more than a contractual formality; it serves as a retention tool that incentivizes employees to remain with their employer for a certain period. Typically, these contributions are made by an employer into an employee’s retirement account as a part of their benefits package.

WiserAdvisor

SEPTEMBER 13, 2022

The average retirement age in America is 63. However, it may still be advised to start planning your retirement as soon as you can. Retirement planning is a long process. It can take several years to understand your future needs and accumulate enough savings to prepare for a financially secure retirement.

Park Place Financial

NOVEMBER 29, 2022

Retirement Planning 5 Ways to Catch Up on Retirement Planning Later in Life Schedule a Complimentary Financial Review CLICK HERE TO SCHEDULE. Retirement is a significant investment, which is why so many financial experts recommend establishing goals and starting when still a younger adult.

Harness Wealth

APRIL 16, 2025

Roth IRA conversions present a significant challenge for retirement planners: pay taxes now or later? Moving funds from traditional IRAs to Roth accounts triggers immediate taxation but promises tax-free withdrawals in retirement. This flexibility becomes increasingly valuable as your retirement portfolio grows more complex.

Carson Wealth

MARCH 14, 2024

By Matt Kory, Vice President, Retirement Programs Changing careers is an emotional move – there’s excitement for the new opportunity, sadness about leaving your favorite coworkers behind, depression if you weren’t ready to leave, worry about how to financially bridge the unemployment gap and anticipation of the new career all at once.

WiserAdvisor

SEPTEMBER 14, 2022

The average retirement age in America is 63. However, it may still be advised to start planning your retirement as soon as you can. Retirement planning is a long process. It can take several years to understand your future needs and accumulate enough savings to prepare for a financially secure retirement.

WiserAdvisor

SEPTEMBER 13, 2023

While grappling with various aspects of retirement planning, it is imperative to acknowledge a critical factor that often does not receive its due attention – longevity risk. While this is undoubtedly positive, it introduces the challenge of ensuring that your financial resources last an extended retirement period.

Envision Wealth Planning

MARCH 24, 2022

Retirement planning for women can be trickier than most people may think. Most women I talk to are more concerned about paying less in taxes today than when they retire. This means even more money will be spent on retirement. Let’s look at saving money for retirement using a regular account, an IRA, and a Roth IRA.

James Hendries

AUGUST 24, 2022

Planning for retirement can seem premature when you have only been in the workforce for a decade or so. But as the oldest Millennials begin to hit middle age, retirement suddenly does not seem so far away. Here are five things Millennials should consider when planning for retirement. Free Money May Be Available.

Harness Wealth

JANUARY 9, 2025

Backdoor strategies are retirement contribution methods that allow individuals to bypass income limits and contribute to tax-advantaged retirement accounts. While a Mega Backdoor Roth IRA rolls these contributions into a Roth IRA, a Mega Backdoor Roth 401(k) converts them directly into a Roth 401k within the employer’s plan.

Indigo Marketing Agency

FEBRUARY 8, 2025

For example, your target audience could be young professionals saving for retirement or retirees focused on wealth preservation. You can start hosting webinars by first choosing topics that matter to your audiencethings like retirement planning, wealth preservation, or smart investment strategies.

Sara Grillo

DECEMBER 16, 2024

Today I have Brian Williams of Northshire Consulting and were going to be talking about how financial advisors can help improve 401k plan access to the American people who are working at small businesses who currently do not offer them. What if the local baker had a 401k plan? The neighborhood laundry? The neighborhood laundry?

Darrow Wealth Management

AUGUST 14, 2023

Who doesn’t love the sound of an early retirement? But before focusing solely on whether you can retire early financially , also consider what you plan to do after retiring early. Retirement is a major lifestyle change. First, individuals retiring early may find their friends don’t have the same luxury.

Clever Girl Finance

DECEMBER 13, 2023

Saving money is an important task at any age, but as you hit your 40s, the need to save for retirement grows. While savers in their 40s and 50s typically have a decade or two left to save for retirement given the traditional age of 65, emphasizing saving now can set you up for a dream-worthy retirement.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content