Debt Management in Estate Planning

Wealth Management

NOVEMBER 10, 2023

What if a client burdened with substantial debts or liabilities from their business unexpectedly passes away?

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Debt Management Related Topics

Debt Management Related Topics

Wealth Management

NOVEMBER 10, 2023

What if a client burdened with substantial debts or liabilities from their business unexpectedly passes away?

Wealth Management

AUGUST 29, 2022

China’s distressed-debt managers have been in turmoil as aggressive lending to embattled developers and unchecked expansion into other areas during the sector’s boom years has beset the $730 billion funds with heavy credit losses.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Profit in the Details: Rethinking Spend for Monumental Impact

Fall In Love With the Month-End Close

Next-Level Fraud Prevention: Strategies for Today’s Threat Landscape

Advisor Perspectives

SEPTEMBER 13, 2023

Incorporating debt planning into your services helps your clients achieve a more comprehensive and sustainable financial future.

Wealth Management

MARCH 4, 2024

How technology is helping advisors navigate the debt management landscape.

Nerd's Eye View

DECEMBER 6, 2023

Notably, while many financial coaches satisfy the majority of these requirements – they are in the business of offering advice to clients and are compensated as such – they often steer clear of making specific securities recommendations, focusing instead on areas like budgeting, debt management, savings, and retirement planning.

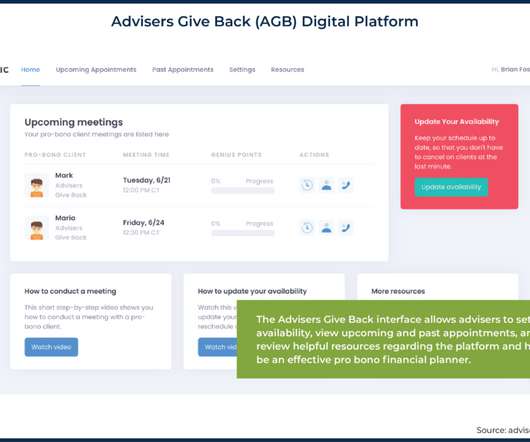

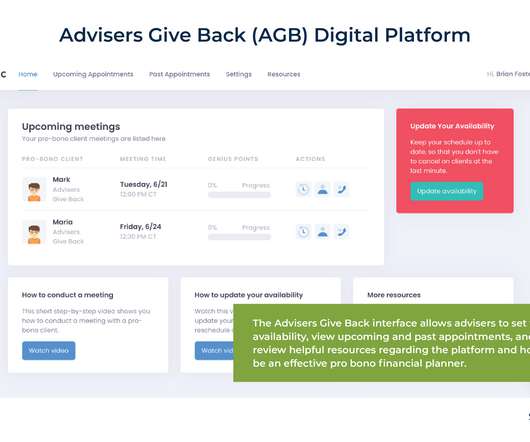

Nerd's Eye View

AUGUST 15, 2022

Most advisors are already familiar with many of the issues these individuals face, from setting goals to debt management, although the specifics might be slightly different given the typically lower incomes and wealth of pro bono clients. law) with established pro bono programs.

Nationwide Financial

MARCH 13, 2023

By taking a holistic approach to financial planning, you can help your clients manage their debt effectively and work toward building financial security. Here are three things financial professionals can do to help their clients deal with debt management: 1.

Nerd's Eye View

AUGUST 15, 2022

Most advisors are already familiar with many of the issues these individuals face, from setting goals to debt management, although the specifics might be slightly different given the typically lower incomes and wealth of pro bono clients. law) with established pro bono programs.

MainStreet Financial Planning

SEPTEMBER 12, 2024

In this article, we’ll explore three key areas: savings, debt management, and investment strategies, and provide actionable advice to help you stay ahead of the curve. Debt Management While lower interest rates are good news for borrowers, high-interest debt will still weigh heavily on your finances.

Clever Girl Finance

JANUARY 26, 2024

A step-by-step guide on how to use consumer credit counseling Expert tip: A credit counselor can help with more than debt management Where to find a reputable credit service How credit counseling can help you How do you select a credit counseling service? Table of contents What is consumer credit counseling and who might need it?

Validea

SEPTEMBER 5, 2024

Debt Management : GWW could pay off its debt with less than two years of earnings, demonstrating conservative financing. Efficient Capital Allocation : Management has delivered a 21.6% Debt Management : While not as strong as GWW, ITW can pay off its debt with less than five years of earnings.

Carson Wealth

APRIL 25, 2024

Once you have your goals set, you can build your plan with any combination of the following elements: Budgeting and expense management: Create a detailed budget outlining income, expenses, and savings targets. Debt management: Develop a strategy to pay off existing debts efficiently, minimizing interest costs.

Clever Girl Finance

JANUARY 22, 2024

However, in some cases, you may need to sign up for a Debt Management Program (DMP), which will usually have a cost. You can get basic budget counseling at their various agencies as well as debt management plans. They can help connect you to a member agency that will offer debt relief solutions.

Validea

DECEMBER 3, 2024

Debt Management: With earnings of $1.47 million in debt, NVR could pay off its entire debt in less than two years. NVR excels across multiple Buffett criteria: Earnings Predictability: NVR shows consistently expanding earnings, with EPS growing from $63.50 over the past decade, demonstrating a robust 22.8%

Carson Wealth

AUGUST 25, 2022

Your financial advisor can help you plan for challenges you may face in retirement, such as spending, efficient savings, taxes, inflation, debt management, Social Security and Medicare. “ Working with a qualified financial advisor to develop a holistic retirement plan can help prepare you for the road ahead.

Validea

JANUARY 18, 2025

and the company carries minimal debt. Management has generated a 22.7% LPL Financial Holdings (LPLA) This investment advisory firm earns perfect scores by combining strong growth with reasonable valuations. historical earnings growth paired with an 8.6 P/E ratio creates a compelling PEG ratio of 0.40. ROE averages 15.2%

Fortune Financial

SEPTEMBER 5, 2023

A lack of comprehensive understanding of credit cards, interest rates and debt management can set the stage for a cycle of uninformed choices, ultimately contributing to the substantial rise in credit card balances. Work with a Fortune Financial advisor to learn how to manage your current debt.

Clever Girl Finance

AUGUST 30, 2023

If you’re considering a debt settlement company, be wary of any company that guarantees they can make your debt go away and charges you before they settle your debt. Consult a credit counseling company Credit counselors advise you on your money and debt , helping you figure out a healthy debt management plan.

Carson Wealth

JANUARY 4, 2024

Now is when you should be more focused on managing debt and planning for – not just looking toward – the future. Debt management: In your 30s it’s important you manage debt obligations carefully.

International College of Financial Planning

MAY 30, 2023

Debt management Debt management involves understanding the different types of debt,evaluating their costs, and creating a strategy to pay off debts efficiently.Financially literate individuals can make informed decisions about borrowing money, negotiate better interest rates, and avoid falling into debt traps.

Clever Girl Finance

OCTOBER 7, 2022

Credit and debt management counselors. Unfortunately, many people turn to credit cards and amass more debt during financial hardship. As people add to their credit card balances, more are going to need help managing their debt. So you see why accountants have the best recession proof careers!

Fortune Financial

SEPTEMBER 5, 2023

A lack of comprehensive understanding of credit cards, interest rates and debt management can set the stage for a cycle of uninformed choices, ultimately contributing to the substantial rise in credit card balances. Work with a Fortune Financial advisor to learn how to manage your current debt.

WiserAdvisor

JULY 3, 2023

Not prioritizing debt management Debt management is another reason why financial planning for physicians is necessary. In most cases, healthcare professionals have a lot of unpaid debt. Medical schools can be costly. and to know which of these strategies can help you and your unique financial considerations.

Trade Brains

DECEMBER 7, 2023

At the end of the course, you will gain knowledge on personal finance, budgeting, debt management plans and retirement planning. Also, it helps you understand how to implement strategies to meet your financial goals. You can enroll in the course here.

WiserAdvisor

DECEMBER 18, 2023

Debt management Consider minimizing your existing debts, particularly high-interest loans. Risk tolerance Assessing your risk tolerance as a couple is the first step to determining your investment strategy. If you are risk-averse, you may prefer conservative investments with lower potential returns but greater stability.

WiserAdvisor

JULY 25, 2023

Hiring a financial advisor can provide several benefits that are essential for managing your financial well-being. They can create a comprehensive financial plan tailored to your specific needs and goals. In addition to their financial expertise, a financial advisor can also address your emotional needs.

WiserAdvisor

NOVEMBER 4, 2022

They can also help with debt management, retirement planning, estate planning, and more. Financial advisors can help you invest in the right instruments according to your risk appetite, and help you make the most of emerging market opportunities. To conclude. Financial planning for dual-income families is not all that complicated.

Trade Brains

JULY 13, 2024

The stock market emerged as a vital medium for expansion and debt management, allowing widespread ownership of businesses. With the decline of kingdoms and the rise of governments came laws and regulations that fostered the formation of companies. Brokers facilitated these transactions, driving further innovation.

Clever Girl Finance

DECEMBER 1, 2022

Pay off debt. When you create a financial plan, be sure it includes a debt management system and how you'll pay off debt. Sadly, you can't really kick-start your financial future if you're carrying a ton of debt.

Clever Girl Finance

MAY 13, 2023

Credit and debt management counselors Unfortunately, many people turn to credit cards and amass more debt during financial hardship. As people add to their credit card balances, more are going to need help managing their debt. So you see why accountants have the best recession proof careers!

Trade Brains

SEPTEMBER 6, 2024

Debt Levels: The debt-to-equity ratio edged up to 0.60 ratio in FY20, reflecting better debt management and improved financial stability. ROE (%) 9.96% ROCE (%) 7.64% Promoter Holding (%) 50.33% FII Holdings (%) 21.75% Debt to Equity Ratio 0.57 in FY24 from 0.52 in FY23, indicating a slight increase in leverage.

Fortune Financial

SEPTEMBER 25, 2023

It may encompass budgeting, debt management and developing strategies for saving and investing. Investment Management Investment management is a critical aspect of wealth management.

Darrow Wealth Management

OCTOBER 1, 2022

Is retiring with a mortgage a good idea? Most individuals will jump through hoops to live mortgage-free, regardless of whether it makes the most sense financially. Sure, all else equal, it’s always better to reduce your expenses.

Trade Brains

SEPTEMBER 21, 2024

Improved debt management may lead to better financial health. What are your thoughts on Reliance Infrastructure’s strategy to reduce debt? The rise in foreign and domestic institutional investor holdings reflects growing confidence in its future.

Trade Brains

AUGUST 26, 2024

This approach helps maintain high asset utilisation and healthy debt management. Asset Light Business Model: The company operates in 109 Indian cities and has a fleet of over 12,000 vehicles. It uses an asset-light model, owning only 5.81% of its fleet.

Gen Y Planning

JULY 1, 2023

Create a Debt Management Plan The less debt on your plate, the fewer recurring financial obligations you have to tend to each month. Make debt repayment a priority for your budget to free up your future cash flow.

Carson Wealth

DECEMBER 7, 2022

If you’re under significant debt pressure, consider talking with a Certified Financial Planner Professional or an Accredited Financial Counselor who specializes in consumer credit and debt management. . Establishing Appropriate Insurance Coverage . You may feel invincible at thirty, healthy and ready to tackle the next 5k.

International College of Financial Planning

AUGUST 2, 2021

Wealth Management Firms. Debt Management Firms. Financial advisors work with different kinds of organizations, and these include –. Banks & NBFCs. Brokerage Firms. Insurance Companies. Accounting & Tax Planning Firms.

Tucker Advisors

SEPTEMBER 27, 2021

They have been called the debt managers of the world. Are Insurance Companies Safe? By Sam Deleo Tucker Advisors Senior Content Specialist/Editor. Follow Follow Follow Follow Follow Follow. But just how solvent and safe are insurance companies?

Clever Girl Finance

OCTOBER 16, 2023

Earning involves simple money management, such as budgeting and debt management. The more you know about money, the more you’ll feel confident and stable in your financial situation. The three basics to practice for financial literacy are earning, saving, and growing.

Fortune Financial

SEPTEMBER 25, 2023

It may encompass budgeting, debt management and developing strategies for saving and investing. Investment Management Investment management is a critical aspect of wealth management.

Clever Girl Finance

APRIL 29, 2024

How to stop delaying financial decisions: To stop delaying important financial decisions, start by breaking down the actions you need to take into smaller, manageable steps. Educate yourself about the decisions you need to make, whether it’s investing, budgeting, or debt management, so you feel more confident and empowered.

WiserAdvisor

AUGUST 3, 2023

A reputable financial advisor should provide a comprehensive range of services, including budgeting, debt management, insurance optimization, tax planning, retirement planning, estate planning, and investment management. A financial advisor’s service is equally significant when assessing their value proposition.

Brown Advisory

MAY 4, 2020

As is often the case, its strategic and investment choices are intertwined, because the college needs to allocate its precious capital across several competing options.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content