Debt Management in Estate Planning

Wealth Management

NOVEMBER 10, 2023

What if a client burdened with substantial debts or liabilities from their business unexpectedly passes away?

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

NOVEMBER 10, 2023

What if a client burdened with substantial debts or liabilities from their business unexpectedly passes away?

Wealth Management

AUGUST 29, 2022

China’s distressed-debt managers have been in turmoil as aggressive lending to embattled developers and unchecked expansion into other areas during the sector’s boom years has beset the $730 billion funds with heavy credit losses.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Wealth Management

MARCH 4, 2024

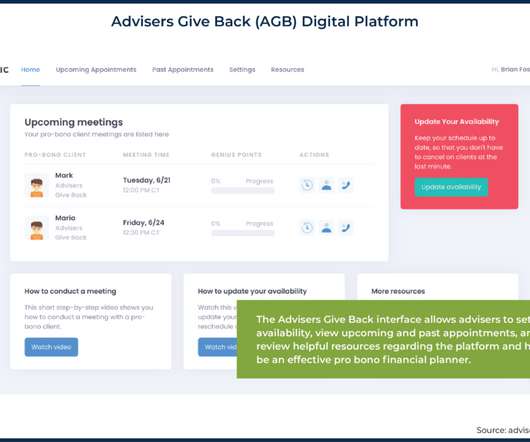

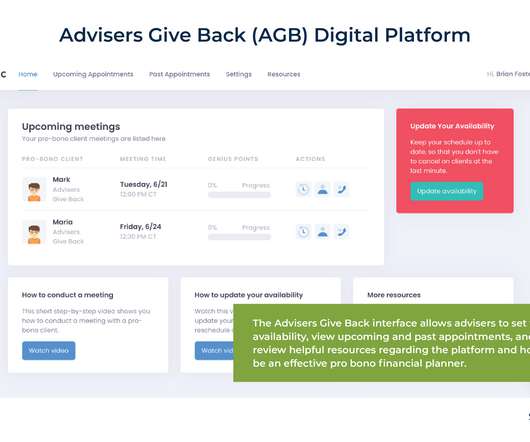

How technology is helping advisors navigate the debt management landscape.

Advisor Perspectives

SEPTEMBER 13, 2023

Incorporating debt planning into your services helps your clients achieve a more comprehensive and sustainable financial future.

Nerd's Eye View

DECEMBER 6, 2023

In this guest post, Chris Stanley, investment management attorney and Founding Principal of Beach Street Legal, explores the specific conditions under which a financial coach must register as an investment adviser. Nevertheless, the 'securities' component of the definition has several nuanced exceptions.

Nationwide Financial

MARCH 13, 2023

Key Takeaways: Managing debt can be a common, yet daunting problem for many Americans. As a financial professional, one of the most important things you can do for your clients is to help them manage their debt effectively and work toward building financial security.

Nerd's Eye View

AUGUST 15, 2022

Most advisors are already familiar with many of the issues these individuals face, from setting goals to debt management, although the specifics might be slightly different given the typically lower incomes and wealth of pro bono clients. law) with established pro bono programs.

Nerd's Eye View

AUGUST 15, 2022

Most advisors are already familiar with many of the issues these individuals face, from setting goals to debt management, although the specifics might be slightly different given the typically lower incomes and wealth of pro bono clients. law) with established pro bono programs.

Validea

DECEMBER 3, 2024

Debt Management: With earnings of $1.47 million in debt, NVR could pay off its entire debt in less than two years. per share and effective capital management, as evidenced by their share reduction from 3.63 over the past decade, demonstrating a robust 22.8% long-term growth rate. billion against $911.6

Validea

MARCH 1, 2025

Management effectiveness is evaluated by their ability to produce at least a 12% return on retained earnings, demonstrating wise use of shareholders’ capital. The model emphasizes prudent debt management, restricting long-term debt to no more than five times annual earnings to ensure financial flexibility.

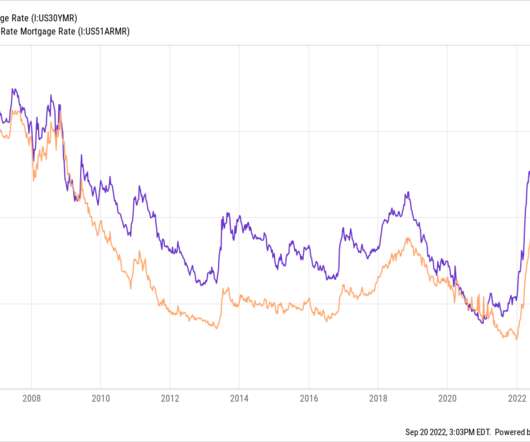

MainStreet Financial Planning

SEPTEMBER 12, 2024

Interest rates are expected to drop soon, and this shift presents both opportunities and challenges for savers, investors, and anyone managing debt. In this article, we’ll explore three key areas: savings, debt management, and investment strategies, and provide actionable advice to help you stay ahead of the curve.

Validea

FEBRUARY 2, 2025

At its core, the strategy seeks companies that demonstrate sustained excellence through strong earnings, prudent financial management, and exceptional returns for shareholders. Debt management is crucial – the strategy limits long-term debt to no more than five times annual earnings, ensuring companies maintain financial flexibility.

Validea

JANUARY 18, 2025

The company maintains high returns on equity around 16%, has minimal debt, and shows consistent earnings growth. Free cash flow remains positive, and management has proven skilled at reinvesting earnings with a 18.9% and the company carries minimal debt. Management has generated a 22.7% Management has delivered a 20.2%

Validea

FEBRUARY 6, 2025

When a company maintains strong shareholder yield through a balanced mix of dividends, buybacks, and debt management, it often indicates skilled leadership making effective decisions about how to deploy capital.

Validea

MARCH 20, 2025

Validea’s Graham-Based Investment Model Validea has created a quantitative model based on Graham’s principles, incorporating specific criteria across four key areas: Operational Fundamentals Size Requirement : Annual revenue must exceed $340 million, ensuring sufficient business scale and stability Earnings Consistency : Companies must (..)

Fortune Financial

SEPTEMBER 25, 2023

How to Choose the Right Wealth Management Firm in Kansas City Managing your wealth is a crucial aspect of financial success and security. Let’s look at key factors to consider when selecting the ideal wealth management firm in the Kansas City metro area. But with many options available, how do you choose the right one?

Clever Girl Finance

JANUARY 22, 2024

When you’re drowning in large amounts of debt or chronic struggles with money management, working with a trained counselor is likely worth a small investment. Help with managing your money Money management is one of the key ways you could benefit from budget counseling. The FCAA is a non-profit organization.

Fortune Financial

SEPTEMBER 25, 2023

How to Choose the Right Wealth Management Firm in Kansas City Managing your wealth is a crucial aspect of financial success and security. Let’s look at key factors to consider when selecting the ideal wealth management firm in the Kansas City metro area. But with many options available, how do you choose the right one?

Harness Wealth

JUNE 1, 2023

When it comes to managing wealth and planning for a secure financial future, the services of financial professionals, such as financial advisors or wealth managers, are invaluable. Wealth managers and financial advisors offer a wide range of wealth management services designed to help clients achieve their financial goals.

Validea

SEPTEMBER 5, 2024

Conservative Management : Both dividend consistency and Buffett’s model favor companies that manage capital efficiently. Debt Management : GWW could pay off its debt with less than two years of earnings, demonstrating conservative financing. Efficient Capital Allocation : Management has delivered a 21.6%

Clever Girl Finance

JANUARY 26, 2024

A step-by-step guide on how to use consumer credit counseling Expert tip: A credit counselor can help with more than debt management Where to find a reputable credit service How credit counseling can help you How do you select a credit counseling service? Table of contents What is consumer credit counseling and who might need it?

Darrow Wealth Management

MARCH 17, 2025

5 ways to use extra savings Invest excess cash using a brokerage account Increase contributions to a 401(k), 403(b), or IRA Consider using the funds to pay the tax on a Roth IRA conversion Refinance your mortgage Pay off student loans or bad debt Read more about ways to use extra savings. appeared first on Darrow Wealth Management.

Carson Wealth

JANUARY 4, 2024

Which decade should you focus on managing debt? Now is when you should be more focused on managing debt and planning for – not just looking toward – the future. Debt management: In your 30s it’s important you manage debt obligations carefully. Which decade can you afford to take more risk?

Carson Wealth

AUGUST 25, 2022

Your financial advisor can help you plan for challenges you may face in retirement, such as spending, efficient savings, taxes, inflation, debt management, Social Security and Medicare. A wealth management team can build your investment and insurance strategy, helping to eliminate any health care and spending gaps before you retire.

Trade Brains

DECEMBER 7, 2023

From budgeting basics to investments, these courses offer a comprehensive foundation for managing your money in a better way. By enrolling in this course you will learn to manage your finances more effectively by mastering budgeting and portfolio creating for a healthy retirement corpus. You can enroll in the course here.

Clever Girl Finance

OCTOBER 16, 2023

Earning involves simple money management, such as budgeting and debt management. Today’s young adults are faced with managing their money through societal challenges. We’re in the age of student loan debt and a nationwide housing crisis. So Get A Financial Life gives concrete, actionable tips.

Fortune Financial

SEPTEMBER 5, 2023

A lack of comprehensive understanding of credit cards, interest rates and debt management can set the stage for a cycle of uninformed choices, ultimately contributing to the substantial rise in credit card balances. Work with a Fortune Financial advisor to learn how to manage your current debt.

Darrow Wealth Management

OCTOBER 1, 2022

appeared first on Darrow Wealth Management. Article written by Darrow Advisor Kristin McKenna, CFP® and originally appeared on Forbes. The post Should You Pay Off Your Mortgage Before Retirement?

International College of Financial Planning

MAY 30, 2023

Financial literacy, the skill of effectively managing one’s financial resources, plays a vital role in every aspect of our lives. Risk management and insurance Risk management involves identifying, assessing, and mitigating financial risks.

Fortune Financial

JANUARY 11, 2024

For human resource (HR) managers, curating a benefits package that resonates with the workforce boosts talent attraction, enhances employee retention and fosters a thriving organizational culture. The strategic management of employee benefits is vital in creating an outstanding workplace.

WiserAdvisor

NOVEMBER 4, 2022

Use the right financial tools for dual-income families: Having two sources of income can be confusing to manage. Take help from a financial advisor: A financial advisor can offer expert financial planning tips for dual-income families that can help you use your income adequately, manage taxes, plan for the future, and optimize your expenses.

Clever Girl Finance

AUGUST 30, 2023

If you’re considering a debt settlement company, be wary of any company that guarantees they can make your debt go away and charges you before they settle your debt. Consult a credit counseling company Credit counselors advise you on your money and debt , helping you figure out a healthy debt management plan.

Fortune Financial

SEPTEMBER 5, 2023

A lack of comprehensive understanding of credit cards, interest rates and debt management can set the stage for a cycle of uninformed choices, ultimately contributing to the substantial rise in credit card balances. Work with a Fortune Financial advisor to learn how to manage your current debt.

WiserAdvisor

DECEMBER 18, 2023

60s: Final preparations for retirement As you near retirement in your 60s, the focus naturally shifts from accumulation to preservation and strategic management of your assets. Debt management Consider minimizing your existing debts, particularly high-interest loans.

Don Connelly & Associates

NOVEMBER 4, 2024

A critical aspect of advising clients is to ascertain their financial goals correctly. If you or your clients don't genuinely understand the goal, your advice could be dangerously off base, and you could lose your client's confidence.

WiserAdvisor

JULY 3, 2023

Managing and optimizing this income can be complex. Not prioritizing debt management Debt management is another reason why financial planning for physicians is necessary. In most cases, healthcare professionals have a lot of unpaid debt. Medical schools can be costly. Need a financial advisor?

WiserAdvisor

JANUARY 27, 2023

Due to the complex and diverse range of their financial assets, these individuals also require specialized high-net-worth financial planners and personalized investment management tailored to meet their specific needs. HNW wealth management – Tips for 2023 1. under the Securing a Strong Retirement Act of 2022 (SECURE 2.0).

Clever Girl Finance

APRIL 29, 2024

Stay diligent with debt management, paying it down, and avoiding future debts. Nothing will block the path toward your goals like persistent bad habits such as credit card debt or overspending. Of course, any kind of movement is amazing for our health , including managing anxiety and improving mood.

Clever Girl Finance

MARCH 19, 2024

It’s simply a long-term, organized approach to money management. Pay off debt When you make your money plan, be sure it includes a debt management system and a plan for paying off debt. Sadly, you can’t really kick-start your financial future if you’re carrying a ton of debt.

WiserAdvisor

JUNE 2, 2023

These professionals also hold expertise in various fields, such as retirement planning, tax management, estate planning, investment management, insurance, debt management, wealth management, and more. Investment advisors help manage and diversify a client’s portfolio to limit their exposure to market volatility.

Harness Wealth

MAY 25, 2023

The right advisor can help manage your wealth, plan for retirement, navigate tax implications, and more. Fee Type Fee Description Typical Cost* Examples Assets Under Management (AUM) A fee based on the percentage of your total managed assets. Investing in financial guidance is an investment in your future. Between 0.5%

Trade Brains

JULY 13, 2024

The stock market emerged as a vital medium for expansion and debt management, allowing widespread ownership of businesses. The complexities of derivative products such as futures and options require a deep understanding of market dynamics, risk management, and derivatives pricing models.

Trade Brains

AUGUST 26, 2024

ETS manages employee home-office-home transportation. They use technology to integrate with customer systems, improving efficiency and convenience for corporate travel management. This approach helps maintain high asset utilisation and healthy debt management. It uses an asset-light model, owning only 5.81% of its fleet.

WiserAdvisor

JULY 25, 2023

Hiring a financial advisor can provide several benefits that are essential for managing your financial well-being. They can create a comprehensive financial plan tailored to your specific needs and goals. A skilled financial advisor must tailor your portfolio to meet your financial aspirations within the desired timeframe.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content