Blended Families, Remarriages and Estate Planning

Wealth Management

DECEMBER 20, 2023

When it comes to divorce, a will or trust often is not the last word on estate distribution.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

DECEMBER 20, 2023

When it comes to divorce, a will or trust often is not the last word on estate distribution.

Abnormal Returns

FEBRUARY 19, 2024

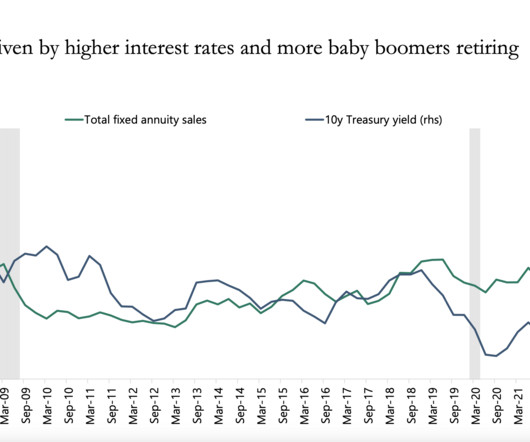

washingtonpost.com) Daniel Crosby offers another sneak preview of an essay from his upcoming book, "The Soul of Wealth." standarddeviationspod.com) Trends The wealth management industry is going to be slammed with demand. morningstar.com) The biz Creative Planning was able to retain some 60% of the United Capital assets.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Cornerstone Financial Advisory

FEBRUARY 26, 2025

After all, financial resources are a divine gift, which means dutiful financial stewardship is essential to faithful wealth management. This includes how we plan and manage our estate. Effective estate planning is an act of financial stewardship. How Should Christians Approach Estate Planning ?

Darrow Wealth Management

JANUARY 16, 2025

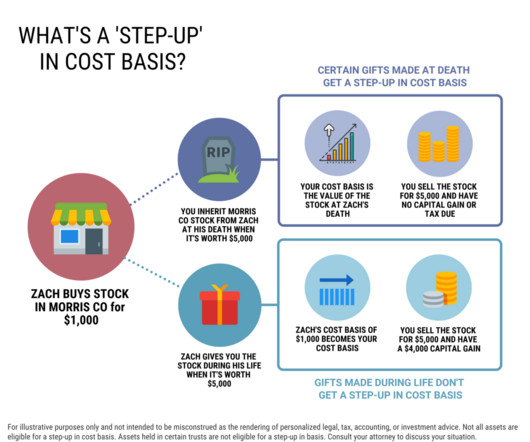

Inheriting a Trust Fund: Distributions to Beneficiaries Do You Pay Tax on an Inheritance? At a high level, if the asset is part of the decedent’s estate it’s typically eligible for a step-up. This can get very tricky so it’s important to work with the estate planning attorney settling the estate.

eMoney Advisor

MARCH 7, 2023

Stepchildren, remarriages, and ex-spouses: For the modern wealth management client with a blended family, planning to transfer wealth presents a web of complexity. Why Focus on Estate Planning for Blended Families A thoughtful plan and good communication can go a long way in heading off conflict in large families.

Darrow Wealth Management

AUGUST 8, 2022

” This meant annual required minimum distributions (RMDs) were out. Another key aspect that the 2019 Secure Act changed was the required minimum distribution age. Assuming the changes pass, some beneficiaries will have missed a required distribution. Individuals born before July 1, 1949 will retain an RMD age of 70 1/2.

Darrow Wealth Management

MAY 6, 2024

If your parent had a trust, the individual(s) named in the trust documents as successor trustee will control the distribution of the trust assets. Checklist for executors of their parent’s estate Get organized Where are the original estate planning documents located? Who is the attorney who drafted the estate plan?

Darrow Wealth Management

JANUARY 29, 2024

This article is a high-level overview of the various estate planning techniques and considerations when using revocable living trusts from the perspective of a wealth advisor (e.g. The US has 50 states – each with their own tax laws and estate planning opportunities. Equitable distribution of your assets.

Harness Wealth

JULY 29, 2024

covers some of the top estate planning trends that tax advisors should be tracking during the second half of 2024. Now that the mid-point of 2024 has passed, we are faced with an environment where little has changed with respect to the wait-and-see posture of estate and wealth transfer planning. The SECURE Act 2.0

Park Place Financial

NOVEMBER 29, 2022

Estates Estate Planning in this Economic Climate Schedule a Complimentary Financial Review CLICK HERE TO SCHEDULE. If you are in the middle of estate planning , consider the following strategies to develop a sound plan amidst widespread economic challenges. . Create a Trust . Charitable Remainder Unitrust .

Fortune Financial

SEPTEMBER 25, 2023

How to Choose the Right Wealth Management Firm in Kansas City Managing your wealth is a crucial aspect of financial success and security. Let’s look at key factors to consider when selecting the ideal wealth management firm in the Kansas City metro area.

Harness Wealth

JUNE 23, 2023

Estate planning is a critical component of a comprehensive financial plan. It involves deciding how your assets will be distributed upon your death or incapacitation. Furthermore, estate planning includes aspects such as tax minimization strategies, asset protection, and charitable giving.

Darrow Wealth Management

OCTOBER 1, 2024

Choosing whether to fund a trust with your assets is an important decision in the estate planning process. A will and a trust are two different estate planning tools. Probate is a legal process where certain assets that were owned in the individual’s name are distributed by the probate court.

Darrow Wealth Management

MARCH 13, 2025

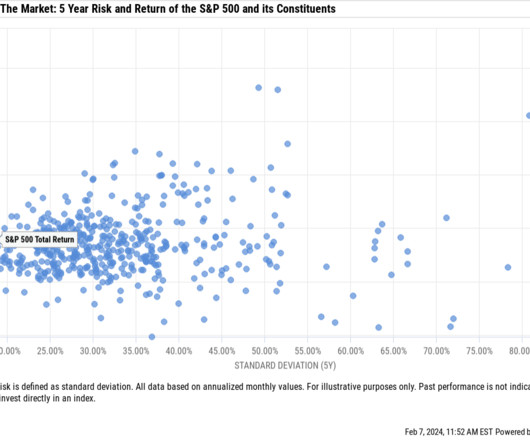

When considering the distribution of excess lifetime returns of individual stocks vs the Russell 3000, the median stock underperformance was almost -10%.(J.P. Morgan Private Bank) 6 ways to manage a concentrated stock position In no particular order, here are some strategies to reduce the risk of concentrated stock holdings.

Fortune Financial

SEPTEMBER 25, 2023

How to Choose the Right Wealth Management Firm in Kansas City Managing your wealth is a crucial aspect of financial success and security. Let’s look at key factors to consider when selecting the ideal wealth management firm in the Kansas City metro area.

Integrity Financial Planning

FEBRUARY 10, 2023

It can also be helpful to have a dialogue with your family about how to manage the wealth you are going to pass down to them. [3] 3] One in four adults in the US said that their parents did not provide them with money lessons when they were children, which shows how little we talk with our kids about money and how to manage it. [4]

Darrow Wealth Management

JUNE 14, 2023

Depending on the nature of the windfall, planning opportunities and considerations will vary. For example, the tax laws and distribution terms for an inheritance is quite different to the tax and liquidity considerations during an IPO. At Darrow Wealth Management, we specialize in helping individuals manage a sudden wealth event.

Fortune Financial

JULY 28, 2022

Anyone who owns company stock will eventually have to decide how to distribute their assets — typically when there is a job change or retirement involved. To recap, NUA is the difference in value between the price initially paid for a stock (the cost basis) and its current market value at the time it is distributed. Cost Tradeoff.

Yardley Wealth Management

JUNE 6, 2023

The post Secure Your Financial Legacy appeared first on Yardley Wealth Management, LLC. Secure Your Financial Legacy When planning for your legacy, it’s important to consider various financial aspects. Financial planning services can assist with developing a comprehensive estate plan.

Darrow Wealth Management

APRIL 25, 2023

In addition to making funeral arrangements and notifying family and friends, another priority is alerting your estate planning attorney and financial advisor. Asset Titling, Beneficiary Elections, and Probate The estate planning attorney is going to be critical here. But not everything needs to get done today.

Darrow Wealth Management

MAY 6, 2024

If your parent had a trust, the individual(s) named in the trust documents as successor trustee will control the distribution of the trust assets. Checklist for executors of their parent’s estate Get organized Where are the original estate planning documents located? Who is the attorney who drafted the estate plan?

Darrow Wealth Management

OCTOBER 23, 2023

This simplified explainer summarizes how most inherited homes are taxed to beneficiaries when they’re inherited by a will or owned in a revocable trust at death (and then distributed to heirs). Estate plans are about distributions, not sentiments.

Darrow Wealth Management

JULY 1, 2024

Since investors pay tax annually on dividends, interest, and capital gains distributions in a taxable brokerage account, even if they don’t sell assets, it can be worthwhile to consider allocating more tax-efficient investments here. appeared first on Darrow Wealth Management. Are You Ready?

Harness Wealth

SEPTEMBER 18, 2024

Only 26% of Americans have an estate plan. If you’re thinking, “But my clients are high-net-worth…many more have an estate plan.” And you’ll see in our Q&A below, that tax advisors can bring estate planning into the conversation early on in a client relationship. What do these numbers tell us?

Yardley Wealth Management

MAY 23, 2023

The post Legacy Planning appeared first on Yardley Wealth Management, LLC. Legacy Planning for People in Their 50’s and 60’s: A Step-by-Step Guide As you near retirement age, it’s natural to consider your legacy. Planning for your legacy is crucial to ensuring your values and goals have a lasting impact.

Trade Brains

JANUARY 24, 2024

Anand Rathi Wealth Limited: In the dynamic change happening in India’s wealth management, one company shines for its personal touch and dedication to client success: Anand Rathi Wealth Limited (ARWL). The company also provides holistic services like estate planning and succession planning without charging clients.

The Big Picture

JANUARY 21, 2025

And I think you will also, if you are at all curious about estate planning or investing or personal finance, this is not the usual discussion and I think it’s very worthwhile for you to hear this and share it with friends and family. And so, you know, that’s why I’ve started to distribute money to them.

Yardley Wealth Management

MAY 29, 2020

appeared first on Yardley Wealth Management, LLC. By Michael Garry Yardley Wealth Management May 21, 2020. A minor one that most can do is to not automatically increase their distributions every year for inflation. My name is Mike Garry, and my company is Yardley Wealth Management, LLC.

Darrow Wealth Management

FEBRUARY 19, 2024

When considering the distribution of excess lifetime returns of individual stocks vs the Russell 3000, the median underperformance was almost -10%.³ 5 ways to manage a concentrated stock position In no particular order, here are some strategies to reduce the risk of concentrated stock wealth. Further estate planning objectives.

Harness Wealth

JUNE 9, 2023

In this article, we’ll go into detail on what to think about when it comes to financial planning, as well as a step-by-step process of how to build a sample financial plan that aligns with your personal goals and needs. Table of Contents What is a Financial Plan? Why is Financial Planning so Important?

Yardley Wealth Management

FEBRUARY 1, 2022

The post Part 1: The Tools of the Tax-Planning Trade appeared first on Yardley Wealth Management, LLC. Part 1: The Tools of the Tax-Planning Trade Whether you’re saving, investing, spending, bequeathing, or receiving wealth, there’s scarcely a move you can make without considering how taxes might influence the outcome.

Yardley Wealth Management

FEBRUARY 1, 2022

The post Part 1: The Tools of the Tax-Planning Trade appeared first on Yardley Wealth Management, LLC. Part 1: The Tools of the Tax-Planning Trade. Whether you’re saving, investing, spending, bequeathing, or receiving wealth, there’s scarcely a move you can make without considering how taxes might influence the outcome.

Fortune Financial

SEPTEMBER 29, 2022

If your retirement accounts are comprised of pre-tax assets, most of your distributions from the accounts will be taxed at your marginal tax brackets. This requires you to also determine your tax status once you start withdrawing funds and is an important part of the retirement planning process to accurately gauge cash flows.

Darrow Wealth Management

JULY 1, 2024

Since investors pay tax annually on dividends, interest, and capital gains distributions in a taxable brokerage account, even if they don’t sell assets, it can be worthwhile to consider allocating more tax-efficient investments here. appeared first on Darrow Wealth Management. Are You Ready?

Sara Grillo

JULY 8, 2022

Read the blog to see what these financial advisor said about what a typical day looks like, and how someone in wealth management typically spends their time. Yesterday it was early retirement projections for a corporate executive, tomorrow it’s a call with a planner to review a client’s estate plan. hours of it.

Yardley Wealth Management

JANUARY 4, 2022

The post Protecting What’s Yours (While You’re Alive) appeared first on Yardley Wealth Management, LLC. Distribute copies to your primary physician and any of your other healthcare providers to keep on file. This can be stressful if not heartbreaking for everyone involved. Additional Tips. Give it to key family members.

Yardley Wealth Management

JANUARY 4, 2022

The post Protecting What’s Yours (While You’re Alive) appeared first on Yardley Wealth Management, LLC. Distribute copies to your primary physician and any of your other healthcare providers to keep on file. The post Protecting What’s Yours (While You’re Alive) appeared first on Yardley Wealth Management, LLC.

Abnormal Returns

NOVEMBER 25, 2024

podcasts.apple.com) Rex Salisbury talks with Ritholtz Wealth CEO Josh Brown about AI and wealth management. youtube.com) Harry Morton talks with Jacob Turner about his journey from MLB player to wealth manager. xyplanningnetwork.com) On the benefits of distributing equity in wealth management.

Sara Grillo

APRIL 11, 2022

Please conduct your own diligence on any wealth manager you are considering hiring. Ryan Firth, CPA. Did I leave anyone off the list? Let me know. I also want to be clear that I am not recommending any of these advisors. As you may have noticed, the list above is quite short.

WiserAdvisor

JULY 24, 2022

However, the success of their children and grandchildren lies in the individual’s estate planning to a large degree. Estate planning is the process of ensuring that a person’s estate reaches its rightful heirs after them. One of the issues with estate planning is that most people leave it to the last minute.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content