IRS Issues New Guidance on Retirement Plan Early Distributions

Wealth Management

JUNE 26, 2024

Notice 2024-55 clarifies two exceptions to the 10% additional tax.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 26, 2024

Notice 2024-55 clarifies two exceptions to the 10% additional tax.

The Chicago Financial Planner

OCTOBER 21, 2021

HSAs are not subject to required minimum distributions , allowing the HSA to continue to grow tax-free. Your HSA can be another leg on the retirement planning stool. If a spouse is named as the beneficiary of the account, he or she can inherit the money tax-free. Click To Tweet. The Bottom Line.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Wealth Management

DECEMBER 15, 2023

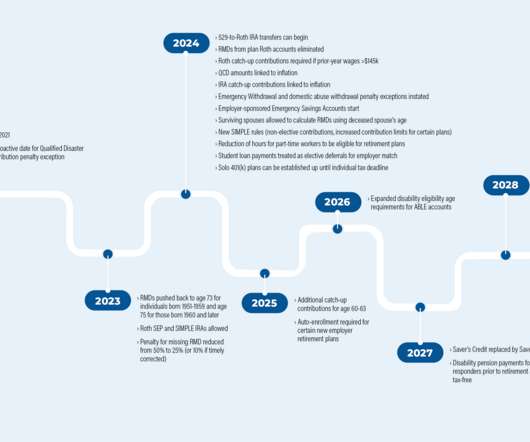

Act regarding individual retirement accounts, including changing when the first required minimum distribution can be made from the account, new rules for inhe The panel of experts will discuss and answer questions about the changes made by SECURE 2.0

Carson Wealth

MARCH 7, 2024

By Jake Anderson, CFP ® , Wealth Planner When helping clients begin retirement planning, the same questions often arise: What should my retirement plan look like? Your lifestyle, goals, family situation, and risk tolerance will give a unique signature to your retirement plan. How much should I be saving?

Nerd's Eye View

DECEMBER 28, 2022

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in December 2019, brought a wide range of changes to the retirement planning landscape, from the death of the ‘stretch’ IRA to raising the age for Required Minimum Distributions (RMDs) to 72. In addition, SECURE 2.0

Nerd's Eye View

DECEMBER 28, 2022

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in December 2019, brought a wide range of changes to the retirement planning landscape, from the death of the ‘stretch’ IRA to raising the age for Required Minimum Distributions (RMDs) to 72. In addition, SECURE 2.0

Darrow Wealth Management

NOVEMBER 11, 2024

The deductibility phase-out is based on filing status, income (MAGI), and whether or not the individual(s) are eligible to participate in a retirement plan at work. When you make a distribution, the original nondeductible IRA contribution amount isn’t included in your taxable income, but the earnings and growth from it is.

Getting Your Financial Ducks In A Row

APRIL 3, 2023

We’ve covered a lot of ground with regard to how various tax laws impact your retirement plans: pensions, IRAs, 403(b) and 401(k) plans. But we’ve primarily focused on the US income tax laws (the IRS) affect your plans – and there are many nuances that you need to take into account with regard to state tax laws.

Carson Wealth

MARCH 28, 2024

Retirement planning is a journey that generally takes decades to complete and most of us start out along the do-it-yourself path. More than likely, your first step was to enroll in an employer-provided plan such as a 401(k) or setting up an individual retirement account, also known as an IRA.

Nerd's Eye View

JANUARY 4, 2023

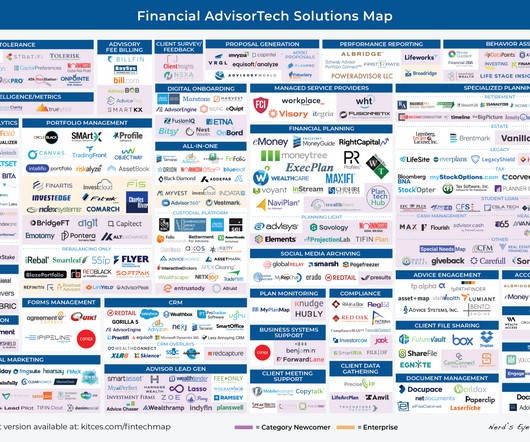

Financial advisors have a wide range of strategies at their disposal to create financial plans for their clients. And when it comes to retirement planning, one popular technique is the use of ‘guardrails’, which set an initial monthly withdrawal rate that can be later adjusted as the size of the client’s portfolio changes.

WiserAdvisor

MARCH 13, 2024

Within this framework, the concept of the five pillars of retirement planning emerges as a valuable strategy. These pillars provide a comprehensive framework for building a resilient and sustainable plan. Withdrawals from tax-deferred retirement accounts are taxed as ordinary income.

The Big Picture

FEBRUARY 27, 2023

equity valuations: “Baby-boomers’ huge flow of 401K plan contributions helped to drive equities higher; now that ~70 million Boomers are retiring, when do demographics flip this from a huge positive to a net drag?” aka The Hidden World of Failure ) (October 23, 2020) Stock Ownership : Distribution of Household Wealth in the U.S.

Carson Wealth

JUNE 2, 2023

IRAs and 401(k)s are primarily designed to help fund retirement not pass wealth onto future generations. As part of that, Congress established rules that require annual distributions from tax-advantaged plans once you reach age 72, 73 or 75. Recent changes in legislation have changed this age. for those who turned 70.5

Carson Wealth

DECEMBER 20, 2024

You can move these large stock holdings to a DAF, get the tax break, and then use the money to make donations every year through your retirement. Donate Your Required Minimum Distributions If youre 73 or older, required minimum distributions (RMDs) are kicking in.

Carson Wealth

JANUARY 5, 2023

Qualified retirement plans – such as 401(k)s, 403(b)s and IRAs – offer clear tax advantages. Traditional 401(k)s, 403(b)s, and IRAs offer a tax deferral on contributions and growth until distribution. One of those is the Required Minimum Distribution (RMD) rule. Jamie Hopkins, Managing Partner, Wealth Solutions.

Darrow Wealth Management

JANUARY 30, 2023

just upended retirement planning…again. The age when retirees must begin drawing from non-Roth retirement accounts increases to 73 in 2023, then 75 in 2033. Raising the age when withdrawals must begin is great as it gives investors more planning opportunities. The Secure Act 2.0

Nerd's Eye View

JANUARY 1, 2024

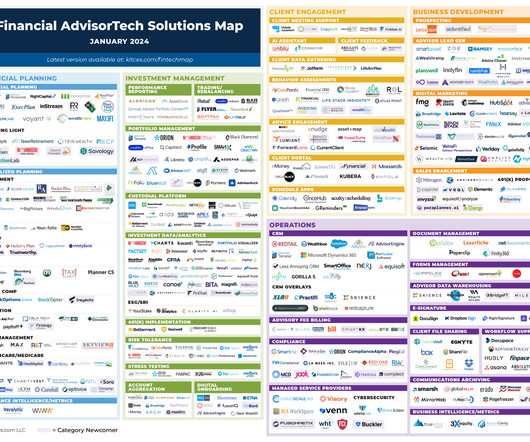

This month's edition kicks off with the news that held-away asset management platform Pontera has raised $60 million in venture capital funding as advisors increasingly seek to directly manage clients' 401(k) and other outside assets – although an ongoing investigation by Washington state regulators over whether advisors' use of Pontera violates (..)

Getting Your Financial Ducks In A Row

NOVEMBER 7, 2022

When you have the bulk of your financial assets in retirement plans, you might accidentally expose yourself to some risks that you haven’t thought about… since retirement plan assets are much more likely to be impacted by changes to legislation – as we have seen in the past. No related posts.

Darrow Wealth Management

SEPTEMBER 19, 2024

Unlike most types of retirement plans, the SEP IRA is funded by the employer. A SEP IRA (Simplified Employee Pension Individual Retirement Account) is a type of retirement plan specifically designed for self-employed individuals and small business owners. What is a SEP IRA?

Nerd's Eye View

DECEMBER 23, 2022

”, a series of measures that will have significant impacts on the world of retirement planning. Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that Congress appears poised to pass “SECURE Act 2.0”,

MainStreet Financial Planning

NOVEMBER 25, 2024

Qualified charitable distributions are made directly to the eligible charity from a traditional IRA, inherited IRA, inactive Simplified Employee Pension (SEP) plan and inactive Savings Incentive Match Plan for Employees (SIMPLE) IRAs. 2025 amounts should become available later this year.

Nerd's Eye View

APRIL 19, 2024

Also in industry news this week: The Office of Management and Budget (OMB) has completed its review of the Department of Labor's new "fiduciary rule ", indicating that it could be released in the coming days or weeks (though, like its predecessors, its ultimate disposition is likely to be determined in the courts) The IRS announced this week that it (..)

Nerd's Eye View

JANUARY 13, 2023

From there, we have several articles on retirement planning: The latest rules for 2023 Required Minimum Distributions from inherited retirement accounts. How reviewing and adjusting capital market assumptions can help advisors refine their use of Monte Carlo simulations.

Nerd's Eye View

AUGUST 2, 2023

These include tapping employer-provided resources for adoption support, seeking out grants from charitable organizations, or, if funds are very tight, taking out loans or taking distributions from retirement plans (as the SECURE Act created a new opportunity for parents to withdraw up to $5,000 from their IRAs or employer-sponsored plans without the (..)

Nerd's Eye View

NOVEMBER 4, 2022

From there, we have several articles on investment planning: While I Bonds have received significant attention during the past year, TIPS could be an attractive alternative for many client situations. A survey showing how millionaires allocate their assets and the importance they place on the recommendations of their financial advisors.

Nerd's Eye View

AUGUST 9, 2023

The original SECURE Act, signed into law in December 2019, changed many of the long-standing rules governing IRAs and other retirement accounts, and no single measure in the legislation had a more seismic impact on planning than the changes to the post-death distribution rules for retirement accounts.

Nerd's Eye View

NOVEMBER 23, 2022

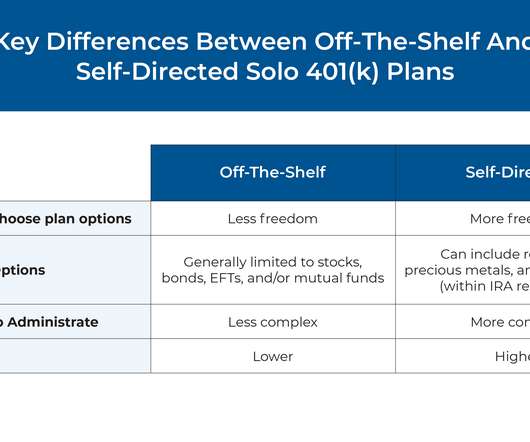

Among the several different types of retirement plans that are available to self-employed workers, solo 401(k) plans can offer the most flexibility and the ability to contribute the highest amount of tax-advantaged savings.

Darrow Wealth Management

AUGUST 8, 2022

” This meant annual required minimum distributions (RMDs) were out. Unless a non-spouse beneficiary qualifies for an exception¹, previous guidance stipulated that funds from an inherited 401(k), IRA, 403(b), or other qualified retirement plan (including Roth IRAs) must be taken in 10 years following the year of death.

Nerd's Eye View

MAY 1, 2023

Rowe Price has acquired Retiree Income, the parent company of popular retirement income planning software SSAnalyzer and Income Solver, to put its resources behind developing and distributing the company’s planning tools (albeit perhaps more to its retail and employee retirement plan clients than to advisors?).

Nerd's Eye View

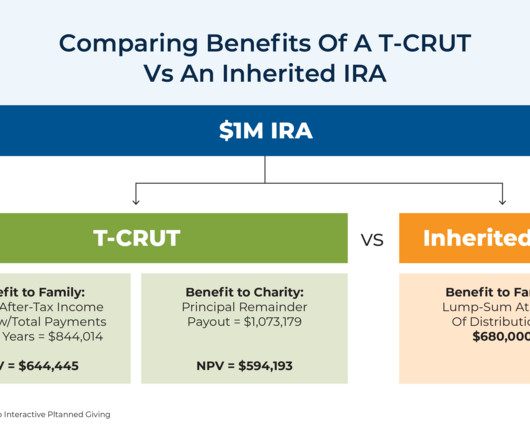

JANUARY 31, 2024

In late 2019, Congress passed the Setting Every Community Up for Retirement Enhancement (SECURE) Act, introducing several significant changes to retirement planning. This allows the account to grow on a tax-deferred basis, with income to beneficiaries being taxed when distributions are made.

Carson Wealth

FEBRUARY 27, 2025

Qualified Charitable Distributions (QCDs) Your distributions from your retirement plans are reported on your 1099-R form , but the form doesnt specify how much went to a QCD.

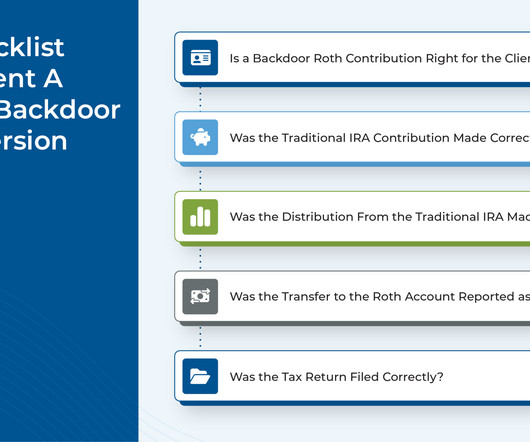

Nerd's Eye View

NOVEMBER 1, 2023

For instance, if the client has existing IRA dollars and/or if they plan to rollover funds from a qualified account at any point during the year, backdoor Roth conversions can be complicated significantly.

Carson Wealth

AUGUST 23, 2022

Retirement plans like 401(k)s and traditional or Roth IRAs can be an easy and effective way to save for retirement. Contributions to a traditional 401(k), IRA, and other retirements plans are usually deductible up to a limit. However, not all retirement plan contributions are tax deductible.

Carson Wealth

JUNE 28, 2023

Your retirement income plan may be sending up bubbles, too, whether around Social Security, retirement account distributions, taxes or somewhere else – and these holes need to be patched up right away. So, to help your retirement plan be more airtight, let’s look at a few of the common leaks.

Your Richest Life

APRIL 15, 2024

Do you have a plan in place for your retirement? For many people, the extent of their retirement planning includes signing up for the plan at work – which is often more of a starting point than a comprehensive retirement plan. You can use multiple accounts to help boost your savings.

Fortune Financial

JULY 28, 2022

Anyone who owns company stock will eventually have to decide how to distribute their assets — typically when there is a job change or retirement involved. To recap, NUA is the difference in value between the price initially paid for a stock (the cost basis) and its current market value at the time it is distributed.

Carson Wealth

AUGUST 1, 2024

Distributions from IRAs and 401(k)s are often taxable. Furthermore, once you hit age 73, you could be subject to RMDs, which can force out taxable distributions, which could cause both the dollars distributed and your Social Security benefits to be taxed. This gives people more control over their money in retirement.

Darrow Wealth Management

OCTOBER 24, 2022

For example, what’s the best time of year to take required minimum distributions, how to reinvest it, or if you can avoid paying tax on RMDs. Here are some of the most common RMD questions and planning opportunities for investors. It’s called a qualified charitable distribution (QCD). Yes, you can reinvest your RMD.

MainStreet Financial Planning

DECEMBER 8, 2022

We would like to take this opportunity to remind you about your annual Required Minimum Distribution (RMD). As you may know, the Internal Revenue Service (IRS) requires that you take an annual distribution from your retirement accounts starting with the year in which you turn 72 years old and every year thereafter.

Carson Wealth

FEBRUARY 2, 2023

Whether an employer-sponsored retirement plan is offered affects the income limits for contribution deductibility. The trade-off for tax-deductible contributions is taxable distributions. IRA distributions can occur at any time but may be subject to an additional 10% penalty if the account owner is under age 59½.

Good Financial Cents

JANUARY 24, 2023

While they do share some similarities, there are enough distinct differences between the two where they can just as easily qualify as completely separate and distinct retirement plans. Either plan is an excellent choice, particularly if you’re not covered by an employer-sponsored retirement plan. Not exactly.

Darrow Wealth Management

DECEMBER 23, 2022

Congress is once again poised to make sweeping changes to the retirement and tax rules in the last two weeks of the year. retirement changes. Raise the required minimum distribution age. Keep in mind, matching contributions are often voluntary so it would be up to the plan as to whether to adopt this provision.

Integrity Financial Planning

OCTOBER 17, 2022

Know these 3 ages that can help you get the most out of your retirement accounts. At age 50, workers with certain qualified retirement plans can make annual “catch-up” contributions in addition to their normal contributions. Some 401(k) plans allow this, and others do not. Required Minimum Distributions at age 72.

Carson Wealth

DECEMBER 27, 2022

As 55% of Americans say they don’t have enough saved for retirement, this bipartisan legislation primarily seeks to make it easier to contribute to retirement plans and use those funds appropriately for their needs in retirement. Required Minimum Distribution Changes. Expanded Savings Opportunities. The SECURE 2.0

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content