Why Pre-Tax Retirement Contributions Are Better Than Roth In Peak Earning Years (Even If Tax Rates Increase)

Nerd's Eye View

SEPTEMBER 25, 2024

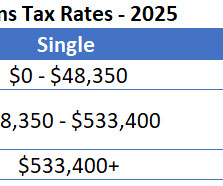

Over the last 60 years, the top Federal marginal tax bracket has steadily decreased from over 90% in the 1950s and 60s to 'just' 37% today. While it's true that the top marginal tax rate has decreased dramatically since the mid-20th century, the difference in the actual tax paid by most Americans has been far more modest.

Let's personalize your content