Demystifying Private Foundation Distributions

Wealth Management

AUGUST 19, 2024

Creative ways to maximize the impact of private foundation distributions.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

AUGUST 19, 2024

Creative ways to maximize the impact of private foundation distributions.

Wealth Management

NOVEMBER 14, 2024

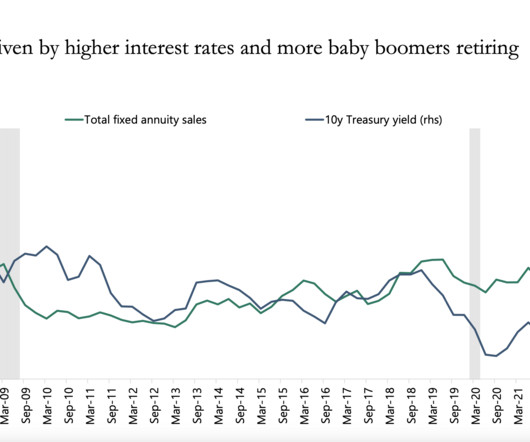

Morgan Christiansen, VP of Distribution at The Pinnacle Group, explores the evolving role of insurance in financial planning at Nitrogen's 2024 Fearless Investing Summit.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Wealth Management

SEPTEMBER 15, 2023

Allianz said it has made a small number of changes to its distribution leadership structure “to better align with our strategic goals for new market growth.”

Wealth Management

MARCH 25, 2024

Hobby comes over from Fidelity Investments, where he served as the head of distribution for private wealth management, executive services, workplace planning and advice and stock plan services.

Wealth Management

JULY 24, 2024

Certain 10-year designated and successor beneficiaries get no extension.

Wealth Management

NOVEMBER 29, 2023

While clients and funding remain under wraps, Tokenbridge has plans to tokenize and revitalize the investment industry.

Wealth Management

APRIL 11, 2024

Accumulation-phase planning software won't cut it for solving your clients' complex retirement income puzzles, but there are dedicated applications that can.

Wealth Management

JUNE 5, 2024

Daniel Noonan joins the firm from Nuveen, filling a void created by Kimberly LaPointe’s departure in February.

Wealth Management

MAY 15, 2024

Alternative investment platforms help connect fund managers with advisors looking for investment opportunities. However, fund managers need to focus on matching advisors with the right options.

Wealth Management

OCTOBER 30, 2024

The provisions apply to IRA recipients outside the United States.

Wealth Management

JUNE 26, 2024

Notice 2024-55 clarifies two exceptions to the 10% additional tax.

Wealth Management

APRIL 26, 2023

Analysis of big-picture data can reveal plan sponsors who might be sources for prospecting.

Wealth Management

AUGUST 30, 2023

But was it worth the cost of getting a the private letter ruling?

Abnormal Returns

FEBRUARY 19, 2024

washingtonpost.com) Daniel Crosby offers another sneak preview of an essay from his upcoming book, "The Soul of Wealth." standarddeviationspod.com) Trends The wealth management industry is going to be slammed with demand. advisorperspectives.com) Fidelity Charitable distributed $11.8 riaintel.com)

Darrow Wealth Management

NOVEMBER 2, 2024

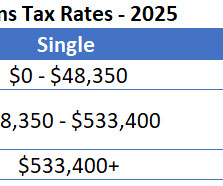

Also updated: health savings accounts, flexible spending accounts, estate and gifting limits, qualified charitable distributions and other cost-of-living adjustments. The IRA and Roth IRA contribution limits are unchanged but income eligibility for tax-deductible IRA contributions and Roth IRA contributions have changed.

Wealth Management

OCTOBER 31, 2022

The conversion of empty retail stores to mini warehouses expected to wane as in-store shopping makes a comeback.

Darrow Wealth Management

NOVEMBER 11, 2024

When you make a distribution, the original nondeductible IRA contribution amount isn’t included in your taxable income, but the earnings and growth from it is. lifetime non-deductible contributions – previous nontaxable distributions) d ivided by Total IRA Assets (e.g. Yes and no.

Wealth Management

OCTOBER 2, 2024

All assets were distributed to the decedent’s husband.

Wealth Management

MARCH 20, 2023

s extension of qualified charitable distribution status to split-interest gifts. Christopher P. Woehrle discusses the 2022 Secure Act 2.0’s

Darrow Wealth Management

JANUARY 30, 2023

However, it doesn’t mean that delaying IRA distributions is the right move for everyone. Tax planning strategies for required minimum distributions Tax planning shouldn’t stop when you retire. The IRS may also require annual distributions during this window. When should you start taking money from IRAs?

Wealth Management

AUGUST 23, 2022

These companies are looking for logistics facilities, warehouses and distribution sites. Over 1,800 companies re-shored production in 2021, setting a new record for re-shoring activity, notes The Reshoring Initiative.

Trade Brains

NOVEMBER 6, 2024

Asian Paints has expanded globally, known for its innovative solutions, quality, and strong distribution network. With a vast distribution network and focus on rural markets, HUL continues to lead the Indian FMCG sector. It offers a range of banking services, including retail, corporate, and wealth management.

Wealth Management

AUGUST 8, 2022

The strongest providers with the best talent, distribution and technology are and will be ones that offer wealth and benefit services to participants.

Wealth Management

MARCH 18, 2025

The asset manager has formed a joint venture led by a former Blackstone exec to create a distribution platform focused on RIAs, IBDs and family offices.

Wealth Management

MAY 30, 2024

Apollo’s products for individual investors are distributed through intermediaries such as bank wealth channels and registered investment advisers, and the firm doesn’t expect that to change.

Wealth Management

SEPTEMBER 5, 2024

The acquisition of Archer will help BNY Mellon handle the infrastructure and distribution of managed accounts to financial advisors and their clients.

Wealth Management

OCTOBER 21, 2024

Strategies to mitigate accumulation distributions of UNI.

Wealth Management

MAY 22, 2024

A comprehensive guide to family conflict and asset distribution.

Darrow Wealth Management

JANUARY 16, 2025

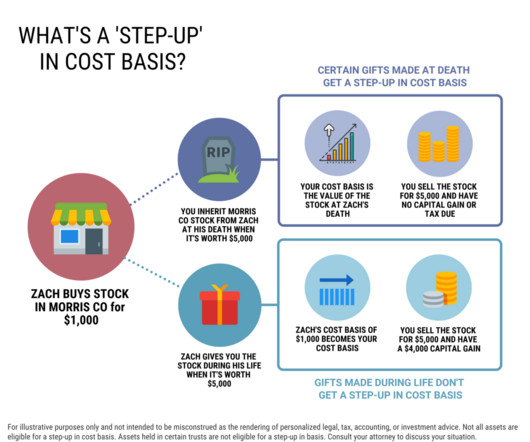

Inheriting a Trust Fund: Distributions to Beneficiaries Do You Pay Tax on an Inheritance? Darrow Wealth Management does not provide tax or legal advice. Darrow Wealth Management is afee-only financial advisory firmand full-timefiduciary. We specialize in helping individuals manage sudden wealth events.By

Wealth Management

DECEMBER 20, 2023

When it comes to divorce, a will or trust often is not the last word on estate distribution.

Wealth Management

APRIL 4, 2024

The RIA platform partnered with Griffin Distribution to offer annuities, life, disability and long-term care insurance.

Wealth Management

SEPTEMBER 7, 2022

No tax deduction when trustee can choose between distributing income to charity or surviving spouse.

Wealth Management

OCTOBER 19, 2022

The combined business will operate under The Standard brand, and include Securian's retirement solutions employees, management, client relationships and distribution networks.

Wealth Management

APRIL 5, 2024

Historically, the real estate investment manager relied on independent broker/dealers to reach private wealth. It wants to diversify both its distribution and its investment offerings.

Darrow Wealth Management

AUGUST 8, 2022

” This meant annual required minimum distributions (RMDs) were out. Another key aspect that the 2019 Secure Act changed was the required minimum distribution age. Assuming the changes pass, some beneficiaries will have missed a required distribution. Individuals born before July 1, 1949 will retain an RMD age of 70 1/2.

Wealth Management

JANUARY 17, 2025

The SEC claims Vanguard made misleading statements about capital gains distributions and tax consequences to retail investors who held target date funds in retirement accounts.

Wealth Management

NOVEMBER 29, 2023

Fractionalized investments and distributed ledger technology will take the friction, and embedded costs, out of investing, Tokenbridge's founders say.

Wealth Management

OCTOBER 12, 2022

The order concerning New Harbor Financial Group's recommendation of an inverse leveraged ETF comes several months after the Commonwealth Secretary announced an investigation into b/ds distributing single-stock ETFs.

Wealth Management

APRIL 4, 2024

The firm, which already works with individual investors, wants to build up its relationships across private wealth distribution channels.

Nerd's Eye View

JUNE 25, 2024

Chris is the founder of Sparrow Wealth Management, an RIA based in Orlando, Florida, that oversees approximately $110 million in assets under management for 68 client households. Welcome everyone! Welcome to the 391st episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Christopher Jones.

Wealth Management

APRIL 25, 2023

The income fund will be distributed through Ares Wealth Management Solutions, the parent’s retail business, and sold through registered investment advisers and financial advisors in the US.

Wealth Management

NOVEMBER 29, 2023

Fractionalized investments and distributed ledger technology will take the friction, and embedded costs, out of investing, Tokenbridge's founders say.

Wealth Management

APRIL 12, 2023

A Mississippi woman claimed Morgan Stanley erred when accepting her removal as a beneficiary to her dementia-striken, de facto mother's estate—as well as ignoring her challenges as they distributed the deceased woman's funds.

The Big Picture

MARCH 10, 2025

” A : The standard answer is Accumulation, Maintenance Distribution , but let’s dig deeper. It’s well understood academically, but it’s still seeping out into the real practice of wealth management. .” Q :“ How does our relationship with money change during different life phases?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content