Overlooked Fiduciary Risks for Retirement Plan Sponsors

Wealth Management

DECEMBER 22, 2023

Potential failures range from cyber theft to fee inflation to document mismanagement.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

DECEMBER 22, 2023

Potential failures range from cyber theft to fee inflation to document mismanagement.

The Chicago Financial Planner

NOVEMBER 27, 2022

One of the best tax deductions for a small business owner is funding a retirement plan. Beyond any tax deduction you are saving for your own retirement. You deserve a comfortable retirement. If you don’t plan for your own retirement who will? You need to start a retirement plan today.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Nerd's Eye View

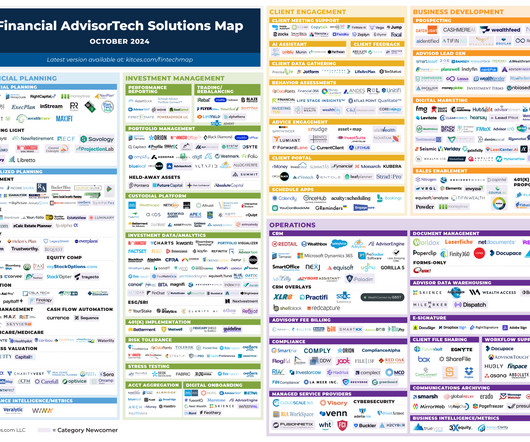

OCTOBER 7, 2024

This month's edition kicks off with the news that digital estate planning platform Wealth.com has raised a whopping $30 million in Series A funding, following on the heels of Vanilla's follow-on $20M capital round just a few months ago – which on the one hand reflects the anticipated enthusiasm for solutions that can help advisors efficiently (..)

Nerd's Eye View

APRIL 8, 2025

In this episode, we talk in-depth about how Seth built and provides his input deliverable (which calculates the appropriate amount of tax-exempt housing allowance pastors can take based on their individual circumstances, and even prepares a request and subsequent resolution that the Church's Board can then use) to demonstrate his expertise to prospective (..)

Abnormal Returns

MARCH 15, 2023

wsj.com) Retirement Retirement planning is a moving target. humbledollar.com) Retirement is, in part, about declaring career victory. wsj.com) How poorly drafted legal documents can land you in trouble. (thisisthetop.substack.com) Consumers are piling into CDs.

Abnormal Returns

JANUARY 17, 2024

peterlazaroff.com) Robin Powell talks retirement planning with Justin King author of "The Retirement Café Handbook: Nine Accelerators for a Successful Retirement." evidenceinvestor.com) Frazer Rice talks with Jenny Rozelle about the roles and responsibilities in trust and estate documents.

Abnormal Returns

FEBRUARY 21, 2024

Rowe Price about non-financial considerations in retirement. morningstar.com) People work in retirement for any number of reasons. wsj.com) Dan Haylett talks retirement planning with Bec Wilson, author of "How to Have an Epic Retirement." nytimes.com) Why you should update your estate documents.

Nerd's Eye View

AUGUST 24, 2022

a single person, a couple, a business, or a retirement plan) and the date on which the agreement will become effective. To start, the agreement should contain basic information about the adviser-client relationship, including who the client is (e.g., The agreement should also lay out some acknowledgments for the client to review.

Nerd's Eye View

AUGUST 24, 2022

a single person, a couple, a business, or a retirement plan) and the date on which the agreement will become effective. To start, the agreement should contain basic information about the adviser-client relationship, including who the client is (e.g., The agreement should also lay out some acknowledgments for the client to review.

Nerd's Eye View

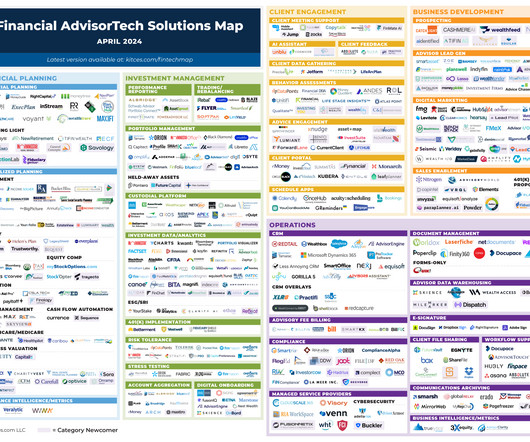

MAY 6, 2024

This month's edition kicks off with the news that self-directed retirement planning software provider NewRetirement has raised a $20M Series A round as the company demonstrates that its DIY tools really do turn a subset of consumers into bona fide prospects for financial advisors.

Carson Wealth

AUGUST 25, 2022

often fail to consider sequence of return, housing, longevity, health or family risks faced in retirement. Focus on Your Retirement Plan Rather Than a Magic Number. would be “How do I plan for retirement?“ And spending helps open conversations about the amount needed to comfortably retire.

Harness Wealth

APRIL 17, 2025

We will cover qualification criteria, documentation requirements, and practical strategies to implement throughout the year. We will cover qualification criteria, documentation requirements, and practical strategies to implement throughout the year. Travel, meals, and supplies must directly relate to legitimate business activities.

Nerd's Eye View

NOVEMBER 23, 2022

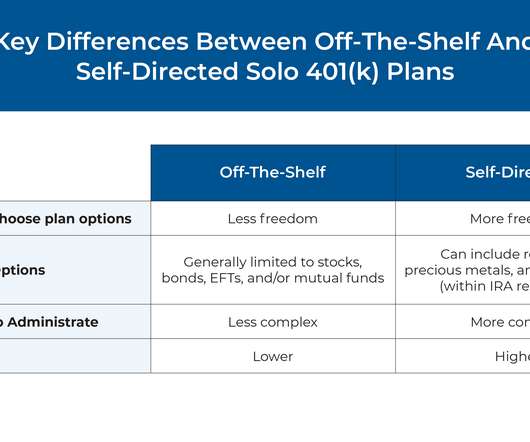

Among the several different types of retirement plans that are available to self-employed workers, solo 401(k) plans can offer the most flexibility and the ability to contribute the highest amount of tax-advantaged savings.

Harness Wealth

APRIL 16, 2025

Each option presents unique advantages, with potential annual tax savings reaching thousands of dollars for well-documented home offices. Smart tech founders maintain detailed photographic documentation of their dedicated workspace, creating a clear record for potential future audits.

Carson Wealth

JULY 3, 2024

Understand your tax obligations at the local, state and federal levels, and keep detailed records of income, expenses and tax-related documents. Plan for Your Retirement As a small business owner, it’s essential to plan for your retirement independently since you may not have the benefit of employer-sponsored retirement plans.

Harness Wealth

APRIL 16, 2025

The fundamentals of Roth and traditional IRAs Traditional IRAs have long served as a cornerstone of retirement planning, offering immediate tax benefits through deductible contributions while deferring taxes until withdrawal. This first step set in motion a carefully orchestrated sequence of events.

MainStreet Financial Planning

MARCH 7, 2023

Gathering all your documents is crucial to complete a tax return free of mistakes. It is a good idea to keep all your tax documents in one place by creating a physical or digital folder. It is a good idea to keep all your tax documents in one place by creating a physical or digital folder. Did you have AMT?

MazumaBusinessAccounting

MAY 31, 2022

Remember, the IRS recommends keeping tax-related documents for at least six years. Determining how long to keep financial records depends on several factors, including the record type and whether it’s for personal or business documentation. Some documentation has no expiration date, such as birth certificates and social security cards.

Carson Wealth

MARCH 14, 2024

Be sure you know the details on balance requirements before you do – the account balance may need to exceed a certain balance to be allowed to stay in the plan. Your plan documents will outline the specifics of this provision, so be sure to check the balance requirement and if there are any deadlines by which you need to move your assets out.

Your Richest Life

JANUARY 20, 2023

Emergency Savings Beginning in 2024, some retirement plans could add an emergency savings component. Exemptions include businesses that are less than 3 years old, governmental plans, SIMPLE plans, church plans, and employers with 10 or less employees. document here. The Secure Act 2.0 Other Secure Act 2.0

Million Dollar Round Table (MDRT)

JULY 21, 2022

This is the time to do comprehensive financial planning: retirement planning, investment planning, tax planning and estate planning. You can help her make those large purchases and housing decisions that she put off during the grief stage.

Cordant Wealth Partners

SEPTEMBER 8, 2022

The Microsoft 401(k) retirement plan offers many excellent choices among actively managed and index funds. Action Items & Summary Microsoft’s 401(k) retirement plan is a significant benefit for those working for Microsoft, but you can’t capture those benefits unless you take action.

Good Financial Cents

JANUARY 24, 2023

While they do share some similarities, there are enough distinct differences between the two where they can just as easily qualify as completely separate and distinct retirement plans. Either plan is an excellent choice, particularly if you’re not covered by an employer-sponsored retirement plan. Not exactly.

International College of Financial Planning

JULY 9, 2022

When we are busy working to earn a living and spending time with our family, first thing needs to think about is Retirement Planning. Generally, people think about Retirement planning after retirement. To plan for retired life important thing is financial plan.

MainStreet Financial Planning

JUNE 7, 2023

Pension Guaranty Corporation National Registry of Unclaimed Retirement Benefits There are some organizations who claim they can help you find unclaimed money for a fee, but don’t do it. These sites listed, mostly governmental sites, are free to use and just takes a little effort to submit the documents to prove the money is yours.

Harness Wealth

JANUARY 9, 2025

Both the Mega Backdoor Roth IRA and Mega Backdoor Roth 401(k) allow the additional contribution of funds to retirement plans after pre-tax and Roth contribution limits have been reached. Roth IRAs are also not subject to Required Minimum Distributions (RMDs), allowing more flexibility in retirement planning.

Random Roger's Retirement Planning

DECEMBER 15, 2023

600,000-$800,000 are workable numbers for long term retirement planning. That range might not equal anyone's retirement number but a couple of lifestyle tweaks or changes and I think it's a range people could adapt to. I guess what they are saying is that Gen-X thinks it needs $44,000/yr (4% of $1.1

Darrow Wealth Management

MARCH 31, 2023

Once the divorce is finalized, a crucial (but often overlooked) part of the process is updating estate documents and beneficiary designations. Here are some key considerations when financial planning for a divorce. Retirement accounts: IRAs vs 401(k)s. Here’s a checklist of post-divorce financial planning moves.

Walkner Condon Financial Advisors

NOVEMBER 11, 2022

As we look forward to 2023, the IRS recently announced that the contribution limits for employer-sponsored retirement plans are going up. You may want to review your contribution amounts and adjust for January payrolls if your goal is to maximize funding your retirement plan contributions. . IRA Accounts.

Carson Wealth

JULY 12, 2022

Attorneys play a critical role in the financial planning process, particularly in estate planning. They can draft wills, trusts and legal documents as well as represent clients during life transitions. . In financial services, you might encounter an LLM in tax or estate planning. . Retirement.

Fortune Financial

JUNE 2, 2023

In retirement, how you distribute that company stock will play a key role in determining your tax liability for its value. In the realm of investment and retirement planning, the concept of Net Unrealized Appreciation (NUA) holds significant importance. The remaining assets may be rolled over.

Clever Girl Finance

NOVEMBER 16, 2022

By filling and documenting this report quickly, you may also be able to limit your financial liability as well. Get access to any documents related to the identity theft. To better prepare, you should gather all the documents that relate to the theft. Correct your credit report. Clear your name of criminal charges.

Fortune Financial

APRIL 11, 2024

According to the Department of Labor , “Based on the experience of Council members, and testimony and conversations with recordkeepers, the value of uncashed retirement plan checks likely exceeds $100 million per year but could be considerably larger.

Harness Wealth

OCTOBER 24, 2024

This article covers a comprehensive list of the most common forms, documents, and information needed to file taxes. To plan your tax timeline, see our article, 2025 Tax Deadline Information for Individual Filers. Income Documentation Records showing income are the most common type of tax information used to file taxes.

Carson Wealth

OCTOBER 6, 2022

The employee benefits business has its own language and most workers — even if they read all of their onboarding documents — won’t necessarily understand the content. I blame it largely on the failure of employers to educate in a coherent and easy-to-understand fashion. 5 Employee Benefits You Might Be Missing Out On.

Fortune Financial

DECEMBER 23, 2022

Tax benefits and owner retirement savings options also make establishing a 401(k) plan a smart choice for employers. This guide will help you learn more about the advantages of offering retirement plans to employees, how to get started and options for effectively distributing plan information.

Harness Wealth

MARCH 6, 2025

This contract serves as documentation for the IRS, substantiating your self-employment. Retirement contributions: Contributions to SEP IRAs, SIMPLE IRAs, or other qualified retirement plans can reduce your taxable income. Keep all receipts, invoices, bank statements, and other documentation.

Good Financial Cents

SEPTEMBER 15, 2022

Ad Make your kids' retirement plan work by investing in a Roth IRA Roth IRAs allow you to save money for their retirement, while providing the flexibility that traditional retirement plans lack. Otherwise, there’s no requirement for your child to make a direct contribution into the plan. Ads by Money.

Brown Advisory

APRIL 28, 2020

Documentation Preparedness Banks should now be in a position where they are facilitating applications. Unlike PPP loans, MSLP loans are not eligible for forgiveness, but a borrower may apply for both a PPP and MSLP loan.

Brown Advisory

APRIL 28, 2020

Documentation Preparedness. documentation showing the total of all health insurance premiums paid by the nonprofit or business under a group health plan for all employees. documentation of the sum of all retirement plan funding paid by the nonprofit or business (excluding contributions from the employees).

Dear Mr. Market

APRIL 6, 2022

Aside from the legalities of estate planning, this exercise is perhaps the single most loving and considerate document you can create for your family that they will forever be grateful for. Review this document annually and share it with your executor so that everything is crystal clear.

Indigo Marketing Agency

MAY 5, 2020

How To Grow Your Retirement Plan Business In The 2020 Economic Crisis. We’ve partnered with the experts at The Retirement Learning Center to update advisors on how the retirement plan landscape has been altered by the 2020 economic crisis. Save your spot today! So I’ll let John take it away from here.

Harness Wealth

JANUARY 29, 2025

Manage Required Minimum Distributions (RMDs) Required Minimum Distributions (RMDs) are mandatory withdrawals from certain retirement accounts, designed to stop individuals deferring taxes on these funds indefinitely. Timing RMDs : Begin taking RMDs by April 1 of the year after you turn 73.

Park Place Financial

SEPTEMBER 30, 2022

To subtract your donations, you must itemize deductions using the Schedule A (Form 1040) document. . Establishing a private foundation could be key to your estate or heritage wealth planning. You also need to obtain the proper federal and state documents. Get Expert Guidance on Charitable Donations . 0 Comments. 0 Comments.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content