How The American Housing and Economic Mobility Act May Affect Estate Planning

Wealth Management

SEPTEMBER 18, 2024

The American Housing and Economic Mobility Act presents challenges and opportunities.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

SEPTEMBER 18, 2024

The American Housing and Economic Mobility Act presents challenges and opportunities.

Wealth Management

NOVEMBER 13, 2024

Advise clients of economic opportunities and potential shifts based on political developments.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Carson Wealth

MAY 23, 2024

One of the most important decisions you’ll make when designing your estate plan is who to name in the various fiduciary roles: trustee, personal representative, executor and agent. The post Choosing the Right Trustee for Your Estate Plan appeared first on Carson Wealth.

Park Place Financial

NOVEMBER 29, 2022

Estates Estate Planning in this Economic Climate Schedule a Complimentary Financial Review CLICK HERE TO SCHEDULE. Between inflation, increasing interest rates, federal changes to monetary policies, and global conflict, many factors are putting a strain on the current economic situation. Create a Trust .

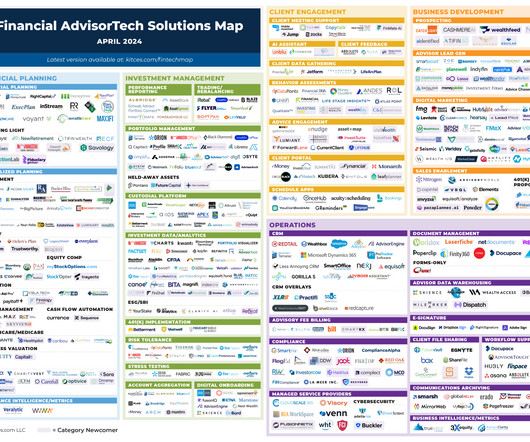

Nerd's Eye View

APRIL 1, 2024

Vanilla announced a new Scenarios tool to facilitate advisors working with ultra-HNW clients that need to model various four-letter estate planning strategies (e.g., GRATs, SLATs, CRUTs, and ILITs) to show the impact of the advisor’s advice (at least for those clients who still have Federal estate tax exposure).

International College of Financial Planning

OCTOBER 26, 2023

The Imperative of Estate Planning: Not Just for the Affluent Often, there’s a prevailing misconception that estate planning is a luxury reserved for the wealthy elite. Real estate planning is a crucial undertaking that every adult and family should prioritize.

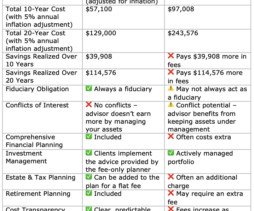

MainStreet Financial Planning

MARCH 7, 2025

Comprehensive Financial Planning is Included Many AUM advisors charge extra for estate planning, tax strategies, and retirement planning. Ongoing Portfolio Monitoring AUM advisors continuously review your investments and adjust strategies based on market conditions and economic trends.

Zoe Financial

DECEMBER 28, 2024

Read books and blogs , attend webinars, or consult with a wealth advisor to deepen your understanding of investments, estate planning, and other topics. Update Your Estate Plan Help ensure your legacy is protected by maintaining an up-to-date estate plan. Economies and markets fluctuate.

Carson Wealth

JULY 12, 2022

Most MSFS programs will contain financial planning classes within their curriculums. . Doctor of Philosophy is a graduate degree awarded in the sciences, branches of economics and social or behavioral areas. Attorneys play a critical role in the financial planning process, particularly in estate planning.

International College of Financial Planning

JULY 30, 2022

Those interested in learning more about their financial future, such as retirement saving, estate planning, and philanthropic giving, often sought out CFP. By paying for CFP services, you strengthen your overall financial plan. They can help you better prepare for future economic challenges and prevent you from going into debt.

Brown Advisory

SEPTEMBER 11, 2016

September 2016 Insights on Markets and Investments achen Mon, 09/12/2016 - 01:00 In this issue: Investors Facing Rising Risks Need Solid Defense, Savvy Offense Increasing political and economic risk during the past year has widened the range of possible positive and negative scenarios for financial markets.

Brown Advisory

SEPTEMBER 11, 2016

In this issue: Investors Facing Rising Risks Need Solid Defense, Savvy Offense Increasing political and economic risk during the past year has widened the range of possible positive and negative scenarios for financial markets. Alternative Investments Proposed Tax Law Changes Prompt Estate Planning Review.

International College of Financial Planning

APRIL 20, 2022

They advise on investments, taxes, retirement, and estate planning. A degree in finance, economics, accounting, or business is preferred, but any degree can be beneficial. Developing Your Financial Planning Skills To become a successful financial planner, you must understand financial planning principles and strategies.

Zoe Financial

DECEMBER 5, 2023

Financial planning, estate planning, tax planning, etc, rather than just picking stocks like in the old days. Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Actual economic or market events may turn out differently than anticipated.

Your Richest Life

MARCH 15, 2022

Global Giving has set up a fund specifically for Ukrainian crisis relief, which provides refugee assistance in accessing shelter, food, clean water, health and psychosocial support, and education and economic assistance. Charitable Giving: How to Work it into Your Life, Budget and Estate Planning. About Your Richest Life.

Yardley Wealth Management

JULY 10, 2020

It was nice to show that planning actually can work and be a useful tool for guiding decisions and feeling confident about them even in uncertain economic times. Please contact us if you’d like to discuss your financial plan. Our law firm is Yardley Estate Planning, LLC and is in the same place.

Yardley Wealth Management

OCTOBER 7, 2020

If you have an established saving and investing plan, stick with it for now. Your timeline might need to change because of the underlying economic consequences of the pandemic, but don’t make rash moves. We are a fiduciary, fee-only financial planning, and wealth management firm in Yardley, Pennsylvania (that’s in Bucks County).

Yardley Wealth Management

AUGUST 24, 2020

The good news is that even with the economic downturn caused by the coronavirus pandemic, millennials are still the most optimistic of any age group about the investment returns they expect in the coming years, a survey has found. Our law firm is Yardley Estate Planning, LLC and is in the same place. The expense ratios are.09%

International College of Financial Planning

APRIL 25, 2024

They possess a deep understanding of financial market dynamics and personal finance management, enabling them to assist clients in navigating the complexities of investing, retirement planning, tax strategies, and estate planning.

Midstream Marketing

NOVEMBER 6, 2024

Or are you focusing on older people who are concerned about estate planning for retirement or retirement income planning? Share economic signs and how they might affect your investment strategies. Retirement Planning: Give tips on how to save for retirement. Tax Planning: Help clients learn smart tax strategies.

WiserAdvisor

MARCH 19, 2024

These investments serve not only to grow their wealth but also to protect it against market volatility and economic downturns. They are characterized by rapid economic growth and increasing integration with the global economy. Political unrest in these regions can disrupt economic activities and erode investor confidence.

Brown Advisory

DECEMBER 2, 2015

Through conservative, bottom-up analysis, we are taking advantage of current market dynamics to buy attractively priced debt in companies with solid revenues and limited vulnerability to an economic downturn. Debt in well-managed companies positioned to weather an economic slump return nearly three times the 2.3%

Diamond Consultants

APRIL 18, 2023

The line between working for an independent firm and a wirehouse is starting to blur for many advisors—and the lack of freedom and control, along with lackluster economics, has become a powerful motivator to consider other options. Much attention has been focused on wirehouse breakaways—and for good reason.

Brown Advisory

DECEMBER 2, 2015

It also encompasses intended lifestyle, charitable giving, retirement and estate planning, and liabilities, including anticipated costs for health care. During times of market volatility, such long-term planning enables clients to shake off an impulse to sell. Ensuring Legacies Last. By Joe Ferlise, Strategic Advisor.

International College of Financial Planning

DECEMBER 4, 2023

Educational and Certification Pathways The path to becoming a financial advisor typically starts with a solid educational background in finance, business administration, or economics. It opens doors to various roles in financial services, including retirement planning and estate planning. Ready to proceed?

The Big Picture

SEPTEMBER 12, 2022

And so, coming out of school, I studied Economics and Spanish Literature, and I applied to a — a program that actually targeted Liberal Arts majors. You have a background, undergraduate, your economics degree from Notre Dame, but you were dual-major Spanish language and Literature degree, how useful was that in Latin America?

Brown Advisory

SEPTEMBER 3, 2015

China’s plummeting stock prices, slowing economic growth and currency volatility have pushed many investors out of the market. Behind the change in investor sentiment lies deteriorating economics in China. Economic recoveries usually feature a surge in consumption as employment and wages rebound. Dream or Opportunity?

Gen Y Planning

FEBRUARY 1, 2023

Our generation has lived through some of modern history’s most monumental economic and social events. Everyone has unique stressors, but the most common are saving money, managing debt, and planning for retirement. Generation Y has, for lack of a better term, “been through it.” The result? Stress, and for some, lots of it.

WiserAdvisor

JANUARY 27, 2023

Economic and market conditions are also likely to change over time, and investors may need to adjust their goals and strategies in response to these changes. Most alternative investments make for excellent estate planning tools. Estate planning strategies can also help in lowering the tax. can be effective.

Harness Wealth

JUNE 9, 2023

Exploring Illustrative Economics Consider the comparison below between a pre-tax retirement account and a post-tax alternative. For many, the plan offered by their employer may be sufficient. For many, the plan offered by their employer may be sufficient. Estate planning is a crucial part of any comprehensive financial plan.

International College of Financial Planning

JANUARY 15, 2024

Curriculum and Faculty: The Pillars of Excellence The financial planning curriculum focuses on investment strategy, taxation, retirement planning, insurance, portfolio management and estate planning, and. A financial advisor is a professional who can directly impact your economic well-being.

Brown Advisory

SEPTEMBER 1, 2015

Economic recoveries usually feature a surge in consumption as employment and wages rebound. Consumer spending accounts for about 70% of economic activity, so any weakness drags down growth, employment, wage gains and stock prices—the biggest engines of prosperity. Such protection can be a cornerstone for sound estate planning.

Brown Advisory

SEPTEMBER 3, 2015

million in 2006, inhibiting demand and economic growth, according to the Krueger report. Economic recoveries usually feature a surge in consumption as employment and wages rebound. China’s plummeting stock prices, slowing economic growth and currency volatility have pushed many investors out of the market. million from about 3.8

Brown Advisory

SEPTEMBER 3, 2015

War and financial turmoil— the bane of Europe’s economic well-being last century—are currently veiling a rebound in regional growth and unanticipated vigor among European companies. Faster economic growth helped increase to 65% the proportion of Stoxx® Europe 600 Index companies that beat estimates for secondquarter earnings per share.

Trade Brains

JANUARY 24, 2024

The company also provides holistic services like estate planning and succession planning without charging clients. The company excels in distributing financial products, emphasizing the HNI segment with a mix of mutual funds and Non-PP Structured Products (Non-PP SPs) for predictable returns with lower risk.

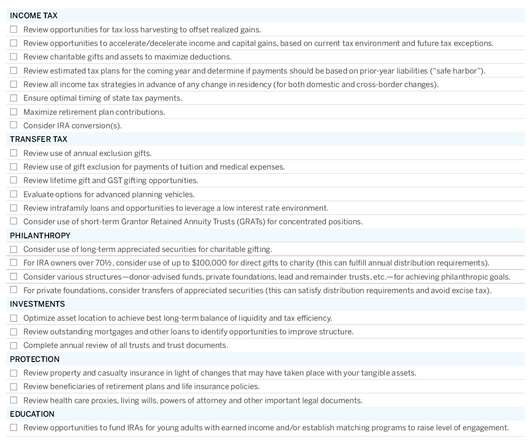

Brown Advisory

NOVEMBER 1, 2019

Market conditions may be volatile, but our planning efforts are, as always, focused on stability and consistency. You can find our annual planning checklist at the end of this article. It is important to evaluate near- and long- term planning options annually—each year can bring different opportunities.

WiserAdvisor

JULY 27, 2023

Explore Estate Planning: Create or update your will and establish trusts if necessary. Periodically Review and Adjust Your Plan: Review your retirement plan regularly and make adjustments as needed based on changes in your life, financial situation, and market conditions.

WiserAdvisor

NOVEMBER 14, 2023

Financial security Among the primary goals of retirement planning is establishing financial security through a sustainable income stream. Traditional retirement plans often rely heavily on pension schemes. Moreover, strategic retirement planning includes aspects of estate planning, which can have complex tax implications.

Carson Wealth

JULY 26, 2023

So, from an economic standpoint, it’s essential to plan for the future as that’s likely where you will realize the bulk of your lifetime wealth. Start succession planning as soon as you start the business, or as I like to say: “now.” The best advice?

Diamond Consultants

JUNE 28, 2023

Although Michael enjoyed growing his practice at his firm, his clients started to ask for more—like tax preparation, in-house estate planning, and unique alternative investments. Plus, true open architecture with 3 rd party asset custody and enticing economics made it difficult to ignore.

Indigo Marketing Agency

OCTOBER 6, 2020

In fact, I’m one of the oldest of the millennial generation and I need help from my advisor with all of the following: Retirement planning. Tax planning. Real estate. College planning for my kids. Long-term care planning. Estate planning. Life insurance. What Millennials Need From You.

Indigo Marketing Agency

AUGUST 22, 2024

You can foster transparency and build trust by keeping clients informed about updates with your firm, market trends, financial tips, and any changes that might affect their plan. Host quarterly webinars where clients learn more about your firm, ask financial questions, and get real-time answers.

Zoe Financial

FEBRUARY 21, 2023

Let’s review both of these in more depth: Financial Advisor A financial advisor helps you plan for your financial future by advising clients on investments, retirement planning, estate planning, insurance policies, tax strategies, and more.

Harness Wealth

MARCH 11, 2024

Qualified opportunity zone investments Qualified Opportunity Zones (QOZs) are economically distressed communities designated for investment to spur economic growth. Investments in these zones are made through Qualified Opportunity Funds (QOFs). Second homes used as residences may also qualify for environmental tax credits.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content