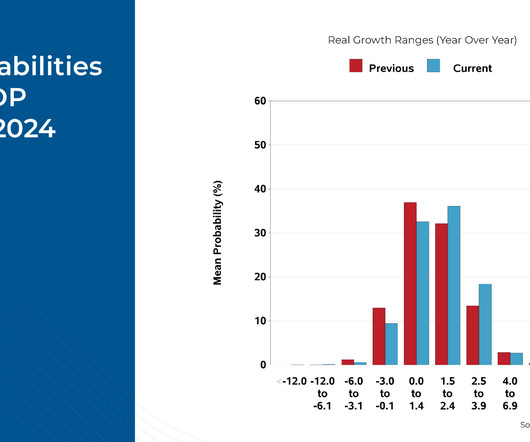

4th Quarter 2023 Economic And Market Outlook: Labor Market, Inflation, And Geopolitics

Nerd's Eye View

JANUARY 3, 2024

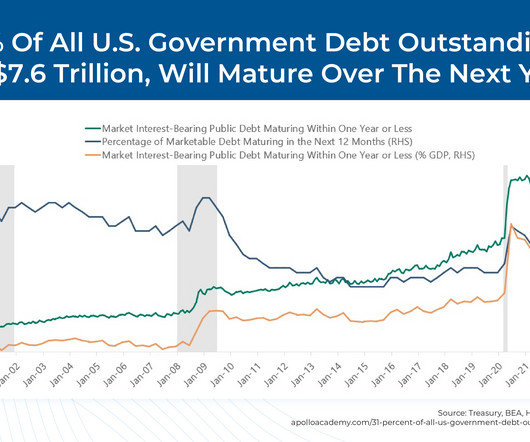

The sentiment is especially poignant when it comes to economic forecasting, as it's nearly impossible to get an accurate picture of the current state of the economy at any given moment. Businesses are also feeling the pinch from higher interest rates, as November saw a rapid increase in the number of Chapter 11 commercial bankruptcies.

Let's personalize your content