Diversifying Client Portfolios With Gold

Wealth Management

DECEMBER 21, 2023

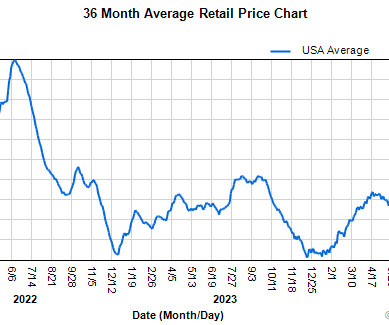

Education about gold investments is key to ensuring clients have a well-balanced portfolio that can withstand economic fluctuations.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The Big Picture

NOVEMBER 15, 2024

This week, we speak with Colin Camerer , Robert Kirby Professor of Behavioral Finance and Economics at California Institute of Technology. He is a member of the American Academy of Arts and Sciences and holds fellowship at the Econometric Society and the Society for the Advancement of Economic Theory.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JANUARY 14, 2025

Nonetheless, investors should focus on building portfolios that are "antifragile." "

Wealth Management

DECEMBER 20, 2024

Todays economic environment is creating dispersion across bond sectors, introducing various levels of opportunity.

The Big Picture

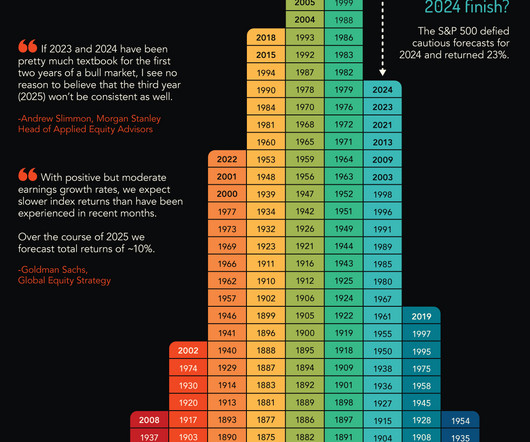

JANUARY 2, 2025

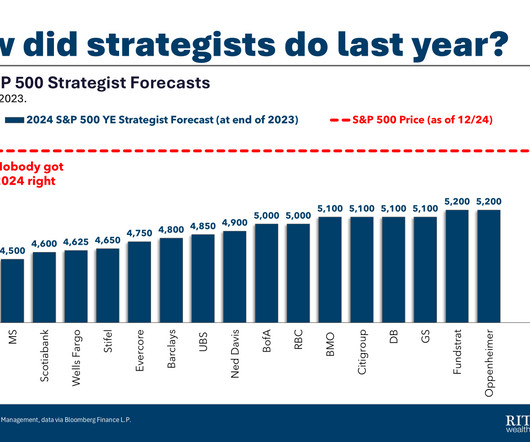

This is true about equity and bond markets, specific company stocks, and economic data series. Or, as John Kenneth Galbraith observed, The only function of economic forecasting is to make astrology look respectable. ~~~ Public Enemy’s 13th album was titled “ Man Plans, God Laughs.”

MainStreet Financial Planning

MARCH 12, 2025

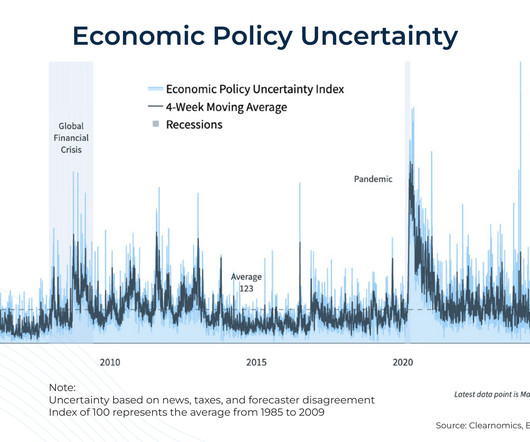

Economic uncertaintywhether it’s due to market volatility, rising inflation, or potential recessionscan feel overwhelming. Here are five practical tactics to help retirees weather economic uncertainty: Take a Break from the News Constantly consuming news and social media can lead to unnecessary panic.

The Big Picture

MARCH 18, 2025

This is as true for professionals as it is for amateurs; it’s also true in music, film, sports, television, and economic and market forecasting. Economic Innumeracy : Some individuals experience math anxiety, but it only takes a bit of insight to navigate the many ways numbers can mislead us. Bad Numbers : 4.

Abnormal Returns

APRIL 8, 2025

mrzepczynski.blogspot.com) Are researchers building portfolios all wrong? papers.ssrn.com) Portfolio rebalancing The benefits of portfolio rebalancing are overstated. roberthuebscher.substack.com) Your portfolio rebalancing frequency doesn't matter all that much. Quant stuff The case for simple models using more data.

Abnormal Returns

NOVEMBER 5, 2024

klementoninvesting.substack.com) Portfolio construction How portfolio diversification works. caia.org) How to use trading volume to optimize portfolio construction. mrzepczynski.blogspot.com) Economics How 'ghost jobs' have messed with the Beveridge Curve. alphaarchitect.com) Regime-based factor allocation.

Nerd's Eye View

OCTOBER 4, 2023

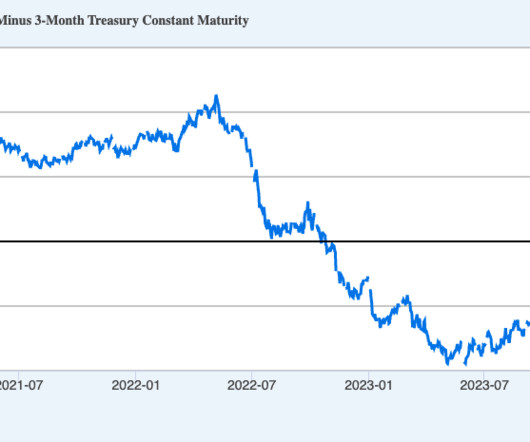

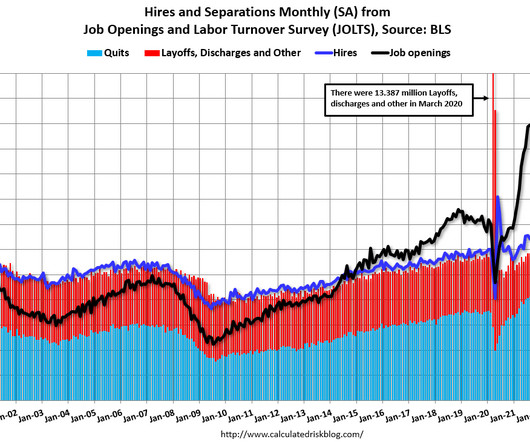

And even though numerous signs are pointing to the looming possibility of a more widespread economic downturn – including the reduction of household savings, reduced lending, and the resumption of student loan payments for many borrowers – the job market remains strong. And even though U.S.

The Big Picture

NOVEMBER 15, 2023

The problem is those behaviors are so destructive to a portfolio. 1 We ignore the reality of human behavior, including the need for some thrills and excitement, at the peril of our portfolios. Note: We deploy many of these solutions at RWM that take advantage of our knowledge of behavioral economics.) We all are! –

Abnormal Returns

MARCH 17, 2025

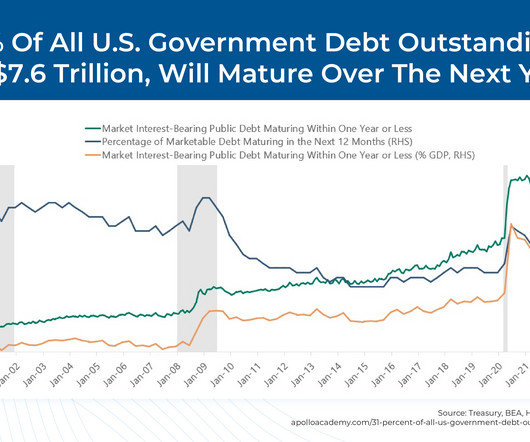

jeffreyptak.substack.com) Global China is more diverse (economic) than you think. apolloacademy.com) Earlier on Abnormal Returns Adviser links: durable portfolios. (axios.com) Fund management How market concentration affects ETF index construction. morningstar.com) People are not dumping target date funds willy-nilly.

Nerd's Eye View

JULY 3, 2024

As a result, advicers have more options than ever to add value for their clients by tailoring investment portfolios that are specific to their unique needs, goals, and risk tolerance. As a result, this macroeconomic and market uncertainty has ostensibly driven a preference for overweighting higher-quality companies in investment portfolios.

Abnormal Returns

FEBRUARY 14, 2024

riaintel.com) Do you really need a separate allocation to real estate in your portfolio? Strategy Alternatives managers want in on the defined contribution space. morningstar.com) Growth in ETFs are a boon to Jane Street. ft.com) Companies Uber's ($UBER) transformation is complete as the company initiates a stock buyback.

The Big Picture

OCTOBER 24, 2024

In other words, if you were forecasting 10-year returns of 3% annually, you are also forecasting an economic shitstorm of rare and historic proportions. I do believe that the economic gains we are going to see in technology justify higher market prices. But that’s a very different discussion than 3% annually for 10 years.

Tobias Financial

APRIL 14, 2025

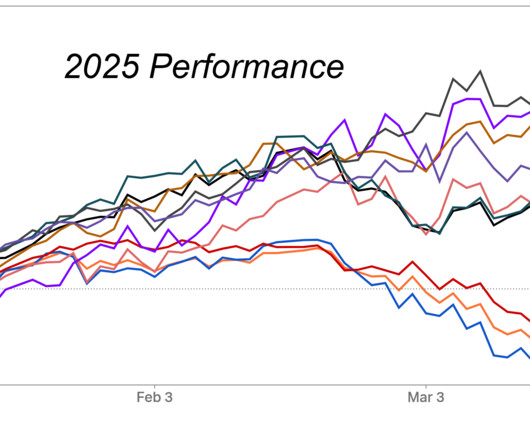

Market downturns can bring uncertainty, and with recent headlines about tariffs and economic shifts, you may be wondering whats next. Just weeks ago, analysts were predicting continued market growth, and now, concerns about global trade and economic conditions are leading to increased volatility.

Nerd's Eye View

APRIL 16, 2025

The current environment also presents an opportunity for advisors to emphasize the benefits of diversification – how it has helped protect client portfolios from the worst of recent market declines while still allowing them to participate in market gains.

The Big Picture

MARCH 3, 2023

The first bear I experienced was utterly meaningless economically but still felt bad. My economic future was uncertain, but I felt confident I could make a go of it. My portfolio was tiny; I had no 401k, and my wife’s 403(b), with less than a decade’s worth of contributions, was barely 5-figures.

Abnormal Returns

SEPTEMBER 24, 2024

clearerthinking.org) Research How identifying economic regimes can help in portfolio allocation. Statistics Comparing the Sharpe and Sortino ratios. caia.org) Correlations, 101. alphaarchitect.com) What investors get wrong about high quality stocks. advisorperspectives.com) A review of historical private equity performance.

Wealth Management

JULY 26, 2023

Advisors are taking a close look at their portfolios given the current market and economic conditions.

Wealth Management

JULY 26, 2023

Advisors are taking a close look at their portfolios given the current market and economic conditions.

The Big Picture

APRIL 17, 2025

All costs impact your returns, but high or excessive fees have an enormous impact as they compound or, more accurately, lessen your portfolios compounding over time. This was impossible, and I said so: Either you guys are either going to win the Nobel prize in economics or go to jail. There is nothing in between. (I

Nerd's Eye View

MARCH 26, 2025

Recent swings have been driven by economic policy shifts, persistent inflation concerns, and geopolitical uncertainty – all of which may unnerve even the steadiest of clients. Rather, it's about constructing a portfolio that aligns with a client's long-term goals. Read More.

Abnormal Returns

DECEMBER 26, 2023

cnbc.com) A round-up of recent research on portfolio design including 'Outperforming Equal Weighting.' alphaarchitect.com) Hong Kong went from a standout on economic freedom to laggard. Quant stuff You don't want your AI model to 'hallucinate' when analyzing SEC filings. capitalspectator.com) Regime changes happen in markets.

Abnormal Returns

NOVEMBER 29, 2024

(sherwood.news) Five economic reasons to be thankful including 'Low unemployment claims. abnormalreturns.com) Personal finance links: a boring portfolio. calculatedriskblog.com) Earlier on Abnormal Returns Podcast links: recycled guests. abnormalreturns.com) Longform links: prediction machines.

The Big Picture

NOVEMBER 17, 2022

That is according to a study by Julian di Giovanni, who publishes at the NY Fed’s blog Liberty Street Economics. My job is not to give policy advice to the Fed, but to interpret what they are doing and its most likely impact on our portfolios. Liberty Street Economics, August 24, 2022). Short answer: 40%. November 7, 2022).

Abnormal Returns

MARCH 4, 2025

(rcmalternatives.com) How skew and kurtosis should play a role in portfolio construction. alphainacademia.substack.com) Some popular economics books to avoid including "Power and Progress," by Daron Acemoglu and Simon Johnson. mailchi.mp) Round-ups A round-up of recent white papers including 'A New Paradigm in Active Equity.'

The Big Picture

JUNE 13, 2024

Barry adds: Two things to add to this discussion: It’s yet another reminder that investors must always be on guard for nonsensical claims from partisans who have zero concern for your portfolio. They are playing a different game, and you are collateral damage.

Abnormal Returns

JANUARY 5, 2025

axios.com) Strategy Don't let dividends take the wheel of your portfolio. nber.org) The economic schedule for the coming week. Markets The 2020s has seen nothing but big market moves. awealthofcommonsense.com) 30-year mortgage rates are at a six-month high. downtownjoshbrown.com) Or your expectations for the Fed.

Abnormal Returns

FEBRUARY 4, 2025

blogs.cfainstitute.org) Economics How optimism affects our willingness to save for the future. ft.com) How people talked about portfolio management in the 19th century. (papers.ssrn.com) A review of "The Making of Modern Corporate Finance: A History of Ideas and How They Build the Wealth of Nations" by Donald H.

Abnormal Returns

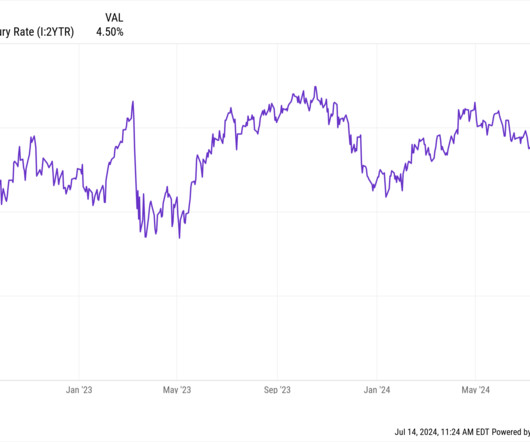

JULY 14, 2024

awealthofcommonsense.com) Seven reasons you may want to venture away from the market portfolio. nbcnews.com) Economy An economic soft landing is still on track. dallasfed.org) The economic schedule for the coming week. Strategy The stock market has changed so much over the past 50 years. Human behavior hasn't.

The Big Picture

DECEMBER 1, 2023

This came up yesterday on Portfolio Rescue with Ben Carlson. The entire discussion is worth watching, but the video below is teed up for the economic forecasting discussion. Economic Forecasts: What’s the Probability of a Recession in 2024? It was before the very encouraging CPI, Unemployment, and GDP data releases.

Abnormal Returns

JULY 12, 2024

vox.com) Global Tyler Cowen talks with Brian Winter discuss the politics and economics of nearly every country from the equator down. conversationswithtyler.com) Russell Napier talks with Harold James, author of "Seven Crashes: The Economic Crises That Shaped Globalisation." (linkedin.com) Spotify ($SPOT) has a bundling problem.

The Big Picture

JANUARY 3, 2025

Additionally, Sunaina serves as Chairman of the Board of Directors of SFC Energy AG and on the boards of the Stanford Institution for Economic Policy Research and the Stanford LEAD Council. She also earned a spot as one of the Twenty Trailblazing Women in Private Equity in 2023.

Abnormal Returns

NOVEMBER 12, 2023

awealthofcommonsense.com) Chances are, you don't need a bespoke portfolio. econbrowser.com) Any economic slowdown is coming with consumers in pretty good shape. mrzepczynski.blogspot.com) Economic activity continues to shift toward these four Sunbelt cities. nytimes.com) The economic schedule for the coming week.

Abnormal Returns

NOVEMBER 22, 2022

elmwealth.com) Are we building portfolios the wrong way? (caia.org) We don't really know how much of the market is held by passive investors. klementoninvesting.substack.com) The case against systematic put protection strategies. pragcap.com).

The Big Picture

MAY 5, 2023

Rather than accept the volatility of month-to-month economic datapoints — NFP, Consumer Spending, Manufacturing, Inflation, etc. Instead, there is a tendency to put too much weight onto the numbers themselves, encouraging a variety of changes and modifications to portfolios due to whatever the latest data suggests.

Abnormal Returns

MARCH 21, 2025

ft.com) Strategy How to think about liquid alternatives in a portfolio (morningstar.com) Barry Ritholtz's "How NOT to Invest" is a master class for investors. bonddad.blogspot.com) Some unconventional measures of economic weakness. Markets Nvidia ($NVDA) stock is struggling. sherwood.news) European stocks are not struggling.

Abnormal Returns

JULY 5, 2024

(paulpodolsky.substack.com) Tyler Cowen talks with Joseph Stiglitz, author of "The Road to Freedom: Economics and the Good Society." pod.link) Alternatives Eric Golden talks with Phil Huber, Head of Portfolio Solutions at Cliffwater, about the case for private credit.

Nerd's Eye View

JULY 5, 2023

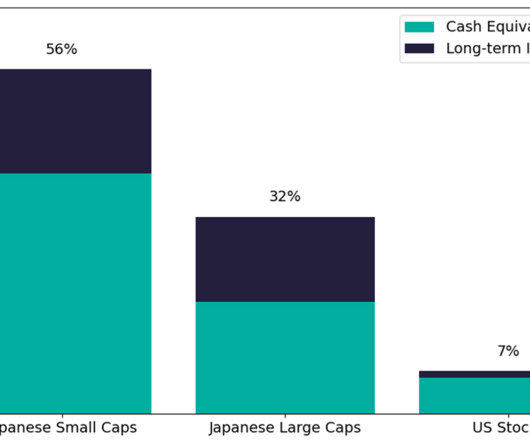

In this guest post, Larry Swedroe, head of financial and economic research at Buckingham Strategic Wealth, discusses why many investors tend to fall prey to recency bias, and explains why global diversification – and keeping short- and long-term results in the right perspective – remains a prudent strategy. and global investments.

Abnormal Returns

AUGUST 29, 2023

Strategy How (and where) to hold cash in your portfolio. calculatedrisk.substack.com) 19 economic charts worth a look including a look at increased business investment. morningstar.com) For alternatives, Is illiquidity a feature or a bug? savantwealth.com) Don't underestimate how weird the world can be. (mr-stingy.com)

Trade Brains

SEPTEMBER 17, 2023

Best Porinju Veliyath Portfolio Stocks: Investors are always on the lookout for small-cap companies which can lead to multi-bagger returns. In this article, we’ll read about such best Porinju Veliyath portfolio stocks. In this article, we’ll read about such best Porinju Veliyath portfolio stocks. EPS ₹8 Stock P/E 196 RoE 3.2%

The Big Picture

AUGUST 25, 2023

China, Clickbait, & Market Crises: What Investors Should Know About Behavioral Economics Here is the Moneyshow’s description: “Barry Ritholtz is Founder and CIO of Ritholtz Wealth Management. He is also a long-time market analyst, commentator, and expert on behavioral economics principles as they apply to investing.

Abnormal Returns

AUGUST 8, 2023

morningstar.com) Behavior Another indication that political polarization is showing up in investor portfolios. klementoninvesting.substack.com) There's no evidence that economic forecasters can actually forecast. (papers.ssrn.com) Target date funds hold more in international stocks than the average investor.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content