Adjusted for Risk: What Financial Advisors Should Know About Private Equity Investing

Wealth Management

APRIL 18, 2024

The questions advisors should ask when considering private equity investments for their clients.

Wealth Management

APRIL 18, 2024

The questions advisors should ask when considering private equity investments for their clients.

Abnormal Returns

APRIL 18, 2024

Strategy Passive investors don't change relative prices. (bloomberg.com) A good outcome doesn't necessarily mean it was a good decision. (novelinvestor.com) Don't change your asset allocation in response to a market pullback. (rogersplanning.blogspot.com) Crypto The Grayscale Bitcoin Trust ($GBTC) continues to leak assets. (wsj.com) Bitcoin is whatever you want it to be.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

APRIL 18, 2024

Monaco Capital and Saling Simms have become the second and third firms to join Steward Partners’ new Legacy Division, established via acquisition late last year.

Calculated Risk

APRIL 18, 2024

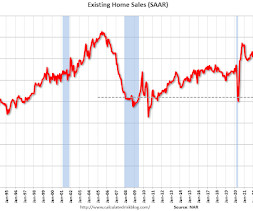

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.19 million SAAR in March Excerpt: Sales Year-over-Year and Not Seasonally Adjusted (NSA) The fourth graph shows existing home sales by month for 2023 and 2024. Sales declined 3.7% year-over-year compared to March 2023. This was the thirty-first consecutive month with sales down year-over-year.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Wealth Management

APRIL 18, 2024

From Telemus Capital, Matt Dmytryszyn's resume spans 20 years as a research analyst for LaSalle Street, Russell Investments and Piper Jaffray,

Calculated Risk

APRIL 18, 2024

From the NAR: Existing-Home Sales Descended 4.3% in March Existing-home sales slipped in March, according to the National Association of REALTORS®. Among the four major U.S. regions, sales slid in the Midwest, South and West, but rose in the Northeast for the first time since November 2023. Year-over-year, sales decreased in all regions. Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – receded 4.3% from February to a season

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

APRIL 18, 2024

The DOL reported : In the week ending April 13, the advance figure for seasonally adjusted initial claims was 212,000 , unchanged from the previous week's revised level. The previous week's level was revised up by 1,000 from 211,000 to 212,000. The 4-week moving average was 214,500, unchanged from the previous week's revised average. The previous week's average was revised up by 250 from 214,250 to 214,500. emphasis added The following graph shows the 4-week moving average of weekly claims since

Wealth Management

APRIL 18, 2024

Jeff Casey, president and senior financial advisor at CG Financial Services, uses integrations of various programs to achieve efficiency for the $3.1 billion AUM firm.

Calculated Risk

APRIL 18, 2024

From STR: U.S. hotel results for week ending 13 April Helped by the total solar eclipse, U.S. hotel performance increased from the previous week, according to CoStar’s latest data through 13 April. 7-13 April 2024 (percentage change from comparable week in 2023): • Occupancy: 65.8% (+2.8%) • Average daily rate (ADR): US$160.20 (+2.9%) • Revenue per available room (RevPAR): US$105.48 (+5.8%) emphasis added The following graph shows the seasonal pattern for the hotel occupancy rate using the four-

Wealth Management

APRIL 18, 2024

It waives excise tax for failure to take RMDS for 2024 for certain accounts

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Calculated Risk

APRIL 18, 2024

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For March, Realtor.com reported inventory was up 23.5% YoY, but still down almost 38% compared to March 2017 to 2019 levels. Now - on a weekly basis - inventory is up 29.1% YoY. Realtor.com has monthly and weekly data on the existing home market.

Wealth Management

APRIL 18, 2024

Edelman Financial Engines is fighting Mariner’s motion to dismiss its lawsuit. In a new filing, Edelman argues that Mariner gets “free rides” off of its competitors.

Abnormal Returns

APRIL 18, 2024

Books An excerpt from James Lawrence Powell’s book “Mysteries of the Deep: How Seafloor Drilling Expeditions Revolutionized Our Understanding of Earth History.“ (thereader.mitpress.mit.edu) An excerpt from "Everest, Inc.: The Renegades and Rogues Who Built an Industry at the Top of the World" by Will Cockrell. (insidehook.com) Lessons learned from "Wuhan: How the Covid-19 Outbreak in China Spiraled Out of Control," by Prof Dali Yang.

Nerd's Eye View

APRIL 18, 2024

For over a decade, the financial advice industry has been bracing for an "any-minute-now" tsunami of advisor retirements and concomitant sales of financial planning practices. Although that wave has yet to materialize (as many advisors may find that they'd prefer to stay engaged and earn well past the 'traditional' retirement age), the fact remains that, at some point, many aging advisors will have the opportunity to capture the enterprise value that they've spent their careers building.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

A Wealth of Common Sense

APRIL 18, 2024

A reader asks: I get all the stuff Ben has been saying about inflation — wages have kept pace, economic growth has been higher than the 2010s, wages have risen the most for lower income people, etc. I get all that. My husband and I own a house and own stocks so we’ve benefitted in recent years. Having said all of that, I STILL CAN’T GET OVER HOW HIGH PRICES ARE!!!

NAIFA Advisor Today

APRIL 18, 2024

Congratulations to NAIFA Trustee Stephen Kagawa , LUTCF, FSS, on being named the 71 st recipient of NAIFA-Los Angeles ’s Will G. Farrell Public Service Award. The CEO and Chairman of the Board of The Pacific Bridge Companies has been a loyal NAIFA member since 1986.

Trade Brains

APRIL 18, 2024

Hanging Man Candlestick Pattern: Investors use technical analysis to predict stock price movements based on historical trends. The candlestick pattern is a popular method that examines the shape and color of individual candlesticks to identify past reactions and predict future stock price movements. This approach is essential for making informed investment decisions in the stock market.

Random Roger's Retirement Planning

APRIL 18, 2024

First, an update on my test drive of the Defiance NASDAQ 100 Enhanced Option Income ETF (QQQY). I bought 100 shares on its first or second day of trading last fall for $2017 and I sold it today for $2114 which includes reinvesting the dividends. The price, without reinvesting dividends has fallen by about 24% but as I've been saying all along with these, if the entire dividend is taken out and spent, they are likely to go to zero (not quite literally).

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Advisor Perspectives

APRIL 18, 2024

Let’s explore the world of cash. One year after the collapse of SVB, fiduciaries need to understand the cash management platforms on the market, including the fine print that can make or break a client relationship. The right platform will help the advisor provide more holistic advice and grow their AUM organically. My guest will discuss what advisors need to know about cash sweep accounts and how advisors can evaluate different platforms.

NAIFA Advisor Today

APRIL 18, 2024

NAIFA Trustee Barbara A. Pietrangelo , an accomplished Financial Planner and a loyal member of NAIFA since 1992, stands out as a beacon of expertise and commitment. Her career began in 1991 at the Prudential Insurance Company of America, where she has since ascended to become the Wealth Solutions Report Financial Planner of the Year as One of the Top Women Industry Leaders for 2024.

Norman Marks

APRIL 18, 2024

My congratulations to David Dufek for his recent article for the IIA’s Internal Auditor magazine, Building a Better Auditor: Be Lazier. He makes several excellent points, but misses one: it can take hard work to be what he calls “the good kind of lazy”.

NAIFA Advisor Today

APRIL 18, 2024

David McKnight is a renowned financial advisor and expert in zero-tax retirement planning, having assisted thousands of Americans in achieving the zero percent tax bracket. He has frequently appeared in numerous national publications, including Forbes , USA Today , the New York Times , Fox Business , CBS Radio, and Bloomberg Radio. With four #1 Amazon best-selling books to his credit, including The Power of Zero , Look Before You LIRP , The Volatility Shield , and Tax-Free Income for Life , Davi

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Carson Wealth

APRIL 18, 2024

Carson Wealth’s Thom Hall CFP®️, ChFC®️, CExP, CEPA Managing Director, Partner & Wealth Advisor and Rick Krebs CPA, CEPA discuss business exit planning and how to make an intelligent exit. Rick Krebs and BSales Group are not an affiliate of Cetera Advisor Networks, LLC, or CWM, LLC. Opinions expressed by the presenter may not be representative of Cetera Advisor Networks, LLC, or CWM, LLC.

Advisor Perspectives

APRIL 18, 2024

Banks have found another way to fight back after private lenders have grabbed ever larger pieces of the lucrative business of financing leveraged buyouts.

Validea

APRIL 18, 2024

Trend following is a popular investment strategy that has gained significant attention in recent years, particularly in the realm of equity investing. This article will delve into the concept of trend following, its effectiveness, the metrics and lookback periods commonly employed, and the behavioral challenges it presents to investors. What is Trend Following?

Advisor Perspectives

APRIL 18, 2024

When does a strong dollar become too strong? “Right now” would be the cry of most emerging-market currencies, not to mention policymakers in Japan. Even the European Central Bank says it’s paying attention to the foreign exchange market.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

SEI

APRIL 18, 2024

Part two: Jim Solloway, Chief market strategist and senior portfolio manager, and Vivian Estadt, Client service director, present our economic outlook in this two-part series.

Advisor Perspectives

APRIL 18, 2024

GMO has published a new 7-Year Asset Class Forecast.

Advisor Perspectives

APRIL 18, 2024

The Northern Trust Economics team shares its outlook for U.S. growth, employment, interest rates and inflation.

Advisor Perspectives

APRIL 18, 2024

Japan has had two big moments in the last month, with the Nikkei 225 equity index breaking above the highs set in 1989, and the Bank of Japan (BoJ) raising interest rates for the first time in 17 years.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Let's personalize your content