Humanizing a Brand

Wealth Management

JUNE 6, 2024

Create a brand focused on you by being relatable and authentic helps gain clients.

Wealth Management

JUNE 6, 2024

Create a brand focused on you by being relatable and authentic helps gain clients.

The Big Picture

JUNE 6, 2024

I spend a lot of time debunking investment-related b t. Given the general innumeracy of the public, it’s easy for a dishonest publisher of economic data to create narratives that are not only false and misleading but effective at confusing the public. Typically, it takes years before sufficient data amasses to prove how wrong these people were.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JUNE 6, 2024

F2 Strategy's co-founder and CEO provides his take on the most important wealth management technology news of the last month.

Calculated Risk

JUNE 6, 2024

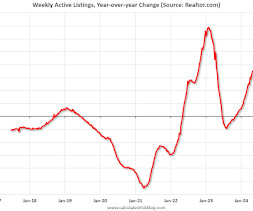

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For April, Realtor.com reported inventory was up 35.2% YoY, but still down almost 34% compared to April 2017 to 2019 levels. Now - on a weekly basis - inventory is up 35.5% YoY. Realtor.com has monthly and weekly data on the existing home market.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Wealth Management

JUNE 6, 2024

The SEC and FINRA are being transparent about their increased regulatory activity around off-channel communications and the marketing rule.

Abnormal Returns

JUNE 6, 2024

Books Jack Raines talks with Kyla Scanlon about her new book "In This Economy?: How Money & Markets Really Work." (sherwood.news) An excerpt from "Triumph of the Yuppies: America, the Eighties, and the Creation of an Unequal Nation" by Tom McGrath. (politico.com) An excerpt from "In the Shadows: True Stories of High-Stakes Negotiations to Free Americans Captured Abroad" by Mickey Bergman.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

JUNE 6, 2024

Markets When does 'talking your book' tip over into market manipulation? (wsj.com) Why you shouldn't be worried about index funds just yet. (thefinancialbodyguard.com) Crypto Robinhood ($HOOD) is buying BitStamp. (theblock.co) Franklin Templeton ($BEN) is exploring funds with altcoins. (coindesk.com) Former FTX customers just got a big break. (sherwood.news) Alternatives There are very good reasons why hedge fund managers are not publicly traded.

Wealth Management

JUNE 6, 2024

Mindy and Louis Diamond share the warning signs all advisors should pay attention to and proactive steps an advisor can take to protect themselves.

Calculated Risk

JUNE 6, 2024

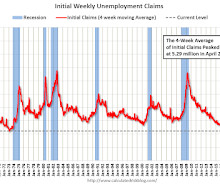

The DOL reported : In the week ending June 1, the advance figure for seasonally adjusted initial claims was 229,000 , an increase of 8,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 219,000 to 221,000. The 4-week moving average was 222,250, a decrease of 750 from the previous week's revised average.

Wealth Management

JUNE 6, 2024

REITs posted total returns north of 5% for the month, although they remain in negative territory year-to-date.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Calculated Risk

JUNE 6, 2024

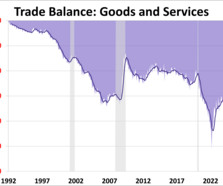

The Census Bureau and the Bureau of Economic Analysis reported : The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $74.6 billion in April , up $6.0 billion from $68.6 billion in March, revised. April exports were $263.7 billion, $2.1 billion more than March exports. April imports were $338.2 billion, $8.0 billion more than March imports. emphasis added Click on graph for larger image.

Wealth Management

JUNE 6, 2024

Portfolio managers have poured money into the active sector for 50 consecutive months after a $22 billion allocation in May, data compiled by Bloomberg Intelligence show.

Calculated Risk

JUNE 6, 2024

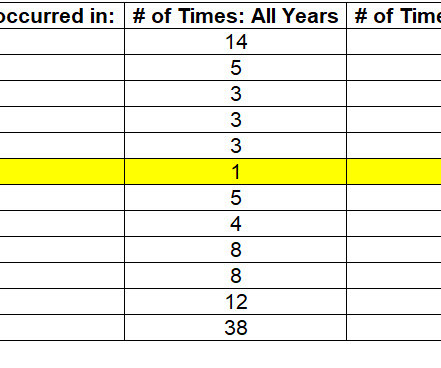

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in May A brief excerpt: NOTE: The tables for active listings, new listings and closed sales all include a comparison to May 2019 for each local market (some 2019 data is not available). This is the first look at several early reporting local markets in May. I’m tracking over 40 local housing markets in the US.

Wealth Management

JUNE 6, 2024

The pace of buyouts is slowing and some private credit funds are struggling to return cash to their investors.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

JUNE 6, 2024

On Friday at 8:30 AM ET, the BLS will release the employment report for May. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 3.9%. There were 175,000 jobs added in April, and the unemployment rate was at 3.9%. From Goldman Sachs economist Spencer Hill We estimate nonfarm payrolls rose by 160k in May , somewhat below consensus.

Wealth Management

JUNE 6, 2024

Scott Baker replaces George Karris, who has opted to retire, and will be responsible for creating growth opportunities for Cetera.

Calculated Risk

JUNE 6, 2024

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Friday: • At 8:30 8:30 AM ET, Employment Report for May. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 3.9%. 12:00 PM: Q1 Flow of Funds Accounts of the United States from the Federal Reserve.

Wealth Management

JUNE 6, 2024

In spite of the Court of Appeals striking down SEC’s Private Fund Adviser Rules, advisors might be compelled to offer clients greater transparency

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

A Wealth of Common Sense

JUNE 6, 2024

We also discussed questions about our personal investment decisions, switching your portfolio from individual stocks to index funds, the potential impact of artificial general intelligence and investment advice for a college senior. Further Reading: If You’re Still Worried You Aren’t Wealthy 1That CFA designation still comes in handy from time to time. 2Assuming you put some thought into that allocation and i.

Wealth Management

JUNE 6, 2024

PhilanthPro's Nicholas Palahnuk details the importance of philanthropy for clients and building connections with the next generation.

NAIFA Advisor Today

JUNE 6, 2024

Message From the CEO Graduates of NAIFA’s Leadership in Life Institute have a deep appreciation for The 7 Habits of Highly Effective People by renowned leadership authority Stephen Covey. They may be familiar with Covey’s quote, “If there’s one thing that’s certain in business, it’s uncertainty.” The same principle applies to life. Transitions often amplify uncertainty, and among the most uncertain times for many is the transition into retirement.

Wealth Management

JUNE 6, 2024

Are you customizing your client portfolios enough? The PSN Mid-Year Outlook outlines substantial reasons SMAs are attracting new investors.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Random Roger's Retirement Planning

JUNE 6, 2024

Several quick hits today. GraniteShares has filed for a suite of what it will call YieldBoost ETFs that will sell put options on levered index and single stock ETFs ranging from 1.5x-3x levered funds. Like a lot of the "derivative income funds," the yields will be sky high. The market won't go against the strategy too often but occasionally, when there are large declines, the risk to these getting torched would be enormous.

Wealth Management

JUNE 6, 2024

Chief Growth Officer Rob Rickey discusses the modifications the $1.1 billion AUM firm has made to serve its clientele.

Million Dollar Round Table (MDRT)

JUNE 6, 2024

By Liz DeCarlo, MDRT Content Manager If you’re not offering clients a full suite of service, you’re probably leaving business on the table, said Saad Anthony Baksh, BSc , a 16-year member from Marabella, Trinidad and Tobago, in his 2017 MDRT Annual Meeting presentation. “If you’re an advisor with a smaller territory or operating in a small country, you’re giving away your clients.

Wealth Management

JUNE 6, 2024

Brooklyn Investments' Erkko Etula explains how advisors can serve clients with personalized portfolios that are tax and cost efficient.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Advisor Perspectives

JUNE 6, 2024

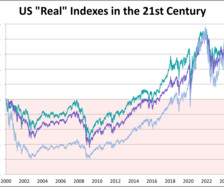

Here is a look at real (inflation-adjusted) charts of the S&P 500, Dow 30, and Nasdaq composite since their 2000 highs. We've updated this through the May 2024 close.

Trade Brains

JUNE 6, 2024

Amara Raja Energy & Mobility: Imagine a world without the constant hum of electricity. Cars sit silent, factories grind to a halt, and even a simple phone call becomes impossible. This power outage might seem like a nightmare, but it highlights the crucial role of energy storage in our daily lives. Here comes Amara Raja Energy and Mobility Ltd which stands tall as a leading player in this vital space.

Advisor Perspectives

JUNE 6, 2024

The U.S. international trade in goods and services is published monthly by the Bureau of Economic Analysis with data going back to 1992 and details U.S. exports and imports of goods and services. In April, the trade deficit widened to an 18-month high by expanding 8.7% to $74.56B. The latest reading was better than the forecast of $76.20B.

NAIFA Advisor Today

JUNE 6, 2024

In the ever-evolving landscape of retirement planning, Social Security remains a critical source of income for most Americans. The annual release of the Trust Fund Report, issued in May, sparked widespread media coverage and client concern. Questions such as "Will Social Security still be there?" and "Is it going broke?" continue to circulate. Join us for a webinar on Wednesday, June 26, 2024, from 12:00 pm to 1:00 pm Eastern, sponsored by Security Mutual Life which can help you deal with the co

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Let's personalize your content