3 Underutilized Estate Planning Strategies for Business Owners

Wealth Management

JULY 15, 2024

With the estate tax exemption sunset looming, the time to begin planning is now.

Wealth Management

JULY 15, 2024

With the estate tax exemption sunset looming, the time to begin planning is now.

Abnormal Returns

JULY 15, 2024

Markets When it comes to markets, speed isn't always better. (forkingpaths.co) Europe's luxury good stocks have had a good decade. (sherwood.news) Asset management Asset managers are seeing falling profitability. (institutionalinvestor.com) Goldman Sachs' ($GS) asset and wealth management division saw a boost in revenue. (cnbc.com) Funds The outskirts of the ETF industry are growing and getting weirder.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 15, 2024

InterVal's Trevor Greenway explains how advisors can solve the challenge of determining the value of small- and medium-sized business when creating a financial plan for owners.

Abnormal Returns

JULY 15, 2024

Podcasts Brendan Frazier talks with Andy Baxley about drafting a statement of financial purpose. (wiredplanning.com) Daniel Crosby talks financial adviser marketing with Phil Bray, Founder and Director of The Yardstick Agency. (standarddeviationspod.com) Elena Krasnow and Jimmy Moock talk with Michael Batnick about how Ritholtz Wealth goes about hiring and what he enjoys most about creating content.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

JULY 15, 2024

The bank's Asset & Wealth Management segment is becoming a bigger contributor to the firm’s overall growth.

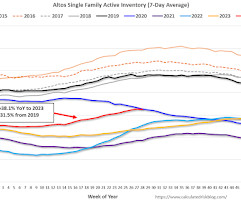

Calculated Risk

JULY 15, 2024

Inventory growth paused this week, likely due to the July 4th holiday weekend. Altos reports that active single-family inventory was down 0.2% week-over-week. Inventory is now up 31.9% from the February seasonal bottom. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of July 12th, inventory was at 651 thousand (7-day average), compared to 653 thousand the prior week.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

JULY 15, 2024

From Matthew Graham at Mortgage News Daily: Mortgage Rates' Impressive Winning Streak Faces Increasing Resistance We occasionally reference 5 day winning streaks for mortgage rates as the sort of uncommon occurrence that greatly increases the odds of at least a temporary pullback. Longer streaks do happen, but odds of a pullback increase sharply after 8 days.

Wealth Management

JULY 15, 2024

RPAs, wealth advisors and record keepers are competing for the same assets.

Calculated Risk

JULY 15, 2024

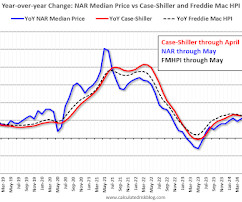

Today, in the Calculated Risk Real Estate Newsletter: Part 2: Current State of the Housing Market; Overview for mid-July 2024 A brief excerpt: Last week, in Part 1: Current State of the Housing Market; Overview for mid-July 2024 I reviewed home inventory, housing starts and sales. In Part 2, I will look at house prices, mortgage rates, rents and more.

Wealth Management

JULY 15, 2024

Summit Planning Group is the latest team to move to the independent broker/dealer in response to Osaic's acquisition of Lincoln’s $115 billion wealth business.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

A Wealth of Common Sense

JULY 15, 2024

Today’s Talk Your Book is brought to you by Standpoint Asset Management: On today’s show, we spoke with Eric Crittenden, CIO of Standpoint Asset Management to discuss trend following and all-weather portfolios. See here for the Content Library and here for Standpoint’s monthly update. On today’s show, we discuss: Standpoints total investable universe Eric’s background prior to Standpoint As.

Wealth Management

JULY 15, 2024

Investors added $83 billion to ETFs and $35 billion to fixed-income overall.

Advisor Perspectives

JULY 15, 2024

Notwithstanding whether there was a formal agreement, the petrodollar is not going anywhere. Even if Saudi Arabia accepts rubles, yuan, pesos, or gold for its oil, it will need to convert those currencies into dollars in almost all instances.

Wealth Management

JULY 15, 2024

ETF managers remained busy in closing out the first half of 2024. Overall, asset mangers launched 50 ETFs in June.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Meb Faber Research

JULY 15, 2024

What’s the best performing stock of all time? We’re talking about a total percentage gain of 265,528,901%. $1,000 invested in this stock would be worth over $2.5 billion today. To answer this question, we turned to Hank Bessembinder, who authored the famous academic paper “Do Stocks Outperform Treasury Bills?“ 80 stocks […] The post What is the Best Performing Stock of All Time?

Wealth Management

JULY 15, 2024

Younger investors are wrong to think all assets are interchangeable. Watches and sneakers can’t compare with a traditional 60/40 portfolio.

XY Planning Network

JULY 15, 2024

Today’s financial advisor doesn’t have the time to independently vet each new technology that comes onto the scene. XYPN LIVE is the conference for fee-only financial advisors where finding your people, learning from the experts, and staying ahead of the advice tech solutions game is the agenda. Wednesday, October 16th is XYPN LIVE’s unique full-day Exhibit Hall that pulls back the curtain on what other advisors are adopting, outsourcing, and leveraging in their tech stack.

Norman Marks

JULY 15, 2024

I have written a lot of blog posts and books over the years. Earlier this year, my blog passed two lifetime milestones: over a million individual readers and two million page views[1]. Join in my celebration! I don’t write to make money.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Financial Symmetry

JULY 15, 2024

One of the retirement questions many wrestle with is whether to take a pension or a lump sum payment. On this episode we flesh out an example from baseball: Did Bobby Bonilla Day make the right decision to take annual … Continued The post How to Decide Whether to Take a Pension or a Lump Sum, Ep #220 appeared first on Financial Symmetry, Inc.

Advisor Perspectives

JULY 15, 2024

Goldman Sachs Group Inc.’s trading unit powered a surge in earnings in the second quarter.

XY Planning Network

JULY 15, 2024

Today’s financial advisor doesn’t have the time to independently vet each new technology that comes onto the scene. XYPN LIVE is the conference for fee-only financial advisors where finding your people, learning from the experts, and staying ahead of the advice tech solutions game is the agenda. Wednesday, October 16th is XYPN LIVE’s unique full-day Exhibit Hall that pulls back the curtain on what other advisors are adopting, outsourcing, and leveraging in their tech stack.

Advisor Perspectives

JULY 15, 2024

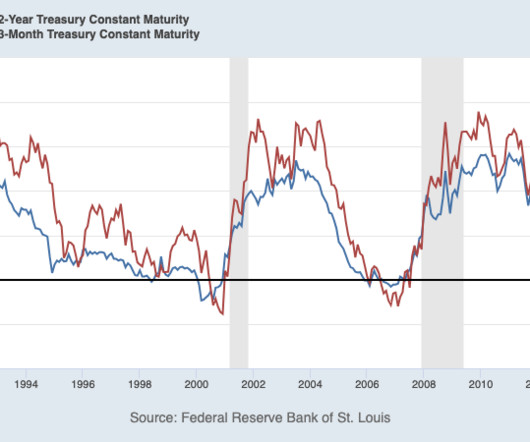

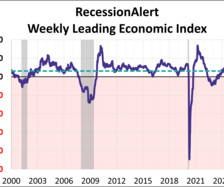

The weekly leading economic index (WLEI) is a composite for the U.S economy that draws from over 20 time-series and groups them into the following six broad categories which are then used to construct an equally weighted average. As of July 5th, the index was at 18.568, down 1.062 from the previous week, with 4 of the 6 components in expansion territory.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Cornerstone Financial Advisory

JULY 15, 2024

Weekly Market Insights | July 15th, 2024 Stocks Advance After New Inflation Data Stocks advanced last week as market leadership shifted amid fresh inflation data and quarterly corporate reports starting to roll in. The Standard & Poor’s 500 Index advanced 0.87 percent, while the Dow Jones Industrial Average picked up 1.59 percent. The tech-heavy Nasdaq Composite Index, which has led all year, rose 0.25 percent.

Advisor Perspectives

JULY 15, 2024

Conflicts are everywhere in financial planning. They exist in all fee models, whether they be commissions, assets under management, fixed fee, or hourly. Any time money changes hands there are conflicts of interests.

Random Roger's Retirement Planning

JULY 15, 2024

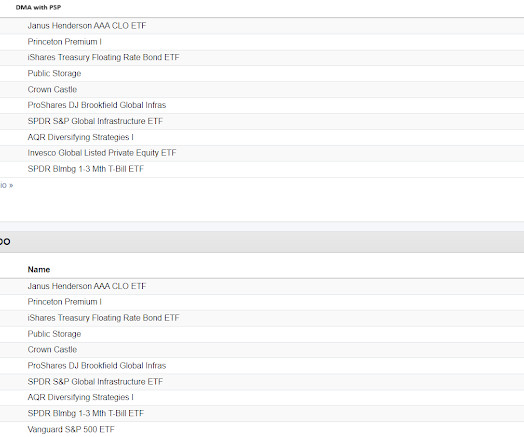

On Sunday and Monday, I went down a bit of a replication rabbit hole. Replication is pretty much what it sounds like. Usually a replication strategy will build a portfolio based on reported hedge fund holdings filed on a 13f or in the case of managed futures will sample maybe the ten biggest futures markets believing they can get 90% (or some high number) of the full effect, do it for cheaper such that the cost advantage ends up being the difference in performance.

Advisor Perspectives

JULY 15, 2024

All eight indexes on our world watch list have posted gains through July 15th, 2024. Tokyo's Nikkei 225 finished in the top spot with a YTD gain of 23.09%. The U.S.'s S&P 500 finished in second with a YTD gain of 18.73% while India's BSE SENSEX finished in third with a YTD gain of 12.20%.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

MainStreet Financial Planning

JULY 15, 2024

In our fast-paced world – we are increasingly conducting more and more of our lives online. From paying our credit cards, viewing investments or bank accounts, connecting with friends and family and so on. I wrote an article about this last spring with five of the best ways to protect your identity online and they are still some of the most tried and true ways to protect yourself and are worth reiterating – Freeze your credit Use a password manager Review your credit report annually Use only sec

Advisor Perspectives

JULY 15, 2024

BlackRock Inc. hauled in $51 billion of client cash to its long-term investment funds in the second quarter, pushing the world’s largest money manager to a record $10.6 trillion of assets.

Alpha Architect

JULY 15, 2024

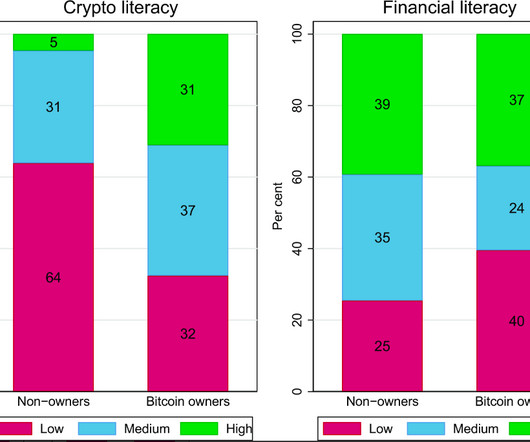

We find that a significant share of Canadian Bitcoin owners have low crypto knowledge and low financial literacy. We also find gender differences in crypto literacy among Bitcoin owners, with female owners scoring lower in Bitcoin knowledge than male owners. Crypto owners know Crypto…but not finance was originally published at Alpha Architect.

Advisor Perspectives

JULY 15, 2024

Apple Inc. surged to another record high on Monday after the tech giant was named a top pick at Morgan Stanley, with the broker seeing the launch of the company’s artificial intelligence platform triggering a record rush among users to upgrade their smartphones, tablets and computers.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content