Olympic Gold Means Victory for the IRS Too

Wealth Management

AUGUST 16, 2024

Some athletes might see a tax bill for their Olympics triumphs.

Wealth Management

AUGUST 16, 2024

Some athletes might see a tax bill for their Olympics triumphs.

Nerd's Eye View

AUGUST 16, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the Securities and Exchange Commission (SEC) announced that a total of 26 broker-dealers, investment advisers, and dually-registered firms agreed to pay combined civil penalties of almost $400 million for failing to maintain and preserve required records for "off-channel" communications, signaling the regulator's interest in cracking down on text messages and other communi

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 16, 2024

Neil Gilfedder, the firm’s CIO, talks about how the RIA has incorporated its co-founder’s risk-adjusted investment analysis and how it stays transparent with clients.

Calculated Risk

AUGUST 16, 2024

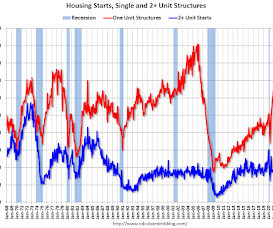

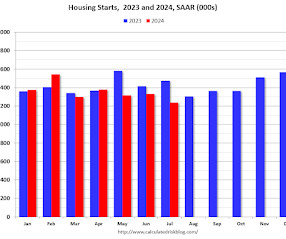

From the Census Bureau: Permits, Starts and Completions Housing Starts: Privately-owned housing starts in July were at a seasonally adjusted annual rate of 1,238,000. This is 6.8 percent below the revised June estimate of 1,329,000 and is 16.0 percent below the July 2023 rate of 1,473,000. Single-family housing starts in July were at a rate of 851,000; this is 14.1 percent below the revised June figure of 991,000.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

AUGUST 16, 2024

There have been six deals at $100 million or above this year through the end of July, just three shy of a record set in 2021.

Calculated Risk

AUGUST 16, 2024

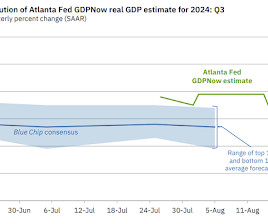

From BofA: We initiated our 3Q US GDP tracker with the July retail sales print. The 3Q GDP tracking estimate went up from our official forecast of 2.5% q/q saar to 2.6% q/q saar. [August 16th update] emphasis added From Goldman: We left our Q3 GDP tracking estimate unchanged at +2.4% (quarter-over-quarter annualized) and our Q3 domestic final sales forecast stands at +2.0%.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

AUGUST 16, 2024

Today, in the Calculated Risk Real Estate Newsletter: Housing Starts: Single Family Down Year-15% over-year in July; Multi-Family Down 18% YoY A brief excerpt: Total housing starts in July were below expectations and starts in May and June were revised down. A very weak report. The third graph shows the month-to-month comparison for total starts between 2023 (blue) and 2024 (red).

Wealth Management

AUGUST 16, 2024

Art sales have slowed, leading wealthy clients to look for ways to unlock liquidity while keeping their collections.

A Wealth of Common Sense

AUGUST 16, 2024

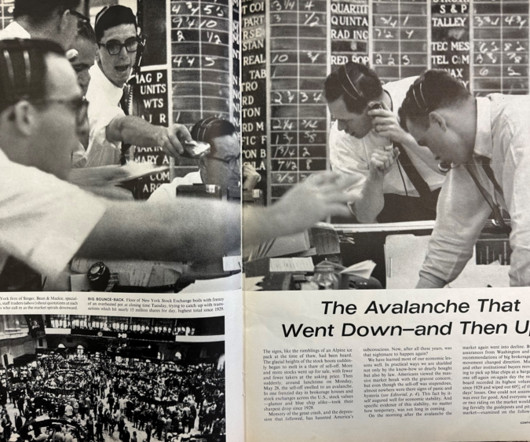

I’m a neat freak, so occasionally, I clean out my office and re-organize. While doing so earlier this week I came across an old Life magazine a reader sent me a number of years ago. It’s from June 1962 and the stock market was the cover story: The pictures are fantastic. So was the lede of the story: The signs, like rumblings of an Alpine ice pack at the time of thaw, had been heard.

Wealth Management

AUGUST 16, 2024

While the slide that started last month was sharp and swift, driven by. narrow number of stocks.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

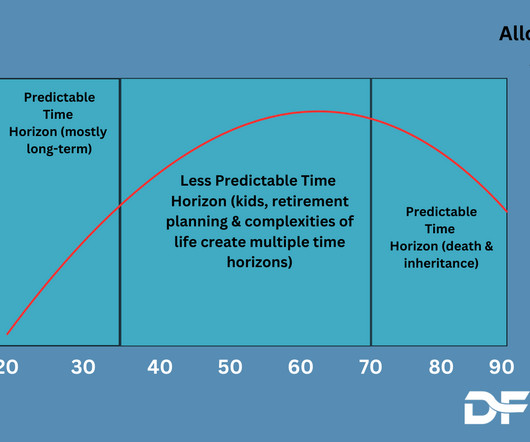

Discipline Funds

AUGUST 16, 2024

Here are three things I think I am thinking about this weekend: 1) Three Terrible Ideas That Won’t Die. The Great Financial Crisis was wonderful because it got people interested in economics. And it was terrible in that it convinced a lot of people that mainstream economics was wrong about almost everything. This led to a revival in some heterodox ideas that the mainstream had long thrown in the dustbin.

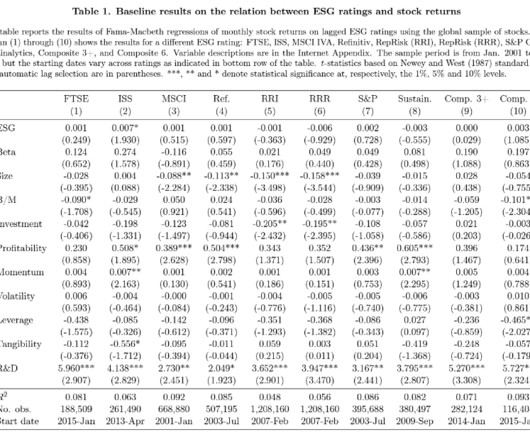

Alpha Architect

AUGUST 16, 2024

To determine the impact of sustainable investment strategies on equity returns, Romulo Alves, Philipp Krueger, and Mathijs van Dijk analyzed the relationship between ESG ratings and global stock returns. They found very little evidence that ESG ratings were related to global stock returns over the two-decade period. The Effect of ESG Strategies on Global Equity Returns was originally published at Alpha Architect.

Advisor Perspectives

AUGUST 16, 2024

It’s a good time to check on consumer health.

Truemind Capital

AUGUST 16, 2024

Freedom. This one word I believe is the ultimate objective of all human endeavors. Freedom not only from an oppressive regime but also from everything that restricts us from expressing our true selves. Physical freedom – Our ability to move from one location to another. This needs not just the absence of external boundaries but good health that allows us to travel comfortably.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Advisor Perspectives

AUGUST 16, 2024

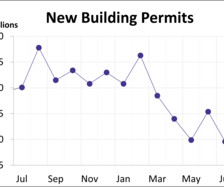

In the latest report by the Census Bureau, building permits fell to a seasonally adjusted annual rate of 1.396 million in July, the lowest level since June 2020. The latest data was below the forecasted rate of 1.430 million. This marks a 4.0% decrease from June and a 7.0% decline compared to one year ago.

Cordant Wealth Partners

AUGUST 16, 2024

During layoffs, Intel offers severance packages or voluntary separation packages (VSP) when cost reductions are a priority. Most recently, Intel announced layoffs impacting 15% of the workforce with a plan to cut $10 billion in total costs. If you’ve been offered a severance, layoff, or voluntary separation package at Intel, this guide will cover: The key components of the package The 4 steps you should take How to optimize the timing (if possible) Intel Severance Package (Enhanced Retirement an

Advisor Perspectives

AUGUST 16, 2024

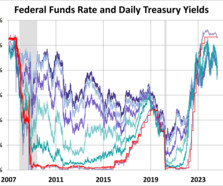

When US Federal Reserve Chair Jerome Powell speaks at next week’s annual economic conference in Jackson Hole, Wyoming, people will be listening intently for any hint about what the central bank will do with interest rates at its September policy making meeting.

Fortune Financial

AUGUST 16, 2024

Welcome to Episode 11 of the Preferred Shares Podcast. In this episode—the second part in our series on the beneficiaries of the spending on the interstate highway system of the United States —Preferred Shares explores the aggregates industry. In particular, we go over the early history of Birmingham Slag, the family-owned business that evolved into Vulcan Materials Company (VMC).

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Random Roger's Retirement Planning

AUGUST 16, 2024

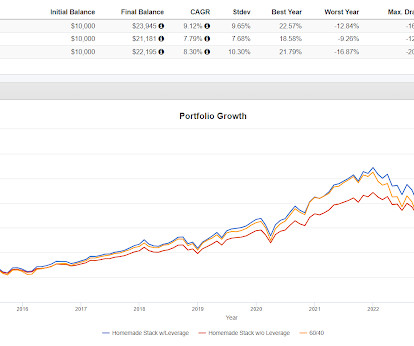

It looks like the ReturnStacked crew is spooling up a fund that will lever up to have equity and merger arbitrage exposure. They wrote an extensive paper about merger arbitrage and toward the end was a section called Potential Applications to Return Stacking. They've done this sort of thing in the process for bringing managed futures and carry funds to the market.

Advisor Perspectives

AUGUST 16, 2024

The S&P 500 experienced its best week since November 2023, finishing up 3.9% from last Friday. The index is currently 1.99% off its record high from July 16th, 2024 and is now up 17.11% year to date.

NAIFA Advisor Today

AUGUST 16, 2024

Most Americans are unaware of the complexities surrounding Social Security. With over 2,700 rules, it's no wonder many feel lost about where to seek help and how to make informed decisions. Shockingly, 96% of those currently collecting Social Security missed out on maximizing their benefits, leading to large losses per household. The stakes are high, and with Social Security, you only have one chance to get it right – forever.

Advisor Perspectives

AUGUST 16, 2024

The yield on the 10-year note ended August 16, 2024 at 3.89%, the 2-year note ended at 4.06%, and the 30-year at 4.15%.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Validea

AUGUST 16, 2024

Today, Wall Street analysts upgraded Cisco Systems and Nike, reflecting positive shifts in their financial outlooks. Cisco received upgrades from both HSBC and New Street Research. HSBC upgraded Cisco from “Hold” to “Buy” and raised its price target from $46 to $58, citing expectations of a compound annual growth rate of 11.6% for non-GAAP EPS over the next few years.

Advisor Perspectives

AUGUST 16, 2024

In the latest report by the Census Bureau, housing starts decreased to a seasonally adjusted annual rate of 1.238 million in July, the lowest level since May 2020. The latest data fell short of the forecasted rate of 1.340 million. This marks a 6.8% decrease from June and a 16.0% decline compared to one year ago.

Validea

AUGUST 16, 2024

Validea’s Peter Lynch investment strategy is based on the investing principles of Peter Lynch, who managed the Fidelity Magellan Fund with great success. The strategy emphasizes a few key criteria to identify potential investment opportunities, particularly focusing on growth-at-a-reasonable-price (GARP) principles. Here’s a summary of the criteria: Price-to-Earnings Growth (PEG) Ratio : This is the cornerstone of the Lynch strategy.

Advisor Perspectives

AUGUST 16, 2024

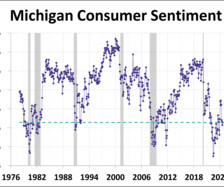

Consumer sentiment was essentially unchanged for a fourth straight month according to the preliminary August report for the Michigan Consumer Sentiment Index. The index rose 1.4 points (2.1%) from July's final reading to 66.4. The latest reading was above the forecast of 66.7.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Tobias Financial

AUGUST 16, 2024

Earlier this month, the stock market took a dramatic plunge, causing investors worldwide to reconsider their strategies. The Dow Jones Industrial Average fell nearly 1,000 points as a global market sell-off spread across Asia and Europe. Amidst growing fears of a recession and concerns about the Federal Reserve’s interest rate policies, many investors have been left wondering how to navigate these uncertain times.

Advisor Perspectives

AUGUST 16, 2024

If rising layoffs and weakening consumption are going to snowball into a US recession at some point, my interpretation is that the mass of macroeconomic ice crystals is still only about the size of a marble.

Carson Wealth

AUGUST 16, 2024

Do you have questions about Social Security? We have answers! Our How to Effectively Manage Your Social Security Retirement Benefits webinar, featuring Carson Group’s Sr. Wealth Planner Tom Fridrich and Wealth Planner Jake Anderson, is now available on-demand. The post How To Effectively Manage Your Social Security Retirement Benefits appeared first on Carson Wealth.

Advisor Perspectives

AUGUST 16, 2024

With US equities on the rebound, this summer’s selloff is looking more like a pause in the bull market than the beginning of its end.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content