Will Presidential Immunity Ruling Weaponize the IRS?

Wealth Management

JULY 17, 2024

A recent U.S. Supreme Court decision raises concerns among tax lawyers.

Wealth Management

JULY 17, 2024

A recent U.S. Supreme Court decision raises concerns among tax lawyers.

Calculated Risk

JULY 17, 2024

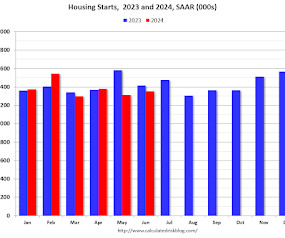

Today, in the Calculated Risk Real Estate Newsletter: Single Family Starts Up Year-over-year in June; Multi-Family Starts Down 23% YoY A brief excerpt: Total housing starts in June were above expectations and starts in April and May were revised up. The third graph shows the month-to-month comparison for total starts between 2023 (blue) and 2024 (red).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 17, 2024

Rather than stifling creativity, set processes ensure efficiency, accuracy and repeatability in client service.

Calculated Risk

JULY 17, 2024

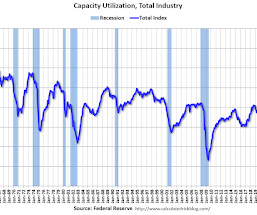

From the Fed: Industrial Production and Capacity Utilization Industrial production rose 0.6 percent in June after advancing 0.9 percent in May. For the second quarter as a whole, industrial production increased at an annual rate of 4.3 percent. Manufacturing output moved up 0.4 percent in June and rose 3.4 percent (annual rate) in the second quarter.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Wealth Management

JULY 17, 2024

With a massive transfer of money to younger generations looming, a new report says the financial services industry needs to change how it connects with Gen Z and millennials.

Abnormal Returns

JULY 17, 2024

Strategy Rebalance your portfolio to tame risk, not to increase returns. (morningstar.com) It's never been easier to get distracted by other people's wealth. (awealthofcommonsense.com) Finance The commercial real estate mess is well under way. (wsj.com) How Charles Schwab ($SCHW) is changing its banking business. (riabiz.com) Apple Taboola is going to sell ads for Apple ($AAPL).

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

JULY 17, 2024

Podcasts Barry Ritholtz talks with Brian Portnoy about why investing is so hard. (ritholtz.com) Benjamin Felix and Cameron Passmore on when its time to hire a financial advisor. (rationalreminder.libsyn.com) Dan Haylett talks with Suzi Campi about repurposing one's life in retirement. (humansvsretirement.com) Thomas Kopelman and Jacob Turner talk about the mindset shift needed in retirement.

Wealth Management

JULY 17, 2024

Fresh off a rebrand, World Investment Advisors adds Boston Harbor Wealth Advisors, as it continues to build out its wealth business.

Abnormal Returns

JULY 17, 2024

EVs Generac ($GNRC) is launching a home EV charger. (theverge.com) An EV road trip check list. (npr.org) Energy How California has strengthened its electrical grid. (kottke.org) Utilities are having to spend big to upgrade the grid. (wsj.com) It's not just the U.S. that has grid issues. (bloomberg.com) Wildfires Canada's forests are again on fire. (wsj.com) California's fire season has turned into the 'fire year.

Wealth Management

JULY 17, 2024

Human Interest helps small businesses set up 401(k) services.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Nerd's Eye View

JULY 17, 2024

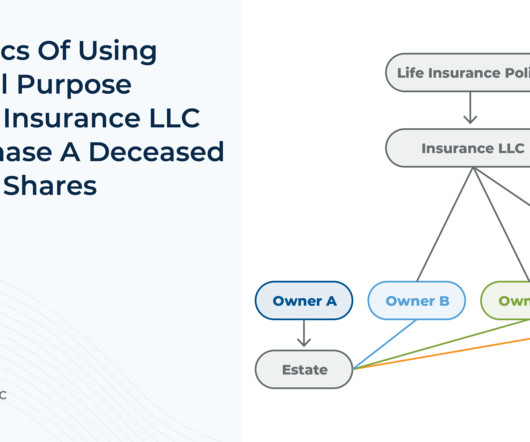

Buy-sell agreements are a common succession planning tool for business owners where, upon a triggering event like the death of one owner, the surviving owners have either the option or the contractual obligation to purchase the deceased owner's shares of the business. Traditionally, buy-sell agreements are structured either as cross-purchase agreements (where the surviving owners buy the deceased owners' shares directly from their estate) or entity-purchase agreements (where the business itself

Wealth Management

JULY 17, 2024

When Martine Lellis woke up from a coma doctors didn’t think she’d come out of, she was given a new lease on life, and it has fueled her passion for making bold, compassionate choices in the financial services industry.

Calculated Risk

JULY 17, 2024

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 228 thousand initial claims, up from 222 thousand last week. • Also at 8:30 AM, the Philly Fed manufacturing survey for July. The consensus is for a reading of 2.9, up from 1.0.

Wealth Management

JULY 17, 2024

Targeting wealthy individuals could gain traction regardless of the party in power.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

JULY 17, 2024

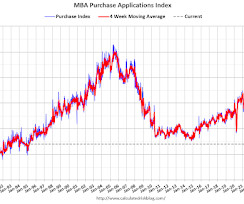

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey Mortgage applications increased 3.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending July 12, 2024. The Market Composite Index, a measure of mortgage loan application volume, increased 3.9 percent on a seasonally adjusted basis from one week earlier.

Wealth Management

JULY 17, 2024

Open, honest and candid discussion about broker/dealer satisfaction among advisors, mutual fund and ETF prices, fallout from the Chevron decision, the future of IRA rollovers and more.

Calculated Risk

JULY 17, 2024

Fed's Beige Book Economic activity maintained a slight to modest pace of growth in a majority of Districts this reporting cycle. However, while seven Districts reported some level of increase in activity, five noted flat or declining activity—three more than in the prior reporting period. Wages continued to grow at a modest to moderate pace in most Districts, while prices were generally reported to have risen modestly.

Wealth Management

JULY 17, 2024

Terri Kallsen joined Joe Duran’s new venture after previous stints at Wealth Enhancement Group and Schwab. She’ll succeed current CFP Board Chair Matthew Boersen and Chair-Elect Liz Miller.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Calculated Risk

JULY 17, 2024

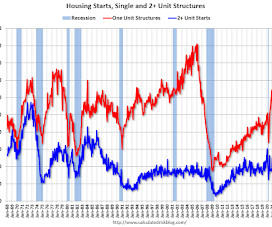

From the Census Bureau: Permits, Starts and Completions Housing Starts: Privately-owned housing starts in June were at a seasonally adjusted annual rate of 1,353,000. This is 3.0 percent above the revised May estimate of 1,314,000, but is 4.4 percent below the June 2023 rate of 1,415,000. Single-family housing starts in June were at a rate of 980,000; this is 2.2 percent below the revised May figure of 1,002,000.

Wealth Management

JULY 17, 2024

A senior fellow at the Wharton School disputes the notion that the correlation between well-being and wealth levels off once people reach a certain income level.

Advisor Perspectives

JULY 17, 2024

Industrial production rose 0.6% in June, coming in higher than the expected 0.3% growth. Compared to one year ago, industrial production is up 1.6%.

Wealth Management

JULY 17, 2024

Transcript of Episode 114 of 401(k) Real Talk.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

A Wealth of Common Sense

JULY 17, 2024

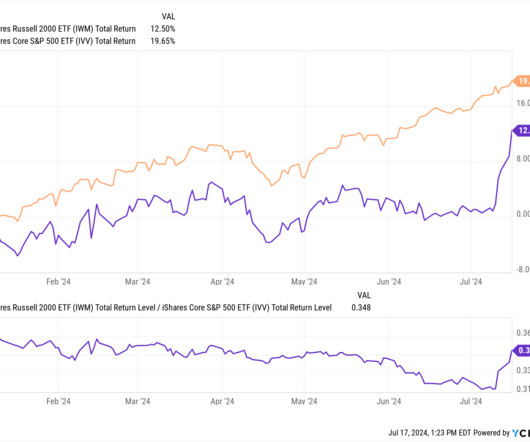

Today’s Animal Spirits is brought to you by YCharts and CME Group: See here for 20% off (new customers only) and for more info on the tearsheet builder See here for more information on CME Group’s valuable educational materials and trading tools and learn more about what adding futures can do for you. On today’s show, we discuss: How Many Benign Inflation Prints Are Enough?

Advisor Perspectives

JULY 17, 2024

The myth of work-life balance has perpetuated unrealistic expectations and unnecessary stress. By recognizing the fluidity of life and embracing a more flexible approach, you can find greater fulfillment and mental well-being.

Your Richest Life

JULY 17, 2024

In the 10 years I’ve spent running a financial planning firm, I’ve learned a lot about how people handle (or don’t handle) their finances. And it doesn’t matter how much money someone has coming in; it can still be challenging to manage money and investments well. Here are the top ten money lessons that I have learned after working with more than 150 clients over the past decade: Money lesson #1: You have more power than you think.

Advisor Perspectives

JULY 17, 2024

Jane Edmondson, Head of Thematic Strategy for VettaFi interviews MUSQ Founder and CEO David Schulhof about the Index behind the MUSQ ETF, providing pure-play exposure to the global music industry.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

SEI

JULY 17, 2024

Public Invited to Monitor Conference Call at 4:30 p.m.

Advisor Perspectives

JULY 17, 2024

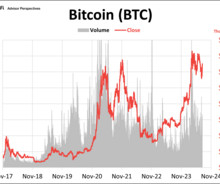

Bitcoin's price climbed back above $65,000 this week for the first time in almost a month. BTC is currently up ~47% year to date. Here's the latest charts on three of the largest cryptocurrencies by market share through 7/16/24.

Trade Brains

JULY 17, 2024

Do we ever wonder on how executives or key managerial personnel make decisions based on rational or irrational choices? The whole world of business and life is more speculative and uncertain. Having a path makes things easier and more clearer. The managers or KMPs of the company provides the roadmap for the organisation. This in turn these KMPs get rewards for not only for the idea part but it is mainly based on the execution.

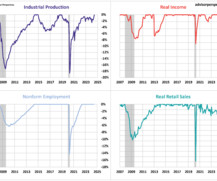

Advisor Perspectives

JULY 17, 2024

Official recession calls are the responsibility of the NBER Business Cycle Dating Committee, which is understandably vague about the specific indicators on which they base their decisions. There is, however, a general belief that there are four big indicators that the committee weighs heavily in their cycle identification process.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Let's personalize your content