What Is A Chief Behavioral Officer?

Wealth Management

OCTOBER 1, 2024

They can help deepen advisors' understanding of client behaviors, biases and decision-making processes.

Wealth Management

OCTOBER 1, 2024

They can help deepen advisors' understanding of client behaviors, biases and decision-making processes.

Abnormal Returns

OCTOBER 1, 2024

Alpha Can skewness help identify outperforming mutual funds? (alphaarchitect.com) Is having tomorrow's newspaper today sufficient to make for profitable trades? (papers.ssrn.com) A historical estimate of private equity alpha. (papers.ssrn.com) Bonds Treasury market liquidity is centered around month-end. (libertystreeteconomics.newyorkfed.org) What happens when the stock-bond correlation declines.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

OCTOBER 1, 2024

The new programs are part of an effort to attract more high-net-worth clients with broader offerings.

Calculated Risk

OCTOBER 1, 2024

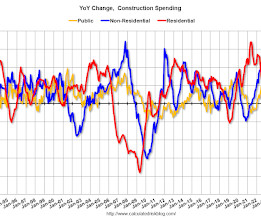

From the Census Bureau reported that overall construction spending decreased: Construction spending during August 2024 was estimated at a seasonally adjusted annual rate of $2,131.9 billion, 0.1 percent below the revised July estimate of $2,133.9 billion. The August figure is 4.1 percent above the August 2023 estimate of $2,047.4 billion. emphasis added Private spending decreased and public spending increased: Spending on private construction was at a seasonally adjusted annual rate of $1,642.2

Speaker: Claire Grosjean

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Wealth Management

OCTOBER 1, 2024

Rich Steinmeier, managing director and chief growth officer, will serve as interim CEO, effective immediately.

Nerd's Eye View

OCTOBER 1, 2024

Welcome everyone! Welcome to the 405th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Gaetano Sacco. Gaetano is a partner and senior financial advisor at Fountainhead Advisors, an RIA based in Warren, New Jersey, that oversees approximately $900 million in assets under management for 1,000 client households. What's unique about Gaetano, though, is how after breaking away from an insurance broker-dealer with barely $5M in assets under management, he has been abl

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

OCTOBER 1, 2024

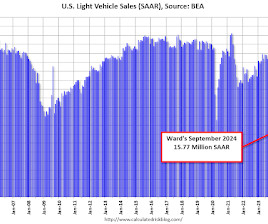

Wards Auto released their estimate of light vehicle sales for September: September U.S. Light-Vehicle Sales up Slightly on SAAR basis; Q3 Volume Down 1.9% (pay site). Sales over the past six months have been mostly in negative territory even though inventory continued to rise. Affordability and a slowdown in fleet orders have been the bane to growth.

Wealth Management

OCTOBER 1, 2024

Josh Hederick filed his complaint in North Carolina federal court, alleging that Edelman’s litigation record means he can’t trust they’ll work with him on his departure “in good faith.

Calculated Risk

OCTOBER 1, 2024

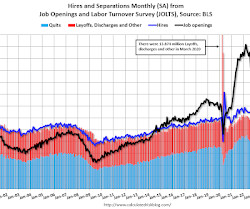

From the BLS: Job Openings and Labor Turnover Summary The number of job openings was little changed at 8.0 million on the last business day of August , the U.S. Bureau of Labor Statistics reported today. Over the month, hires changed little at 5.3 million. Total separations changed little at 5.0 million. Within separations, quits (3.1 million) continued to trend down and layoffs and discharges (1.6 million) changed little. emphasis added The following graph shows job openings (black line), hires

Wealth Management

OCTOBER 1, 2024

Wealth advisors and asset managers expect a boost in flows to actively managed fixed income strategies in the wake of lower interest rates, reports FundFire. Schwab Asset Management is splitting shares on two-thirds of its ETFs in an attempt to boost sales. These are among the investment must reads we found this week for wealth advisors.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Abnormal Returns

OCTOBER 1, 2024

September 2024 The S&P 500 was up 2.14% in September 2024. (on.spdji.com) How major asset classes performed in September 2024. (capitalspectator.com) The S&P 500 is off to its best start since 1997. (sherwood.news) No matter how you slice it, the stock market has done pretty well. (axios.com) Q3 asset class returns, visualized. (novelinvestor.com) Markets Why Chinese stocks dropped, and now bounced back.

Wealth Management

OCTOBER 1, 2024

By 2029, the firm anticipates that the global wealth business could represent 50% of its annual third-party capital-raising volume.

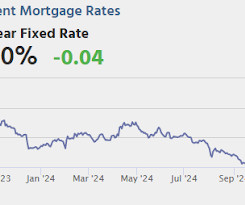

Calculated Risk

OCTOBER 1, 2024

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • At 8:15 AM, The ADP Employment Report for September. This report is for private payrolls only (no government). The consensus is for 110,000 jobs added, up from 99,000 in August.

Wealth Management

OCTOBER 1, 2024

Auxesys' John Swystun details what advisors can learn from SAAS companies.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

A Wealth of Common Sense

OCTOBER 1, 2024

The pictures and videos from the wake of Hurricane Helene are unfathomable. One emergency respondent said the flooding in parts of North Carolina resembles biblical devastation. I can’t imagine trying to pick up the pieces if your town, home or business was destroyed by the storm. The good news is this country is pretty good about rallying the troops to help in situations like these.

Wealth Management

OCTOBER 1, 2024

Mercer Advisors, Savant, Beacon Pointe and Credent are among the RIAs announcing acquisitions on Tuesday.

Advisor Perspectives

OCTOBER 1, 2024

Expanding outreach to include a well-orchestrated digital lead generation strategy is the most effective and efficient way to grow a client roster and help new generations navigate the Great Wealth Transfer with optimal financial strategies.

Wealth Management

OCTOBER 1, 2024

Bettinger, who turns 65 next year, has led Schwab since 2008. He's handing the role to President Rick Wurster.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

OCTOBER 1, 2024

(Posted with permission). The ISM manufacturing index indicated expansion. The PMI® was at 47.2% in September, unchanged from 47.2% in August. The employment index was at 43.9%, down from 46.0% the previous month, and the new orders index was at 46.1%, up from 44.6%. From ISM: Manufacturing PMI® at 47.2% September 2024 Manufacturing ISM® Report On Business® Economic activity in the manufacturing sector contracted in September for the sixth consecutive month and the 22nd time in the last 23 month

Million Dollar Round Table (MDRT)

OCTOBER 1, 2024

By Michael DePilla, MDRT in-language content strategist Creating miracles, helping clients to understand why managing money is more important than making money and seeing past appearances can all be some of the skills it takes to be a financial advisor. Find out more from MDRT members worldwide with these simple ideas to think differently and perhaps see what others miss.

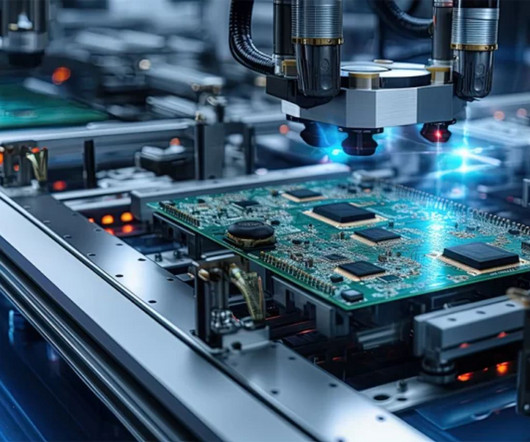

Trade Brains

OCTOBER 1, 2024

In today’s fast-paced world, electronic manufacturing companies are the backbone of technological progress. They produce the devices we use daily, from smartphones to home appliances. Their innovative technologies make communication, work, and entertainment more accessible. In this article, we will see some of the best EMS stocks in India. These companies drive economic growth by creating jobs and supporting industries.

Darrow Wealth Management

OCTOBER 1, 2024

Do I need a revocable living trust? Choosing whether to fund a trust with your assets is an important decision in the estate planning process. Since a trust is different from a will, many individuals need both. Here are three main reasons you may want to consider putting your assets in a trust. Do I need a living trust if I have a will? Don’t think of it like a will vs a trust.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Advisor Perspectives

OCTOBER 1, 2024

Trusted authorities don’t market their solutions or dispense free advice pre-sale, to impress their prospects and compete in the market.

Steve Sanduski

OCTOBER 1, 2024

Guest: Joe Anderson , the CEO and President of Pure Financial Advisors. Joe founded the firm in 2007 and it has grown to over $7 billion in assets under management and more than 6,000 clients. In a Nutshell: Building a corporate marketing machine that delivers a consistent stream of high-quality prospects and new clients is pretty much every advisor’s dream.

Advisor Perspectives

OCTOBER 1, 2024

Business divorces are often painful, expensive, and damaging – not just to the individuals involved, but to the advisory firm’s reputation and, most importantly, to its clients. However, with some foresight and planning, many of the common triggers for a business split can be avoided.

Alpha Architect

OCTOBER 1, 2024

Current Exposures: Full exposure to domestic equities. Full exposure to international equities. Full exposure to REITs. No exposure to commodities. Full exposure to intermediate-term bonds. DIY Trend-Following Allocations: October 2024 was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Advisor Perspectives

OCTOBER 1, 2024

Victor Haghani, James White and Jerry Bell of Elm Partners Management conducted a fascinating experiment to investigate the value of getting tomorrow’s headlines today, and the trading acumen of finance students. The results may suggest to some that finance courses need an upgrade, but to me the study is interesting because of what it says about good decision-making.

SEI

OCTOBER 1, 2024

Firms must adapt to meet the needs of future generations.

Advisor Perspectives

OCTOBER 1, 2024

Companies and governments around the globe spent the past month streaming into debt markets, seizing on declining interest rates ahead of an uncertain US presidential election that many fear will spur volatility in markets.

SEI

OCTOBER 1, 2024

Ryan Hicke highlights our pillars of technology, operations, and asset management.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Let's personalize your content