Commercial Real Estate is Poised to Benefit from Rate Cuts

Wealth Management

SEPTEMBER 23, 2024

The full extent of the benefits to real estate investment of lower rates will also depend on whether the Fed sticks a soft landing.

Wealth Management

SEPTEMBER 23, 2024

The full extent of the benefits to real estate investment of lower rates will also depend on whether the Fed sticks a soft landing.

Abnormal Returns

SEPTEMBER 23, 2024

Markets The U.S. stock market is up 35 of the past 52 weeks. (sherwood.news) The U.S. is 26% of global GDP. The stock market makes up 63% of global market cap. (mailchi.mp) The Fed It's not unusual for the Fed to cut rates when stocks are at an all-time high. (awealthofcommonsense.com) We give the Fed way more credit than they deserve. (aswathdamodaran.blogspot.com) Fed members talk WAY too much these days.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

SEPTEMBER 23, 2024

Finance is rushing to use rapidly evolving AI tools. As the machines get smarter, the risks get weirder.

Calculated Risk

SEPTEMBER 23, 2024

Today, in the Calculated Risk Real Estate Newsletter: Watch Months-of-Supply! A brief excerpt: Both inventory and sales are well below pre-pandemic levels, and I think we need to keep an eye on months-of-supply to forecast price changes. Historically nominal prices declined when months-of-supply approached 6 months - and that is unlikely any time soon - however, as expected, months-of-supply is back to 2019 levels.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

SEPTEMBER 23, 2024

The bar is only getting higher for retirement plan advisors.

Abnormal Returns

SEPTEMBER 23, 2024

Podcasts Josh and Michael talk with Peter Mallouk, founder and CEO of Creative Planning. (youtube.com) Carl Richards and Michael Kitces talk about managing your firm knowing that market-related revenue declines happen. (kitces.com) Brendan Frazier talks with Isaac Presley about how to create more intentional goals. (podcasts.apple.com) Thomas Kopelman and Jacob Turner talks estate planning for business owners.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

SEPTEMBER 23, 2024

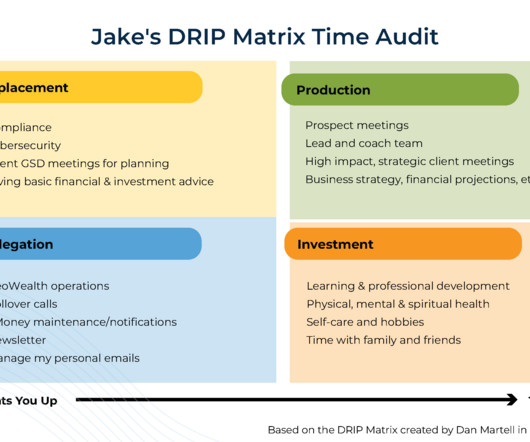

Starting a new firm can be a nerve-wracking time for an entrepreneurially minded financial advisor, as making the jump involves a significant amount of professional and financial risk. Nonetheless, after a year or 2 in business, some firm owners will find that their plate is becoming full and their available time is shrinking as they balance servicing current clients with marketing for new ones and also possibly managing staff.

Wealth Management

SEPTEMBER 23, 2024

Debra Brennan Tagg was with Osaic for 25 years before making the change to NewEdge.

Calculated Risk

SEPTEMBER 23, 2024

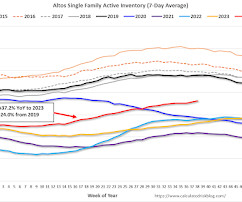

Altos reports that active single-family inventory was up 1.6% week-over-week. Inventory is now up 46.8% from the February seasonal bottom. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of September 20th, inventory was at 725 thousand (7-day average), compared to 714 thousand the prior week. This is the highest level of inventory since May 2020.

Wealth Management

SEPTEMBER 23, 2024

Look for these prompts when clients broach the topic.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

SEPTEMBER 23, 2024

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic. The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Wealth Management

SEPTEMBER 23, 2024

Listen as Jamie Hopkins, Chief Wealth Officer and CEO of Bryn Mawr Trust Company, addresses the complexities of estate planning and highlights how his firm’s ‘Wealth as a Service’ solution assists advisors in navigating these challenges effectively.

Calculated Risk

SEPTEMBER 23, 2024

From the MBA: Share of Mortgage Loans in Forbearance Increases to 0.31% in August The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance increased to 0.31% as of August 31, 2024. According to MBA’s estimate, 155,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 8.2 million borrowers since March 2020.

Wealth Management

SEPTEMBER 23, 2024

Listen as Sheila Cuffari-Agasi, Chief Revenue Officer at United Planners Financial Services, as she discusses how being an employee-owned firm empowers advisors to prioritize client relationships without external pressures.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Calculated Risk

SEPTEMBER 23, 2024

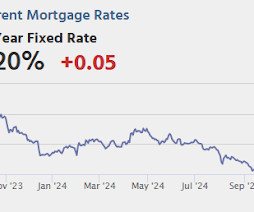

From Matthew Graham at Mortgage News Daily: Mortgage Rates Move Slightly Higher to Start New Week Mortgage rates rose modestly last week after hitting long term lows before the Fed announced its 0.50% rate cut. In not so many words, mortgage rates had already gotten in position for that cut and were thus left to undergo a mild correction. [ 30 year fixed 6.20% ] emphasis added Tuesday: • At 9:00 AM ET, S&P/Case-Shiller House Price Index for July.

Advisor Perspectives

SEPTEMBER 23, 2024

There’s opportunism — and there’s Qualcomm Inc.’s approach to buy Intel Corp. The acquisitive semiconductor giant has an opening to attempt such a momentous deal thanks to the yawning gap between their market capitalizations. The snag is that many obstacles remain to a successful transaction.

Carson Wealth

SEPTEMBER 23, 2024

Stocks Like Rate Cuts The big story this week was the Fed cutting interest rates for the first time since March 2020. We will get into all of the ramifications of the Fed’s decision below, but to kick off this week’s market commentary we will discuss why rate cuts can indeed be a bullish development for investors. First things first, why are they cutting?

Advisor Perspectives

SEPTEMBER 23, 2024

The Federal Reserve’s interest rate cut last week has led many to wonder what it means for mortgage rates. The housing website Redfin noted that some would-be homebuyers aren’t aware that we’ve already seen a steep decline, while others are waiting for mortgage rates to fall more.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

XY Planning Network

SEPTEMBER 23, 2024

Email marketing remains a powerful tool in the digital marketing landscape, especially for financial professionals. Despite the rise of social media, email campaigns continue to deliver high engagement rates due to the trusted relationships financial advisors build with their clients. Choosing the right email campaign software is crucial for maximizing these benefits and ensuring effective client communication.

Advisor Perspectives

SEPTEMBER 23, 2024

I’m moving up a letter I was planning to share with you on my birthday weekend in two weeks. The story about sandpiles and the financial system may be the most popular letter I’ve written in the last 25 years. It is one we should all re-read every few years to remind us how change happens slowly, then suddenly.

Norman Marks

SEPTEMBER 23, 2024

Sometimes, auditors are responsible for a serious risk continuing. At Business Objects, I attended an audit committee (I was the VP, Internal Audit) when the two EY partners reported that their testing of internal controls had identified a serious weakness.

Advisor Perspectives

SEPTEMBER 23, 2024

What is your personal financial code of conduct? Whether you’re consciously aware of it or not, chances are you have an internal set of standards and taboos that guide the way you handle money.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Truemind Capital

SEPTEMBER 23, 2024

Are you feeling lost when it comes to managing your finances? Or maybe you’ve got big goals like buying a home, paying off debt, or saving for retirement, but you’re not sure where to start? That’s where a financial coach comes in! A financial coach helps you understand your financial situation, set realistic goals, and create a plan to reach financial stability.

Advisor Perspectives

SEPTEMBER 23, 2024

Today, I’m going to share stories about my best and worst investment decisions. Don’t worry, this isn’t just a brag-and-cringe session about making or losing money. These stories are about the valuable lessons learned, and how these adventures in investing helped shape my current approach.

International College of Financial Planning

SEPTEMBER 23, 2024

The financial planning sector is booming, offering countless opportunities for individuals to build a rewarding career. With the global demand for financial advisors rising, gaining the right credentials has become crucial for long-term success. One of the fastest and most respected ways to enter this field is through the CFP® challenge pathway. This program offers a streamlined route to earning the prestigious Certified Financial Planner (CFP®) certification, especially for experienced professi

Advisor Perspectives

SEPTEMBER 23, 2024

The weekly leading economic index (WLEI) is a composite for the U.S economy that draws from over 20 time-series and groups them into the following six broad categories which are then used to construct an equally weighted average. As of September 13, the index was at 23.029, up 0.875 from the previous week, with 4 of the 6 components in expansion territory.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

SEI

SEPTEMBER 23, 2024

Advisers must reconsider their investment strategies to drive growth.

Trade Brains

SEPTEMBER 23, 2024

India’s fast-moving consumer goods (FMCG) sector faces a dynamic landscape in 2024, with companies navigating shifting consumer preferences, rural demand fluctuations, and digital transformation. This analysis article examines the top FMCG stocks, evaluating their financial performance, market positioning, and growth strategies. We’ll explore how industry leaders adapt to challenges and capitalize on opportunities in India’s evolving consumer market.

Random Roger's Retirement Planning

SEPTEMBER 23, 2024

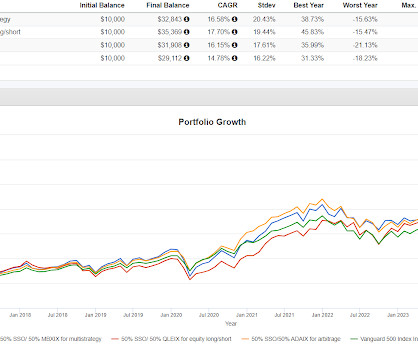

I went down a portable alpha rabbit hole. We've discussed it plenty, using the terms capital efficiency and return stacking more often that portable alpha. It is essentially using leverage to add exposure beyond a 100% portfolio. Portable alpha a little more specifically is the matching up of beta (simple market exposure like via an index fund) with an alpha seeking strategy.

NAIFA Advisor Today

SEPTEMBER 23, 2024

The National Association of Insurance and Financial Advisors (NAIFA) is proud to announce a new exclusive partnership with the Hoopis Performance Network (HPN) and LIMRA that will provide NAIFA members with access to the highly acclaimed Trustworthy Selling Program. Previously available only to enterprises, this partnership marks the first time the program, developed by LIMRA and HPN, will be accessible to individual NAIFA members.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content