The Rise of High Net Worth Investors in Pre-IPO Securities

Wealth Management

OCTOBER 13, 2023

Why have wealthy investors surged as the leading buy-side participants in this market segment?

Wealth Management

OCTOBER 13, 2023

Why have wealthy investors surged as the leading buy-side participants in this market segment?

The Big Picture

OCTOBER 13, 2023

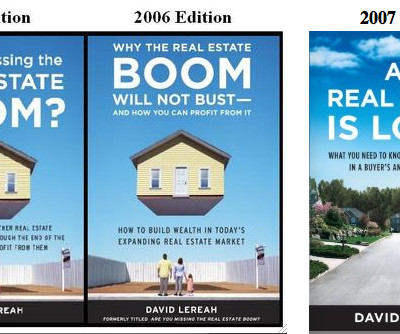

My buddy Jonathan Miller does not hesitate to call out the weasels who represent those who work in his industry: NAR Proves That Trade Groups Aren’t Infallible With an appalling culture of secrecy maintained by wildly overpaid executives (I believe their CEO is paid close to $3 million per year), NAR seems to be imploding right now. These three prominent real estate firms are backing away from the management cesspool that has severely damaged the National Association of Realtors (NAR) brand.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

OCTOBER 13, 2023

Why have wealthy investors surged as the leading buy-side participants in this market segment?

Calculated Risk

OCTOBER 13, 2023

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from Sabrina Speianu: Weekly Housing Trends View — Data Week Ending Oct 7, 2023 • Active inventory declined, with for-sale homes lagging behind year ago levels by 2.4%. During the past week, we observed the 16th successive drop in the number of homes available for sale when compared to the previous year.

Speaker: Claire Grosjean

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Wealth Management

OCTOBER 13, 2023

Steward Partners adds the first team to its IAR-only channel, Allworth Financial names a new CEO and other news from Wealth Enhancement Group, EP Wealth Advisors, Kestra PWS, Gaddis Premier Wealth Advisors and Pitcairn.

Abnormal Returns

OCTOBER 13, 2023

Companies What now for Microsoft ($MSFT) after closing the Activision Blizzard deal? (theringer.com) The customer experience at Amazon ($AMZN) is getting worse. (ritholtz.com) Is Apple ($AAPL) making it too hard to do stuff on the Mac? (macworld.com) Sports gambling Disney ($DIS) wanted no part of sports gambling, now its all in. (wsj.com) Sports books are embracing novelty bets.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

OCTOBER 13, 2023

The biz The bots have come for podcasting. (semafor.com) Rogue AI voices are already out in the wild. (nytimes.com) We don't have great defenses for deepfakes. (variety.com) Companies Benjamin Gilbert and David Rosenthal talk about the latest iteration of Nvidia ($NVDA). (acquired.fm) Logan Bartlett talks AI with Dario Amodei, co-founder and CEO of Anthropic.

Wealth Management

OCTOBER 13, 2023

“Volatility is off the chart,” said Ben Emons, a senior portfolio manager at NewEdge Wealth. “People are trading bonds like stocks.

Nerd's Eye View

OCTOBER 13, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with a new study from Herbers & Company that provides insight into the financial planning services that consumers demand the most, and which services financial advisory firms offer the most often. The study also identified factors that separated firms experiencing the greatest organic growth from others, which include offering a comprehensive suite of services, having a higher 'close' ra

Calculated Risk

OCTOBER 13, 2023

From BofA: Overall, the data flow since our last weekly pushed up our 3Q US GDP tracking estimate from 3.7% to 3.8% q/q saar. [Oct 13th estimate] emphasis added From Goldman: We left our Q3 GDP tracking estimate unchanged at +3.7% (qoq ar) and our domestic final sales growth forecast also unchanged at +2.4%. [Oct 10th estimate] And from the Altanta Fed: GDPNow The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2023 is 5.1 percent on October 10

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

The Reformed Broker

OCTOBER 13, 2023

Welcome to the latest episode of The Compound & Friends. This week, Michael Batnick, Jan Van Eck, and Andrew Beer discuss the bond market, the national debt, private-credit, alts, managed futures, the Sam Bankman-Fried trial, and much more! You can listen to the whole thing below, or find it wherever you like to listen to your favorite pods! Listen here: Apple podcasts Spotify podcasts Google podcasts Everywhere else.

Calculated Risk

OCTOBER 13, 2023

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Due to changes at the CDC, weekly cases are no longer updated. For deaths, I'm currently using 3 weeks ago for "now", since the most recent two weeks will be revised significantly. Recently hospitalizations have almost tripled from a low of 5,150 in June 2023. Hospitalizations are far below the peak of 150,000 in January 2022.

A Wealth of Common Sense

OCTOBER 13, 2023

In 1950 long-term U.S. government bonds yielded a little more than 2%. By the end of that decade they would hit 4.5%. Yields jumped to 6.9% by the end of the 1960s and 10.1% by the end of the inflationary 1970s. Then they skyrocketed in the early-1980s, going from just over 10% at the end of 1979 to nearly 15% by the fall of 1981. In a little over 30 years, bond yields went from 2% to 15%.

Calculated Risk

OCTOBER 13, 2023

From STR: U.S. hotel results for week ending 7 October U.S. hotel performance increased from the previous week, and year-over-year comparisons were mostly positive, according to CoStar’s latest data through 7 October. 1-7 October 2023 (percentage change from comparable week in 2022): • Occupancy: 67.8% (-0.2%) • Average daily rate (ADR): US$163.19 (+5.4%) • Revenue per available room (RevPAR): US$110.68 (+5.2%) emphasis added The following graph shows the seasonal pattern for the hotel occupancy

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Alpha Architect

OCTOBER 13, 2023

This article examines four digital filters commonly used for trend-following: moving average linear weighted moving average exponential smoothing time series momentum Trend-Following Filters – Part 7 was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Calculated Risk

OCTOBER 13, 2023

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in September A brief excerpt: Note: The National Association of Realtors (NAR) is scheduled to release September existing home sales next week on Thursday, October 19th, at 10:00 AM ET. The consensus is the NAR will report sales of 3.94 million SAAR, down from 4.04 million in August.

Advisor Perspectives

OCTOBER 13, 2023

I've updated this series to include the September release of the consumer price index as the deflator and the monthly employment update. The latest hypothetical real (inflation-adjusted) annual earnings are at $49,111, down 8.2% from over 50 years ago. Hourly earnings are below their all-time high after adjusting for inflation.

Validea

OCTOBER 13, 2023

The losses sustained by the U.S. bond market over the last few years are the worst in the nation’s recorded history, according to research from strategists at Bank of America that is cited in an article in Bloomberg. While some of the data from 200-plus years ago may be less than accurate, it’s still a startling statistic, and drives home what a significant impact inflation and high interest rates had on the bond market.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

OCTOBER 13, 2023

The S&P 500 posted gains for a second straight week despite weak performance during the latter part of the week. The index is currently up 13.17% year to date and is 9.77% below its record close from January 3, 2022.

Trade Brains

OCTOBER 13, 2023

High FII holding Stocks Under Rs 100 : When it comes to investing in the stock market, we always try to find the most intricate balance between affordability & sustainability. We are always on the lookout for Companies that have the highest growth and the best management. At the same time, we also hope to find them at throw away prices, so we can enter in its journey, at the earliest.

Advisor Perspectives

OCTOBER 13, 2023

Consumer sentiment fell sharply this month amid growing inflation concerns. The October preliminary report for the Michigan Consumer Sentiment Index came in at 63.0, down 5.1 (-7.5%) from the September final. This morning's reading was below the forecast of 67.2.

Gen Y Planning

OCTOBER 13, 2023

The traditional view of what retirement should be is quickly fading in the rearview mirror as Gen X and Baby Boomers are flipping the script on what your post-career lifestyle can look like. An increasing percentage of pre-retirees are now planning to retire early (at age 62 or earlier), and it’s becoming more common to see people opting for an alternate lifestyle once they do take the retirement plunge.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Advisor Perspectives

OCTOBER 13, 2023

Crypto may have grabbed headlines last year, but the talk on Wall Street these days is all about options.

SEI

OCTOBER 13, 2023

Jim Smigiel, SEI's Chief Investment Officer, discusses the third quarter industry report.

Advisor Perspectives

OCTOBER 13, 2023

The weekly leading economic index (WLEI) is a composite for the U.S economy that draws from over 20 time-series and groups them into the following six broad categories which are then used to construct an equally weighted average. As of September 29th, the index was at 13.184, up 1.582 from the previous week.

Clever Girl Finance

OCTOBER 13, 2023

Are you fed up with the 9 to 5 grind? Do you need to earn some extra cash or find a job that fits around your daily commitments? Night shift jobs may be the solution you’re looking for, and the good news is there are lots of opportunities out there and we’ve got several to share. So keep reading! Table of contents Who are night shift jobs suitable for?

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Advisor Perspectives

OCTOBER 13, 2023

US consumers’ year-ahead inflation expectations rose sharply in early October, driving a steep deterioration in Americans' views of their finances as well as sentiment.

Validea

OCTOBER 13, 2023

With stocks up 20% this year, offering the highest returns from any major global market, as well as a significant shot of confidence from Warren Buffett’s spring visit, Japan’s stock market has been wildly robust. But the Japanese market’s success this year could also be the result of the yen collapsing, contends an article in The Wall Street Journal , and indeed Japanese stocks have followed the same trajectory as the S&P 500 this year.

Advisor Perspectives

OCTOBER 13, 2023

Breaking a mirror, walking under a ladder, and a black cat crossing your path have all been seen as bad omens.

Clever Girl Finance

OCTOBER 13, 2023

Looking for a way to make extra cash? Well, finding out how to sell printables on Etsy is a solid move. Not only is this a great side hustle, but it allows you the opportunity to be creative, too. Keep reading to learn more about this income idea! Table of contents What are printables, anyway? Can you make an income selling printables on Etsy? 5 Simple steps to selling printables on Etsy Expert tip: Offer seasonal promotions on your Etsy printables Is it worth selling printables on Etsy?

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Let's personalize your content