Thursday links: embedded optionality

Abnormal Returns

MARCH 7, 2024

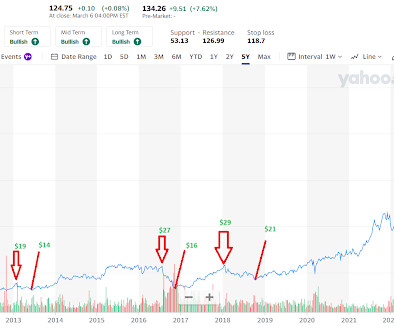

Markets Apple, Google and Tesla are underperforming. (allstarcharts.com) How much BBB-rated debt does your corporate bond fund own? (morningstar.com) Finance Just how risky is the prime brokerage business? (ft.com) Robinhood ($HOOD) has hired Klutch Sports to help with marketing. (sportico.com) Apple Why Apple ($AAPL) cut bait on its car efforts. (bloomberg.com) The Apple ($AAPL) Car is not a total write-off.

Let's personalize your content