The Power of Silence: Turning Off Notifications Enhances Productivity

Wealth Management

MARCH 25, 2024

Reclaim your attention by embracing intentional disconnection.

Wealth Management

MARCH 25, 2024

Reclaim your attention by embracing intentional disconnection.

Calculated Risk

MARCH 25, 2024

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales at 662,000 Annual Rate in February Brief excerpt: The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 662 thousand. The previous three months were revised up slightly. The next graph shows new home sales for 2023 and 2024 by month (Seasonally Adjusted Annual Rate).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

MARCH 25, 2024

Proactive succession planning can ensure a smooth transition and continued success.

Calculated Risk

MARCH 25, 2024

From WardsAuto: March U.S. Light-Vehicle Sales Tracking a Steady Course with Potential Upside (pay content). Brief excerpt: If the March forecast holds firm, the first quarter will total a 15.5 million-unit seasonally adjusted annual rate, down from Q4-2023’s 15.7 million but up from like-2023’s 15.0 million. However, the forecasted steady climb in inventory should put sales in good stead to rise above 16-million-unit annualized rates for most of the remainder of 2024. emphasis added Click on gr

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

MARCH 25, 2024

Focusing on client’s problems, not industry solutions and jargon.

Abnormal Returns

MARCH 25, 2024

Bonds The U.S. Treasury market is only getting bigger. (wsj.com) The yield curve has been inverted for a record amount of time. (axios.com) Junk bond issuers are rushing to refinance and extend maturities with spreads at multi-year lows. (finance.yahoo.com) Which bonds prove as the best portfolio diversifier? (morningstar.com) AI Don't let AI mumbo jumbo from a fund manager fool you.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

MARCH 25, 2024

For the advisor leading a virtual team, the day-to-day can offer a rewarding blend of flexibility, creativity, and productivity; at the same time, though, many of the benefits of remote work can also make it challenging to build a tight-knit team culture. For example, with flexibility comes fewer synchronous interactions, which in turn can result in less innovation, team bonding, and collaboration.

Wealth Management

MARCH 25, 2024

The trio of Sarah, William and Dexter Grafton will form Grafton Wealth Advisors by joining LPL's independent broker/dealer channel for advisors from wirehouses or full-service firms.

Calculated Risk

MARCH 25, 2024

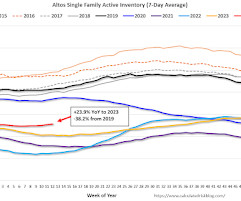

Altos reports that active single-family inventory was up 1.1% week-over-week. Inventory bottomed in mid-February, as opposed to mid-April in 2023, and inventory is now up 3.8% from the 2024 February bottom. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of March 22nd, inventory was at 513 thousand (7-day average), compared to 507 thousand the prior week.

Wealth Management

MARCH 25, 2024

Ninety-two percent of advisors report that their clients have expressed interest in HYSAs.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

MARCH 25, 2024

From Matthew Graham at Mortgage News Daily: Mortgage Rates Basically Unchanged Over The Weekend Mortgage rates enjoyed a decently strong week last week, with the average top tier conventional 30yr fixed rate moving down to 6.91% by Friday from 7.09% on the previous Friday. To put today's "unchanged" headline in perspective, that same number is up to 6.92% this afternoon. [ 30 year fixed 6.92% ] emphasis added Tuesday: • At 8:30 AM ET, Durable Goods Orders for February from the Census Bureau.

Wealth Management

MARCH 25, 2024

Hobby comes over from Fidelity Investments, where he served as the head of distribution for private wealth management, executive services, workplace planning and advice and stock plan services.

Abnormal Returns

MARCH 25, 2024

Podcasts Michael Kitces and Carl Richards talk about how to help clients find their 'enough.' (kitces.com) Daniel Crosby talks financial well-being with Philip Courtenay. (standarddeviationspod.com) The biz Goldman Sachs ($GS) wants its place at the model portfolio table. (investmentnews.com) Vanguard is not budging in its negative view on crypto products.

Wealth Management

MARCH 25, 2024

Wilmington Trust's Alvina Lo delves into the complexities of NFL team ownership.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Alpha Architect

MARCH 25, 2024

This study offers valuable information to provide insights into the underlying mechanisms driving investment behavior. For example, recognizing the impact of Neuroticism on belief formation and risk perception can help explain why some investors exhibit greater aversion to stock market volatility. Similarly, understanding how Openness influences risk preferences can shed light on why certain individuals are more willing to take investment risks than others.

Wealth Management

MARCH 25, 2024

Discover how Advyzon defied expectations to achieve top user ratings in the latest T3 study.

Advisor Perspectives

MARCH 25, 2024

Here are some reasons couples should sign a formal prenuptial agreement.

Wealth Management

MARCH 25, 2024

Adding private real estate boosts returns and quells volatility.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Advisor Perspectives

MARCH 25, 2024

At a time when financial professionals are increasingly looking for differentiated alternative investment products for diversification and return benefits, these are the three things you need to know about the growing asset class.

Cornerstone Financial Advisory

MARCH 25, 2024

Weekly Market Insights: Fed Talk Boosts Stocks Presented by Cornerstone Financial Advisory, LLC Stocks posted their best week of the year, sparked by news that the dovish Fed decided to keep rates steady and signaled three rate cuts were still possible this year. Stocks Bounce Back As widely expected, the Fed left rates unchanged at the conclusion of its two-day meeting.

Advisor Perspectives

MARCH 25, 2024

If one wants a guaranteed store of real purchasing power to pay off a future liability or to provide a multi-year income stream such as for retirement, then a ladder of TIPS provides a much stronger guarantee than other readily available assets.

A Wealth of Common Sense

MARCH 25, 2024

Today’s Talk Your Book is brought to you by KraneShares: Today we are joined by Jonathan Shelon, Chief Operating Officer of KraneShares to discuss investing strategies surrounding China. On today’s show, we discuss: Clients most popular question about investing in China An economic update in China The buyer of last resort in China KraneShares buffered ETFs on Chinese internet Understanding the intervals of C.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Carson Wealth

MARCH 25, 2024

“Please, God, just one more bubble.” — Popular Silicon Valley bumper sticker after the tech bubble burst With stocks near all-time highs, many believe they must be in a bubble. Take note, many of these bubble callers are the same bears that fought this bull market all the way up. Now they are taking a different angle on their incorrect calls and blaming a bubble for the stock market’s strength.

XY Planning Network

MARCH 25, 2024

As RIA owners you face a multitude of choices and decisions every day. As a parent, choosing the right childcare center for your little one is one of the most important decisions you'll make. With so many options available, it can be challenging to determine which facility will provide the best care and support for your child's growth and development In most childcare settings you will find very similar environments, schedules, routines, and policies.

Advisor Perspectives

MARCH 25, 2024

There is an important warning here for everyone giddy with the recent advances of generative AI. Breathtaking developments in the realm of technology do not render history obsolete. It lives on alongside the latest gadgetry, because the present is not where history ends and the future begins; it is where the past and the future fuse.

Validea

MARCH 25, 2024

For billionaire investor Warren Buffett, one stock has continued to play a pivotal role in his investment strategy over the years. It has also become his largest position by a wide margin. As you probably have already guessed, that company is Apple. Buffett, who was once hesitant to invest in technology stocks due to a lack of understanding, has become one of the largest shareholders of Apple through his conglomerate, Berkshire Hathaway.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Advisor Perspectives

MARCH 25, 2024

It’s budget season in Washington, which means the politicians are delivering their annual warnings about the looming Social Security crisis.

Norman Marks

MARCH 25, 2024

For 13th years, the Association of Certified Fraud Examiners (ACFE) has shared with us the results of their annual survey, with the latest being Occupational Fraud 2024: A Report to the Nations.

Advisor Perspectives

MARCH 25, 2024

The February release for new home sales from the Census Bureau came in at a seasonally adjusted annual rate of 662,000 units, falling short of the 675,000 forecast. New home sales were down 0.3% month-over-month from a revised rate of 664,000 in January and are up 5.9% from one year ago.

Don Connelly & Associates

MARCH 25, 2024

As I have mentioned already on the Don Connelly 24/7 learning center, I was taught a method of selling called Professional Selling Skills (PSS) many years ago. It was and still is the bestselling course in the world. Let’s talk about the first step in giving a Professional Selling Skills presentation. That step is called the Initial Benefit Statement.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content