Wednesday links: portfolio entropy

Abnormal Returns

OCTOBER 25, 2023

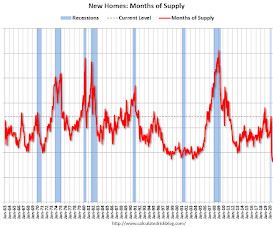

Strategy A big regime shift has happened in the economy and financial markets. (ritholtz.com) Rapid company growth comes with its own risks. (onveston.substack.com) Not all share buybacks are created equal. (investmenttalk.co) Finance Poor recent performance has put the IPO market back on ice. (finance.yahoo.com) Banks are still sitting on the Twitter debt they underwrote.

Let's personalize your content