Interest Rate Cuts Don't Spell Doom for Private Credit

Wealth Management

SEPTEMBER 25, 2024

The impact lower rates are likely to have on private credit funds goes beyond an expected decline in yields.

Wealth Management

SEPTEMBER 25, 2024

The impact lower rates are likely to have on private credit funds goes beyond an expected decline in yields.

Abnormal Returns

SEPTEMBER 25, 2024

Podcast Barry Ritholtz talks with Brian Portnoy about whether money can buy happiness. (ritholtz.com) Peter Lazaroff on the importance of simplicity in personal finance. (peterlazaroff.com) Carl Richards talks money and life with journalists Jodi Kantor and Ron Lieber. (50fires.com) Tim Ranzetta talk financial literacy with Tony and Dina Isola of Ritholtz Wealth Management.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

SEPTEMBER 25, 2024

The collaboration brings together the tax management technology of Vestmark with the highly scalable model construction capabilities of BlackRock.

Abnormal Returns

SEPTEMBER 25, 2024

Strategy On the strange math of stock returns. (fortunesandfrictions.com) Betting on smart beta has generally not worked out well for investors. (morningstar.com) Companies Uber ($UBER) is making progress towards becoming a 'super-app.' (on.ft.com) A Q&A with Duolingo ($DUO) CEO Luis Von Ahn. (sherwood.news) CEOs are all over LinkedIn. (sherwood.news) Finance The hidden costs of options trading are real.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

SEPTEMBER 25, 2024

The two firms are in hot water over sales of Harvest’s “Iron Condor” strategy that resulted in $5 million in excess management fees and commissions.

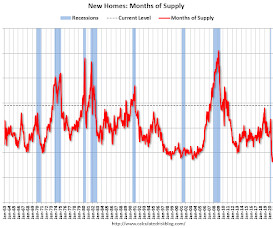

Calculated Risk

SEPTEMBER 25, 2024

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales Decrease to 716,000 Annual Rate in August Brief excerpt: The Census Bureau reported New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 716 thousand. The previous three months were revised up. The next graph shows new home sales for 2023 and 2024 by month (Seasonally Adjusted Annual Rate).

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

SEPTEMBER 25, 2024

Over the last 60 years, the top Federal marginal tax bracket has steadily decreased from over 90% in the 1950s and 60s to 'just' 37% today. However, with the national debt expanding rapidly, observers of U.S. tax policy are predicting that Congress will inevitably be forced to again increase tax rates in order to raise revenue and balance the national budget – and that the current regime of relatively low tax rates will prove to be a temporary phenomenon.

Wealth Management

SEPTEMBER 25, 2024

More than 99% of stockholders agreed to the deal, which valued the technology giant to advisors at $4.5 billion.

Calculated Risk

SEPTEMBER 25, 2024

The Census Bureau reports New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 716 thousand. The previous three months were revised up. Sales of new single-family houses in August 2024 were at a seasonally adjusted annual rate of 716,000 , according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.

Wealth Management

SEPTEMBER 25, 2024

Shared wisdom to apply to your practice.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

SEPTEMBER 25, 2024

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey Mortgage applications increased 11.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending September 20, 2024. The Market Composite Index, a measure of mortgage loan application volume, increased 11.0 percent on a seasonally adjusted basis from one week earlier.

Wealth Management

SEPTEMBER 25, 2024

In a WealthManagement.com interview, Price also said he didn’t expect PE backer Reverence Capital to sell a majority stake in Osaic “any time soon.

Calculated Risk

SEPTEMBER 25, 2024

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 226 thousand initial claims, up from 219 thousand last week. • Also at 8:30 AM, Gross Domestic Product, 2nd Quarter 2024 (Third Estimate), and Corporate Profits (Revised) The consensus is that real GDP increased 3.0% annualized in Q2, unchanged from the second estimate of 3.0%. • Also at 8:30 AM, Durabl

Wealth Management

SEPTEMBER 25, 2024

Harness the expertise and influence of external professionals to strengthen a charity’s planned giving program.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Calculated Risk

SEPTEMBER 25, 2024

From ICE: ICE First Look at Mortgage Performance: Mortgage delinquencies remain low despite modest year-over-year rise • The national delinquency rate fell 3 basis points (bps) to 3.34% in August , dropping 0.9% for the month but up 5.1% from last year • The number of borrowers a single payment past due dropped by -26K, while 60-day delinquencies rose marginally by 1K • Serious delinquencies (loans 90+ days past due but not in active foreclosure) rose 14K (+3.3%) to a six-month high, but remain

Wealth Management

SEPTEMBER 25, 2024

Expressive Wealth's Vanessa Martinez details how her journey shaped her commitment to empowering clients through education and comprehensive wealth management.

Advisor Perspectives

SEPTEMBER 25, 2024

News of that day included rioting in northern England, apparently in response to misinformation spread online claiming the person who stabbed to death three children and injured eight others in Southport was a Muslim immigrant.

Wealth Management

SEPTEMBER 25, 2024

Open, honest and candid discussion about retirement plan assets, Fidelity's crackdown on credential sharing, Commonwealth's new PEP and more.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Advisor Perspectives

SEPTEMBER 25, 2024

With the advent of artificial intelligence (AI) in financial services, the pressure to move away from the AUM model is mounting. Has the time come for you to rethink your approach to compensation?

Wealth Management

SEPTEMBER 25, 2024

Understanding the differing needs of younger and veteran advisors.

Advisor Perspectives

SEPTEMBER 25, 2024

Taxes may be the biggest fee your tax-sensitive clients are paying on their investment portfolios. And neither they nor you, their advisor, may be aware of just how big that fee is.

Wealth Management

SEPTEMBER 25, 2024

MMKT is the first to follow the so-called Rule 2a-7—a provision of a 1940s Securities and Exchange Commission law that governs money-market funds.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Advisor Perspectives

SEPTEMBER 25, 2024

Home prices continued to trend upwards in July as the benchmark 20-city index rose for a eighteenth consecutive month to a new all-time high. The S&P Case-Shiller Home Price Index revealed seasonally adjusted home prices for the 20-city index saw a 0.3% increase month-over-month (MoM) and a 5.9% increase year-over-year (YoY). After adjusting for inflation, the MoM was reduced to -0.1% and the YoY was reduced to 0.5%.

A Wealth of Common Sense

SEPTEMBER 25, 2024

Today’s Animal Spirits is brought to you by Innovator ETFs and the CME Group: See here for more information on Innovator ETFs suite of risk-managed ETFs and here for more information on CME Group’s valuable educational materials and trading tools On today’s show, we discuss: Future Proof 2024 Yardeni Says Fed Cut Raises Odds of ‘Outright Melt-Up’ in Stocks JPM Guide to ETFs What’s Left.

Tobias Financial

SEPTEMBER 25, 2024

Join us on Tuesday, October 15th at 12:30 PM Eastern for our Quarterly Market Update Webinar. When : Tuesday, October 15th at 12:30 PM Eastern Registration : Click here to register. Cost : Complimentary After registering, you will receive a confirmation email with instructions for joining the webinar. We look forward to your attendance.

Trade Brains

SEPTEMBER 25, 2024

The world is changing and ever-evolving. Climate change has provoked severe temperatures and environmental changes, impacting all living creatures. To limit the carbon emissions into the atmosphere there are some changes taking place and governments are implementing some policies regarding it. One of the changes is that electric vehicles will replace ICE in the future to reduce emissions.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Random Roger's Retirement Planning

SEPTEMBER 25, 2024

John Rekenthaler wrote an article at Morningstar about smart beta or factor funds or as Morningstar calls them strategic beta funds that looks at the space in a manner that is shortsighted. A spoiler, I'm not making an argument for factor funds really but the article missed an opportunity to talk about them in a constructive manner. Excerpt: What I overlooked, though, was whether smart-beta investors would choose well.

Advisor Perspectives

SEPTEMBER 25, 2024

A surprising trend has emerged when it comes to discussing inheritance. While very and ultra-high-net-worth clients often engage in these conversations, they tend to occur far less frequently with other segments.

Validea

SEPTEMBER 25, 2024

The NASDAQ 100 has outperformed all the other major indexes for a long time now. Due to its strong run, and the fact that it is dominated by growth companies, many investors think that there aren’t too many fundamentally sound stocks left in the index. But our quantitative models are still seeing value in some names within the index. Validea’s guru system uses 22 quantitative strategies based on historically successful investors like Warren Buffett and Peter Lynch and academic resear

Advisor Perspectives

SEPTEMBER 25, 2024

Care about being a financial “doctor” and don't assume all is well because you have addressed the surface issue. Here are some ways to avoid delivering a poor bedside manner when clients need help.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content