Goldman Sachs: More Than One in Four Women Retire with Less Than $50K

Wealth Management

MARCH 29, 2024

In a gender-based look at saving for retirement, the bank found some signs of improvement amid ongoing challenges faced by women.

Wealth Management

MARCH 29, 2024

In a gender-based look at saving for retirement, the bank found some signs of improvement amid ongoing challenges faced by women.

Calculated Risk

MARCH 29, 2024

From the BEA: Personal Income and Outlays for February: Personal income increased $66.5 billion (0.3 percent at a monthly rate) in February , according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI), personal income less personal current taxes, increased $50.3 billion (0.2 percent) and personal consumption expenditures (PCE) increased $145.5 billion (0.8 percent).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

MARCH 29, 2024

Triad Wealth Partners' Sara Baker details the innovation and tailor client experiences high-growth firms use to differentiate in a 'sea of sameness.

Nerd's Eye View

MARCH 29, 2024

Enjoy the current installment of “Weekend Reading For Financial Planners” – this week’s edition kicks off with the news that a recent survey suggests Americans are increasingly prioritizing work-life balance over higher salaries, with 2/3 of respondents indicating that they would rather work at a job that they loved rather than a job they disliked but paid more money.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

MARCH 29, 2024

Mohan Gurupackiam, CIO of $32 billion AUM Steward, shares how evaluating and adopting new technology strengthens the firm.

Calculated Risk

MARCH 29, 2024

Here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report this morning, both through February 2024. CPI Shelter was up 5.8% year-over-year in February, down from 6.1% in January, and down from the cycle peak of 8.2% in March 2023. Housing (PCE) was up 5.8% YoY in February , down from 6.1% in January, and down from the cycle peak of 8.3% in April 2023.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

MARCH 29, 2024

From BofA: 1Q GDP tracking remained at 2.2% q/q saar largely due to downward revisions to core capital goods orders and shipments and lower than expected core capital goods shipments being offset by higher than expected manufacturing inventories in the February durable goods print [Mar 28th estimate] emphasis added From Goldman: After incorporating this morning’s data and yesterday’s GDP release, we have increased our Q1 GDP tracking estimate by 0.3pp to +2.1% (qoq ar) , reflecting stronger cons

Wealth Management

MARCH 29, 2024

Christopher Turean used the money he embezzled from an unnamed client to gamble and pay down a home equity loan, according to the Department of Justice.

A Wealth of Common Sense

MARCH 29, 2024

I got a new credit card this week. What can I say? I’m a sucker for a good sign-up bonus and the free bags on American flights will basically pay for the annual fee. A new card always comes with a lot of paperwork. They have all sorts of numbers to run by you, along with plenty of fine print. As a personal finance junkie, I always like to thumb through this stuff.

Wealth Management

MARCH 29, 2024

Plus multiple enhancements at Interactive Brokers; FP Alpha and PreciseFP, and EagleBrook and Franklin Templeton deepen partnerships respectively.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

MARCH 29, 2024

Today, in the Calculated Risk Real Estate Newsletter: FHFA’s National Mortgage Database: Outstanding Mortgage Rates, LTV and Credit Scores A brief excerpt: Here are some graphs on outstanding mortgages by interest rate, the average mortgage interest rate, borrowers’ credit scores and current loan-to-value (LTV) from the FHFA’s National Mortgage Database through Q4 2023 (released this morning).

Meb Faber Research

MARCH 29, 2024

Guest: Steve Edmundson is the Chief Investment Officer at the Public Employees’ Retirement System of Nevada (NVPERS), overseeing over $60 billion in assets. Recorded: 3/18/2024 | Run-Time: 48:01 Summary: As pension funds continue to hire more employees, pay more and more fees and build more complex portfolios, Steve is an outlier for his approach that emphasizes […] The post Episode #526: Indexing Nevada PERS: Steve Edmundson’s $60 Billion Strategy appeared first on Meb Faber

Alpha Architect

MARCH 29, 2024

Strong empirical evidence demonstrates that momentum (both cross-sectional and time-series) provides information on the cross-section of returns of many risk assets and has generated alpha relative to existing asset pricing models. Economic Momentum was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Clever Girl Finance

MARCH 29, 2024

When you’re budgeting and want to boost your savings, the last thing you might consider doing is spending more money. But there are situations where choosing quality over quantity can actually help you save more in the long run. Keep reading to learn more! Table of contents Quality over quantity meaning How spending more can save you money in the long run 10 Quality over quantity examples Expert tip: Be consistent in your choices on quality Why choosing quality improves your life: 6 Reasons What

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Random Roger's Retirement Planning

MARCH 29, 2024

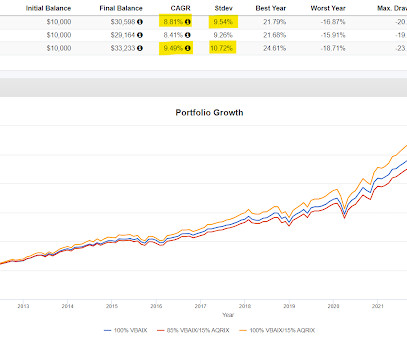

Return Stacked ETFs wrote a short paper in support of their ETF suite about how to incorporate return stacking into a portfolio. For anyone new, return stacking, also known as capital efficient, involves leverage to build a diversified portfolio. Return Stacked currently has three funds. RSBT is 100% bonds and 100% managed futures. RSST is 100% equities and 100% managed futures.

Clever Girl Finance

MARCH 29, 2024

When you are paid on a biweekly basis, it may make sense to create a biweekly budget. A biweekly budget is perfect for those who get paid every other week. You can structure your budget around your paychecks so you don’t miss anything with your money, and you can find out how here! Table of contents What is a biweekly budget? How does a biweekly budget work?

Darrow Wealth Management

MARCH 29, 2024

If you have incentive stock options, you’ve probably heard of the alternative minimum tax (AMT). Essentially, the alternative minimum tax is a prepayment of taxes. In years when not subject to the AMT, you can receive an AMT credit. The credit reduces your tax liability to reflect prepaid tax. Here’s a summary of how exercising ISOs can trigger the alternative minimum tax – with examples.

Clever Girl Finance

MARCH 29, 2024

Interest is no fun unless you are earning it. When you have to pay for it, it can be a major hindrance. It’s even worse when you have capitalized interest that starts to compound. So how do you avoid that? Keep reading to learn more about how capitalized interest works and how borrowers can avoid it or pay it off on their student loans. Table of contents What is capitalized interest?

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Trade Brains

MARCH 29, 2024

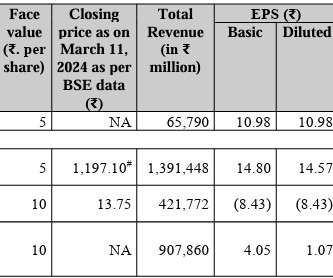

Bharti Hexacom IPO Review 2024: Bharti Hexacom is coming up with its IPO issue of Rs. 4,275 Cr which will open on 3rd April 2024. The issue will close on 5th April and be listed on the exchange on 12th April 2024. This article will analyze the Financials, GMP, strengths and weaknesses of the Bharti Hexacom Limited IPO Review 2024. Keep reading to find out!

Darrow Wealth Management

MARCH 29, 2024

If you have incentive stock options, you’ve probably heard of the alternative minimum tax (AMT). Essentially, the alternative minimum tax is a prepayment of taxes. In years when not subject to the AMT, you can receive an AMT credit. The credit reduces your tax liability to reflect prepaid tax. Here’s a summary of how exercising ISOs can trigger the alternative minimum tax – with examples.

Sara Grillo

MARCH 29, 2024

If you are frustrated by marketing failures, or feel like you are throwing away money on marketing that doesn’t work, here are the reasons why. Stop throwing money away! Question from a subscriber: “ I spent $1k on marketing and got zero leads. Should I stop marketing ?” Nah. You should not necessarily stop marketing, but you should press the “pause” button until you figure out why it failed.

NAIFA Advisor Today

MARCH 29, 2024

Out of the work that NAIFA has done through its Limited & Extended Care Planning Center spearheaded by Carroll Golden , best-selling author of three books on funding a dignified life and caregiving, as well as the organizer of NAIFA's Legislative Working Group that focuses on state and federal issues that will affect producers, we are proud to announce that we're continuing to expand our work in the Medicare space by partnering with Medicarians Vegas 2024.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Sara Grillo

MARCH 29, 2024

Question from a member, “I have less than 500 followers on LinkedIn. Should I get 500 just so my profile page says “500+ followers?“ While it’s important to grow your network on LinkedIn, “growth for growth’s sake” doesn’t make any sense. I’d rather see you have 30 connections if they are on the same mission […] To access this post, you must purchase Membership Prime Portal.

Advisor Perspectives

MARCH 29, 2024

Pending sales of previously-owned homes in the US recovered last month after declining at the start of the year, adding to evidence that the housing market is gradually improving.

Sara Grillo

MARCH 29, 2024

Here’s how to handle a financial planning fee objection. Don’t get talked down – follow these steps! Financial planning fees can be hard to justify Question from a subscriber: “Prospects all say my financial planning fee is too high, and try to negotiate down.” The issue here is most likely they have no idea what they are actually getting for the financial planning fee they are about to pay.

Advisor Perspectives

MARCH 29, 2024

Ray Dalio warned that China should cut its debt and ease monetary policy or face “a lost decade.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Sara Grillo

MARCH 29, 2024

Use your out-of-office response as a way to make people laugh ; it conveys positive energy. Why does your out-of-office message matter? Every touch you have with a client or prospect is branding. It does not matter how small an element it is. Your brand should convey energy and better if it is positive energy. Why? Positive people are rare. Try being so positive in your business, that people think you are on crack.

Advisor Perspectives

MARCH 29, 2024

The dollar is poised for its best quarter since late 2022 as Federal Reserve officials push back against the latest bout of rate-cut wagers.

Abnormal Returns

MARCH 29, 2024

Huberman The profile of star podcaster Andrew Huberman that everyone is talking about. (nymag.com) Why you should be wary of health advice from podcasters. (slate.com) You should be careful who you take moral advice from. (insidehook.com) Business Derek Thompson talks with Robinson Meyer about the threat facing Detroit automakers on EVs. (theringer.com) Joe Weisenthal and Tracy Alloway talk with Austin Frerik author of "Barons: Money, Power, and the Corruption of America's Food Industry.

Advisor Perspectives

MARCH 29, 2024

Federal Reserve Chair Jerome Powell’s increasing focus on protecting the job market is encouraging a swath of bond traders putting bets on inflation rates to remain elevated.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content