Can O.J. Simpson’s Executor Stiff-Arm the Goldman Family?

Wealth Management

APRIL 15, 2024

Or will the family be able to squeeze the over $33 million they’re owed in civil judgments out of The Juice’s estate?

Wealth Management

APRIL 15, 2024

Or will the family be able to squeeze the over $33 million they’re owed in civil judgments out of The Juice’s estate?

Calculated Risk

APRIL 15, 2024

Altos reports that active single-family inventory was up 2.6% week-over-week. Inventory bottomed in mid-February this year, as opposed to mid-April in 2023, and inventory is now up 5.6% from the February bottom. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of April 12th, inventory was at 526 thousand (7-day average), compared to 513 thousand the prior week.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

APRIL 15, 2024

Most ETF issuers have agreed to pay a new maintenance fee to Fidelity, leaving only a handful that investors will have to pay $100 service fees to purchase.

Calculated Risk

APRIL 15, 2024

On a monthly basis, retail sales were up 0.7% from February to March (seasonally adjusted), and sales were up 4.0 percent from March 2023. From the Census Bureau report : Advance estimates of U.S. retail and food services sales for March 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $709.6 billion, up 0.7 percent from the previous month , and up 4.0 percent above March 2023.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

APRIL 15, 2024

Goldman’s asset- and wealth-management business posted revenue of $3.79 billion, up 18% from a year earlier.

Calculated Risk

APRIL 15, 2024

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in March A brief excerpt: NOTE: The tables for active listings, new listings and closed sales all include a comparison to March 2019 for each local market (some 2019 data is not available). This is the third look at several early reporting local markets in March.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

APRIL 15, 2024

From Matthew Graham at Mortgage News Daily: After Months of Relative Calm, Rates are Starting to Look Panicked Again In 2023, there were multiple examples of mortgage rates moving up by roughly half a percent in a relatively short amount of time (1-3 weeks). Since the big shift in November, we've only seen one similar example and it was more of a technicality (a sharp drop in rates followed by a correction in early Feb), until today.

Wealth Management

APRIL 15, 2024

iCapital's Lawrence Calcano explores the world of alternative investments and their role in modern portfolio strategies.

Abnormal Returns

APRIL 15, 2024

Podcasts Daniel Crosby talks about the unique needs of women and money with Lindsey Lewis. (standarddeviationspod.com) Christine Benz and Amy Arnott talk asset allocation and more with Matt Krantz. He is the personal finance and management editor at Investor’s Business Daily. (morningstar.com) The biz Why Dynasty Financial stands since putting plans for an IPO on ice.

Wealth Management

APRIL 15, 2024

Around four dozen new ETFs launched in March. The majority are equities-based with a handful based off bonds or other asset types.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Nerd's Eye View

APRIL 15, 2024

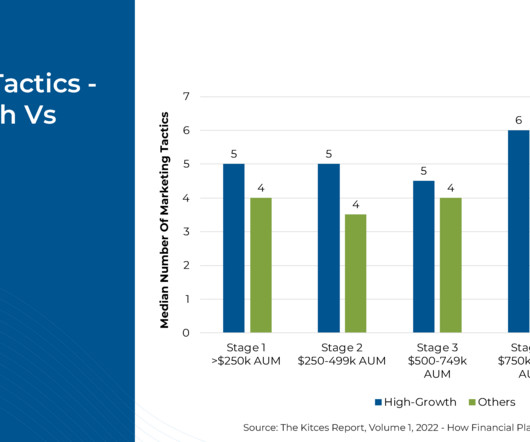

Growing an advisory firm is no easy task – and advisors who start firms often have few resources to spare (beyond their own knowledge and time), face huge to-do lists, and are required to wear a number of hats. Foremost among their responsibilities is business development, which compels them to seek out prospects who will eventually become clients (so that they can grow their firms, allocate resources accordingly, and do even more financial planning!).

Wealth Management

APRIL 15, 2024

The state securities agency is trying to shut down two entities falsely claiming to be wealth management firms operating out of the same building as the agency itself.

Abnormal Returns

APRIL 15, 2024

Strategy Even the best investors make big mistakes. (mrzepczynski.blogspot.com) Don't let one mistake keep your from investing over the long run. (bestinterest.blog) Big winners require patience. (awealthofcommonsense.com) Finance The CBOE's ($CBOE) defense of 0DTE options as risk management tool. (ft.com) Goldman Sachs ($GS) traders had a good Q1 2024.

Wealth Management

APRIL 15, 2024

Does the 401(k) and workplace platform offer unique opportunities?

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Alpha Architect

APRIL 15, 2024

The justification for neutralizing sectors in factor strategies is a work in progress. To date, academic researchers haven't had an empirical model to mimic the impact of removing sector "effects" on the measurement and performance of factor strategies. The authors develop and test a two-component model to address the question of, "Is Sector Neutrality in Factor Investing a Mistake?

Wealth Management

APRIL 15, 2024

Schwab’s in-house advisors saw a record $4.4 billion in net flows this quarter, which President Rick Wurster attributed partly to enrollment by TD Ameritrade households.

A Wealth of Common Sense

APRIL 15, 2024

Today’s Talk Your Book is brought to you by Direxion On today’s show, we spoke with Ed Egilinsky, Managing Director, Head of Alternatives, and Head of Sales and Distribution at Direxion to discuss diversifying away from the Magnificent 7. For more information, see here or email info@direxion.com On today’s show, we discuss: Flows into bullish and bearish funds Magnificent 7 concentration risk Nasdaq 10.

Wealth Management

APRIL 15, 2024

F.L.Putnam Investment Management is adding talent and ancillary services through a growth strategy predicated primarily on opportunity and trust.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Darrow Wealth Management

APRIL 15, 2024

It goes by many different names: semi-retirement, partial or phased retirement, second career, and so on. But typically, it means the same thing: working in some capacity after retiring early. According to the 2024 State of Retirement Planning Study by Fidelity Investments, the rise of remote and hybrid work has shifted retirement preferences for working Americans under age 42.

Wealth Management

APRIL 15, 2024

Wednesday, May 22, 2024 | 2:00 PM Eastern Daylight Time

Advisor Perspectives

APRIL 15, 2024

Rob Copeland’s marvelously readable and well-researched book, The Fund: Ray Dalio, Bridgewater Associates, and the Unraveling of a Wall Street Legend , details a detachment from reality borne on the absolute power deployed by Dalio at Bridgewater.

Wealth Management

APRIL 15, 2024

Everyone should have a Power of Attorney for Healthcare.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

XY Planning Network

APRIL 15, 2024

We're excited to share another member story from our "How I Did It" series. Deciding to take the leap to start your own financial planning firm can be very scary. And actually "leaping" can feel overwhelming. There are so many decisions and responsibilities. How am I going to make this work? What business model should I use? How do I manage compliance?

Wealth Management

APRIL 15, 2024

Deadlifts beat discounted cash flow on the new buff Wall Street.

Advisor Perspectives

APRIL 15, 2024

With an understanding of reversion to the mean, it is possible to contextualize market volatility for investors in a way that helps them view it more constructively.

Wealth Management

APRIL 15, 2024

KKR is betting on gains in private equity as some of its peers move away from buyouts on the belief that the business is at scale and the biggest returns are in the past.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Advisor Perspectives

APRIL 15, 2024

With the interest-rate peak being the highest in 15 years, now is the opportunity to lock in near-peak lifetime income payments while avoiding future stock market losses.

Sara Grillo

APRIL 15, 2024

Yes, there is life after AUM fees! In this podcast I interview Sarah Charles , an hourly financial planner who used to work under the AUM fee model. She talks about why she made the jump and what life is like now as an hourly financial planner. For those of you who are new to my blog, my name is Sara. I am a CFA® charterholder and financial advisor marketing consultant.

Darrow Wealth Management

APRIL 15, 2024

It goes by many different names: semi-retirement, partial or phased retirement, second career, and so on. But typically, it means the same thing: working in some capacity after retiring early. According to the 2024 State of Retirement Planning Study by Fidelity Investments, the rise of remote and hybrid work has shifted retirement preferences for working Americans under age 42.

Tobias Financial

APRIL 15, 2024

Tobias Financial Advisors is pleased to announce that Yesenia Realejo , CFP®, Catalina Franco-Cicero , MS, CFP®, CTS , and Edgar Collado , CEPA®, have become new shareholders and co-owners of the firm. Their elevation reflects their unwavering dedication, expertise, and invaluable contributions to our company. Wealth Advisors Yesenia Realejo, CFP® and Catalina Franco-Cicero, MS, CFP®, CTS have continuously exceeded our and our client’s expectations.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content