Carolyn Armitage on Change Management

Wealth Management

OCTOBER 8, 2024

Navigating the complex waters of organizational change requires a multi-faceted approach that addresses the needs of both the business and its people.

Wealth Management

OCTOBER 8, 2024

Navigating the complex waters of organizational change requires a multi-faceted approach that addresses the needs of both the business and its people.

Abnormal Returns

OCTOBER 8, 2024

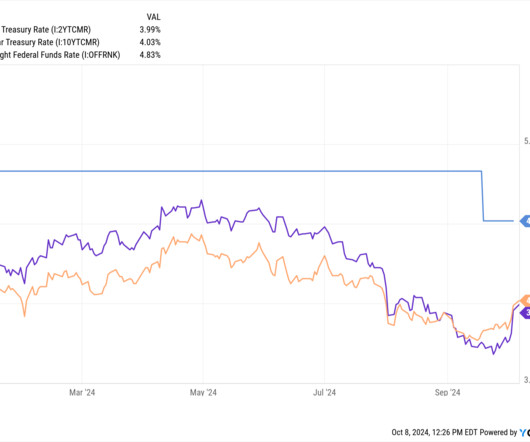

Markets Q3 earnings estimates are muted. (sherwood.news) The yield curve is coming to terms with a new Fed regime. (mrzepczynski.blogspot.com) Strategy Two questions you should ask about any piece of market information. (behaviouralinvestment.com) For taxable investors a preference for dividends doesn't make a lot of sense. (rethinking65.com) Why trading successfully is difficult.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

OCTOBER 8, 2024

S&P Dow Jones’ updated methodology for some of its indices has impacted $300 billion in ETFs, reports Financial Times. Mergers & Acquisitions looks at whether evergreen funds can scale up, given their promise of greater liquidity for investors. These are among this week’s investment must reads for wealth advisors.

Abnormal Returns

OCTOBER 8, 2024

Factors Are factors just a proxy for systematic forecast errors? (mailchi.mp) What matters for bond pricing, factor-wise? (caia.org) Looking for factor returns in old historical stock market data. (blogs.cfainstitute.org) Research Benchmarking funds isn't as easy as it looks. (etf.com) Index replication need not be entirely mechanistic. (alphaarchitect.com) Volatility and anxiety are not the same thing.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Wealth Management

OCTOBER 8, 2024

Concourse Financial Group Securities will bring over 350 financial professionals overseeing about $4 billion in AUM to Cetera.

Calculated Risk

OCTOBER 8, 2024

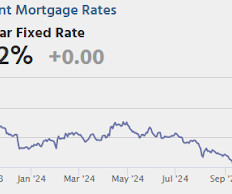

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

OCTOBER 8, 2024

Welcome everyone! Welcome to the 406th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Michael Kramer. Michael is the manager of Natural Investments, an RIA based in San Francisco, California that has offices across the country, overseeing $1.9 billion in assets under management for 1,300 client households. What's unique about Michael, though, is how his firm used the unique perpetual purpose trust structure to facilitate an internal succession plan, allowing th

Wealth Management

OCTOBER 8, 2024

The Federal Reserve’s signaling to market that their next moves will be rate cuts actually makes it more difficult to cut rates.

Calculated Risk

OCTOBER 8, 2024

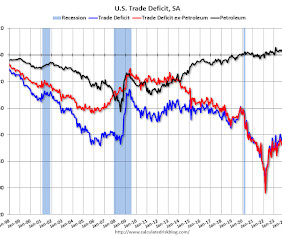

Note: the power was out in my neighborhood due to a large fallen tree. So, this is late. The Census Bureau and the Bureau of Economic Analysis reported : The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $70.4 billion in August , down $8.5 billion from $78.9 billion in July, revised.

Wealth Management

OCTOBER 8, 2024

Alternative investment platform iCapital doubled the volume of assets on its platform since December 2023.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

A Wealth of Common Sense

OCTOBER 8, 2024

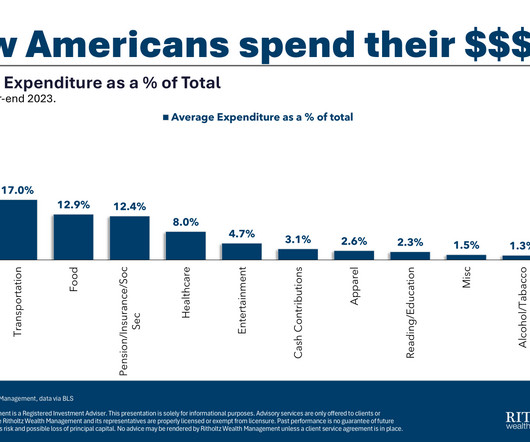

Each year the Bureau of Labor Statistics (BLS) updates consumer expenditure data on how Americans collectively spend and earn their money. These numbers are averages so your personal household budget probably looks different in some ways. Your circumstances — where you live, your standard of living, how much you make, family situation, etc. — often dictate how you spend.

Wealth Management

OCTOBER 8, 2024

Learn how to attract and retain the growing number of UHNW clients.

Million Dollar Round Table (MDRT)

OCTOBER 8, 2024

By Caroline A. Banks, FPFS Worldwide, we face a dreadful undercoverage of insurance. Too many financial advisors have become simply wealth managers, not realizing that insurance is the foundation of a financial plan. It’s crucial we make sure that this foundation is strong enough to support clients financially, no matter what happens. My own company received a critical illness payout when my husband, who was both the finance and IT director, was ill.

Wealth Management

OCTOBER 8, 2024

The firm has a growth equity investment from The 4100 Group Financial Services, the backer of several wealth and asset management firms.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

OCTOBER 8, 2024

More than anything else, the combination of these two services defines the D.C. swamp; it’s hard to imagine a greater conflict of interest than peddling access to BMSK’s powerful elite campaign clients to the nation’s wealthiest corporations.

Wealth Management

OCTOBER 8, 2024

Allworth's acquisition of George McKelvey Company in Manasquan, N.J. represents its sixth deal this year, bringing the RIA to 43 offices nationwide.

Clever Girl Finance

OCTOBER 8, 2024

Is now a good time to invest? That’s a question many people have, especially with the stock market being so unpredictable. Prices can go from all-time highs to major lows in just a few days, all thanks to global economics, interest rates, and political happenings. Just one event can shake things up, causing wild swings and even crashes. I’m sharing some key investment insights to help you navigate your financial choices and calm any worries you might have about the stock market.

Wealth Management

OCTOBER 8, 2024

The flat-fee planning firm has now raised $210 million and will use the latest funding to expand its technology and planning services.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Advisor Perspectives

OCTOBER 8, 2024

Just like road trips can bring unexpected detours, the economy and financial markets are at their own crossroads: recession or soft landing?

Wealth Management

OCTOBER 8, 2024

Schwab Advisor Services' Jalina Kerr discusses how the firm is trying to follow advisors’ lead when it comes to prioritizing the custodian’s approach to tech development.

Advisor Perspectives

OCTOBER 8, 2024

Regardless of the numbers, so many coffee drinkers will still be at their favorite café tomorrow. I might even be among them.

Wealth Management

OCTOBER 8, 2024

Blazing a new trail for the next generation of investors & advisors.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Financial Symmetry

OCTOBER 8, 2024

Reaching your financial goals builds confidence and peace of mind, which are essential for making informed decisions that benefit your entire family. In this episode, we’re following a fictional pop culture couple from newlyweds to pre-retirement, to demonstrate how their … Continued The post The Evolution of Your Emergency Fund, Ep #226 appeared first on Financial Symmetry, Inc.

Advisor Perspectives

OCTOBER 8, 2024

Whether you’re transitioning from another firm or starting from scratch, setting up your own independent registered investment advisor (RIA) firm is a tremendous opportunity that can provide higher earning potential, freedom, flexibility, and the opportunity to build a legacy.

Trade Brains

OCTOBER 8, 2024

The Indian spirits market is making waves globally, with a third of the world’s 30 fastest-growing spirit brands hailing from India. This impressive statistic, reported by Drinks International, highlights India’s growing dominance in the global alcohol industry. The country’s influence is particularly strong in the whisky category, where six out of the top ten brands worldwide are Indian.

Advisor Perspectives

OCTOBER 8, 2024

All of our eight indexes on our world watch list have posted gains through October 4th, 2024. The Hong Kong's Hang Seng finished in the top spot with a year-to-date gain of 35.43%. The U.S. S&P 500 finished in second with a year-to-date gain of 21.26% while Tokyo's Nikkei 225 finished in third with a year-to-date gain of 15.45%.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Harness Wealth

OCTOBER 8, 2024

Key Takeaways: The Harness Marketplace allows your tax firm to be paired with high-value tax clients whose unique needs align with your expertise. The Harness Marketplace attracts employees, founders, and investors in tech, healthcare, management consulting, and other high-earning industries who need help managing complex tax needs. Tax practices that provide comprehensive tax planning services are better positioned to gain new clients in the Harness Marketplace compared to firms that mainly foc

Trade Brains

OCTOBER 8, 2024

In a remarkable five-year journey, India has risen from a minor player to dominate the global equity derivatives market. This explosive growth, driven largely by new retail investors seeking high-risk opportunities, has caught the attention of financial experts and regulators alike. The market’s annual turnover now surpasses India’s entire economic output, marking an unprecedented boom.

Harness Wealth

OCTOBER 8, 2024

Key Takeaways: T ax Season Start: The IRS will likely begin accepting 2024 tax returns between January 15 and 31, 2025. Key Deadlines: The federal tax filing deadline (Tax Day) is April 15, 2025, with an extension deadline of October 15, 2025. Document Deadlines: Most key tax forms (W-2, 1099, etc.) must be received by January 31, 2025. Hurricane Helene Relief: Taxpayers in affected areas have until May 1, 2025, to file their federal tax returns.

Trade Brains

OCTOBER 8, 2024

Railways are the backbone of the country. It helps to move tonnes of freight across the country inland. The connectivity has aided companies in delivering goods in bulk. The government is looking to increase investments to improve the logistics cost and maintain its infrastructure. Stocks Rallying Railway stocks were not performing in earlier days as it was linked to government policies and regulations.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Let's personalize your content