The Empirical Relationship Between Market Share and Profitability

Wealth Management

APRIL 22, 2024

Companies with the largest industry market share often have below-market profit margins.

Wealth Management

APRIL 22, 2024

Companies with the largest industry market share often have below-market profit margins.

Calculated Risk

APRIL 22, 2024

This is something I check occasionally. The Department of Transportation (DOT) reported : • Travel on all roads and streets changed by +2.0% (+4.8 billion vehicle miles) for February 2024 as compared with February 2023. Travel for the month is estimated to be 240.2 billion vehicle miles. • The seasonally adjusted vehicle miles traveled for February 2024 is 274.8 billion miles, a +1.4% ( +3.9 billion vehicle miles) change over February 2023.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

APRIL 22, 2024

The RIA said it was acquiring the two San Francisco-based teams. This follows last week’s announcements that multi-billion-dollar former First Republic teams had joined Merrill Lynch and Citizens Bank.

Calculated Risk

APRIL 22, 2024

Altos reports that active single-family inventory was up 3.0% week-over-week. Inventory bottomed in mid-February this year, as opposed to mid-April in 2023, and inventory is now up 8.5% from the February bottom. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of April 19th, inventory was at 543 thousand (7-day average), compared to 526 thousand the prior week.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

APRIL 22, 2024

BlueRock's Miguel Sosa explains why real estate is a lot more then just office space.

Abnormal Returns

APRIL 22, 2024

Podcasts Brian Portnoy talks human-centric advice with Kelsey McKenna and Zachary Conway of Seeds Investor. (youtube.com) Larry Sprung talks with Josh Brown about his path to wealth management. (mitlinmoneymindset.libsyn.com) Jordan Haynes talks with Justin Castelli about his transition into life planning, especially for financial advisers. (getelements.com) Frazer Rice talks with Christopher Holtby about the role of a directed trustee.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

APRIL 22, 2024

Markets Commodities are having a standout 2024. (capitalspectator.com) When did investing become so political? (economist.com) ETFs Grayscale's Bitcoin Mini Trust will have a 0.15% expense ratio. (coindesk.com) More mutual fund to ETF conversions are coming. (advisorhub.com) Finance The NYSE is testing 24-hour trading. (on.ft.com) Want a stake in a hot AI startup?

Wealth Management

APRIL 22, 2024

Mary Kate Gulick claimed to be psychologically 'broken like a twig' from Carson’s lack of response to allegations an employee sexually assaulted a conference attendee, according to a lawsuit filed in Nebraska federal court.

Nerd's Eye View

APRIL 22, 2024

Broadly speaking, there are 2 models of working as a financial advisor: operating independently as a firm owner or with a large affiliate platform such as a wirehouse broker-dealer, independent broker-dealer, or larger corporate RIA. Deciding which model to work under is a key moment in beginning or evolving a career as an advisor. In the independent model, owners/advisors are generally paid directly by the clients they serve, and they select and pay for the vendors, services, and employees that

Wealth Management

APRIL 22, 2024

Internal professionals at employers are poorly trained or ill-equipped to properly handle plans.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

APRIL 22, 2024

From Matthew Graham at Mortgage News Daily: Mortgage Rates Essentially Flat Just Under 5 Month Highs Mortgage rates began the new week at almost exactly the same levels seen at the end of last week. There were no major events or economic reports to cause volatility in the underlying bond market, but bonds were able to improve modestly by the end of the day.

Wealth Management

APRIL 22, 2024

Berkshire Hathaway's succession plan is an invaluable case study for businesses of all sizes, exemplifying the importance of forward-thinking leadership and strategic planning.

Calculated Risk

APRIL 22, 2024

From the MBA: Share of Mortgage Loans in Forbearance Remains at 0.22% in March The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance remained unchanged at 0.22% as of March 31, 2024. According to MBA’s estimate, 110,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 8.1 million borrowers since March 2020.

Wealth Management

APRIL 22, 2024

These funds saw the most activity over the past 30 days.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Calculated Risk

APRIL 22, 2024

The TSA is providing daily travel numbers. This data is as of April 21st. Click on graph for larger image. This data shows the 7-day average of daily total traveler throughput from the TSA (Blue). The red line is the percent of 2019 for the seven-day average. Air travel - as a percent of 2019 - is tracking at about 105% of pre-pandemic levels.

Wealth Management

APRIL 22, 2024

Andrew Page is stepping into the second new role Homrich Berg has announced this month to support strategic growth.

Advisor Perspectives

APRIL 22, 2024

With the right tech in place, advisors can access reliable, high-quality models that can be used repeatedly across their book of business.

Wealth Management

APRIL 22, 2024

The $4 billion AUM firm serves high-net-worth clients and institutions and now has 11 offices nationwide.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Million Dollar Round Table (MDRT)

APRIL 22, 2024

By Antoinette Tuscano, MDRT Senior Content Specialist There was a time when writers needed a strong grasp of spelling. Otherwise, your writing time doubled because, to avoid the embarrassment of egregious spelling errors, much effort was spent thumbing through the massive dictionary on your desk. Then came spellcheck, and writers rejoiced. Dictionaries moved online.

Wealth Management

APRIL 22, 2024

Clayton Ortloff, an advisor out of Midland, Texas, will join the independent broker/dealer’s model for advisors looking for more autonomy while buttressed by back office support.

A Wealth of Common Sense

APRIL 22, 2024

Today’s Talk Your Book is brought to you by Simplify Asset Management: On today’s show, we spoke with Anupam Ghose, Managing Partner at System Two Advisors to discuss active equity exposure in India On today’s show, we discuss: Why India is different than China Growth opportunities within India How GDP growth translates to higher stock prices Why it’s important to have local staff in India.

Wealth Management

APRIL 22, 2024

Mary Kate Gulick claimed to be psychologically 'broken like a twig' from Carson’s lack of response to allegations an employee sexually assaulted a conference attendee, according to a lawsuit filed in Nebraska federal court.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Random Roger's Retirement Planning

APRIL 22, 2024

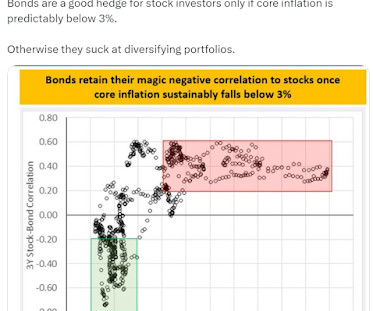

Jason Zweig wrote an article titled How Not to Invest in the Bond Market. The title of course piqued my interest. This blog has pretty much evolved into 100 ways to build a portfolio without bonds. I've been like a broken record for years on the need to avoid bonds that have any sort of duration or at least be extremely underweight duration versus the typical benchmarks.

Wealth Management

APRIL 22, 2024

BlackRock will flip the more than $700 million BlackRock International Dividend Fund into an exchange-traded fund in November.

Random Roger's Retirement Planning

APRIL 22, 2024

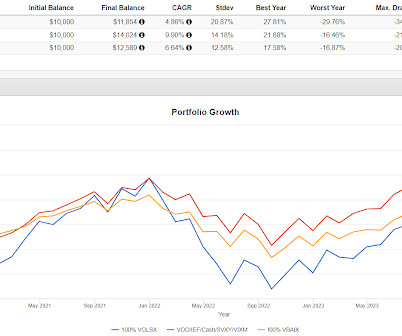

We look at a lot of alternative funds here. Basically, I'm willing to dig into just about anything that does something that might be a little different or have its own take on a strategy that interests me. A high level answer I am looking for is what should the fund look like, what expectation should investors have and is the fund meeting those expectations.

Wealth Management

APRIL 22, 2024

Private equity participation picked up after a 2023 dip, more than five deals involving more than $20 billion in assets were announced and a couple of new names appeared on the list of top buyers.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Advisor Perspectives

APRIL 22, 2024

Imagine you were running for king of the world on a platform of slashing economic growth by 20% forever. You’d be lucky to get your own family to vote for you. And yet humanity insists on running the global economy on fossil fuels that are doing exactly that sort of damage.

Wealth Management

APRIL 22, 2024

Private wealth represents about 9% of total client commitments across active EQT funds, according to the statement.

XY Planning Network

APRIL 22, 2024

Imagine a world where financial advisors can spend less time on tedious tasks and more time delivering personalized, high-value services to their clients. This world is not a distant future – it's today, and artificial intelligence (AI) is making it possible. As powerful AI tools like ChatGPT, Google's Bard, and Microsoft's Bing AI continue to advance, advisors who embrace this technology stand to gain a significant competitive edge.

Wealth Management

APRIL 22, 2024

Financial advisors continued to be more optimistic about the stock market than the broader economy in March, according to Wealthmanagement.com’s Advisor Sentiment Index.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content