Do Magazine Covers Contain Market Signals?

The Big Picture

MARCH 18, 2024

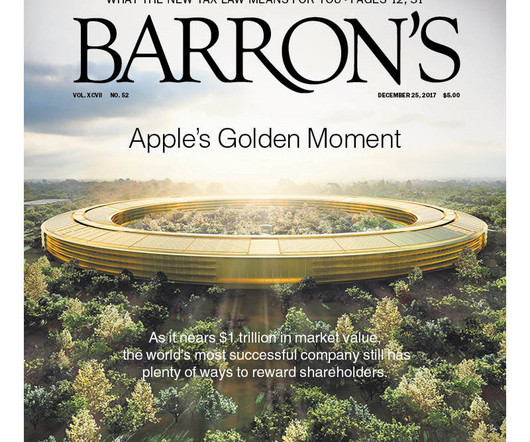

There has been a lot of chatter about magazine covers lately; I thought I might clarify some of the with this post, originally published in Bloomberg on December 27, 2017, along with commentary from Ben and Josh addressing the sdame issue. The key takeaway: The value of the signal here is just about zero. The 2017 Barron’s cover (above) showing Apple’s extravagant new headquarters and suggesting that the company’s market value would reach $1 trillion in 2018 generated some chat

Let's personalize your content