RIAs to Pay $1.2M To Settle SEC Marketing Rule Violations

Wealth Management

SEPTEMBER 9, 2024

The firms named include Integrated Advisors Network, Richard Berstein Advisors and Abacus Planning Group, all of which paid six-figure civil penalties.

Wealth Management

SEPTEMBER 9, 2024

The firms named include Integrated Advisors Network, Richard Berstein Advisors and Abacus Planning Group, all of which paid six-figure civil penalties.

Abnormal Returns

SEPTEMBER 9, 2024

Finance Analysts are in no rush to cut earnings estimates. (sherwood.news) Kalshi won its lawsuit against the CFTC to offer political prediction markets. (coindesk.com) Apple Will AI drive a renewed iPhone upgrade cycle? (spyglass.org) What is Apple ($AAPL) spending all that R&D money on? (sherwood.news) How Apple ($AAPL) turned the watch into THE wearable.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

SEPTEMBER 9, 2024

Attendees got heated talking about record keepers investing in and promoting services that compete with advisors.

Abnormal Returns

SEPTEMBER 9, 2024

Podcasts Michael Kitces talks financial wellness with Zack Hubbard. Zack is the Director of Financial Planning and Participant Engagement of Greenspring Advisors. (kitces.com) Dave Zoller talks with Brian Portnoy about the essential skills of the best advisers. (youtube.com) Brendan Frazier talks with Michael Kitces about mastering the human side of financial advice.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

SEPTEMBER 9, 2024

Working through a high-net-worth divorce is challenging for all parties involved, but it doesn’t have to be overwhelming.

Calculated Risk

SEPTEMBER 9, 2024

From Manheim Consulting today: Wholesale Used-Vehicle Prices Increased in August Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) were higher in August compared to July. The Manheim Used Vehicle Value Index (MUVVI) rose to 203.9, a decline of 3.9% from a year ago. The seasonal adjustment to the index mitigated the impact on the month, resulting in values that rose 1.2% month over month.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

SEPTEMBER 9, 2024

Altos reports that active single-family inventory was down 0.1% week-over-week. Inventory is now up 42.4% from the February seasonal bottom. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of September 6th, inventory was at 704 thousand (7-day average), compared to 704 thousand the prior week. It is possible inventory is at or close to the peak for the year (this would be normal timing pre-pandemic).

Wealth Management

SEPTEMBER 9, 2024

While the NFL is welcoming some private equity players, its rules are more stringent than those adopted by other professional leagues, meaning funds allowing individual investor participation are not eligible.

Calculated Risk

SEPTEMBER 9, 2024

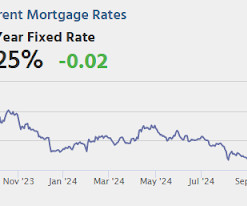

From Matthew Graham at Mortgage News Daily: Mortgage Rates Holding Near Long-Term Lows to Start New Week The average lender's top tier 30yr fixed rate fell to the lowest level since April 2023 last week. That's down more than 1.25% over the past 5 months. Today brought a significantly smaller improvement, but an improvement on a long-term low technically makes another long-term low.[ 30 year fixed 6.55% ] emphasis added Tuesday: • At 6:00 AM ET, NFIB Small Business Optimism Index for August.

Wealth Management

SEPTEMBER 9, 2024

The 2024 "Wealthies" Awards were held on Sept. 5 at the Ziegfeld Theater in New York City.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

SEPTEMBER 9, 2024

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in August A brief excerpt: NOTE: The tables for active listings, new listings and closed sales all include a comparison to August 2019 for each local market (some 2019 data is not available). This is the first look at several early reporting local markets in August.

Wealth Management

SEPTEMBER 9, 2024

Chief executives at some of the largest and fastest-growing RIAs in the country argue for the need to institutionalize business development.

Nerd's Eye View

SEPTEMBER 9, 2024

While the share of advisors with the CFP marks has risen steadily over time, today, about 2/3 of financial advisors are not CFP professionals. This means that, for most advisors, the decision to obtain this designation remains an open one. A crucial factor in an advisor's decision to prepare for the CFP exam – often requiring them to sacrifice evenings and weekends to complete the requisite coursework (which can take more than a year), and spending many thousands of dollars – is whet

Wealth Management

SEPTEMBER 9, 2024

Some athletes might see a tax bill for their triumphs.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Alpha Architect

SEPTEMBER 9, 2024

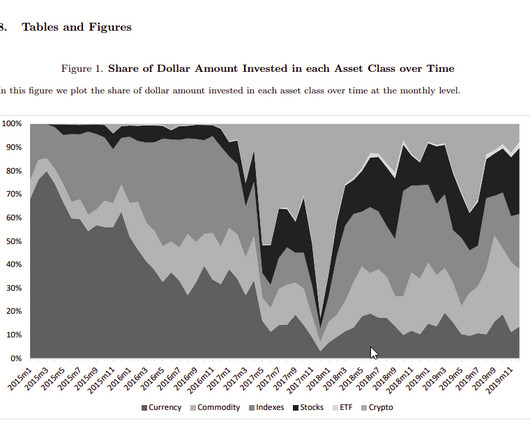

Retail traders are contrarian in stocks and gold, yet the same traders follow a momentum-like strategy in cryptocurrencies. The differences are not explained by individual characteristics, investor composition, inattention, differences in fees, or preference for lottery-like assets. We conjecture that retail investors have a model where cryptocurrency price changes affect the likelihood of future widespread adoption, which leads them to further update their price expectations in the same directi

Wealth Management

SEPTEMBER 9, 2024

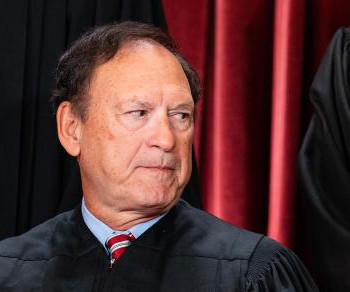

Supreme Court justices are allowed to hold individual stocks, but ethics rules deem they should disqualify from cases involving the companies.

Advisor Perspectives

SEPTEMBER 9, 2024

78 million baby boomers are about one-third of the voter-eligible population and 77 percent of them vote, so there are 60 million baby boomer votes. That 60 million is 38 percent of the 158 million votes cast in the 2020 presidential election. The baby boomer voters’ bloc is a big deal.

Wealth Management

SEPTEMBER 9, 2024

Take advantage of the full menu of options when going independent.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

A Wealth of Common Sense

SEPTEMBER 9, 2024

Today’s Talk Your Book is sponsored by Schafer Cullen Capital Management: On today’s show, we spoke with Jennifer Chang, Portfolio Manager and Executive Director to discuss Schafer Cullen’s high dividend value strategies. On today’s show, we discuss: Utilizing active management within dividend strategies Indexing vs active stock picking dividend stocks How high dividend stocks are affected by.

Wealth Management

SEPTEMBER 9, 2024

Wednesday, October 09, 2024 | 2:00 PM ET

Trade Brains

SEPTEMBER 9, 2024

Recycling and waste management have been transforming the way we deal with our daily waste. People were increasingly realizing the importance of reducing, reusing, and recycling to create a sustainable environment. Innovative companies have been finding new ways to turn waste into valuable resources. Gravita India Limited has been a key player in this industry.

Wealth Management

SEPTEMBER 9, 2024

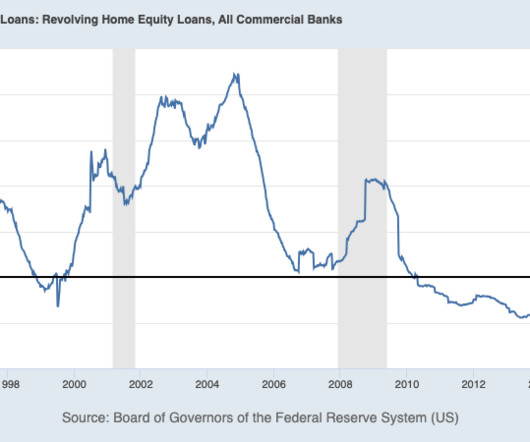

Home equity loans are beginning to look more attractive after fading into irrelevance after the financial crisis.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Cornerstone Financial Advisory

SEPTEMBER 9, 2024

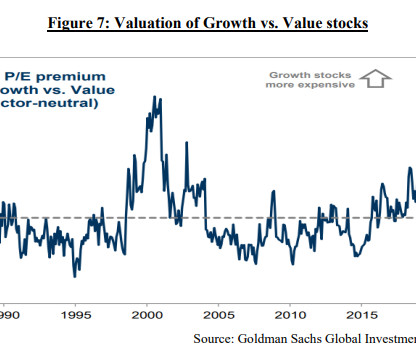

Weekly Market Insights | September 9th, 2024 Rough Start, Unsettling End. Stocks fell last week as soft economic data rattled investors focused on the Fed’s next move with interest rates. The Dow Jones Industrial Average lost 2.93 percent, while the Standard & Poor’s 500 Index dropped 4.25 percent. The tech-heavy Nasdaq Composite fell 5.77 percent.

XY Planning Network

SEPTEMBER 9, 2024

Maybe you’re building your business and you feel a bit scattered when pulling all of the disparate parts together. You seem to have a lot of challenges to overcome, and it’s up to you to solve them all. Challenges like: How should I become an expert on my target market ? How do I establish credibility ? Where can I find my audience ? What will spur them to contact me ?

Carson Wealth

SEPTEMBER 9, 2024

The Worst Month of the Year We noted last week that September was historically a rough one for stocks and after one week, that is playing out, as stocks just had their worst week since the Regional Bank crisis in March 2023. But let’s look at the bigger picture before we dive into the minutia of markets. The S&P 500 has been higher every month this year except April.

Aleph

SEPTEMBER 9, 2024

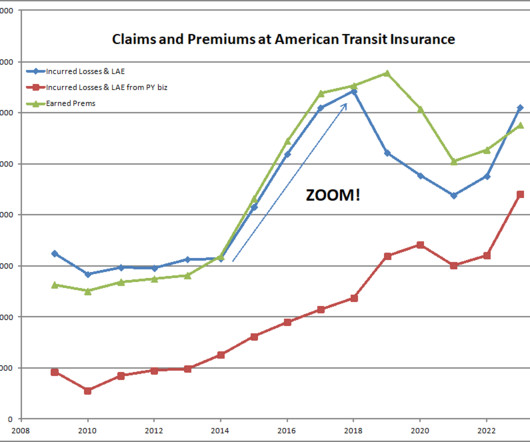

Hey! Maybe we can grow our way out of the problem! || All images from Aleph Blog At one point in time, I was a Fellow in the Society of Actuaries, a Life Actuary specializing in investment issues. Eventually, I was hired by a hedge fund to analyze all types of insurance stocks. I knew some things about reserving outside of life insurance, but I had to learn more to become competent at understanding what made for good insurance stocks.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Advisor Perspectives

SEPTEMBER 9, 2024

The US stock market has given us plenty of real and perceived calendar anomalies to think about. There’s the observed tendency for stocks to experience a “Santa Claus rally” (during the last five trading days of the year and the first two of the next) and the weekend effect (where stocks have a habit of slumping on Mondays).

SEI

SEPTEMBER 9, 2024

Breadth of Capabilities and Strength of Global Operations to Help Accelerate Growth

Random Roger's Retirement Planning

SEPTEMBER 9, 2024

An update on the Tradr 2X Long SPY Weekly ETF (SPYB). The fund is 2x leveraged but unlike most leveraged funds, it does not reset daily, it resets weekly. SPYM from the same shop resets monthly. SPYB went through it's first weekly reset and while SPY was up 112 basis points on Monday, SPYB was up 218 basis points. So it didn't nail it to the basis points for perfect tracking but that is very close as a first impression.

NAIFA Advisor Today

SEPTEMBER 9, 2024

We look forward to seeing everyone who is attending the combined Apex and National Leadership Conference September 19-21 at the Arizona Biltmore. To see who has signed up, check the Who's Coming? page on the conference website. And if you're a last-minute planner, it's not too late to register and add your name to the list. The preferred rate for NAIFA's room block at the Biltmore has expired, but i f you would like assistance locating accommodations in the vicinity of the Arizona Biltmore pleas

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content