The Non-Compete Revolution Begins

Wealth Management

JULY 29, 2024

RIAs are especially vulnerable to the potential changes stemming from the FTC’s rule.

Wealth Management

JULY 29, 2024

RIAs are especially vulnerable to the potential changes stemming from the FTC’s rule.

Abnormal Returns

JULY 29, 2024

Markets Commodities are back down to their lows of the year. (sherwood.news) Why forecasting is so difficult. (mrzepczynski.blogspot.com) Crypto Politicians are falling all over themselves to cater to the crypto crowd. (downtownjoshbrown.com) The U.S. government continues to move Silk Road Bitcoin. (coindesk.com) Finance Convertible bonds are having a moment this year.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 29, 2024

In his new book, the ‘father of life planning’ advocates for a broader fiduciary duty, one that extends to all institutions. Here’s how advisors play into that grand vision.

Abnormal Returns

JULY 29, 2024

Podcasts Josh and Michael talk with Alec Crawford, CEO of AI Risk, about the future of financial advice, how AI will be used by most advisors, and the critical role of AI cybersecurity in the financial industry (youtube.com) Michael Kitces talks with John Bowen, CEO and founder of CEG Worldwide and CEG Insights, about what makes advisory firms work.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

JULY 29, 2024

Cryptocurrency ETFs were among those posting the best returns over the last year.

Nerd's Eye View

JULY 29, 2024

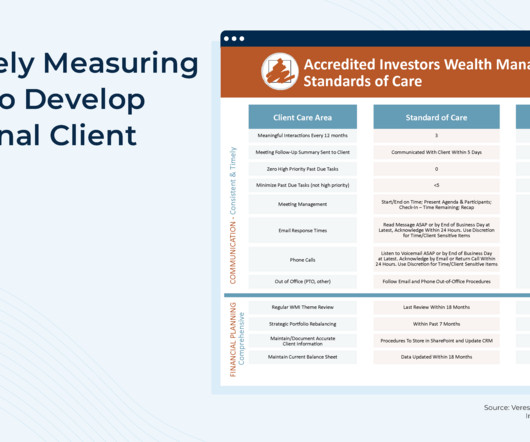

Most financial advisors strive to provide excellent client care and prioritize a systematic process to maintain regular communication with their clients both on a scheduled (e.g., annual meeting) and an "on demand" basis. And while individual advisors running solo firms are often able to intuitively sense when they're delivering their best, as they grow and scale their firms, that same advisor eventually goes from individually 'owning' every client relationship to sharing the workload with first

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

JULY 29, 2024

Altos reports that active single-family inventory was up 1.3% week-over-week. Inventory is now up 37.1% from the February seasonal bottom. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of July 26th, inventory was at 677 thousand (7-day average), compared to 668 thousand the prior week. This is the highest level of inventory since June 2020 ; however, inventory is still far below pre-pandemic levels.

Wealth Management

JULY 29, 2024

How style drift and allocation decisions are clouding the picture for perpetual BDC investors.

Calculated Risk

JULY 29, 2024

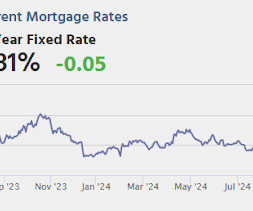

From Matthew Graham at Mortgage News Daily: Mortgage Rates Start Week at 6 Month Lows Although the range has been very narrow for the past few weeks, average mortgage rates nonetheless fell to the lowest levels in more than 6 months. Top tier conventional 30yr fixed scenarios are well into the high 6's now, with our proprietary daily average at 6.81, matching the levels seen on July 15th and 18th.

Wealth Management

JULY 29, 2024

Is convergence a fad or will it define the winners and losers in the DC world?

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

JULY 29, 2024

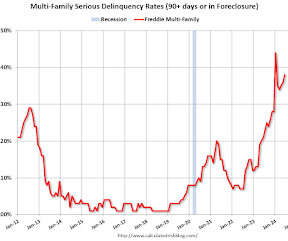

Today, in the Calculated Risk Real Estate Newsletter: Fannie and Freddie: Single Family Serious Delinquency Rate Mostly Unchanged in June, Multi-family Increased Brief excerpt: Single-family serious delinquencies were mostly unchanged in June, and multi-family serious delinquencies increased again. Freddie Mac reports that the multi-family delinquencies rate increased to 0.38% in June, up from 0.36% in April, but down from the recent peak of 0.44% in January.

Wealth Management

JULY 29, 2024

How style drift and allocation decisions are clouding the picture for perpetual BDC investors.

Calculated Risk

JULY 29, 2024

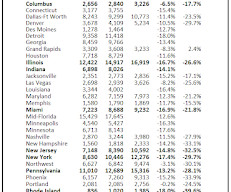

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in June and a Look Ahead to July Sales A brief excerpt: In June, sales in these markets were down 13.1% YoY. Last month, in May, these same markets were down 0.1% year-over-year Not Seasonally Adjusted (NSA). This was a year-over-year decrease NSA for these markets.

Wealth Management

JULY 29, 2024

The eight new Ether exchange-traded funds minted following last week’s approval from the US Securities and Exchange Commission took in $1.17 billion in the four trading days ended July 26.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Discipline Funds

JULY 29, 2024

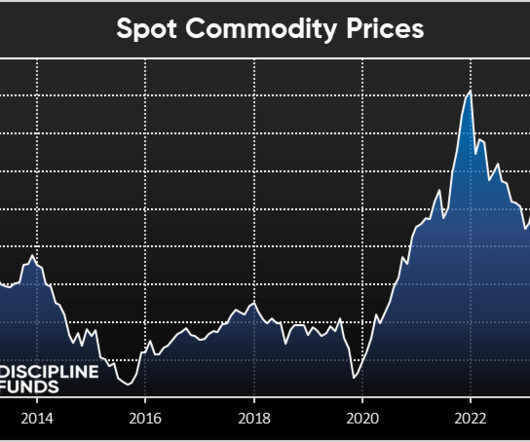

Here are three things I think I am thinking about to start the week. Let’s talk about three big asset classes… 1) Commodities and an inflation resurgence. I think I’ve had a decent track record on inflation over the last few years during a pretty tumultuous period of inflation. Early in Covid I said the huge government deficits created high inflation risk.

Wealth Management

JULY 29, 2024

Ellen Zentner will lead the new thematic and macro investing team at Morgan Stanley’s Global Investment Office starting Aug. 1.

Advisor Perspectives

JULY 29, 2024

Baby boomers need to be concerned about worst cases because the rest of their lives could be ruined by the next crash, and with $70 trillion at risk the stakes are high for them and their heirs. So rather than averages, let’s look at worst cases. That’s what baby boomers need to protect against.

NAIFA Advisor Today

JULY 29, 2024

The award recognizes NAIFA members who achieve extraordinary professional success before age 40 and will be awarded at the combined Apex and National Leadership Conference in September 2024.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Advisor Perspectives

JULY 29, 2024

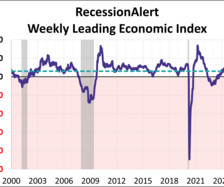

The weekly leading economic index (WLEI) is a composite for the U.S economy that draws from over 20 time-series and groups them into the following six broad categories which are then used to construct an equally weighted average. As of July 19th, the index was at 18.120, down 1.757 from the previous week, with 4 of the 6 components in expansion territory.

Carson Wealth

JULY 29, 2024

The S&P 500 fell 0.8% last week, declining for the second consecutive week, but there’s still a lot of strength under the surface, as the small cap Russell 2000 Index climbed 3.5%. While we do expect continued outperformance by small caps, recent small cap strength also suggests the bull market in the S&P 500 will continue. Second quarter real GDP growth surprised to the upside coming in at 2.8% compared to a consensus expectation of 2.0%.

XY Planning Network

JULY 29, 2024

So, you’ve decided to go independent and are committed to starting your RIA. Congrats! This is an exhilarating step for many soon-to-be business owners as you visualize your best life, dream practice, and ideal clients. What often gets overlooked until much later in the planning phase is registering as an investment adviser at the State or SEC level and how to prepare for that effectively.

Alpha Architect

JULY 29, 2024

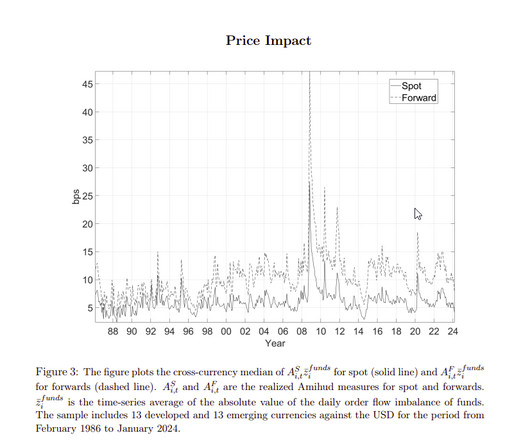

Transaction costs have a first-order effect on the performance of currency portfolios. Proportional costs based on quoted bid–ask spread are relatively small, but when a fund is large, costs due to the trading volume price impact are sizable and quickly erode returns, leaving many popular strategies unprofitable. Transaction costs for asset allocation and foreign exchange markets was originally published at Alpha Architect.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Advisor Perspectives

JULY 29, 2024

Clearly, managing windfall wealth requires more than financial acumen. It calls for careful planning, emotional resilience, and trusted advice. Engaging an experienced financial advisor is crucial for setting realistic lifestyle and legacy goals, understanding investment strategies, and managing risks.

Harness Wealth

JULY 29, 2024

In this guest post, Harness Tax Advisory Council member, Griffin Bridgers, J.D., LL.M. covers some of the top estate planning trends that tax advisors should be tracking during the second half of 2024. Now that the mid-point of 2024 has passed, we are faced with an environment where little has changed with respect to the wait-and-see posture of estate and wealth transfer planning.

A Wealth of Common Sense

JULY 29, 2024

Today’s Talk Your Book is brought to you by BlackRock: See here to learn more about BlackRock’s full suite of ETFs On today’s show, we discuss: Dissecting the Bitcoin ETF launch What’s popular right now within thematics The 5 pillars of Mega Forces The manufacturing and infrastructure theme Trading volume within IBIT The Ethereum ETF launch The fee war within crypto BlackRock’s house view.

NAIFA Advisor Today

JULY 29, 2024

David McKnight is a best-selling author, dynamic speaker, and expert in the field of tax mitigation in retirement planning. He is also a keynote speaker at NAIFA's Apex and National Leadership Conference , September 19-21 at the Arizona Biltmore. Over the past 23 years McKnight has helped put thousands of Americans on the road to the zero percent tax bracket.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Advisor Perspectives

JULY 29, 2024

Six of our eight indexes on our world watch list have posted gains through July 29th, 2024. The U.S.'s S&P 500 finished in the top spot with a YTD gain of 15.20%. Tokyo's Nikkei 225 finished in second with a YTD gain of 14.95% while India's BSE SENSEX finished in third with a YTD gain of 13.16%.

Cornerstone Financial Advisory

JULY 29, 2024

Weekly Market Insights | July 29th, 2024 Down Corporate Reports Shake Investors Stocks had a mixed, see-saw week as disappointing corporate reports unsettled investors who appeared to rotate away from some leading groups in favor of other names. The Dow Jones Industrial Average picked up 0.75 percent. Meanwhile, the Standard & Poor’s 500 Index declined 0.83 percent, and the Nasdaq Composite Index dropped 2.08 percent.

Advisor Perspectives

JULY 29, 2024

Economic indicators are released every week to provide insight into the overall health and performance of an economy.

Carson Wealth

JULY 29, 2024

It’s been an exciting Q2 for us at Carson Wealth Pella, and we have plenty of exciting news to share, starting with a new face in the office. Meet Summer Intern Cole Hillman Cole is our summer intern at Carson Wealth Pella, serving as a Client Services Intern. Cole is a student-athlete at Bethel University in Minneapolis, and as a Finance major, he brings a wealth of knowledge and determination to his role.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content