Fasten Your Seat Belts

Advisor Perspectives

JANUARY 25, 2025

The Northern Trust Economics team shares its outlook for key APAC markets.

Advisor Perspectives

JANUARY 25, 2025

The Northern Trust Economics team shares its outlook for key APAC markets.

Calculated Risk

JANUARY 25, 2025

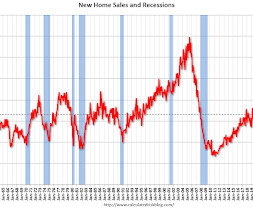

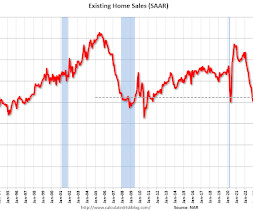

The key reports scheduled for this week are the advance estimate of Q4 GDP, December New Home sales, December Personal Income and Outlays and November Case-Shiller house prices. The FOMC meets this week, and no change to policy is expected. -- Monday, January 27th -- 8:30 AM: Chicago Fed National Activity Index for December. This is a composite index of other data. 10:00 AM: New Home Sales for December from the Census Bureau.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Advisor Perspectives

JANUARY 25, 2025

A seemingly unstoppable flood of money has Vanguard Group Inc. on the brink of claiming a crown that State Street Corp. has held for decades.

Calculated Risk

JANUARY 25, 2025

At the Calculated Risk Real Estate Newsletter this week: Click on graph for larger image. NAR: Existing-Home Sales Increased to 4.24 million SAAR in December NMHC on Apartments: "Looser market conditions for the tenth consecutive quarter 1.73 million Total Housing Completions in 2024 including Manufactured Homes; Most Since 2006 4th Look at Local Housing Markets in December 3rd Look at Local Housing Markets in December This is usually published 4 to 6 times a week and provides more in-depth

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Advisor Perspectives

JANUARY 25, 2025

Apple Inc.’s stock has had a rough start to the year and is now flirting with a key level that could signal more downside ahead if breached.

Calculated Risk

JANUARY 25, 2025

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. SPECIAL NOTE: The CDC has stopped releasing health data (hopefully temporarily). For deaths, I'm currently using 4 weeks ago for "now", since the most recent three weeks will be revised significantly. Note: " Effective May 1, 2024, hospitals are no longer required to report COVID-19 hospital admissions, hospital capacity, or hospital occupancy data. " So I'm no longer tracking hospitalizations.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

The Big Picture

JANUARY 25, 2025

The weekend is here! Pour yourself a mug of Colombia Tolima Los Brasiles Peaberry Organic coffee, grab a seat by the fire, and get ready for our longer-form weekend reads: How Long Can Toyota Put Off Figuring Out EVs? The worlds No. 1 automaker has kept its focus on hybrids and gas-guzzlers, for better and worse. ( Businessweek ) The Spectacular Burnout of a Solar Panel Salesman : He thought hed make millions of dollars selling solar panels door-to-door.

Advisor Perspectives

JANUARY 25, 2025

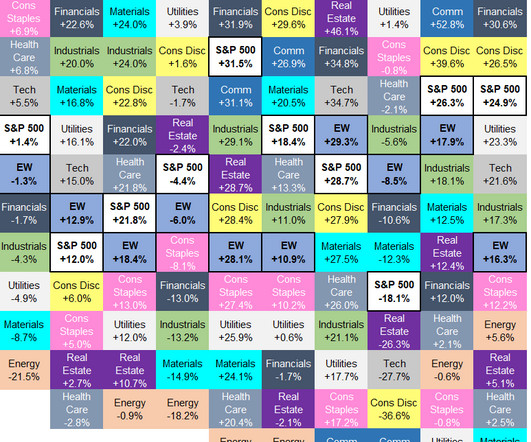

For stocks, Christmas came with a 'Santa Clause' rally soon after the election. Since then, there's been a correction in US markets.

Random Roger's Retirement Planning

JANUARY 25, 2025

We have a lot of ground to cover today involving volatility and portfolio construction. The starting point is a podcast featuring Jeff Park from Bitwise. Jeff has some interesting takes on some topics but there is also a fair bit of sifting required to get to the good stuff. Where the utility came in was taking a second order effect from what he was saying.

Indigo Marketing Agency

JANUARY 25, 2025

The financial advisory world is evolving faster than ever. To thrive, advisors must learn from todays top influencersleaders who push boundaries, share insights, and spark innovation. Here are the 30 voices to follow in 2025, along with rising stars you shouldnt miss. 1. Michael Kitces Reason to Follow: Deep insights into financial planning and wealth management Michael Kitces continues to dominate as a thought leader in financial planning.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Validea

JANUARY 25, 2025

In an era where market volatility and economic uncertainty can quickly expose corporate weaknesses, high-quality stocks have proven to be resilient cornerstones of successful investment portfolios. These exceptional companies typically demonstrate consistent earnings growth, strong balance sheets, and durable competitive advantages that allow them to maintain high returns on capital even during challenging times.

Advisor Perspectives

JANUARY 25, 2025

In a small Texas city nearly 200 miles west of Dallas, the first data center associated with the $100 billion Stargate venture from OpenAI, SoftBank Group Corp. and Oracle Corp. is taking shape.

Abnormal Returns

JANUARY 25, 2025

Autos Car makers have a lot of data about your driving patterns. (wired.com) Drivers don't like them, but speed cameras help reduce crashes. (amny.com) NYC congestion pricing has helped reduce crashes. (nyc.streetsblog.org) Energy The energy transition is happening because of solar's falling costs. (klementoninvesting.substack.com) Pulling out of the Paris Accord complicates life for oil companies.

Discipline Funds

JANUARY 25, 2025

Here are some things I think I am thinking about this weekend. 1) There’s Still a Strong Disinflationary Bias at Work. One of the most important pieces of news this week was the New Tenants Rent Index. The NTRI leads the actual CPI rental data and came in at a the lowest rate of change this cycle at -2.4%. This has been and continues to be the main reason why I am not really worried about inflation flaring up again.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Let's personalize your content