Estate Planning in a Spooky 2024 Landscape

Wealth Management

OCTOBER 2, 2024

Five ways to turn potential tax scares into sweet savings.

Wealth Management

OCTOBER 2, 2024

Five ways to turn potential tax scares into sweet savings.

Abnormal Returns

OCTOBER 2, 2024

Markets The U.S. is roughly 50% of global market cap. (apolloacademy.com) Are small cap stocks declining in quality? (advisorperspectives.com) Finding and exploiting an edge costs both time and money. (riskofruinpod.substack.com) Gen Z is getting a jump start on investing compared to prior generations. (downtownjoshbrown.com) Eli Lilly Can Eli Lilly ($LLY) avoid the boom/bust cycle of other pharma companies?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

OCTOBER 2, 2024

All assets were distributed to the decedent’s husband.

Calculated Risk

OCTOBER 2, 2024

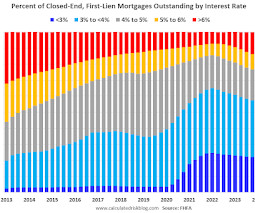

Today, in the Calculated Risk Real Estate Newsletter: FHFA’s National Mortgage Database: Outstanding Mortgage Rates, LTV and Credit Scores A brief excerpt: Here are some graphs on outstanding mortgages by interest rate, the average mortgage interest rate, borrowers’ credit scores and current loan-to-value (LTV) from the FHFA’s National Mortgage Database through Q2 2024 (just released).

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

OCTOBER 2, 2024

Grewal’s last day will be Oct. 11. He joined the commission in 2021 and has overseen numerous notable cases, including the first actions related to Regulation Best Interest.

Abnormal Returns

OCTOBER 2, 2024

Podcasts Jill Schlesinger talks with Bill McBride of Calculated Risk about the state of the housing market. (youtube.com) Barry Ritholtz talks with Jeremy Schwartz about stocks for the long run. (ritholtz.com) Khe Hy talks about the pros and cons of cashing out in a company IPO with Rick Foerster. (youtube.com) Dan Haylett talks about the evolution of the 4% safe withdrawal rate with Bill Bengen.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

OCTOBER 2, 2024

From ADP: ADP National Employment Report: Private Sector Employment Increased by 143,000 Jobs in September; Annual Pay was Up 4.7% Private sector employment increased by 143,000 jobs in September and annual pay was up 4.7 percent year-over-year, according to the September ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”).

Wealth Management

OCTOBER 2, 2024

The deal with FinTrust Capital Advisors adds $2.39 billion in AUM and expands Wealth Enhancement Group’s presence in the Southeast.

Nerd's Eye View

OCTOBER 2, 2024

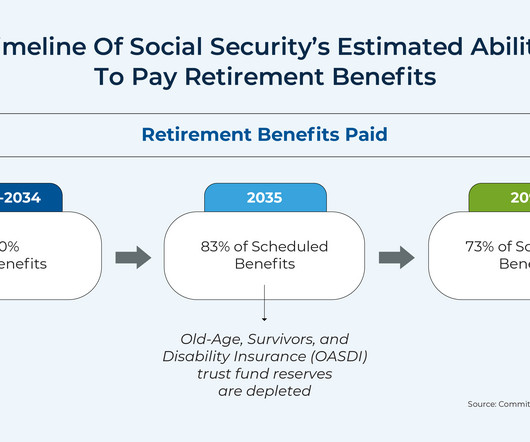

Given the frequent news headlines on the (un)sustainability of the Social Security system, many working-age financial advisory clients might harbor doubts about receiving their full estimated Social Security benefits (and many current Social Security recipients might be concerned that they will not continue to receive their full benefits throughout the remainder of their lives).

Wealth Management

OCTOBER 2, 2024

Fixed-income strategies dominated, with over 60 new ETFs in that segment alone amid a torrent of new funds.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

OCTOBER 2, 2024

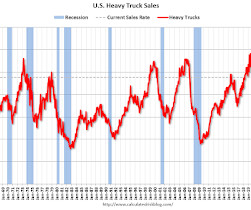

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the September 2024 seasonally adjusted annual sales rate (SAAR) of 477 thousand. Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new record high of 570 thousand SAAR in April 2019.

Wealth Management

OCTOBER 2, 2024

Open, honest and candid discussion about Empower acquiring a stock option administrator, forefeiture lawsuits, group plans, HSAs and more.

Calculated Risk

OCTOBER 2, 2024

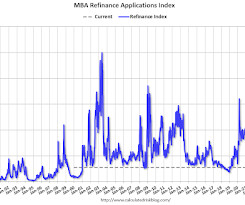

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey Mortgage applications decreased 1.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending September 27, 2024. The Market Composite Index, a measure of mortgage loan application volume, decreased 1.3 percent on a seasonally adjusted basis from one week earlier.

Wealth Management

OCTOBER 2, 2024

Election season, economic instability and inflation, artificial intelligence and succession planning top the list.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

The Big Picture

OCTOBER 2, 2024

At The Money: Finding Overlooked Private Investments , with Soraya Darabi, TMV (October 02, 2024) The Efficient Market Hypothesis informs us that stock markets reflect all of the information known about any company. But is that also true for start-ups and venture-funded private companies? As it turns out, it depends on where you look… Full transcript below. ~~~ About this week’s guest : Soraya Darabi, partner in the venture firm TMV.

Wealth Management

OCTOBER 2, 2024

How to build client relationships, the key to advisor success.

Calculated Risk

OCTOBER 2, 2024

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 224 thousand initial claims, up from 218 thousand last week. • At 10:00 AM, the ISM Services Index for September.

Wealth Management

OCTOBER 2, 2024

Altium, which has offices in New York and Connecticut, is adding Kimblery Clouse and Kristen Caseley to expand its footprint in the Northeast.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

The Big Picture

OCTOBER 2, 2024

At The Money: Finding Overlooked Private Investments , with Soraya Darabi, TMV (October 02, 2024) We expect our investments to generate positive financial returns, but can they also have a positive societal effect? Can your capital make an impact? Full transcript below. ~~~ About this week’s guest : Soraya Darabi, partner in the venture firm TMV. She has been an early investor in companies that went public such as FIGS, Casper, and CloudFlare, as well as startups like Gimlett and Lightwell, th

Wealth Management

OCTOBER 2, 2024

The personal financial administration firm has been building out its C-Suite with an eye towards growth and bringing the technology down-market.

Advisor Perspectives

OCTOBER 2, 2024

By aligning your event format with the brain’s natural tendencies, you can create more engaging, effective, and enjoyable experiences for your audience.

Wealth Management

OCTOBER 2, 2024

What is the role your charitable clients can play in the economic development of disadvantaged communities and how does the IRS view charitable activities that can support it?

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Indigo Marketing Agency

OCTOBER 2, 2024

How Often Should Financial Advisors Post to Social Media? You already know that social media plays a vital role in your overall marketing strategy. But a common question many advisors ask is: How often should I be posting on social media? While there’s no one-size-fits-all answer, the frequency and quality of your posts can make a significant difference in how effectively you engage with your audience.

Wealth Management

OCTOBER 2, 2024

A potentially creative solution to a serious problem.

Advisor Perspectives

OCTOBER 2, 2024

Earned media acts as a third-party stamp of approval for your firm, generating more referrals while boosting existing referrals.

Wealth Management

OCTOBER 2, 2024

The quality of smaller listed companies has deteriorated as raising private capital becomes easier than ever.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Advisor Perspectives

OCTOBER 2, 2024

A lot of people are worried about the shrinking number of public companies in the US, but quality is an even bigger problem than quantity.

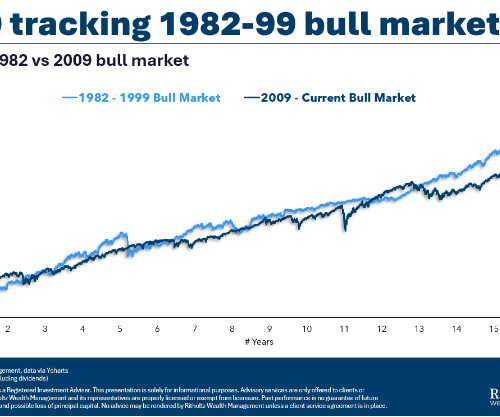

A Wealth of Common Sense

OCTOBER 2, 2024

Today’s Animal Spirits is brought to you by YCharts and Fabric: See here for more information on which asset classes perform the best as inflation drops Go to meetfabric.com/spirits for more information on life insurance from Fabric by Gerber Life On today’s show, we discuss: List: Ways to donate and help flood victims in Western North Carolina after Hurricane Helene Zillow home listings to feature climate.

Trade Brains

OCTOBER 2, 2024

In the era of technological advancements across the globe, some sectors would benefit the most, such as electric vehicles and solar power. People need to mitigate the risks of Climate change and overcoming these sectors looks promising in the longer run. The companies are trying to grab the opportunities arising from these sectors which various governments push through policies.

Harness Wealth

OCTOBER 2, 2024

Table of Contents: Tip 1: Create and Optimize Your Website for Lead Generation Tip 2: Leverage Content Marketing to Build Authority Tip 3: Build a Social Media Presence Tip 4: Leverage Email Marketing to Nurture Leads Tip 5: Host Webinars or Virtual Workshops Additional Digital Marketing Tactics for Tax Advisors Building a thriving tax advisory business goes beyond providing excellent tax planning services.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content