Nobody Knows Anything, Dot Plot Edition

The Big Picture

SEPTEMBER 22, 2023

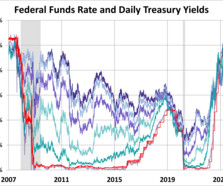

The September Federal Reserve meeting is behind us we still have November and December ahead of us. Markets are nervous expecting another hike before years over before two cuts in 2024. My advice: ignore those expectations as they have been wildly inaccurate over the past few years; they have been mostly inaccurate over the past decade. When it comes to forecasting economic outcomes, the Fed is no better or worse than anybody else.

Let's personalize your content