Morgan Stanley Snags $700M Merrill Advisor Group

Wealth Management

JANUARY 31, 2025

The Zelin Group and its five advisors made the move after the lead partner, Jonathan Zelin, had been with Merrill for more than seven years.

Wealth Management

JANUARY 31, 2025

The Zelin Group and its five advisors made the move after the lead partner, Jonathan Zelin, had been with Merrill for more than seven years.

Nerd's Eye View

JANUARY 31, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that following the change of administration (and a new incoming chair of the SEC), the Investment Adviser Association is seeking to find ways to help RIAs (particularly smaller firms) manage the compliance responsibilities they face.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JANUARY 31, 2025

Summit Financial's investment in Genex Consulting represents the firm's first of the year.

Calculated Risk

JANUARY 31, 2025

Today, in the Calculated Risk Real Estate Newsletter: Freddie Mac House Price Index Increased in December; Up 4.0% Year-over-year A brief excerpt: Freddie Mac reported that its National Home Price Index (FMHPI) increased 0.54% month-over-month on a seasonally adjusted (SA) basis in December. On a year-over-year basis, the National FMHPI was up 4.0% in December, up from up 3.9% YoY in November.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Wealth Management

JANUARY 31, 2025

F2 Strategy co-founder Doug Fritz provides his take on the most important wealth management technology news of the last month.

Calculated Risk

JANUARY 31, 2025

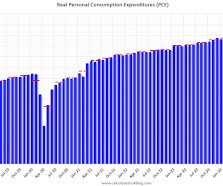

The BEA released the Personal Income and Outlays report for December: Personal income increased $92.0 billion (0.4 percent at a monthly rate) in December , according to estimates released today by the U.S. Bureau of Economic Analysis. Disposable personal income (DPI)personal income less personal current taxesincreased $79.7 billion (0.4 percent) and personal consumption expenditures (PCE) increased $133.6 billion (0.7 percent).

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

JANUARY 31, 2025

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. For deaths, I'm currently using 4 weeks ago for "now", since the most recent three weeks will be revised significantly. Note: " Effective May 1, 2024, hospitals are no longer required to report COVID-19 hospital admissions, hospital capacity, or hospital occupancy data. " So I'm no longer tracking hospitalizations.

Wealth Management

JANUARY 31, 2025

Planning charitable gifts? Don't forget non-cash contributions.

Calculated Risk

JANUARY 31, 2025

From Goldman: We launched our Q1 GDP tracking estimate at +2.6% (quarter-over-quarter annualized) and our Q1 domestic final sales estimate at +2.3%. We launched our past-quarter GDP tracking estimate at +2.3%, in line with the advance reading. [Jan 31st estimate] emphasis added And from the Atlanta Fed: GDPNow The initial GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2025 is 2.9 percent on January 31.

Wealth Management

JANUARY 31, 2025

Different ways a client can donate life insurance.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Abnormal Returns

JANUARY 31, 2025

Strategy Timing the market requires getting two decision right. (awealthofcommonsense.com) On the benefits of embracing failure. (theatlantic.com) Trading Questions remain about how all-day stock trading would work. (on.ft.com) Kalshi is moving to make its contracts available more widely. (nytimes.com) Apple Services revenue keeps growing at Apple ($AAPL).

Wealth Management

JANUARY 31, 2025

Topics and resources to help guide your clients charitable giving.

Alpha Architect

JANUARY 31, 2025

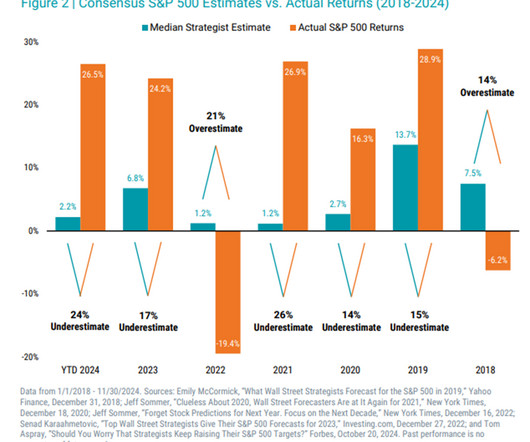

In 2024 investors were provided with nine lessons. Many of them are repeats from prior years. Unfortunately, too many investors fail to learn themthey keep making the same errors. Nine Lessons the Market Taught in 2024 was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Wealth Management

JANUARY 31, 2025

When Mallouk took over Creative Planning more than two decades ago, its clients numbered in the dozens. In September, TPG acquired a minority stake in a deal that valued the RIA at $16 billion.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

A Wealth of Common Sense

JANUARY 31, 2025

Financial markets are always interesting in the information age because the narratives change even faster than Ali Larter’s mood swings at a family meal in Landman.1 Two years ago everyone was convinced we were going into a recession. It was the most over-forecasted recession of all-time that never happened. Now no one thinks a recession is a possibility and the worries have shifted to concerns about a speculative b.

Wealth Management

JANUARY 31, 2025

In earnings calls, both Raymond James and Ameriprise cited strong recruiting pipelines as they beat analysts income estimates.

Advisor Perspectives

JANUARY 31, 2025

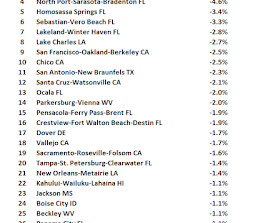

The Chicago Purchasing Managers’ Index (Chicago Business Barometer) edged up in January but remains historically low. The index rose to 39.5 from 36.9 in December, marking its first increase in four months. However, it fell short of the 40.3 forecast and remained in contraction territory for the 14th consecutive month.

Wealth Management

JANUARY 31, 2025

When Mallouk took over Creative Planning more than two decades ago, its clients numbered in the dozens. In September, TPG acquired a minority stake in a deal that valued the RIA at $16 billion.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Advisor Perspectives

JANUARY 31, 2025

Personal income ( excluding transfer receipts ) rose 0.4% in December and is up 4.6% year-over-year. However, when adjusted for inflation using the BEA's PCE Price Index, real personal income (excluding transfer receipts) was up 0.2% month-over-month and up 2.0% year-over-year.

Meb Faber Research

JANUARY 31, 2025

Savita Subramanian came on the podcast last week and did not disappoint! Savita is the Head of US Equity Strategy and Quantitative Strategy at Bank of America and one of the most followed investment strategists on Wall Street. If you missed the episode, dont worryIve pulled out some highlights (and a couple of her epic […] The post My Conversation with Bank of America’s Savita Subramanian appeared first on Meb Faber Research - Stock Market and Investing Blog.

Advisor Perspectives

JANUARY 31, 2025

The yield on the 10-year note ended January 31, 2025 at 4.58%. Meanwhile, the 2-year note ended at 4.22% and the 30-year note ended at 4.83%.

Carson Wealth

JANUARY 31, 2025

This week on Take 5, Ryan Detrick, Chief Market Strategist at Carson Group, and Sonu Varghese, VP, Global Macro Strategist at Carson Group, discuss the sudden rise of Deep Seek, a new AI company out of China, and its sudden impact on the markets: The markets reaction to Deep Seeks rapid rise How Chinas technological growth is reshaping global AI competition What cheaper AI could mean for the broader economy and market sectors Tune in as they break down why this sudden development is shaking up t

Speaker: Duke Heninger, Partner and Fractional CFO at Ampleo & Creator of CFO System

Are you ready to elevate your accounting processes for 2025? 🚀 Join us for an exclusive webinar led by Duke Heninger, a seasoned fractional CFO and CPA passionate about transforming back-office operations for finance teams. This session will cover critical best practices and process improvements tailored specifically for accounting professionals.

Advisor Perspectives

JANUARY 31, 2025

With the release of December's report on personal incomes and outlays, we can now take a closer look at "real" disposable personal income per capita. At two decimal places, the nominal 0.32% month-over-month change in disposable income comes to 0.06% when we adjust for inflation. The year-over-year metrics are 4.22% nominal and 1.63% real.

MainStreet Financial Planning

JANUARY 31, 2025

My kitchen was in desperate need of a makeover. The cabinets were over 25 years old, the appliances were about 10 years old, and the original layout had a few problem areas that needed fixing. My husband and I had spent 11+ years dealing with private school tuition for our sons, so we finally had some breathing room in our budget to tackle this deferred home maintenance.

Advisor Perspectives

JANUARY 31, 2025

The BEA's Personal Income and Outlays report showed inflation remained elevated at the end of 2024. The Fed’s preferred inflation gauge, the PCE price index, rose 2.6% year-over-year in December and 0.3% from November, aligning with expectations.

Inside Information

JANUARY 31, 2025

In one of my periodic e-messages to my mailing list (more than 8,000 advisors currently) I repeated a complaint that I constantly hear from Joel Bruckenstein and other leading tech consultants. They have told me that one of the major dysfunctions in the advisor community is that tech adoption tends to be slow and cautious. This (they believe) is increasingly dysfunctional today, as powerful new tech capabilities (some of them made possible by AI) are coming to market faster than ever before.

Speaker: Ashley Harlan, MBA

What if your role as a fractional CFO went beyond operational support to actively shaping the future of your clients’ businesses? 💼 ✨ In this session, discover how fractional finance professionals can position themselves as architects of growth, guiding their clients toward sustainable success and preparing them for full-time financial leadership.

Advisor Perspectives

JANUARY 31, 2025

Investors may be at a crossroad in early 2025. US equities have recovered from the 2022 bear market with two exceptional years of +25% returns.

Validea

JANUARY 31, 2025

Dividend growth stocks represent a powerful cornerstone for building long-term wealth, offering investors a unique combination of current income and potential capital appreciation. These companies, which consistently increase their dividend payments year after year, typically demonstrate strong financial health, stable business models, and a commitment to shareholder returns.

Advisor Perspectives

JANUARY 31, 2025

The S&P 500 see-sawed through a data-packed week but ultimately closed with a 1.0% loss from last Friday. The index now sits 1.28% below its record close on January 23, 2025 and is up 2.93% year to date.

Wealth Management

JANUARY 31, 2025

The investment manager, who will advise on investments and financial products for Truth.fi, has a prior relationship with Trump Media and beat out SEC allegations of falsifying investment results in 2018.

Speaker: Abdi Ali, Sr. Lease Accounting Consultant

Join this insightful webinar with industry expert Abdi Ali, who will discuss the challenges that can arise from managing lease accounting with spreadsheets! He will share real-world examples of errors, compliance issues, and risks that may be present within your spreadsheets. Learn how these tools, while useful, can sometimes lead to inefficiencies that affect your time, resources, and peace of mind.

Let's personalize your content