Navigating the Complexities of Medicare in Financial and Estate Planning

Wealth Management

JUNE 12, 2024

Four key considerations for advisors regarding Medicare.

Wealth Management

JUNE 12, 2024

Four key considerations for advisors regarding Medicare.

Calculated Risk

JUNE 12, 2024

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey Mortgage applications increased 15.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending June 7, 2024. The Market Composite Index, a measure of mortgage loan application volume, increased 15.6 percent on a seasonally adjusted basis from one week earlier.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JUNE 12, 2024

The chief investment officers for T. Rowe Price and Schwab Asset Management discussed disconnects between how RIAs and retail investors view current opportunities.

Calculated Risk

JUNE 12, 2024

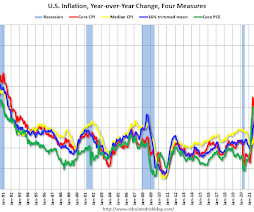

The Cleveland Fed released the median CPI and the trimmed-mean CPI. According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% in May. The 16% trimmed-mean Consumer Price Index increased 0.1%. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

JUNE 12, 2024

Open, honest and candid discussion about May's job numbers, managed accounts lawsuits, OneDigital and a 'second' golden age for the 401(k) industry.

Abnormal Returns

JUNE 12, 2024

Podcasts Barry Ritholtz talks with Larry Swedroe about avoiding distractions. (ritholtz.com) Katie Gatti Tassin talks with Katy Song of Domain Money about how to break up with your financial advisor. (podcast.moneywithkatie.com) Thomas Kopelman and Jacob Turner talk about finding your enough. (podcasts.apple.com) Sam Parr talks with the owner of a 24,000 square foot house.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

JUNE 12, 2024

Financial advisors, as professionals whose clients rely on their advice to make financial decisions, are legally and financially responsible for the advice that they give. For example, if an advisor recommends an investment that prioritizes the commission they would receive rather than any benefit the client would derive from it, they could incur fines and sanctions for violating their fiduciary duty as an advisor.

Wealth Management

JUNE 12, 2024

The funding will be put toward research and development, hiring and enhancements to data quality.

Calculated Risk

JUNE 12, 2024

Here are a few measures of inflation: The first graph is the one Fed Chair Powell had mentioned when services less rent of shelter was up around 8% year-over-year. This declined, but has turned up recently, and is now up 5.0% YoY. Click on graph for larger image. This graph shows the YoY price change for Services and Services less rent of shelter through May 2024.

Wealth Management

JUNE 12, 2024

The late musician's Beverly Hills home is at the center of the dispute.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Calculated Risk

JUNE 12, 2024

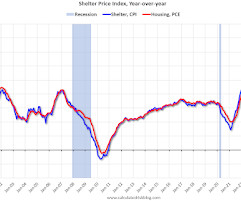

From the BLS : The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in May on a seasonally adjusted basis, after rising 0.3 percent in April, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.3 percent before seasonal adjustment. More than offsetting a decline in gasoline, the index for shelter rose in May, up 0.4 percent for the fourth consecutive month.

Wealth Management

JUNE 12, 2024

Are you ready to help your clients and the next generations of their families?

Calculated Risk

JUNE 12, 2024

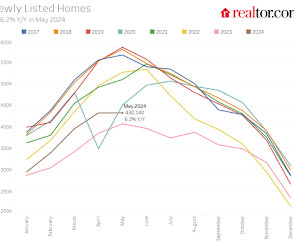

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-June 2024 A brief excerpt: This 2-part overview for mid-May provides a snapshot of the current housing market. I always like to start with inventory, since inventory usually tells the tale ! Here is a graph of new listing from Realtor.com’s May 2024 Monthly Housing Market Trends Report showing new listings were up 6.2% year-over-year in May.

Wealth Management

JUNE 12, 2024

Our experts provide answers to some common questions.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Calculated Risk

JUNE 12, 2024

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 226 thousand initial claims, down from 229 thousand last week. • Also at 8:30 AM, The Producer Price Index for May from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.3% increase in core PPI.

Wealth Management

JUNE 12, 2024

LPL executives Anna Howard and Kimberly Sanders are both highly accomplished leaders in wealth management.

Abnormal Returns

JUNE 12, 2024

Markets Momentum thrusts have to burn out at some point. (mrzepczynski.blogspot.com) Nothing compares to the Nasdaq Internet bubble. (theirrelevantinvestor.com) Strategy Small advantages, consistently applied compound over time. (fortunesandfrictions.com) How to use TIPS in your portfolio. (morningstar.com) Health Why Eli Lilly's ($LLY) Alzheimer's treatment is controversial.

Wealth Management

JUNE 12, 2024

Trust & Will's Andrew Mazabel discusses what's at stake for advisors that don't offer estate planning as a service.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

A Wealth of Common Sense

JUNE 12, 2024

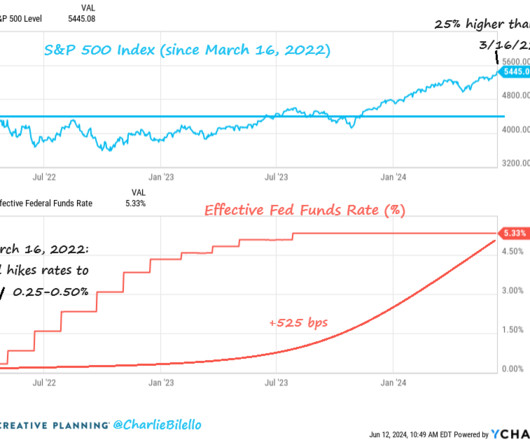

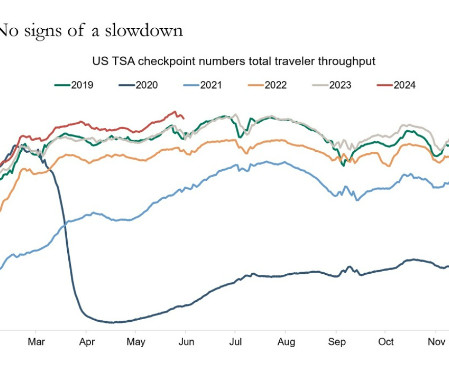

Today’s Animal Spirits is brought to you by Nasdaq and Fabric: See here for more information on Nasdaq’s ETF ecosystem Go to meetfabric.com/spirits for more information on life insurance from Fabric by Gerber Life On today’s show, we discuss: Daily TSA travel data still strong The loneliness of the American worker Why the recession still isn’t here Americans have more investment income than e.

Wealth Management

JUNE 12, 2024

The former Key Client Group has 10 financial professionals across the country and establishes footholds for Summit Trail in Portland, Ore. and Denver.

Random Roger's Retirement Planning

JUNE 12, 2024

Bloomberg had a longish writeup about quantitative investment strategies or QIS. The very basic idea seems to be that it is in the neighborhood of being strategy replication. From the article, QIS are usually structured products or swaps that target risk premia with the following list of different strategies provided in the article. Risk premia is a fancy term often ascribed to alternative strategies.

Wealth Management

JUNE 12, 2024

TIFIN's founder discusses the opportunities and challenges AI presents and the importance of adaptability for achieving success.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Advisor Perspectives

JUNE 12, 2024

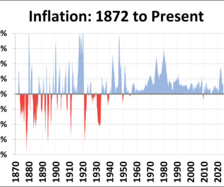

Let's do some analysis of the Consumer Price Index, the best-known measure of inflation. The Bureau of Labor Statistics (BLS) divides all expenditures into eight categories and assigns a relative size to each. The pie chart illustrates the components of the Consumer Price Index for Urban Consumers, the CPI-U.

Wealth Management

JUNE 12, 2024

Sound Income Strategies CEO David Scranton describes why growth might not be the only goal of clients nearing retirement.

Advisor Perspectives

JUNE 12, 2024

Consider toning your prospecting efforts by prioritizing referrals and integrating them into your broader strategy for sustainable growth.

Wealth Management

JUNE 12, 2024

Envestnet's Dana D'Auria discusses what the driving forces are behind this shift to personalized investments and what they look like.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Trade Brains

JUNE 12, 2024

ITC: ITC, with a legacy spanning over a century, has been a stalwart since its establishment on August 24, 1910. Originating as a tobacco and cigarette manufacturer, the company has evolved significantly. It now encompasses a wide array of sectors including hotels, paperboards, FMCG, packaging, and agribusiness. ITC Hotels, the company that brought meaning to the phrase “responsible luxury,” has announced its demerger.

Wealth Management

JUNE 12, 2024

Goldman Sachs' Jeremy Eisenstein talks about creating choice and growth potential for RIAs in the custodial space.

Advisor Perspectives

JUNE 12, 2024

The Consumer Price Index for Urban Consumers (CPI-U) released for May puts the year-over-year inflation rate at 3.27%. The latest reading keeps inflation below the 3.74% average since the end of the Second World War for the 12th straight month. However, inflation remains above the 10-year moving average which is now at 2.81%.

Wealth Management

JUNE 12, 2024

Transcript of Episode 109 of 401(k) Real Talk.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content