Unlocking the Unrealized Potential in Banks' Wealth Management Programs

Wealth Management

APRIL 12, 2024

The lines between wealth management and banking are blurring, opening up new opportunities, as well as new competition.

Wealth Management

APRIL 12, 2024

The lines between wealth management and banking are blurring, opening up new opportunities, as well as new competition.

Calculated Risk

APRIL 12, 2024

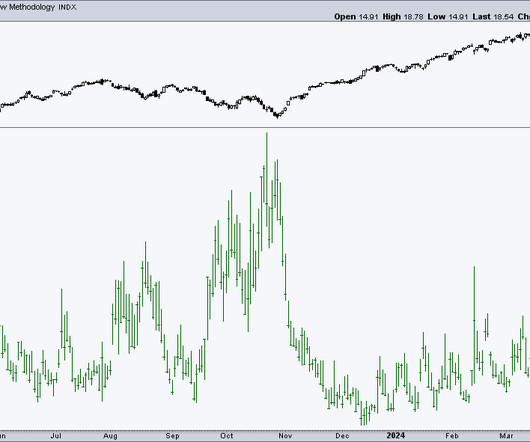

From STR: U.S. hotel results for week ending 6 April U.S. hotel performance showed mixed results from the previous week but positive comparisons year over year, according to CoStar’s latest data through 6 April. 31 March through 6 April 2024 (percentage change from comparable week in 2023): • Occupancy: 64.1% (+4.7%) • Average daily rate (ADR): US$156.96 (+2.1%) • Revenue per available room (RevPAR): US$100.59 (+6.9%) emphasis added The following graph shows the seasonal pattern for the hotel oc

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abnormal Returns

APRIL 12, 2024

Strategy Prospective bond returns are buoying the prospects for a 60/40 portfolio. (axios.com) How indexing came to dominate the investment business. (ritholtz.com) 15 investing principles including 'I believe managing one’s behavior is more important than managing one’s investments.' (betterletter.substack.com) Companies BP ($BP) is the cheapest stock among the giants.

Wealth Management

APRIL 12, 2024

Interaxis' Adam Blumberg shares how cryptocurrencies evolved as trillion-dollar disruptors.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Abnormal Returns

APRIL 12, 2024

Audio The head of the world's largest sovereign wealth fund also hosts a podcast. (wsj.com) The NYTimes will soon offer automated voice narration for nearly all of its articles. (axios.com) You can now listen to Substack podcasts on Spotify ($SPOT). (engadget.com) Is Theo Von the new Joe Rogan? (theatlantic.com) Business Patrick O'Shaughnessy talks with Ken Langone about Home Depot and American capitalism.

Wealth Management

APRIL 12, 2024

Plus, a Los Angeles firm serving the ultra-wealthy taps a CPA from AdvicePeriod to manage multi-family office services and other reported news of the week.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Wealth Management

APRIL 12, 2024

The firms will collectively pay $200,000 to settle the charges, which focused primarily on their use of hypothetical performance.

Nerd's Eye View

APRIL 12, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent study has found that many small- and mid-sized advisory firms that use "supported independence" platforms for their technology and back-office needs, have the potential to see greater growth in the years ahead given the efficiencies gained (and potential cost savings compared to creating a tech stack and hiring their own staff 'a la carte'), and give aspiring firm

Wealth Management

APRIL 12, 2024

As the economy stabilizes, financial advisors are recognizing the benefits of mergers and acquisitions.

Calculated Risk

APRIL 12, 2024

From BofA: Since our update last week, 1Q GDP tracking is down one-tenth to 1.9% q/q saar. [Apr 12th estimate] emphasis added From Goldman: We left our Q1 GDP tracking estimate unchanged at +2.5% (qoq ar) and our Q1 domestic final sales forecast unchanged at +2.6% (qoq ar). [Apr 10th estimate] And from the Altanta Fed: GDPNow The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2024 is 2.4 percent on April 10, down from 2.5 percent on April 4.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

A Wealth of Common Sense

APRIL 12, 2024

According to Redfin, we just hit another new all-time high in the median monthly payment (based on current home prices and mortgage rates): The median payment for a new purchase has doubled since 2021. Mortgage rates were back up to 7.4% this week. Nationwide housing prices are still are all-time highs and up around 50% since the end of 2019. There has been this feeling of something has to give for a while now but nothi.

Alpha Architect

APRIL 12, 2024

While the empirical research on cross-sectional (long-short) momentum has shown that returns have been high, investors have also experienced huge drawdowns—momentum exhibits both high kurtosis and negative skewness. Since 1926 there have been several momentum crashes that featured short, but persistent, periods of highly negative returns. For example, from June to August 1932, the momentum portfolio lost about 91%, followed by a second drawdown from April to July 1933.

Truemind Capital

APRIL 12, 2024

Do you know that direct plans of mutual funds offer much higher returns than regular plans, more than the difference in their expense ratio? To know better, read it till the end. Every mutual fund scheme has two plans to offer – Regular & Direct. Both plans have the same fund manager and the same portfolio. The only difference is the expense ratio.

Advisor Perspectives

APRIL 12, 2024

Consumer sentiment moved sideways for the fourth straight month in April according to the preliminary report for the Michigan Consumer Sentiment Index. The index fell 1.5 points (-1.9%) to 77.9 from the March final. The latest reading was below the forecast of 79.0.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Tobias Financial

APRIL 12, 2024

Tobias Financial Advisors is pleased to announce that Yesenia Realejo, CFP®, Catalina Franco-Cicero, MS, CFP®, CTS , and Edgar Collado, CEPA®, have become new shareholders and co-owners of the firm. Their elevation reflects their unwavering dedication, expertise, and invaluable contributions to our company. Wealth Advisors Yesenia Realejo , CFP® and Catalina Franco-Cicero , MS, CFP®, CTS have continuously exceeded our and our client’s expectations.

Advisor Perspectives

APRIL 12, 2024

The S&P 500 stumbled for a second straight week, posting its biggest weekly loss of the year (-1.55%). The index is currently up 8.02% year to date and now sits 2.49% below its record close from March 28, 2024.

NAIFA Advisor Today

APRIL 12, 2024

Understanding the intersection between financial assets and estate planning is extremely important for maximizing wealth and enhancing asset protection. Join us on Wednesday, May 1, 2024, from 12:00 pm to 1:00 pm Eastern for an in-depth webinar that focuses on aligning your clients' financial assets with their estate planning goals. This session is ideal for professionals looking to deepen their understanding of estate planning essentials like revocable trusts, wills, and powers of attorney, and

Advisor Perspectives

APRIL 12, 2024

The weekly leading economic index (WLEI) is a composite for the U.S economy that draws from over 20 time-series and groups them into the following six broad categories which are then used to construct an equally weighted average. As of March 29th, the index was at 26.520, down 0.103 from the previous week, with 5 of the 6 components in expansion territory.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

WiserAdvisor

APRIL 12, 2024

The role of a financial advisor is indispensable in today’s world. These professionals serve as trusted guides, helping individuals understand the intricacies of investment, wealth management, and financial planning to achieve their long-term goals. The time and attention they can dedicate to each client is a significant contributor to their effectiveness.

Advisor Perspectives

APRIL 12, 2024

Investors wagering on an extension of last year’s global bond gains have been served a harsh reality check.

Tobias Financial

APRIL 12, 2024

When you ask Lonnie Sluchak , CPA, to describe a unique detail about himself, he shares a surprising past. For seven years, Lonnie worked at Home Depot, immersing himself in the world of construction. But that’s not all; during his academic pursuits in accounting, Lonnie also ventured into the travel industry, working as a travel agent. “The travel industry helped me develop crucial customer service skills and taught me the importance of prioritizing client satisfaction,” Lonni

Advisor Perspectives

APRIL 12, 2024

Choosing a school that enables you to graduate with the least amount of debt, or, even better, with no debt at all, is a message more students need to hear.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Validea

APRIL 12, 2024

What is Momentum Investing? Momentum investing is a strategy that aims to capitalize on the continuance of existing trends in the market. It involves buying stocks that have performed well in the recent past and selling those that have performed poorly, based on the idea that those trends will persist in the near-term future. Momentum investors believe that stocks which have outperformed recently will continue to do so, while those that have underperformed will continue lagging.

Advisor Perspectives

APRIL 12, 2024

The US is somehow home to the most valuable electric vehicle producer in the world and, simultaneously, an also-ran in the race for EVs. How did that happen?

Norman Marks

APRIL 12, 2024

I had a lot of fun writing my new novel. Hopefully people will pick it up and enjoy it as well.

Advisor Perspectives

APRIL 12, 2024

As pharma giants spend billions on acquisitions of startups developing new ways to harness radiation in the fight against cancer, the chief executive officer of Perspective Therapeutics Inc. found himself getting top billing at two different industry gatherings this week.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

ModernAdvisor

APRIL 12, 2024

Commentary As expected, the Bank of Canada left the benchmark rate at 5% at their last meeting and maintained the stance that it needs to see further progress that inflation is on the right path. Results from the Bank of Canada’s Q4 Business Outlook Survey released in January showed that high interest rates continue to soften consumer demand, but firms […] The post Market Update – Q1 2024 appeared first on ModernAdvisor Blog.

Advisor Perspectives

APRIL 12, 2024

The stock market has punished Apple Inc. this year for failing to offer a vision of where its future growth will come from. The shares caught a bid Thursday after the tech giant took a step toward providing an answer.

Advisor Perspectives

APRIL 12, 2024

March U.S. consumer prices rose faster than expected. The reacceleration in supercore inflation suggests the strong inflation readings at the start of the year may not have been mere blips.

Advisor Perspectives

APRIL 12, 2024

The S&P 500 has been touching new highs after a rocky start to the first quarter of 2024, and is doing the same thing again at the start of Q2. While market corrections will happen invariably, it’s a reminder that traders can always take advantage of any short-term weakness.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content