UBS Is Latest Facing Cash Sweep Lawsuit

Wealth Management

AUGUST 23, 2024

According to the federal complaint calling for a class action, the firm’s policies “maximize profits for UBS while at the same time disregarding its clients’ best interests.

Wealth Management

AUGUST 23, 2024

According to the federal complaint calling for a class action, the firm’s policies “maximize profits for UBS while at the same time disregarding its clients’ best interests.

Abnormal Returns

AUGUST 23, 2024

The biz Apple ($AAPL) is losing its dominance as a podcast player. (bloomberg.com) Apple has launched a web app for podcasts. (theverge.com) The story of how Alex Cooper of “Call Her Daddy” fame went from unemployed to a nine-figure deal with SiriusXM. (readtrung.com) How Stephen West's 'Philosophize This' podcast became a hit. (substack.com) Nate Silver Jeff Ma and Rufus Peabody talk with Nate Silver author of "On the Edge.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 23, 2024

Verity Larsen, Founder and CEO of Versoft Consulting, discusses key strategies for a seamless post-deal integration strategy.

Abnormal Returns

AUGUST 23, 2024

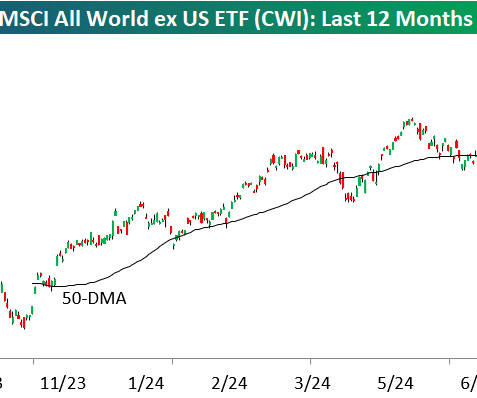

Markets Nvidia ($NVDA) is larger than all countries, except four. (allstarcharts.com) It's now or never to lock in CD rates. (sherwood.news) Global The Tokyo Stock Exchange is not messing around. (morningstar.com) How New Zealand (successfully) manages its sovereign wealth fund. (ft.com) EVs EVs made up 8% of sales in Q2. (coxautoinc.com) Ford ($F) is backtracking on big EV SUVs and doubling down on hybrids.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

AUGUST 23, 2024

Advisor Katie Medina and her team launch TOVA Wealth, with Sanctuary's support, while John Terrion leaves Merrill to join RBC's Boulder, Colo. office.

Nerd's Eye View

AUGUST 23, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a new study indicates that while financial advisory firms are largely satisfied with their tech stacks, they take a range of approaches to applying tech: from "innovators" that invest in tech to differentiate themselves from their competition and to enhance the client experience to "operators" that invest in technology largely to improve operations and internal efficiency

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

The Big Picture

AUGUST 23, 2024

This week, we speak with Ricky Sandler , the chief investment officer and the founder of Eminence Capital. Today, Eminence is a $7B global investment management organization. Sandler came to prominence as a savvy long/short investor and Eminence continues to successfully run several different Long/Short portfolios. Prior to launching Eminence, Ricky was co-founder and co-general partner of Fusion Capital Management, LLC.

Wealth Management

AUGUST 23, 2024

AI boom increases demand for expertise in compliance, cybersecurity and permissioning; Edward Jones tech milestones; and CHIPS Act-related expansion in Southwest.

A Wealth of Common Sense

AUGUST 23, 2024

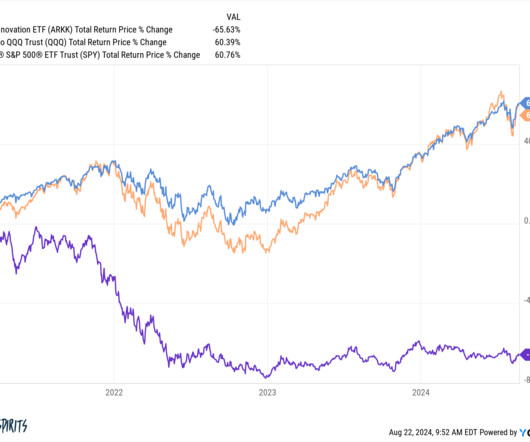

In December 2020 I wrote a short history of chasing the best performing funds. At the time, Cathie Wood’s ARK Innovation fund was on fire, absolutely destroying the market: Wood quickly became one of the most famous fund managers alive. She was in the headlines every day. Her stock picks and pronouncements about the future were reported by every financial media publication in the country.

Wealth Management

AUGUST 23, 2024

Several key points to explain to clients.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Dear Mr. Market

AUGUST 23, 2024

Dear Mr. Market: Budgeting apps play a vital role in helping us keep track of our spending, save for future goals, and maintain control over our financial health. With the retirement of Mint, many are left wondering which tool to turn to next to stay on top of their financial game. The sun has set on Mint, and for many of us, it feels like a beloved companion has gone away.

Wealth Management

AUGUST 23, 2024

Many stem from failing to understand the governing agreement.

Advisor Perspectives

AUGUST 23, 2024

The Big Tech boom is causing headaches for all-powerful index providers on Wall Street, who can send billions of benchmark-tracking dollars on the move with just a stroke of the pen.

Wealth Management

AUGUST 23, 2024

Martin M. Shenkman and Joy Matak discuss the business succession planning challenges created by a new rule that restricts the use of non-compete agreements.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Truemind Capital

AUGUST 23, 2024

A friend who shares her honest opinion with you is more valuable than a friend who agrees with everything that pleases you. We met a prospective client a few days ago and enlightened him about our 0% commission, conflict-free advisory model. The client deals with a wealth manager from a reputed bank. In a display of confidence, he told us how he does thorough due diligence before purchasing a product and does not completely rely upon the recommendations of his wealth manager.

Wealth Management

AUGUST 23, 2024

Organic growth has become a challenge for wealth managers. Advisors in these 10 cities, where demand for their services is high, may have a better chance at it.

Alpha Architect

AUGUST 23, 2024

Evergreen funds are a relatively new concept in the private equity (PE) world compared to traditional closed-end funds. They were introduced to address the negatives of the traditional way to invest in private equity which had been in the form of partnerships. Evergreen Private Equity Funds Attracting Assets was originally published at Alpha Architect.

Wealth Management

AUGUST 23, 2024

The most pressing tax law developments of the past month.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Validea

AUGUST 23, 2024

Understanding Warren Buffett’s Investment Strategy: Validea’s Model and Top Picks Warren Buffett is renowned for his exceptional investment track record. While Buffett doesn’t publicly disclose his exact methodology, he does disclose his holdings. Validea’s Warren Buffett model is based on the fundamental criteria we have extracted from the book Buffettology written by Mary Buffett.

Wealth Management

AUGUST 23, 2024

Suggested approaches to foster resilience.

Trade Brains

AUGUST 23, 2024

Premier Energies Limited is coming up with its IPO fresh issue of Rs. 1,291.40 crores and offer for sale worth Rs. 1,539 crores totalling Rs. 2,830.40 crores, which will open on 27 th August 2024. The issue will close on 29 th August 2024 and be listed on the exchange on 3rd September 2024. In this article, we will look at Premier Energies Limited IPO Review and analyze its strengths and weaknesses.

Wealth Management

AUGUST 23, 2024

A former industry insider’s perspective.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Random Roger's Retirement Planning

AUGUST 23, 2024

We spend a lot of time bagging on the Global X Covered Call ETF (XYLD) for how little upcapture it has. The above chart excludes dividends. Without the yield, the compounding is negative. Today I learned there is another variation from Global X, the Global X Covered Call & Growth ETF (XYLG). It is similar to XYLD in that it sells a very near the money, monthly call option.

Wealth Management

AUGUST 23, 2024

Editor in Chief Susan R. Lipp weighs in on the contents of this month's issue.

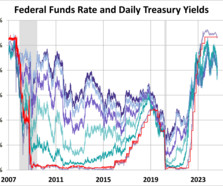

Advisor Perspectives

AUGUST 23, 2024

The yield on the 10-year note ended August 23, 2024 at 3.81%, the 2-year note ended at 3.90%, and the 30-year at 4.10%.

Wealth Management

AUGUST 23, 2024

Legal Editor Anna Sulkin Stern discusses this month's cover art.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Advisor Perspectives

AUGUST 23, 2024

Treasuries rallied after Federal Reserve Chair Jerome Powell’s speech at Jackson Hole cemented expectations that the central bank will cut interest rates next month.

Wealth Management

AUGUST 23, 2024

Craig R. Hersch provides practitioners with a foundation for understanding artificial intelligence.

Advisor Perspectives

AUGUST 23, 2024

Although we think it's too early to declare the economy is in a recession, risk is elevated. For investors who are concerned about a recession, municipal bonds may help buffer a portfolio.

Wealth Management

AUGUST 23, 2024

Using variable rates to achieve intrafamily loan nirvana.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content