NewRetirement Rebrands As Boldin

Wealth Management

SEPTEMBER 4, 2024

Once only a direct-to-consumer play, Boldin is working with independent RIAs and enterprise customers.

Wealth Management

SEPTEMBER 4, 2024

Once only a direct-to-consumer play, Boldin is working with independent RIAs and enterprise customers.

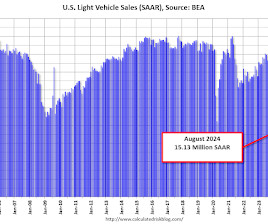

Calculated Risk

SEPTEMBER 4, 2024

Wards Auto released their estimate of light vehicle sales for August: August U.S. Light-Vehicle Sales Rise 4%, Ending Two Straight Declines (pay site). Growth was solid in August despite the period’s results equaling a 7-month-low SAAR. However, after rising 3.4% year-over-year in the first five months of 2024, demand over the three months since then has been nearly flat.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

SEPTEMBER 4, 2024

Private debt REITs offer a unique blend of income stability, risk management, tax efficiency, and diversification, writes Parkview Financial's VP of investor relations.

Abnormal Returns

SEPTEMBER 4, 2024

Podcasts Barry Ritholtz talks with Eric Balchunas about the importance of falling fund fees. (ritholtz.com) Rick Ferri talks with Christine Benz about her new book "How to Retire, 20 Lessons for a Happy, Successful, and Wealthy Retirement." (bogleheads.podbean.com) Christine Benz and Amy Arnott talk financial fraud with Kathy Stokes, director of Fraud Prevention Programs with AARP.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

SEPTEMBER 4, 2024

Pradeep Jayaraman, former co-head of partnerships and business development at Focus Financial, hopes to build on Bluespring’s mergers and acquisitions strategy.

Abnormal Returns

SEPTEMBER 4, 2024

IPOs Don't expect much in the way of IPOs between now and year-end. (news.crunchbase.com) The SPAC market is not dead. (bloomberg.com) Finance Why Blackstone ($BX) purchased data center operator AirTrunk. (wsj.com) How private equity profits from our 'penny problem.' (axios.com) It seems like PE always wins, no matter what. (sherwood.news) A defense of private equity.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

SEPTEMBER 4, 2024

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • 8:15 AM: The ADP Employment Report for August. This report is for private payrolls only (no government). • At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 238 thousand initial claims, up from 233 thousand last week.

Wealth Management

SEPTEMBER 4, 2024

New technology allows advisors to create more personalized and efficient bond portfolios.

The Big Picture

SEPTEMBER 4, 2024

The Best Way to Buy a House Right Now with Jonathan Miller , Miller Samuel (Sept 4, 2024) Buying a house in today’s climate can be challenging. Interest rates are near the highest level in 20 years. Housing inventory is near record lows. So what’s a potential home buyer to do? Jonathan Miller, President of Miller Samuel, discusses the best approaches for purchasing a home today.

Wealth Management

SEPTEMBER 4, 2024

LPL is acquiring the Bedminster, N.J-based firm The Investment Group, with about $9 billion in managed assets supporting approximately 240 advisors.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

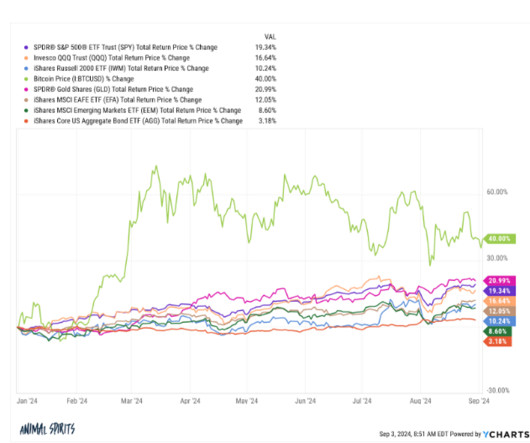

A Wealth of Common Sense

SEPTEMBER 4, 2024

Today’s Animal Spirits is brought to you by YCharts: See here for 20% off your initial YCharts professional subscription On today’s show, we discuss: Americans Are Really, Really Bullish on Stocks Once-In-Lifetime Wall Street Rally Raises Soft-Landing Stakes Ex-Peloton CEO John Foley gets real about company crash — and his unexpected venture into home decor Economist Eugene Fama: ‘Efficient mark.

Wealth Management

SEPTEMBER 4, 2024

Open, honest and candid discussion about TIAA outsourcing, a new report on IRA rollover abuses, analysis of forfeiture lawsuits, state mandates and more.

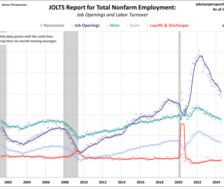

Advisor Perspectives

SEPTEMBER 4, 2024

The latest job openings and labor turnover summary (JOLTS) report showed that job openings slid in July, reflecting cooling hiring. Vacancies decreased to 7.673 million in July from June's downwardly revised level of 7.910 million. The latest reading was below the expected 8.090 million vacancies.

Wealth Management

SEPTEMBER 4, 2024

Amendments refresh outdated terminology, references, responsible parties and procedures.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Advisor Perspectives

SEPTEMBER 4, 2024

The sharp selloff that wiped a record $279 billion off Nvidia Corp.’s market value on Tuesday has traders scouring charts for clues as to where the pain might end.

Wealth Management

SEPTEMBER 4, 2024

Action on pending bills will likely be postponed until after the election.

Advisor Perspectives

SEPTEMBER 4, 2024

There are two radically different visions of our AI future, and they depend on the cost of energy.

YouSet Insurance

SEPTEMBER 4, 2024

While one-way insurance covers damage you cause to others in a car accident, two-way insurance also covers damage to your own car.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

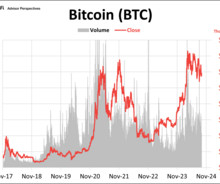

Advisor Perspectives

SEPTEMBER 4, 2024

Bitcoin's price hovered around $59,000 but has edged lower to $57,000 this past week. BTC is currently up ~30% year-to-date. Here are the latest charts on three of the largest cryptocurrencies by market share through 9/3/24.

Steve Sanduski

SEPTEMBER 4, 2024

Guest: Heather Robertson Fortner , Chief Executive Officer and Chair of the Board of SignatureFD , an integrated and comprehensive wealth management firm with offices in Atlanta, Georgia and Charlotte, North Carolina. The firm was recently named to the Inc. 5000 and has grown from $250 million to more than $8 billion in assets under management during Heather’s tenure with the firm.

Advisor Perspectives

SEPTEMBER 4, 2024

Using infographics to illustrate your firm’s financial planning process is a great way to show the value you provide. Whether in your marketing materials, initial consultations, or new client onboarding, these visuals can help set the stage for a successful and growing relationship.

Trade Brains

SEPTEMBER 4, 2024

Shree Tirupati Balajee Company is coming up with its IPO fresh issue of Rs. 122.43 crores and offer for sale worth Rs. 47.23 crores, totalling Rs. 169.65 crores. which will open on 5 th September 2024. The issue will close on 9 th September 2024 and be listed on the exchange on 12 th September 2024. In this article, we will look at the Shree Tirupati Balajee IPO Review and analyze its strengths and weaknesses.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Advisor Perspectives

SEPTEMBER 4, 2024

A record number of blue-chip firms swarmed the US corporate bond market on Tuesday, taking advantage of cheaper borrowing costs as they look to issue debt ahead of the US presidential election.

Validea

SEPTEMBER 4, 2024

David Einhorn is a prominent hedge fund manager and the founder of Greenlight Capital. Known for his value-oriented investment approach and activist investing, Einhorn rose to fame in the financial world for his prescient short positions, including his famous short of Lehman Brothers before its collapse in 2008. Einhorn employs a long-short strategy, taking both long positions in undervalued stocks and short positions in overvalued ones.

Advisor Perspectives

SEPTEMBER 4, 2024

Bond traders are bracing for wilder market swings in the US than in Europe, as signs the world’s largest economy is faltering fuel bets on a jumbo interest-rate cut from the Federal Reserve.

Validea

SEPTEMBER 4, 2024

The energy sector remains a vital part of the global economy, despite ongoing challenges and the increasing focus on renewable energy. Recent fluctuations in commodity prices, driven by geopolitical events and supply-demand imbalances, have contributed to heightened volatility for energy stocks. Additionally, governments worldwide are pushing forward with policies that favor clean energy, which has added pressure on traditional fossil fuel companies to adapt or face reduced long-term growth pros

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Advisor Perspectives

SEPTEMBER 4, 2024

Equity bulls looking for signs of relief after Tuesday’s stock rout may get a hand from a familiar friend: corporate America.

Accounting for Good

SEPTEMBER 4, 2024

The ACNC conducts audits to ensure that organisations comply with the ACNC Act and adhere to their responsibilities under Australian law.

Advisor Perspectives

SEPTEMBER 4, 2024

Successful advisors are persuasive. They understand persuasion is critical to converting prospects into clients and keeping them as clients.

Random Roger's Retirement Planning

SEPTEMBER 4, 2024

Two articles with entirely different viewpoints on when and how to retire. The first one from the WSJ is about people taking intermediate length, six to 12 months I'd guess, sabbaticals every so often without prioritizing the potential consequences for retirement planning. A reader left the link to this article and then of course later on Wednesday, I saw it shared elsewhere a half dozen times.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content